Zeta

Founded Year

2015Stage

Series C - II | AliveTotal Raised

$303MValuation

$0000Last Raised

$30M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+14 points in the past 30 days

About Zeta

Zeta is a company that focuses on providing next-generation credit card processing solutions in the financial technology sector. The company offers a comprehensive range of services including processing, issuing, lending, and core banking, all of which are designed to help banks and financial institutions launch digital credit, debit, and prepaid cards. Zeta primarily serves the financial technology industry. It was founded in 2015 and is based in San Francisco, California.

Loading...

Loading...

Research containing Zeta

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zeta in 1 CB Insights research brief, most recently on Aug 22, 2022.

Expert Collections containing Zeta

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zeta is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Digital Lending

2,374 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

763 items

Zeta Patents

Zeta has filed 11 patents.

The 3 most popular patent topics include:

- battery types

- electrochemistry

- lithium-ion batteries

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/27/2020 | 7/23/2024 | Artificial neural networks, Image processing, Artificial intelligence, Machine learning, Open formats | Grant |

Application Date | 8/27/2020 |

|---|---|

Grant Date | 7/23/2024 |

Title | |

Related Topics | Artificial neural networks, Image processing, Artificial intelligence, Machine learning, Open formats |

Status | Grant |

Latest Zeta News

Aug 30, 2024

The Bengaluru-based company has a presence in Dubai, the UK, North America, Latin America, Europe and Asia. In 2021, the company shared plans to expand in eastern Europe, and in Southeast Asia, Japan and Africa by 2023. “We initially started in India and then shifted our focus to the US, where we secured several new contracts. This shift was partly because we were building our playbooks and delivery capacity along the way," he said. Turakhia said in that capacity, the company could not accommodate the growing contract volumes in both the US and India. During this period, Zeta built its digital credit-as-a-service stack and now plans to prioritise growth in this segment. The service allows users to access pre-approved credit through their UPI-linked accounts. The Zeta chief said that with a separate team in the US, the company will continue its operations with a focus on credit cards and loan management systems. “Zeta is among the first ones to enter this (credit on UPI) segment, but there are more companies that are in the pipeline," said a fintech investor on the sidelines of GFF. “Credit on UPI is a great proposition as long as the underwriter is a regulated entity. While Zeta is taking one route, it will be exciting to see what new use-cases will come up." Founded in April 2015 by serial entrepreneur Turakhia and Ramki Gaddipati, Zeta provides banks with the infrastructure to create digital products that enhance user experience. The company looks at four verticals - transaction card processing, core banking, loan management and digital banking. Zeta’s India business reported an almost 33% increase in operating revenue to ₹816.20 crore in FY23, helping it swing to a profit of ₹21.94 crore from a loss of ₹20.7 crore in the year before. The company is yet to report its FY24 financials. Plans with credit on UPI Turakhia said Zeta plans to onboard a majority of banks approved by the National Payments Corporation of India, which operates retail payment and settlement systems including UPI, and the Reserve Bank of India to leverage credit lines on UPI. Zeta will target NBFCs once the regulators open it up to this segment. The company recently announced a partnership with HDFC Bank to power its Credit Line on UPI (CLOU) offerings. “While we've onboarded one bank in India for credit on UPI, they haven't launched yet. There's a planned launch process, and we're working towards its implementation," he said. Mint reported earlier that Zeta estimates transaction volumes on this scheme will exceed $1 trillion by 2030 and aims to capture about half of this market.

Zeta Frequently Asked Questions (FAQ)

When was Zeta founded?

Zeta was founded in 2015.

Where is Zeta's headquarters?

Zeta's headquarters is located at San Francisco.

What is Zeta's latest funding round?

Zeta's latest funding round is Series C - II.

How much did Zeta raise?

Zeta raised a total of $303M.

Who are the investors of Zeta?

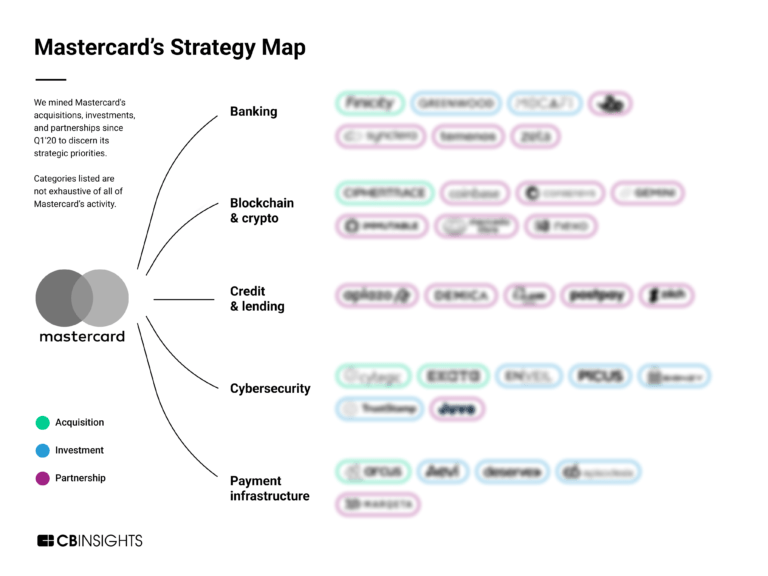

Investors of Zeta include Mastercard, Sodexo Ventures, SoftBank, MasterCard Start Path and Directi Web Technology.

Who are Zeta's competitors?

Competitors of Zeta include Apto and 7 more.

Loading...

Compare Zeta to Competitors

Unit develops financial infrastructure for banking and lending solutions. The company offers a platform that enables technology companies to build banking and lending products, including features such as bank accounts, physical and virtual cards, payments, and lending services. Its dashboard and suite of application programming interface (API), software development kit (SDK), and white-labeled user interface (UI) enable developers to build financial features into their products. It was founded in 2019 and is based in New York, New York.

Apto is a financial technology company that operates in the cards and payments industry. The company provides a platform that enables businesses to design and launch card programs, including physical debit cards, virtual cards, corporate cards, and crypto cards. Apto primarily serves the fintech industry. Apto was formerly known as Shift Payments. It was founded in 2014 and is based in San Francisco, California.

Treasury Prime is an embedded banking platform that specializes in connecting businesses with a network of banks and financial service providers. Their main offerings include API banking integrations that enable companies to develop and launch financial products such as FDIC insured accounts, payment processing solutions, and debit card issuance. Treasury Prime's platform is designed to support compliance program integration and multi-bank operations, facilitating the creation of investment vehicles and instant payout ecosystems for various industries. It was founded in 2017 and is based in San Francisco, California.

LendingUSA is a fintech company that operates in the financial services industry. The company provides point-of-need financing solutions, offering merchants and borrowers a seamless financing experience with quick loan decisions, promotional financing terms, and low monthly payment options. It primarily serves sectors such as medical, pet services, funeral, sporting goods, legal, and tax resolution. It was founded in 2015 and is based in Sherman Oaks, California.

HighNote focuses on providing digital solutions in the presentation and proposal creation industry. It's tool allows users to create presentations by simply dragging and dropping existing materials such as documents, websites, and video links, which are then formatted into a visually appealing presentation. It primarily serves professionals in sales, marketing, and consulting across various industries. It was founded in 2020 and is based in San Francisco, California.

Highnote is a modern card platform specializing in embedded finance experiences within the financial technology sector. The company offers an all-in-one issuer processor platform that enables businesses to issue virtual and physical payment cards, manage customer transactions, and ensure compliance with ease. Highnote primarily serves digital enterprises looking to integrate payment solutions and enhance customer loyalty and revenue. Highnote was formerly known as Bay1, Inc.. It was founded in 2020 and is based in San Francisco, California.

Loading...