Weka

Founded Year

2013Stage

Series E | AliveTotal Raised

$373.2MValuation

$0000Last Raised

$100M | 4 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+15 points in the past 30 days

About Weka

Weka provides a software-defined, cloud-native data platform for seamless and sustainable data management in the cloud and on-premises environments. The company offers solutions that enable organizations to store, process, and manage data with high input-output performance and low latency, catering to next-generation workloads such as AI and high-performance computing (HPC). Weka was formerly known as WekaIO. It was founded in 2013 and is based in Campbell, California.

Loading...

Loading...

Research containing Weka

Get data-driven expert analysis from the CB Insights Intelligence Unit.

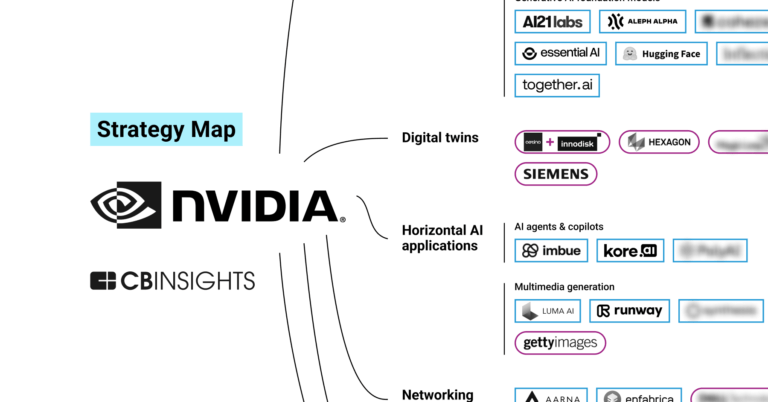

CB Insights Intelligence Analysts have mentioned Weka in 2 CB Insights research briefs, most recently on Jun 20, 2024.

Expert Collections containing Weka

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Weka is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Artificial Intelligence

14,767 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Generative AI

863 items

Companies working on generative AI applications and infrastructure.

Weka Patents

Weka has filed 114 patents.

The 3 most popular patent topics include:

- computer storage devices

- computer memory

- network file systems

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/13/2023 | 9/10/2024 | Computer storage devices, Data management, Computer data storage, Energy storage, Computer memory | Grant |

Application Date | 4/13/2023 |

|---|---|

Grant Date | 9/10/2024 |

Title | |

Related Topics | Computer storage devices, Data management, Computer data storage, Energy storage, Computer memory |

Status | Grant |

Latest Weka News

Sep 12, 2024

Share WEKA , the AI-native data platform company, and S&P Global Market Intelligence unveiled the findings of their second annual Global Trends in AI report. The global study, conducted by S&P Global Market Intelligence and commissioned by WEKA, surveyed over 1500 AI practitioners and decision-makers to understand the underlying trends influencing AI adoption and implementation. It also provides insights into the key practices of organizations now emerging as leaders in the AI revolution. “One of the most striking takeaways from our 2024 Trends In AI study is the astonishing rate of change that’s taken place since the onset of ChatGPT 3 and the first wave of generative AI models reached the market in early 2023. In less than two years, generative AI adoption has eclipsed all other AI applications in the enterprise, defining a new cohort of AI leaders and shaping an emergent market of specialty AI and GPU cloud providers,” said John Abbott, principal research analyst at 451 Research, part of S&P Global Market Intelligence. “We can now see a direct correlation forming with those with a higher degree of AI maturity and increased revenue, operating efficiencies, and faster time to market for product innovation.” Additionally, the new report underscored that, although AI is now more widely implemented in global organizations, obstacles remain in deploying AI successfully at scale. Data architectures were a reoccurring theme in this year’s report, defining the first wave of emerging AI leaders while many enterprises still struggle to scale. GPU availability was another commonly cited challenge, and regional disparities persist, suggesting global AI demand is outpacing access to AI accelerators and GPUs needed to power AI projects. Many organizations have successfully embraced AI infrastructure-as-a-service offerings from hyperscale cloud providers and an emergent market of new AI and GPU cloud markets to overcome this supply-demand gap and fuel their generative AI initiatives. Key findings of the 2024 Trends In AI report include: AI Applications Are Increasingly Pervasive In the Enterprise 33% of survey respondents have reached enterprise scale, with AI projects being widely implemented and driving significant business value, up from 28% last year. North America leads in enterprise AI adoption, with 48% of North American respondents indicating that AI is widely implemented, compared to APAC (26%) and EMEA (25%). Product improvement and operational effectiveness are key investment drivers, with organizations leveraging AI to improve product or service quality (42%), target increased revenue growth (39%), improve workforce productivity (40%) and IT efficiencies (41%), and accelerate their overall pace of innovation (39%). Generative AI Has Rapidly Eclipsed Other AI Applications Related Posts An astonishing 88% of organizations are actively investigating generative AI, far outstripping other AI applications such as prediction models (61%), classification (51%), expert systems (39%) and robotics (30%). Generative AI adoption is exploding: 24% of organizations say they already see generative AI as an integrated capability deployed across their organization. 37% have generative AI in production but not yet scaled. Just 11% are not investing in generative AI at all. Many AI Projects Fail to Scale — Legacy Data Architectures Are the Culprit On average, organizations have 10 AI projects in the pilot phase and 16 in limited deployment, but only six are deployed at scale. Data quality is the top challenge when moving AI projects into production. The most frequently cited technological inhibitors to AI/ML deployments are storage and data management (35%)—significantly greater than computing (26%), security (23%), and networking (15%). This is evidence that weak data foundations impede many organizations’ AI projects. GPU Availability Continues To Be Constrained, Shaping Infrastructure Decision-Making Four in 10 organizations suggest access to AI accelerators is a leading consideration in their infrastructure decision-making, and 30% cite GPU availability among their top three most serious challenges in moving AI models into production. Key channels for companies to access GPUs: respondents leverage hyperscale public clouds (46%) and – increasingly – GPU cloud service providers (32%) for model training. Concerns About AI’s Environmental Impact Persist But Are Not Slowing Adoption Nearly two-thirds (64%) of organizations say they are concerned about the impact of AI/machine learning (ML) projects on their energy use and carbon footprint; 25% indicate they are very concerned. 42% of organizations indicated that they have invested in energy-efficient IT hardware/systems to address the potential environmental impacts of their AI initiatives over the past 12 months. Of those, 56% believe this has had a “high” or “very high” impact. “Like the internet, the smartphone, and cloud computing before it, AI represents a paradigm shift that will leave an indelible mark on business and society and is already defining a new generation of industry leaders and disruptors,” said Liran Zvibel, cofounder and CEO at WEKA. “Unlike past technology transitions, AI’s adoption and maturation are growing with unprecedented velocity. The findings of S&P Global’s 2024 Trends In AI report underscore that the first wave of AI leaders is already scaling their competitive advantage by accelerating organizational and product innovation with faster time to market, positively impacting their bottom line. Those who are less AI mature are at risk of falling behind. To survive and thrive in the AI era, organizations must find trusted technology partners to help them cross the chasm and ensure they can agilely adapt to whatever the future brings.” [To share your insights with us as part of editorial or sponsored content, please write to psen@itechseries.com] PR Newswire, a Cision company, is the premier global provider of multimedia platforms and distribution that marketers, corporate communicators, sustainability officers, public affairs and investor relations officers leverage to engage key audiences. Having pioneered the commercial news distribution industry over 60 years ago, PR Newswire today provides end-to-end solutions to produce, optimize and target content -- and then distribute and measure results. Combining the world's largest multi-channel, multi-cultural content distribution and optimization network with comprehensive workflow tools and platforms, PR Newswire powers the stories of organizations around the world. PR Newswire serves tens of thousands of clients from offices in the Americas, Europe, Middle East, Africa and Asia-Pacific regions. Prev Post

Weka Frequently Asked Questions (FAQ)

When was Weka founded?

Weka was founded in 2013.

Where is Weka's headquarters?

Weka's headquarters is located at 910 East Hamilton Avenue, Campbell.

What is Weka's latest funding round?

Weka's latest funding round is Series E.

How much did Weka raise?

Weka raised a total of $373.2M.

Who are the investors of Weka?

Investors of Weka include Qualcomm Ventures, Hitachi Ventures, MoreTech Ventures, Norwest Venture Partners, Generation Investment Management and 24 more.

Who are Weka's competitors?

Competitors of Weka include SandStone, Unravel, Turntable, ForePaaS, Excelero and 7 more.

Loading...

Compare Weka to Competitors

OSNEXUS is a company that specializes in Software Defined Storage (SDS) within the technology industry. The company's main product, QuantaStor, is a platform that transforms standard servers into multi-protocol scale-out storage appliances, providing unified file, block, and object storage. OSNEXUS primarily serves sectors such as server virtualization, big data, cloud computing, backup/archive, and high performance computing. It is based in Bellevue, Washington.

ProphetStor Data Services is a company that focuses on providing AI-driven data services in the IT infrastructure industry. The company's main offerings include solutions for IT operations, cost management, performance optimization, and application acceleration, all powered by AI and machine learning technologies. These services primarily cater to the cloud computing industry. It is based in Milpitas, California.

SandStone provides enterprise-level software-defined storage (SDS) solutions and services. It offers a range of storage solutions, including massive object storage, unified storage platforms, and cloud-native file storage, designed to help businesses handle the storage challenges associated with IT cloud migration and manage large volumes of unstructured data. It primarily serves sectors such as private and hybrid cloud, fintech, smart government, smart healthcare, smart transportation, and smart security. The company was founded in 2014 and is based in Shenzhen, China.

Atlantis Computing is a company that focuses on software-defined storage (SDS) and operates within the data storage industry. The company offers a flexible and powerful SDS platform that can be delivered as an all-software solution or as a flash-based, hyperconverged appliance. This platform accelerates physical storage performance, increases its capacity, and allows enterprises to transition from costly shared storage systems to lower cost hyperconverged systems and public cloud storage. It was founded in 2006 and is based in Sunnyvale, California.

Alluxio specializes in data orchestration software for the cloud, focusing on the big data and AI/ML sectors. The company's software facilitates memory-speed data access and intelligent data tiering for files and objects, aiming to optimize data management and performance across various computing frameworks and storage systems. Alluxio primarily serves sectors that require high-performance data access, such as financial services, high tech, retail, and telecommunications. Alluxio was formerly known as Tachyon. It was founded in 2015 and is based in San Mateo, California.

DDN Storage is a data storage company that specializes in providing intelligent technology and infrastructure solutions for data-centric organizations. The company offers powerful data management solutions that are designed to support data-centric AI, analytics, and real-time insight. DDN Storage primarily serves enterprises, government, and public-sector customers, including financial services firms, life science organizations, manufacturing and energy companies, research facilities, and web and cloud service providers. It was founded in 1988 and is based in Chatsworth, California.

Loading...