Routable

Founded Year

2017Stage

Series B - II | AliveTotal Raised

$48.02MLast Raised

$490K | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+21 points in the past 30 days

About Routable

Routable is a financial technology company specializing in accounts payable automation for businesses. The company offers a platform that streamlines invoice processing, vendor payments, and compliance management, while also providing tools for customizable approval workflows, payment reconciliation, and vendor onboarding. Routable's solutions cater to various sectors, including marketplaces, gig economy, insurance, real estate, logistics, manufacturing, and nonprofit organizations. It was founded in 2017 and is based in San Francisco, California.

Loading...

Routable's Product Videos

Routable's Products & Differentiators

Mass payouts

Routable’s mass payouts solution enables teams to scale their payout operations to 100,000+ per month while allowing finance teams to collaborate with any department with ease. With an ability to pay domestic and international vendors supporting different payment methods while still keeping track of all your transaction details for easy reconciliation purposes.

Loading...

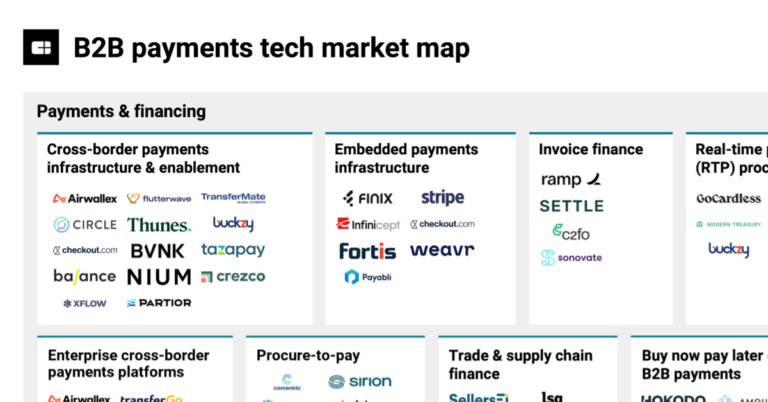

Research containing Routable

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Routable in 1 CB Insights research brief, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market mapExpert Collections containing Routable

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Routable is included in 3 Expert Collections, including SMB Fintech.

SMB Fintech

2,003 items

Payments

3,034 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,254 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Latest Routable News

Sep 12, 2024

LONDON & SEATTLE--(BUSINESS WIRE)--Convera, a global leader in commercial payments, today announced its partnership with Routable, the most efficient and flexible accounts payable platform. This integrated partnership will enable Routable to leverage Convera’s global network and expertise in foreign exchange and compliance to provide its customers with increased global reach, reliability, and competitive rates. Today’s modern businesses want to reduce manual workload and build automation across

Routable Frequently Asked Questions (FAQ)

When was Routable founded?

Routable was founded in 2017.

Where is Routable's headquarters?

Routable's headquarters is located at 600 California Street, San Francisco.

What is Routable's latest funding round?

Routable's latest funding round is Series B - II.

How much did Routable raise?

Routable raised a total of $48.02M.

Who are the investors of Routable?

Investors of Routable include K5 Global Technology, 1984 Ventures, Gokul Rajaram, Scott Belsky, Max Mullen and 20 more.

Who are Routable's competitors?

Competitors of Routable include Cforia Software, Hopscotch, Trolley, Denario, Tipalti and 7 more.

What products does Routable offer?

Routable's products include Mass payouts and 2 more.

Who are Routable's customers?

Customers of Routable include Garmentory, Seated and Mystery.

Loading...

Compare Routable to Competitors

Billtrust focuses on automating accounts receivable and order-to-cash processes for businesses. Its main offerings include artificial intelligence (AI)-powered invoicing, payment processing, cash application, and collections, designed to streamline financial operations and enhance cash flow. Billtrust's solutions cater to a variety of industries, providing tailored automation to meet specific sector needs. It was founded in 2001 and is based in Hamilton, New Jersey.

HighRadius specializes in artificial intelligence (AI) enabled autonomous finance solutions for the office. The company provides a suite of products designed to automate and optimize order-to-cash, treasury, and record-to-report processes for businesses. Its solutions aim to reduce days sales outstanding (DSO), enhance working capital management, accelerate financial close, and improve overall productivity without the need for extensive technical knowledge. It was founded in 2006 and is based in Houston, Texas.

CHERRY is a B2B payment processing solution that specializes in integrating accounting software with bank payment platforms. The company offers a plugin that automates payments, streamlines approvals, and facilitates reconciliation, thereby reducing manual processes for businesses. CHERRY primarily serves businesses looking to enhance their accounting and financial workflows through automation. It was founded in 2018 and is based in Brooklyn, New York.

Tipalti is a global payables automation company that specializes in streamlining all phases of the accounts payable and payment management workflow. The company offers a cloud-based platform that simplifies the management of supplier payments, encompassing supplier onboarding, tax and regulatory compliance, invoice processing, and payments to suppliers worldwide in various methods and currencies. Tipalti's solutions are designed to reduce the workload for accounts payable departments and enhance financial and compliance controls. It was founded in 2010 and is based in San Mateo, California.

Bill360 is a company that focuses on accounts receivable automation for businesses in the B2B sector. The company offers a platform that provides automated invoicing, embedded payments, collections automation, and collaboration tools, all designed to streamline and accelerate the cash flow process. Primarily, Bill360 serves the B2B market, particularly businesses with annual revenues under $100 million. It was founded in 2020 and is based in Tampa, Florida.

Chargezoom is a company that focuses on providing billing and payment solutions, operating in the financial technology sector. The company offers a range of services including online payment terminals, invoicing, customer portals, surcharging, and recurring payments, all designed to streamline and automate accounts receivable processes. Chargezoom primarily serves early and growth stage startups, entrepreneurs, and service businesses. It was founded in 2019 and is based in Irvine, California.

Loading...