Yapily

Founded Year

2017Stage

Incubator/Accelerator - II | AliveTotal Raised

$69.4MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-73 points in the past 30 days

About Yapily

Yapily is an open banking infrastructure platform that specializes in providing secure connectivity between customers and banks across Europe. The company offers services that enable access to financial data and the initiation of payments, aiming to facilitate the creation of personalized financial experiences. Yapily primarily serves industries such as payment services, i-gaming, accounting, lending and credit, crypto, property technology (PropTech), investing, and digital banking. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, United Kingdom.

Loading...

Yapily's Product Videos

ESPs containing Yapily

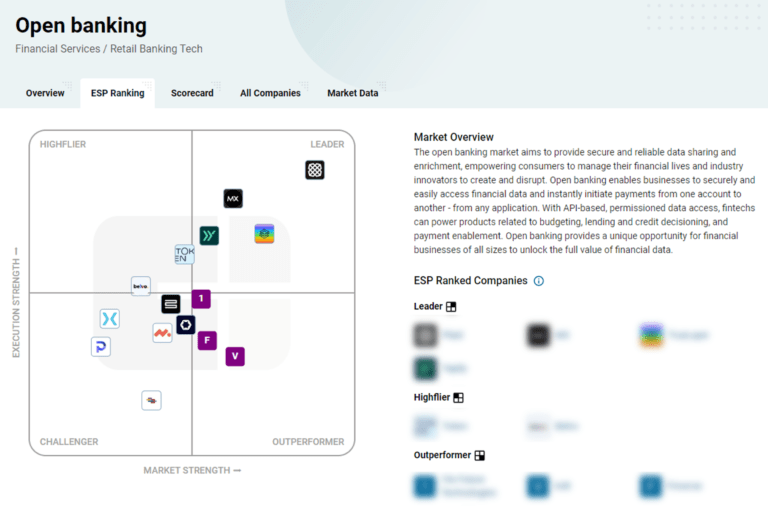

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

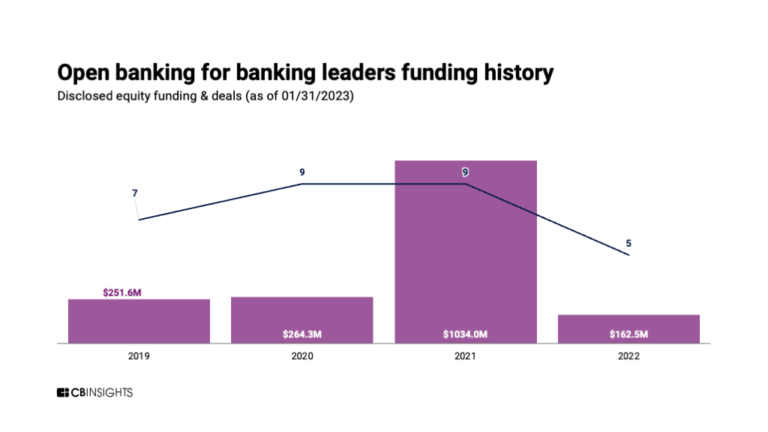

The open banking solutions market aims to provide secure and reliable data sharing and enrichment, helping consumers to manage their financial lives and industry innovators to create new products. Open banking solutions enable businesses to securely and easily access financial data and instantly initiate payments from one account to another — from any application. With API-based, permissioned data…

Yapily named as Leader among 15 other companies, including Tink, Fiserv, and Volt.

Yapily's Products & Differentiators

Payments

Yapily Payments: Single account-to-account payments from over 2000 banks across 19 markets. Used directly by merchants and platforms or PSPs offering open banking as a cheaper payment method to create better user experiences and boost conversions. Yapily Bulk (available in beta UK only): Single bulk payment to multiple recipients at once. Used by PSPs or platforms to pay suppliers, contractors, and run payroll with open banking. Yapily VRP sweeping and non-sweeping (available in beta UK only): Variable recurring payments (VRP) allows users to collect variable payments on an ongoing basis without needing to authorise each payment every single time. It offers a smarter, flexible version of direct debits and will enable businesses to offer faster checkout and manage subscription services.

Loading...

Research containing Yapily

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Yapily in 4 CB Insights research briefs, most recently on Jan 4, 2024.

Jan 4, 2024

The core banking automation market map

Expert Collections containing Yapily

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Yapily is included in 3 Expert Collections, including Fintech.

Fintech

13,396 items

Excludes US-based companies

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

979 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Latest Yapily News

Sep 9, 2024

The embedded finance industry in UK is expected to grow by 6.3% annually to reach US$6.47 billion in 2024. The embedded finance industry is expected to grow steadily over the forecast period, recording a CAGR of 19.5% from 2024 to 2029. The country's embedded finance revenues will increase from US$6.47 billion in 2024 to reach US$15.77 billion by 2029. This report offers a comprehensive, data-centric analysis of the embedded finance industry. It covers lending, insurance, payment, wealth and asset-based finance sectors and provides a detailed breakdown of market opportunities and risks across various sectors. With over 75+ KPIs at the country level, this report ensures a thorough understanding of embedded finance market dynamics, market size, and forecast. The embedded finance sector in the UK is thriving, driven by technological advances, evolving consumer expectations, and regulatory support. Recent innovations and strategic partnerships highlight the sector's dynamic growth, particularly in payments, lending, insurance, and wealth management. With ongoing regulatory changes and increased oversight, the industry is poised for continued expansion, enhancing financial integration across various platforms and improving consumer access to tailored financial services. Growth in the Embedded Finance Sector The embedded finance sector in the United Kingdom has grown substantially over the past half-year, driven by increasing consumer demand for integrated financial services in everyday applications. Segments such as embedded payments, lending, and insurance have expanded as businesses seek to enhance customer experience and engagement. The ongoing trend will persist for the next few months as more businesses enter the market and established entities enhance their services. This growth is largely driven by technological progress, evolving consumer expectations, and regulatory advancements facilitating the integration of financial services into non-financial platforms, instilling confidence in the future of the financial services market. Key Developments in the Embedded Finance Sector Product Launches and Innovations Klarna customers can now "save now, pay later" with new balance and cashback features, allowing them to store money, add funds from their bank account, and receive cashback rewards for shopping in the Klarna app. Embedded Lending Solutions - Fintechs have introduced new APIs and platforms enabling businesses to easily embed lending into customer journeys. Companies like Liberis and iwoca now offer embedded business loans and cash advances, allowing SMEs to access financing directly through their banking or accounting software. Embedded Insurance - Startups like Wrisk and Zego have launched embedded insurance products for consumers and gig workers. Wrisk's "insurance passport" allows users to manage all their insurance policies in one app. At the same time, Zego offers flexible insurance for delivery drivers and couriers that can be paused or adjusted as needed. Embedded Wealth Management - Robo-advisors like Nutmeg and Moneyfarm have partnered with digital banks and investment platforms to provide automated wealth management services. For example, Nutmeg powers the investment offering for Chase UK, allowing customers to invest directly through the bank's mobile app. Strategic Partnerships Lloyds Banking Group Joins Open Property Data Association In February 2024, Lloyds Banking Group announced its partnership with the Open Property Data Association. This collaboration promotes the adoption of open banking standards in the property sector, enabling seamless data sharing and improved financial services for homebuyers and investors. Volt and Bumper Partner for Open Banking in UK and Europe In February 2024, Volt partnered with Bumper to provide Open Banking solutions to major car dealerships in the UK and Europe. This partnership aims to streamline the car buying process by integrating financial services directly into the dealership experience. Moneyhub Named CCS's Open Banking Dynamic Purchasing System Framework Provider Also in February 2024, Moneyhub was named a supplier on the Crown Commercial Service's (CCS) Open Banking Dynamic Purchasing System framework for local government. This partnership allows Moneyhub to offer its Open Banking services to public sector organizations, enabling them to leverage financial data for improved decision-making and service delivery. Yapily and Uncapped Partner to Accelerate Secure Financial Support for Businesses In February 2024, Yapily and Uncapped announced their partnership to provide secure financial support for businesses in the EU, UK, and US. By integrating Yapily's Open Banking platform, Uncapped aims to streamline the process of accessing growth capital for SMEs. Mergers and Acquisitions Chetwood Financial Acquires CHL Mortgages In May 2024, UK digital bank Chetwood Financial acquired buy-to-let mortgage lender CHL Mortgages for Intermediaries (CMI) from Barossa Asset Purchaser Sarl. This move will enable Chetwood to grow its mortgage loan book and expand its reach within the mortgage intermediary market. CUBE Acquires Thomson Reuters Regulatory Intelligence and Oden Products In May 2024, CUBE, an Automated Regulatory Intelligence (ARI) and Regulatory Change Management (RCM) specialist announced its acquisition of the Thomson Reuters Regulatory Intelligence and Oden products and businesses. This acquisition expands CUBE's global customer base to approximately 1,000 customers across regulated industries. HPS Agrees to Acquire CR2 In May 2024, HPS, a global provider of payment software and solutions, agreed to acquire CR2, a digital banking and payments software company in Ireland. CR2 is known for its innovative digital banking and payment solutions, powering 90+ banks across more than 50 countries. FE fundinfo Acquires Dericon Also in May 2024, FE fundinfo, a financial data company, announced the acquisition of Dericon, a FinTech in Germany's wealth management industry. This partnership will enable FE fundinfo's clients to have direct access to one of the largest distribution channels for asset managers in Germany while growing the company's capabilities in the region. Regulatory Changes Consumer Duty Regulation - The UK's Consumer Duty regulation has been a significant focus to ensure transparency and fairness in financial services. This regulation requires fintech companies to communicate their offerings and ensure that consumers understand the products they engage with. The Consumer Duty is expected to shape how embedded finance products are designed and marketed, emphasizing consumer protection and responsible lending practices. Financial Conduct Authority (FCA) Scrutiny - The FCA has heightened oversight of embedded finance providers to ensure consumer protection standards, which poses challenges for fintech companies. This proactive approach promotes innovation while maintaining secure and fair financial services for users. Open Banking Initiatives - The UK government supports Open Banking initiatives, integrating financial services into non-financial platforms, fostering competition and innovation in the financial sector. This benefits consumers with more personalized and accessible financial products. Ongoing Open Banking regulation evolution is expected to drive embedded finance solutions growth across industries. Reasons to buy In-depth Understanding of Embedded Finance Market Dynamics: Understand market opportunities and key trends along with forecast (2019-2028). Insights into Opportunity by end-use sectors - Get market dynamics by end-use sectors to assess emerging opportunity across various end-use sectors. Develop Market Specific Strategies: Identify growth segments and target specific opportunities to formulate embedded finance strategy; assess market specific key trends, drivers, and risks in the industry. Get Sector Insights: Drawing from proprietary survey results, this report identifies opportunities across embedded lending, embedded insurance, embedded finance, and embedded wealth sectors. Get insights at segment level, by the distribution model and by business model in key embedded finance segments Insights into the asset based finance market size and by type of assets, by end users. Key Attributes:

Yapily Frequently Asked Questions (FAQ)

When was Yapily founded?

Yapily was founded in 2017.

Where is Yapily's headquarters?

Yapily's headquarters is located at 86-90 Paul Street, London.

What is Yapily's latest funding round?

Yapily's latest funding round is Incubator/Accelerator - II.

How much did Yapily raise?

Yapily raised a total of $69.4M.

Who are the investors of Yapily?

Investors of Yapily include Tech Nation Future Fifty, HV Capital, Lakestar, Sapphire Ventures, Latitude and 8 more.

Who are Yapily's competitors?

Competitors of Yapily include Finix, Bud, Railsr, Bond, Fabrick and 7 more.

What products does Yapily offer?

Yapily's products include Payments and 4 more.

Who are Yapily's customers?

Customers of Yapily include Intuit Quickbooks, Juni and Yonder.

Loading...

Compare Yapily to Competitors

Fabrick is a open finance platform. The company offers payment solutions that enable and foster a fruitful exchange between players that discover, collaborate, and create solutions for end customers. Fabrick was founded in 2018 and is based in Biella, Italy.

Plaid operates as a technology company that focuses on providing a data network for fintech solutions. The company offers a suite of products that enable secure and easy connection of financial accounts to various applications and services. Plaid primarily serves the financial technology industry, including personal finance, lending, and wealth management sectors. Plaid was formerly known as Plaid Technologies. It was founded in 2013 and is based in San Francisco, California.

TrueLayer provides an open banking platform, specializing in the financial technology sector. The company provides solutions for instant bank payments, verified payouts, and streamlined user onboarding, leveraging real-time financial and identity data. TrueLayer primarily serves businesses in the ecommerce, iGaming, financial services, and cryptocurrency sectors. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, England.

Railsr operates as a banking and compliance platform. It connects together a global network of partner banks with companies offering embedded banking and wallets known as banking-as-a-service, embedded rewards known as reward-as-a-service, embedded cards known as cards-as-a-service, and embedded credit known as credit-as-a-service. Railsr was formerly known as Railsbank. The company was founded in 2016 and is based in London, United Kingdom.

Leveris has developed an end-to-end platform to allow financial institutions and fintech startups such as digital-only banks or challenger banks to run their services.

Teller is a company that focuses on providing API solutions for bank accounts in the financial technology sector. Their main service involves offering an easy-to-use API that allows users to connect their bank accounts to applications, enabling account verification, money transfers, payments, and transaction viewing. The company primarily serves the financial technology industry. It was founded in 2014 and is based in London, England.

Loading...