Volt

Founded Year

2019Stage

Series B | AliveTotal Raised

$83.5MLast Raised

$60M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-24 points in the past 30 days

About Volt

Volt focuses on the development of real-time payment solutions, operating within the financial technology sector. The company offers a platform enabling instant notifications, real-time reporting, fraud prevention, payment tracking, unified commerce, customer bank account verification, and conversion of card payments into open banking payments. Volt primarily serves the e-commerce industry. It was founded in 2019 and is based in London, United Kingdom.

Loading...

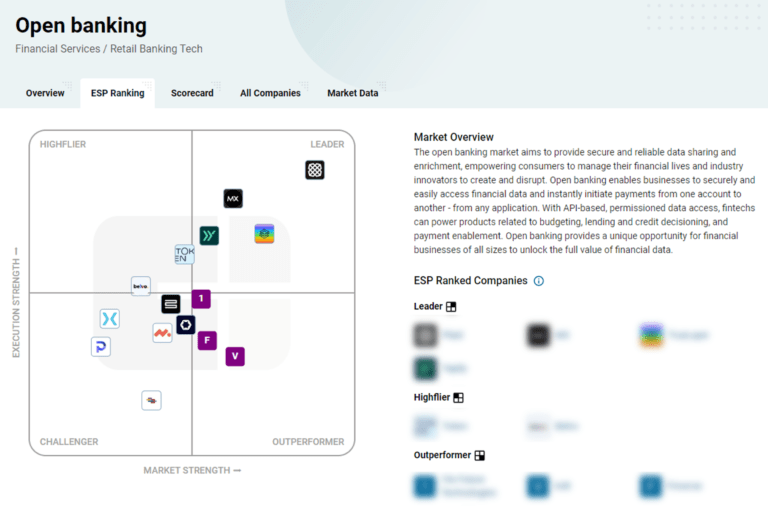

ESPs containing Volt

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The real-time payments (RTP) processing market provides infrastructure and technologies to facilitate instant and seamless electronic payments. This market offers solutions that enable the immediate transfer of funds between financial institutions or individuals, allowing for real-time settlement of transactions. Businesses can benefit from enhanced speed, efficiency, and convenience in their paym…

Volt named as Challenger among 15 other companies, including Mastercard, Visa, and Temenos.

Volt's Products & Differentiators

Checkout

The omnichannel checkout that’s a step ahead. Modular by design and customised by country, our checkout features intelligent bank searches and mobile-optimised journeys.

Loading...

Research containing Volt

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Volt in 2 CB Insights research briefs, most recently on Jan 4, 2024.

Jan 4, 2024

The core banking automation market mapExpert Collections containing Volt

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Volt is included in 3 Expert Collections, including Payments.

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,398 items

Excludes US-based companies

Fintech 100

100 items

Latest Volt News

Sep 18, 2024

18 Sep 2024 Global marketplace for luxury fashion Farfetch has chosen Volt as its real-time payments partner, enabling its customers in the UK, Germany and the Netherlands to make instant payments directly from their bank accounts. Volt’s ‘Pay by Bank’ solution will be made available on farfetch.com and brownsfashion.com. By choosing Pay by Bank at checkout, Farfetch’s customers can select their bank, and approve the payment in their banking app through biometric authentication, thereby speeding up the settlement process. The other benefits of Pay by Bank cited by Volt include the removal of chargebacks and reduction in card fraud risks, as well as the elimination of card processing fees. Farfetch said that geographic coverage, global approach, “far-reaching” bank connectivity and “streamlined” payment experience were the main factors behind partnering with Volt. Kat Marangos, vice president, strategic accounts at Volt, said: “We believe that real-time payments have a transformative potential for retail, enriching customer experience, reducing costs and adding security. “This is particularly important for large-value purchases, so we are excited to see Farfetch leading the real-time payments revolution within the retail landscape.” Marangos added that Farfetch is known for its commitment to quality service and exceptional buyer experience, thereby setting a high standard for Volt to uphold. Mark Hobbs, senior director of fintech operations at Farfetch, added: “We’re pleased to partner with Volt, which provides our customers with secure, fast, and seamless additional payment options that enhance the online purchasing experience. “Volt is dedicated to building the global real-time payment network and is a great partner for improving the payment experience.” Earlier this month, Volt announced the launch of a stablecoin settlement solution, called VX2, which will be headed up by Tom Greenwood, who will transition from his current role as chief executive officer of Volt, to lead VX2 as its new chief executive officer. Share

Volt Frequently Asked Questions (FAQ)

When was Volt founded?

Volt was founded in 2019.

Where is Volt's headquarters?

Volt's headquarters is located at 42 Berners Street, London.

What is Volt's latest funding round?

Volt's latest funding round is Series B.

How much did Volt raise?

Volt raised a total of $83.5M.

Who are the investors of Volt?

Investors of Volt include Augmentum Fintech, EQT Ventures, Fuel Ventures, CommerzVentures, Institutional Venture Partners and 4 more.

Who are Volt's competitors?

Competitors of Volt include Yaspa and 7 more.

What products does Volt offer?

Volt's products include Checkout and 4 more.

Loading...

Compare Volt to Competitors

TrueLayer provides an open banking platform, specializing in the financial technology sector. The company provides solutions for instant bank payments, verified payouts, and streamlined user onboarding, leveraging real-time financial and identity data. TrueLayer primarily serves businesses in the ecommerce, iGaming, financial services, and cryptocurrency sectors. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, England.

Trustly Group is a global company that focuses on providing open banking solutions in the financial services sector. The company offers a range of services including facilitating secure and low-cost payments, instant payouts, and expedited customer onboarding. Additionally, it serves various sectors of the economy including the eCommerce industry, financial services, and gaming. It was founded in 2008 and is based in Stockholm, Sweden.

Banked is a financial technology company specializing in real-time payments for consumers, businesses, and banks within the fintech sector. The company offers a suite of products that facilitate fast, secure, and simple account-to-account payments, including a modular checkout solution, payment links, and QR codes, as well as services for payouts, refunds, and fraud management. Banked's solutions are designed to improve payment security, enhance business efficiency, and reduce costs associated with traditional payment methods. Banked was formerly known as StudioH67. It was founded in 2018 and is based in London, England.

Yaspa operates as a fintech company specializing in instant payments and identity services within the financial technology sector. The company offers a suite of products that enable payments and deposits, instant payouts, and comprehensive account verification services for regulated businesses. Yaspa primarily serves industries such as iGaming, eCommerce, electronic point-of-sale systems, utilities, charities, and trading. Yaspa was formerly known as Citizen. It was founded in 2017 and is based in London, United Kingdom.

Loyalize offers an engagement platform for retailers and financial institutions to connect customers with the loyalty program. The company's platform helps retailers save money on transaction fees and improve the customer experience by adding more value to the payment journey. The company was founded in 2019 and is based in London, United Kingdom.

Yapily is an open banking infrastructure platform that specializes in providing secure connectivity between customers and banks across Europe. The company offers services that enable access to financial data and the initiation of payments, aiming to facilitate the creation of personalized financial experiences. Yapily primarily serves industries such as payment services, i-gaming, accounting, lending and credit, crypto, property technology (PropTech), investing, and digital banking. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, United Kingdom.

Loading...