Xendit

Founded Year

2014Stage

Option/Warrant - II | AliveTotal Raised

$515.01MLast Raised

$16.2M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-42 points in the past 30 days

About Xendit

Xendit is a financial technology company specializing in payment solutions within the fintech sector. The company offers a range of services including a payment gateway that enables businesses to accept various payment methods, disburse funds through automated and on-demand systems, and manage operations with tools for marketplaces, financing, and mobile applications. It was founded in 2014 and is based in South Jakarta, Indonesia.

Loading...

Xendit's Products & Differentiators

xenplatform

A solution for marketplaces and platforms, where customers can manage payments for sub-merchants, franchises or different branches. The feature allows Platform businesses to more simply monetize when offering payments. Merchants can charge a flat or percentage fee that will be automatically transferred to their platform account when payment has settled. Xendit is the first company in Indonesia to provide this feature, enabling marketplaces and platforms to launch and scale very quickly. For example, Xendit’s customer launch for xenplatform saw 100,000 sub-merchants in one weekend.

Loading...

Research containing Xendit

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Xendit in 4 CB Insights research briefs, most recently on Mar 14, 2023.

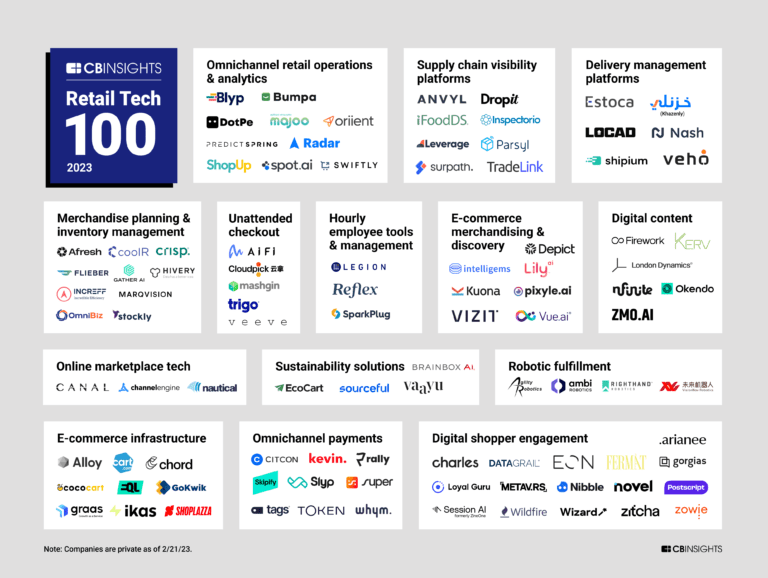

Mar 14, 2023 report

Retail Tech 100: The most promising retail tech startups of 2023

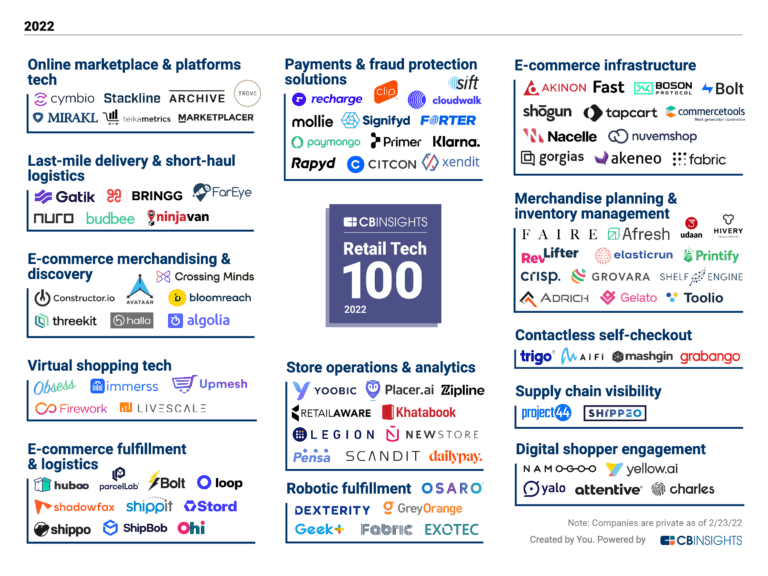

Mar 15, 2022 report

The Retail Tech 100: The top retail tech companies of 2022Expert Collections containing Xendit

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Xendit is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,396 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Retail Tech 100

100 items

The most promising B2B tech startups transforming the retail industry.

Latest Xendit News

Sep 23, 2024

The embedded finance industry in Asia-Pacific is expected to grow by 13.9% annually to reach US$73.75 billion in 2024. The embedded finance industry is expected to grow steadily over the forecast period, recording a CAGR of 28.2% from 2024 to 2029. The region embedded finance revenues will increase from US$73.75 billion in 2024 to reach US$255.49 billion by 2029. This report offers a comprehensive, data-centric analysis of the embedded finance industry. It covers lending, insurance, payment, wealth and asset-based finance sectors and provides a detailed breakdown of market opportunities and risks across various sectors. With over 75+ KPIs at the country level, this report ensures a thorough understanding of embedded finance market dynamics, market size, and forecast. The embedded finance sector in the Asia Pacific region is rapidly evolving, driven by increased digital adoption and integration into non-financial platforms. Recent innovations, strategic partnerships, and regulatory advancements are propelling growth and enhancing financial inclusion. As the region's digital economy matures, embedded finance is set to play a crucial role in shaping the future of financial services. Growth in the Embedded Finance Sector The growth of embedded finance in the Asia Pacific region has accelerated significantly over the past few months, driven by increasing digital adoption and integrating financial services into non-financial platforms. This trend is expected to continue, focusing on sub-segments such as embedded payments, lending, and insurance, as companies leverage technology to enhance customer experiences and promote financial inclusion among underserved populations. In the forthcoming few months, further expansion is anticipated as businesses increasingly acknowledge the significance of providing integrated financial solutions. This transformative process is reshaping traditional financial services into seamless, user-friendly experiences. The region's youthful demographic and rapid digital maturity are expected to drive this growth, with embedded finance becoming a vital component of the evolving digital economy in the Asia Pacific region. Key Developments in the Embedded Finance Sector Product Launches and Innovations Cashfree Payments' Embedded Payments Solution: Launched in March 2024, this solution is designed for software platforms, enabling seamless payment integration for businesses using enterprise resource planning (ERP), customer relationship management (CRM), and other SaaS applications. Finology Group's Regional Expansion: The Malaysian firm expanded its offerings to include personal loans, mortgages, and insurance, aiming to support financial inclusion by providing embedded finance solutions to financial institutions and consumer brands across the Asia Pacific. Xendit's Expansion into Thailand: In March 2024, Xendit entered the Thai market, enhancing its embedded finance and digital payment solutions, which already serve a diverse clientele across Southeast Asia, including over 6,000 clients. Strategic Partnerships Funding Societies and SGeBIZ Partnership - In April 2024, Funding Societies, a leading SME digital financing platform, entered into a strategic partnership with Singapore E-Business (SGeBIZ). As part of this collaboration, Funding Societies integrated its Buy Now, Pay Later (BNPL) solution into SGeBIZ's procurement platform. The two firms aim to provide more than 2,000 SMEs in Singapore with tailored financing solutions to help them enhance their cash flow management in the competitive market. Mergers and Acquisitions Finology Group's Acquisition of Local Fintechs: In early 2024, Finology Group, a Malaysian embedded finance firm, acquired several local fintech companies to expand its service offerings, which now include personal loans, mortgages, and insurance. This move is part of their strategy to enhance financial inclusion and support underbanked populations in the region. Xendit's Acquisition of Payment Solutions: In March 2024, Xendit, an Indonesian fintech, acquired a local payment processing company to bolster its embedded finance capabilities. This acquisition is aimed at enhancing its suite of digital payment solutions, thereby expanding its customer base across Southeast Asia. Regulatory Changes Regulators in Asia Pacific are prioritizing the digital transformation of the financial services sector, with a focus on fostering innovation while maintaining financial stability. Initiatives include: Singapore: The Monetary Authority of Singapore (MAS) launched the Sandbox Express in 2024, a fast-track option for firms to test innovative financial services within a pre-defined environment and parameters. This aims to accelerate the development and adoption of new technologies in the financial sector. Australia: The Australian government announced plans to introduce a new licensing framework for digital banks in 2024, building on lessons learned from the launch and subsequent failure of several digital banks in recent years. The new framework aims to strike a balance between encouraging innovation and mitigating risks. Strengthening Cybersecurity and Data Privacy As financial services become increasingly digitized, regulators are focused on enhancing cybersecurity measures and data privacy protections India: The Reserve Bank of India (RBI) issued guidelines in 2024 requiring banks and non-banking financial companies to implement robust cybersecurity controls, including mandatory reporting of major incidents within stipulated timelines. This aims to strengthen the resilience of the financial system against cyber threats. Japan: The Financial Services Agency (FSA) introduced new regulations in 2024 to enhance data privacy and security standards for financial institutions. This includes requirements for firms to obtain customer consent before sharing data with third parties and to implement strong encryption measures. Promoting Financial Inclusion through Embedded Finance Regulators are leveraging embedded finance to drive financial inclusion, particularly for underserved populations: Indonesia: Bank Indonesia, the central bank, partnered with e-commerce platforms in 2024 to offer embedded financial services such as digital payments and lending to small businesses. This initiative aims to expand access to financial services for the country's large unbanked and underbanked population. Philippines: The Bangko Sentral ng Pilipinas (BSP) issued guidelines in 2024 for the establishment of digital banks, with a focus on serving the unbanked and underserved segments of the population. The BSP aims to leverage digital banking to drive financial inclusion and support the growth of micro, small, and medium enterprises. These regulatory and government policies demonstrate the Asia Pacific region's commitment to harnessing the potential of embedded finance to drive innovation, enhance financial inclusion, and maintain the stability of the financial system in the face of rapidly evolving digital transformation. Key Attributes:

Xendit Frequently Asked Questions (FAQ)

When was Xendit founded?

Xendit was founded in 2014.

Where is Xendit's headquarters?

Xendit's headquarters is located at Jalan Sultan Hasanudin No.47, South Jakarta.

What is Xendit's latest funding round?

Xendit's latest funding round is Option/Warrant - II.

How much did Xendit raise?

Xendit raised a total of $515.01M.

Who are the investors of Xendit?

Investors of Xendit include Accel, Tiger Global Management, Amasia, Goat Capital, Intudo Ventures and 13 more.

Who are Xendit's competitors?

Competitors of Xendit include LinkAja, Maya Bank, Shinhan Indonesia Bank, Red Dot Payment, PayMongo and 7 more.

What products does Xendit offer?

Xendit's products include xenplatform and 4 more.

Who are Xendit's customers?

Customers of Xendit include Papaya Tree Farms, KESAN and IndonesiaPastiBisa.

Loading...

Compare Xendit to Competitors

Boost is a financial technology company offering a spectrum of digital financial services across various sectors. The company provides an application for personal finance management, business financing, and enterprise payment solutions. Boost primarily serves the e-commerce industry, and small and medium businesses, and aims to expand its footprint in the digital banking sector. It was founded in 2017 and is based in Kuala Lumpur, Malaysia.

Maya Bank is a digital financial institution offering a range of mobile financial services. The company provides an online payment account accessible through an app, which includes features such as virtual card activation, peer-to-peer transfers, bills payment, and cryptocurrency transactions. Maya Bank primarily serves individuals looking for convenient digital banking and payment solutions. Maya Bank was formerly known as Voyager Innovations. It was founded in 2013 and is based in Mandaluyong City, Philippines.

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

DOKU is a technology company that operates in the payment gateway industry. The company provides a range of services including facilitating online transactions, managing payments, and offering risk management solutions. Its primary customers are businesses, both small and large, that require digital payment solutions. DOKU was formerly known as PT. Nusa Satu Inti Artha. It was founded in 2007 and is based in Jakarta, Indonesia.

PT Bank Mayapada International Tbk is an Indonesia-based financial institution that offers services in micro banking, savings, safe box, loans, foreign exchange, certificates, bank drafts, and other banking services. It is based in Jakarta, Indonesia.

Obopay is a company that specializes in mobile money technology, operating within the financial technology sector. The company provides a secure and scalable mobile money platform, offering services such as mobile payment solutions, business transaction management, and distribution network development. Obopay primarily serves sectors such as banking, telecom, retail, and government. It was founded in 2005 and is based in Redwood City, California.

Loading...