Viva Wallet

Founded Year

2010Stage

Shareholder Liquidity | AliveTotal Raised

$287.53MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-98 points in the past 30 days

About Viva Wallet

Viva Wallet is a cloud-based neo-bank using Microsoft Azure with branches in twenty-three countries in Europe. It is a principal member of Visa and Mastercard for acquiring and issuing services with direct connectivity to the card schemes, providing processing services through its own platform. Viva Wallet provides businesses of all sizes with card acceptance services through POS terminals and the new Android Viva Wallet POS app, as well as through advanced payment gateways in online stores. It also offers business accounts with local IBAN and business Viva Wallet Mastercard cards. The company was founded in 2010 and is based in Athens, Greece.

Loading...

Viva Wallet's Product Videos

ESPs containing Viva Wallet

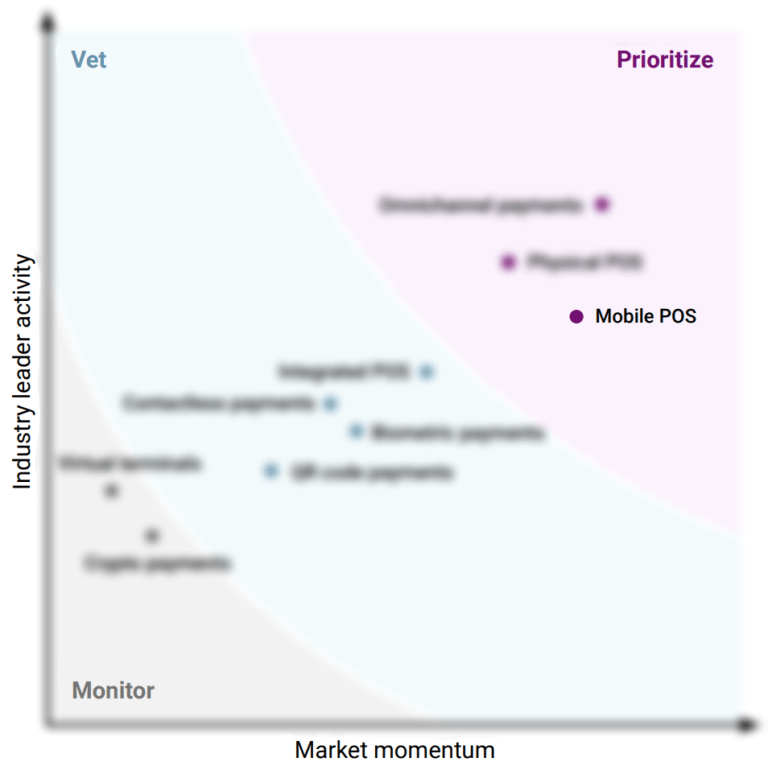

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

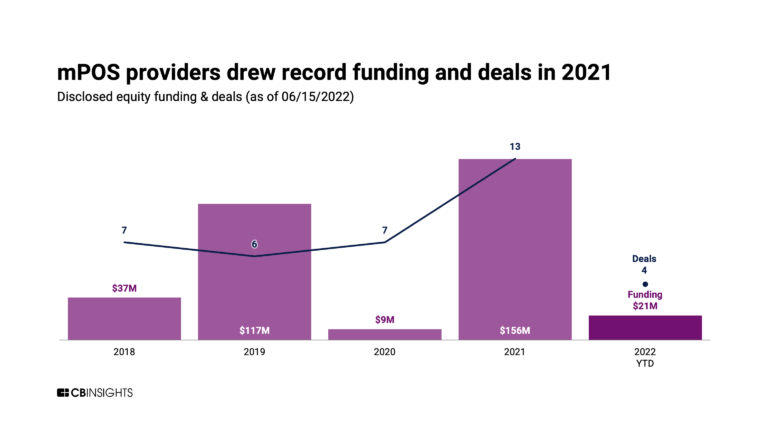

The mobile point-of-sale (mPOS) market offers a range of solutions for merchants to accept payments and engage with customers through mobile devices. These solutions include ordering, payment, and loyalty programs, as well as the ability to accept new payment form factors such as contactless and mobile wallets. The market also offers solutions for legacy POS systems to integrate with mobile platfo…

Viva Wallet named as Leader among 15 other companies, including Fiserv, FIS, and Block.

Viva Wallet's Products & Differentiators

Independent Hardware Vendor & Independent Software Vendor Partnership Programs

We enable payments on any smart device and we can integrate with any software or hardware provider through our cutting-edge software platform. We enable consolidation and less hassle for all businesses that accept payments, while introducing new innovative payment use cases across any industry. All that harnessing the power of our in-house omnichannel technologies, namely Viva Terminal App and Smart Checkout payment gateway.

Loading...

Research containing Viva Wallet

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Viva Wallet in 3 CB Insights research briefs, most recently on Sep 13, 2022.

Jun 2, 2022 report

Why vendors are prioritizing mobile point-of-sale (mPOS) systemsExpert Collections containing Viva Wallet

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Viva Wallet is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,396 items

Excludes US-based companies

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Viva Wallet News

Jun 13, 2024

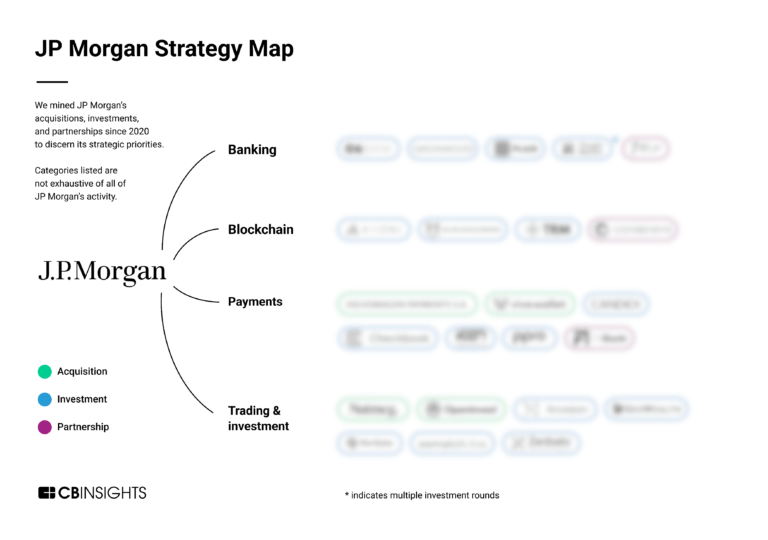

By PYMNTS | June 13, 2024 | A Thursday (June 13) ruling by a London High Court judge reportedly resolved a legal dispute between J.P. Morgan Chase & Co. and Haris Karonis , the founder and CEO of Greek FinTech company Viva Wallet . The resolution of the feud opens the possibility of a sale of Viva Wallet, marking a milestone for J.P. Morgan in its strategy of investing in high-growth FinTech companies, the Financial Times reported Thursday. J.P. Morgan invested more than $800 million in Viva Wallet two years ago, acquiring a 48.5% stake in the company, according to the report. Disagreements between J.P. Morgan and Karonis led to legal claims filed against each other in February. Karonis alleged the banking giant tried to push down Viva Wallet’s valuation, while J.P. Morgan alleged that Karonis had taken steps to limit or circumvent its rights as an investor. The court’s verdict accepted elements of both parties’ arguments, providing clarity on the valuation of Viva Wallet and its potential for expansion into new markets, according to the FT report. The resolution of the dispute ends J.P. Morgan’s legal headache and paves the way for a potential sale of Viva Wallet, the report said. J.P. Morgan expressed its satisfaction with the court’s decision, stating that it provides a step toward fair and transparent valuations, which could expedite the sale of Viva before the FinTech mergers and acquisitions market further softens, per the report. Karonis, too, expressed his excitement about the ruling, saying that it allows Viva Wallet to be properly valued based on its growth strategy in the United States, reflecting its fair market value, according to the report. Viva Wallet, founded in 2000, has become one of the largest FinTech companies in Southern Europe, offering payment services in 24 countries, the report said. In 2020, it acquired a banking license after purchasing Greek digital bank Praxia. This legal dispute is not the first time J.P. Morgan has faced challenges with the founders of businesses it has invested in, per the report. The bank has invested billions of dollars in over 40 FinTech companies since 2021. Last year, J.P. Morgan sued Charlie Javice , the founder of Frank, a student finance platform that the bank had acquired for $175 million in 2021, over allegations of inflating user numbers . Recommended

Viva Wallet Frequently Asked Questions (FAQ)

When was Viva Wallet founded?

Viva Wallet was founded in 2010.

Where is Viva Wallet's headquarters?

Viva Wallet's headquarters is located at Avenue Halandri Maroussi 18-20, Athens.

What is Viva Wallet's latest funding round?

Viva Wallet's latest funding round is Shareholder Liquidity.

How much did Viva Wallet raise?

Viva Wallet raised a total of $287.53M.

Who are the investors of Viva Wallet?

Investors of Viva Wallet include J.P. Morgan Chase, DECA Investments, Hedosophia, Latsis Family, Tencent and 5 more.

Who are Viva Wallet's competitors?

Competitors of Viva Wallet include SumUp and 7 more.

What products does Viva Wallet offer?

Viva Wallet's products include Independent Hardware Vendor & Independent Software Vendor Partnership Programs and 2 more.

Loading...

Compare Viva Wallet to Competitors

HPS is a multinational company that specializes in payment solutions and services, operating in the financial technology sector. The company provides a comprehensive suite of solutions, PowerCARD, that covers the entire payment value chain, enabling the processing of transactions from any channel initiated by any means-of-payment. HPS primarily serves issuers, acquirers, card processors, independent sales organisations, retailers, mobile network operators, and national & regional switches. It was founded in 1995 and is based in Casablanca, Morocco.

Rapyd is a fintech company specializing in global payment processing and financial technology solutions. The company offers a platform for businesses to accept payments online, send payouts, and manage multi-currency accounts, with a focus on simplifying financial transactions across borders. Rapyd's services cater to various sectors including eCommerce, marketplaces, and the gig economy. Rapyd was formerly known as CashDash. It was founded in 2016 and is based in London, England.

Clip is a financial technology company that specializes in providing payment solutions and mobile point-of-sale systems for businesses. The company offers a range of products including card readers, portable terminals, and digital services that facilitate remote payments, inventory management, and financial services such as loans. Clip primarily serves various business sectors, offering tailored solutions for online and physical stores, professional services, and the food and beverage industry. Clip was formerly known as BlitzPay. It was founded in 2012 and is based in Mexico City, Mexico.

Priority Payment Solutions focuses on providing integrated payments and banking solutions within the financial services industry. The company offers a scalable native platform for payment processing, accounts payable automation, and a suite of services for merchants, financial institutions, and other business sectors. Priority Payment Solutions primarily serves sectors such as merchant services, financial wellness, and property management. It was founded in 2005 and is based in Alpharetta, Georgia.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The company offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

FlexM is a company that focuses on providing Fintech as a Service (FaaS) in the financial technology industry. The company offers a range of services including digital banking, payment solutions, and regulatory compliance management systems, all designed to provide modern and digital alternatives to traditional banking and payment methods. It primarily serves sectors such as banks, fintechs, money service businesses, start-ups, and marketplaces. It was founded in 2014 and is based in Singapore.

Loading...