WEX

Founded Year

1983Stage

PIPE | IPOMarket Cap

8.46BStock Price

207.11Revenue

$0000About WEX

WEX is a global commerce platform specializing in operational solutions for businesses across various sectors. The company offers a suite of products including fuel cards, fleet management tools, employee benefits administration, and business payment services. WEX primarily serves industries such as fuel and energy, business and commerce, financial services and technology, and the public sector. It was founded in 1983 and is based in Portland, Maine.

Loading...

Loading...

Research containing WEX

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned WEX in 1 CB Insights research brief, most recently on Jan 18, 2024.

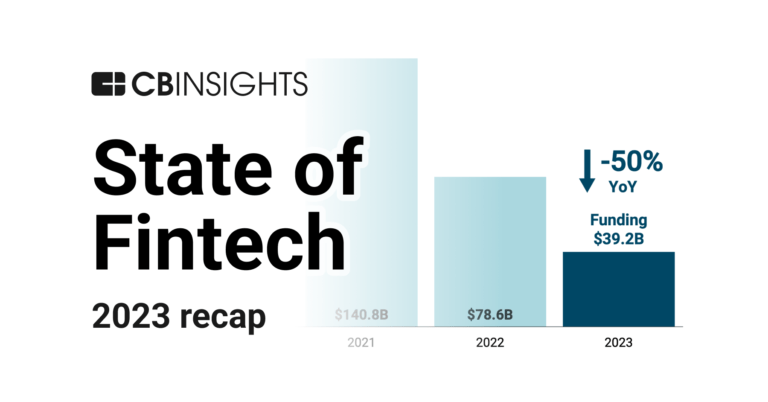

Jan 18, 2024 report

State of Fintech 2023 ReportExpert Collections containing WEX

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

WEX is included in 2 Expert Collections, including Conference Exhibitors.

Conference Exhibitors

5,302 items

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

WEX Patents

WEX has filed 8 patents.

The 3 most popular patent topics include:

- data management

- database management systems

- diagrams

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/26/2020 | 5/30/2023 | Environmental engineering, Sewerage, Sanitation, Water pollution, Sewerage infrastructure | Grant |

Application Date | 10/26/2020 |

|---|---|

Grant Date | 5/30/2023 |

Title | |

Related Topics | Environmental engineering, Sewerage, Sanitation, Water pollution, Sewerage infrastructure |

Status | Grant |

Latest WEX News

Sep 22, 2024

WEX Inc. (NYSE:WEX) Holdings Reduced by Massachusetts Financial Services Co. MA Posted by MarketBeat News on Sep 22nd, 2024 Massachusetts Financial Services Co. MA lessened its holdings in shares of WEX Inc. ( NYSE:WEX – Free Report ) by 40.8% during the second quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 20,825 shares of the business services provider’s stock after selling 14,331 shares during the period. Massachusetts Financial Services Co. MA owned 0.05% of WEX worth $3,689,000 as of its most recent filing with the Securities and Exchange Commission. Other hedge funds also recently made changes to their positions in the company. Principal Securities Inc. acquired a new position in WEX during the 4th quarter worth $31,000. Dimensional Fund Advisors LP grew its position in WEX by 2.4% in the 4th quarter. Dimensional Fund Advisors LP now owns 338,388 shares of the business services provider’s stock valued at $65,838,000 after buying an additional 7,867 shares in the last quarter. Norges Bank bought a new position in WEX in the 4th quarter valued at about $89,745,000. Corient Private Wealth LLC raised its position in shares of WEX by 4.2% during the 4th quarter. Corient Private Wealth LLC now owns 10,158 shares of the business services provider’s stock worth $1,976,000 after buying an additional 409 shares in the last quarter. Finally, Westfield Capital Management Co. LP lifted its stake in shares of WEX by 19.3% in the 4th quarter. Westfield Capital Management Co. LP now owns 228,078 shares of the business services provider’s stock worth $44,373,000 after acquiring an additional 36,906 shares during the period. Institutional investors own 97.47% of the company’s stock. Get WEX alerts: Wall Street Analysts Forecast Growth WEX has been the topic of several recent analyst reports. JPMorgan Chase & Co. dropped their target price on WEX from $210.00 to $200.00 and set a “neutral” rating on the stock in a report on Tuesday, August 20th. Wells Fargo & Company cut their price objective on WEX from $200.00 to $190.00 and set an “equal weight” rating for the company in a report on Friday, July 26th. Keefe, Bruyette & Woods lowered their target price on WEX from $275.00 to $230.00 and set an “outperform” rating on the stock in a report on Monday, July 8th. Finally, William Blair raised shares of WEX to a “strong-buy” rating in a report on Friday, July 26th. Six analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of “Moderate Buy” and an average price target of $239.58. Want More Great Investing Ideas? Insider Activity at WEX In related news, insider Ann Elena Drew sold 1,182 shares of the firm’s stock in a transaction that occurred on Friday, August 2nd. The shares were sold at an average price of $172.73, for a total transaction of $204,166.86. Following the transaction, the insider now owns 5,584 shares of the company’s stock, valued at $964,524.32. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink . In other WEX news, insider Ann Elena Drew sold 1,182 shares of the firm’s stock in a transaction dated Friday, August 2nd. The stock was sold at an average price of $172.73, for a total transaction of $204,166.86. Following the transaction, the insider now directly owns 5,584 shares in the company, valued at $964,524.32. The transaction was disclosed in a filing with the SEC, which is available through this link . Also, CFO Jagtar Narula sold 540 shares of the company’s stock in a transaction dated Monday, July 8th. The stock was sold at an average price of $180.00, for a total value of $97,200.00. Following the sale, the chief financial officer now owns 8,168 shares of the company’s stock, valued at approximately $1,470,240. The disclosure for this sale can be found here . In the last quarter, insiders sold 5,985 shares of company stock valued at $1,094,907. 1.10% of the stock is owned by corporate insiders. WEX Trading Up 0.5 % NYSE:WEX opened at $207.11 on Friday. The stock’s 50-day moving average is $185.29 and its two-hundred day moving average is $199.00. WEX Inc. has a fifty-two week low of $161.95 and a fifty-two week high of $244.04. The stock has a market cap of $8.68 billion, a PE ratio of 33.68, a price-to-earnings-growth ratio of 1.19 and a beta of 1.54. The company has a debt-to-equity ratio of 1.66, a current ratio of 1.03 and a quick ratio of 1.03. WEX ( NYSE:WEX – Get Free Report ) last announced its quarterly earnings data on Thursday, July 25th. The business services provider reported $3.29 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.20 by $0.09. WEX had a return on equity of 31.05% and a net margin of 9.32%. The business had revenue of $673.50 million during the quarter, compared to analyst estimates of $677.44 million. As a group, equities research analysts forecast that WEX Inc. will post 13.75 earnings per share for the current fiscal year. WEX Profile WEX Inc operates a commerce platform in the United States and internationally. The Mobility segment offers fleet vehicle payment solutions, transaction processing, and information management services; and provides account activation and account retention services; authorization and billing inquiries, and account maintenance services; account management; credit and collections services; merchant services; analytics solutions; and ancillary services and offerings. Further Reading

WEX Frequently Asked Questions (FAQ)

When was WEX founded?

WEX was founded in 1983.

Where is WEX's headquarters?

WEX's headquarters is located at One Hancock Street, Portland.

What is WEX's latest funding round?

WEX's latest funding round is PIPE.

Who are the investors of WEX?

Investors of WEX include Warburg Pincus.

Who are WEX's competitors?

Competitors of WEX include AtoB, Benepass, Fillip, Elevate, BluePenguin and 7 more.

Loading...

Compare WEX to Competitors

Provider of fleet fueling and maintenance programs that provide customer-oriented programs to assist businesses in cost management. The company develops business applications based on individual fuel and maintenance needs including onsite inventory control and data management. The company aims to decrease its customers paperwork.

SAP Concur specializes in integrated travel, expense, and invoice management solutions within the business services sector. The company offers a suite of software products that automate the processes of submitting expenses, managing invoices, and capturing business travel details. SAP Concur was formerly known as Portable Software. It was founded in 1993 and is based in Bellevue, Washington.

HSA Bank is a financial institution that specializes in consumer-directed healthcare. The company offers a range of health account services, including Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), Health Reimbursement Arrangements (HRAs), and Commuter Benefits. These services primarily cater to individuals, employers, and partners in the healthcare sector. It was founded in 1997 and is based in Sheboygan, Wisconsin.

Coast specializes in providing fleet fuel cards and expense management solutions for various industries. Its main offerings include fuel cards that enable businesses to control and monitor fuel and other expenses with transaction alerts and customizable spending limits. It primarily serves sectors such as HVAC, plumbing, construction, pest control, roofing, solar, transportation, and landscaping. It was founded in 2020 and is based in New York, New York.

Navia Benefit operates as a consumer-directed benefits provider in health, finance, lifestyle, and compliance. The company offers a range of services including flexible spending accounts, health savings accounts, health reimbursement arrangements, commuter benefits, lifestyle benefits, retirement solutions, benefits administration, education benefits, and the consolidated omnibus budget reconciliation act (COBRA) administration. It primarily serves employers across various sectors of the economy. It was founded in 1989 and is based in Renton, Washington.

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Loading...