Zilch

Founded Year

2018Stage

Debt - II | AliveTotal Raised

$516.56MValuation

$0000Last Raised

$127.36M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+39 points in the past 30 days

About Zilch

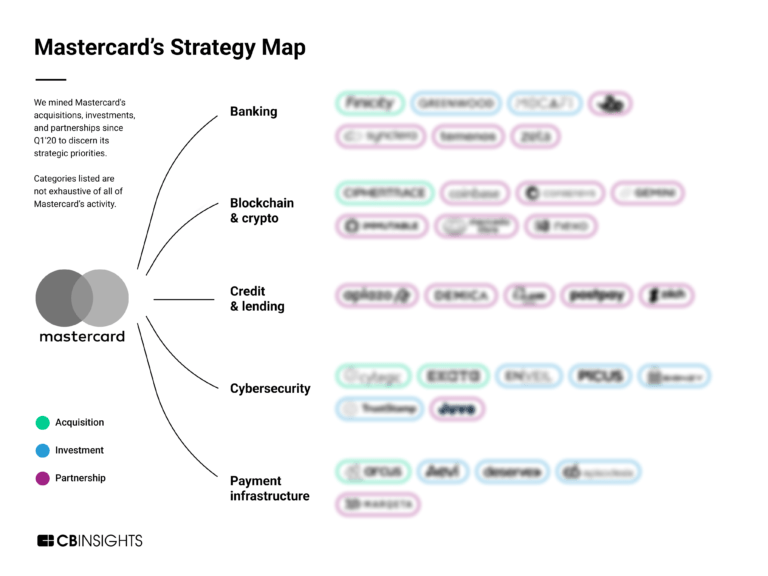

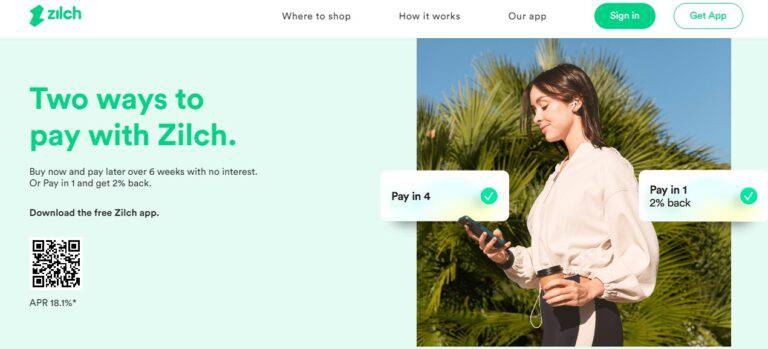

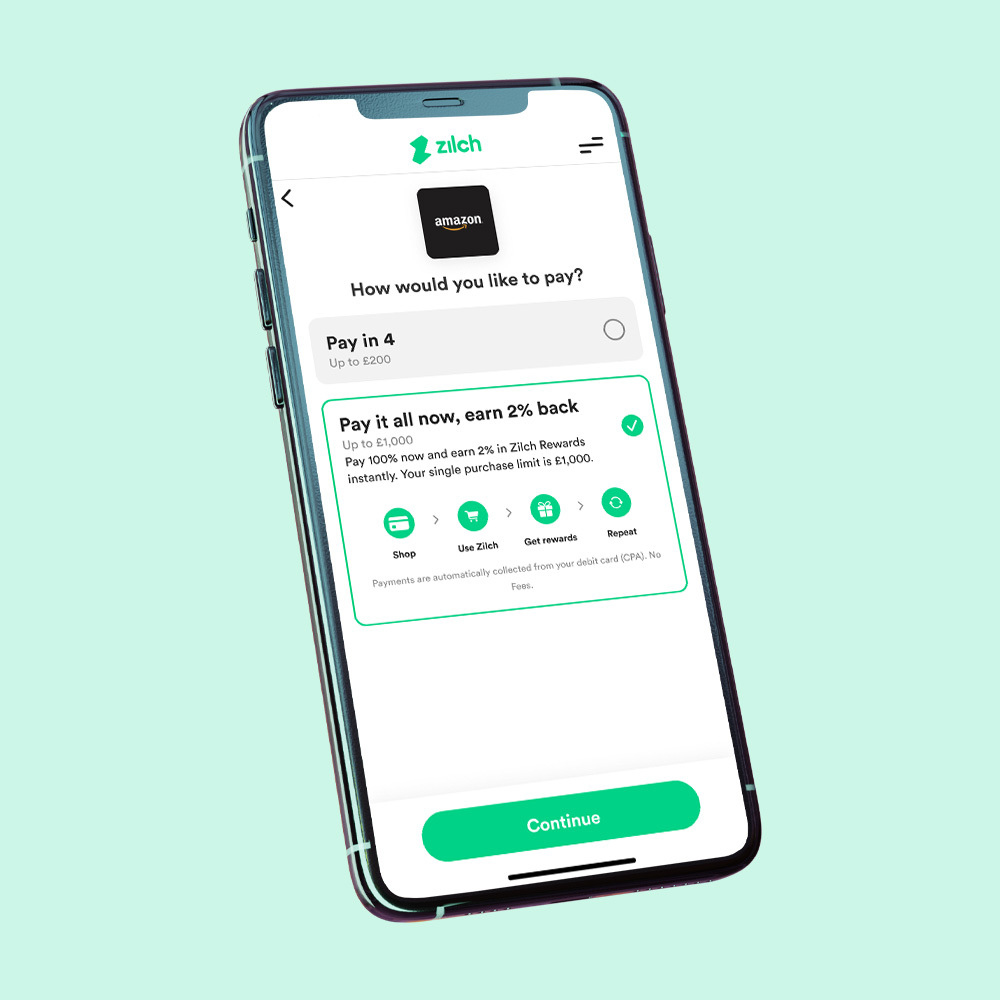

Zilch is a financial services company specializing in consumer credit and payment solutions. The company offers a 'Buy Now, Pay Later' service that allows customers to make purchases and pay for them over a six-week period in four installments, with the option to pay upfront and receive cashback rewards. Zilch provides a virtual Mastercard to facilitate transactions and promotes responsible spending with features like payment notifications and tailored spending limits. It was founded in 2018 and is based in London, United Kingdom.

Loading...

Zilch's Product Videos

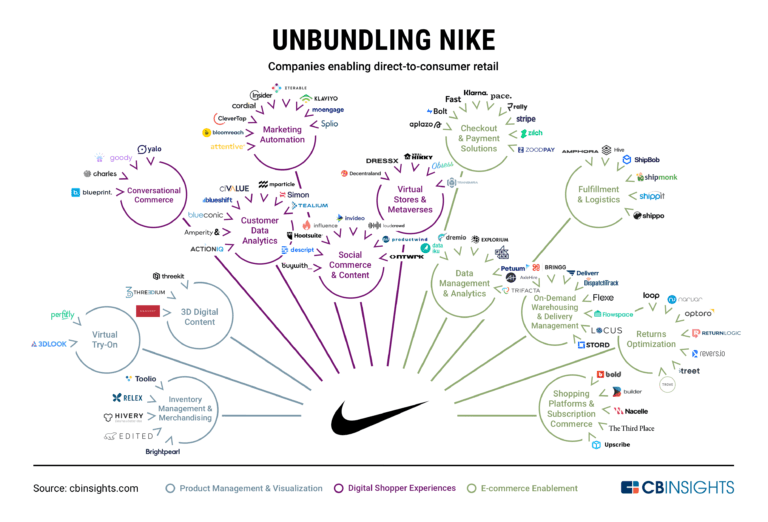

ESPs containing Zilch

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

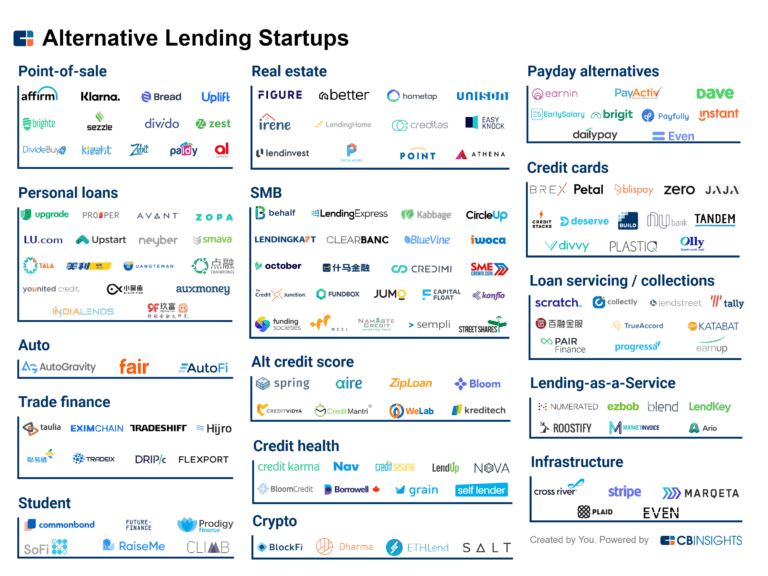

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Zilch named as Outperformer among 15 other companies, including PayPal, Affirm, and Klarna.

Zilch's Products & Differentiators

Pay in 1

Pay online or Tap & Pay anywhere in one and receive immediate cash back

Loading...

Research containing Zilch

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zilch in 5 CB Insights research briefs, most recently on Aug 22, 2022.

Expert Collections containing Zilch

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

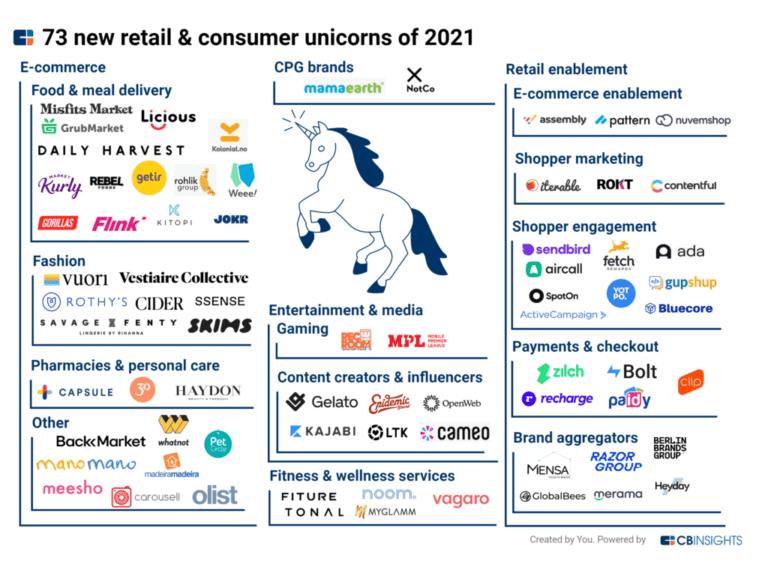

Zilch is included in 6 Expert Collections, including E-Commerce.

E-Commerce

11,249 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,244 items

Digital Lending

2,470 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,034 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,398 items

Excludes US-based companies

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Zilch Patents

Zilch has filed 5 patents.

The 3 most popular patent topics include:

- banking technology

- debit cards

- interbank networks

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/4/2009 | 9/22/2009 | Grant |

Application Date | 3/4/2009 |

|---|---|

Grant Date | 9/22/2009 |

Title | |

Related Topics | |

Status | Grant |

Latest Zilch News

Sep 3, 2024

Zilch turns profitable within just four years post-launch. CEO announces $130m (£100m) annual revenue run rate — 100% YoY growth. Mark Wilson, former CEO of Aviva and AIA and current BlackRock Board member, joins Zilch’s Board. Rapid revenue growth beats average UK and US tech industry growth by over 10 years. LONDON–(BUSINESS WIRE)–Zilch, the world’s first ad-subsidised payments network (ASPN), today announced its first month of operating profit while surpassing a revenue run rate of more than $130m (£100m). The business has reached these milestones within just four years of launching its groundbreaking consumer payment platform. Zilch also announced the appointment to its Board of Mark Wilson, former CEO of Aviva and AIA and current member of BlackRock’s Board of Directors. Zilch achieved both operating profit and surpassed $130 million revenue run rate in July 2024. The speed at which Zilch has achieved profitability places it in the same bracket as European fintech giants such as Revolut, Starling Bank, and Monzo. All four companies also reported revenues in excess of $130 million within three to five years1, with Zilch almost doubling revenues in the year to March 2024. By comparison, industry data shows that it takes the average tech company 8-10 years in the US to break through the $100m revenue ceiling, 15 years in Europe and 17 years in the UK.2 Philip Belamant, CEO and co-founder of Zilch, said: “This milestone fundamentally changes the game for us. Profitability is something that a lot of fast-growing businesses are struggling to achieve, and I am hugely proud of the team for reaching this mark, ahead of plan. While many have cut their way to profit, we’ve doubled our revenue year on year, expanded our team, saved our 4 million customers over half a billion dollars in fees and interest costs, and generated over $3 billion in new sales for merchant partners through our ad-subsidised payments network.” “In a market saturated with competition, we’ve distinguished Zilch from inception by owning the customer relationship, pioneering regulation, and generating real credit profiles, savings, and value for customers where others haven’t. We’re hugely optimistic about the future, all the while recognising that this is our day 1 and it’s all ahead of us.” Zilch is leveraging AI to unlock the full potential of four years of first-party consumer data and drive even more precise, personalised offerings. A deep understanding of users’ needs allows Zilch to convert sales better than any online platform to date – converting sales for advertisers up to 10-20 times more effectively than traditional search and social platforms. As a result, customers now open their Zilch app daily, which creates unrivalled engagement and conversion – all of which continues to drive major merchants to switch their ad budgets to Zilch’s ad-subsidised payments network, in turn fuelling better deals, discounts, and subsidies for customers. Zilch’s remarkable performance accelerates the fintech’s momentum as the business eyes even greater milestones in 2025. Commenting on his new appointment to the Board of Zilch, Mark Wilson, said: “I am excited to join Zilch at this critical juncture. Under Philip’s visionary leadership, Zilch is transforming consumer finance with an innovative and responsible approach that lowers customer finance costs and fills a fast-growing need in society. I look forward to working alongside the Board to further help Zilch steer its path toward sustainable success as a category leader.” Chairman of Zilch, Serge Belamant, remarked: “As Zilch’s Chair, I am delighted Mark has made this commitment as the value he will add will complement the expertise we currently have and help guide the company in its mission to provide affordable credit and rewarding debit for all as part of its financial inclusion vision. Mark’s deep expertise running global financial businesses will be a tremendous asset as Zilch continues its rapid trajectory, profitable growth, and market expansion.” Background and notes. Today’s announcement follows the launch of the company’s second longer-duration zero-interest ‘Pay over 3 Months’ credit payment product; the creation of the Unicorn Council for UK FinTech, where Philip Belamant acts as founding co-chair; the selection of Checkout.com as Zilch’s primary acquiring partner globally; the extension of Zilch’s collaboration with Amazon Web Services to accelerate the rollout of its AI innovation; surpassing the milestone of 4 million registered customers; and raising $125 million in a securitised debt financing arranged by Deutsche Bank. Zilch’s vision is to eliminate the high cost of consumer credit. For good. Zilch is a multi-award-winning pioneer of the world’s first direct-to-consumer, ad-subsidised payments network (ASPN). Leveraging its unique, vertically integrated, first-party-data business model, Zilch sets itself apart from the incumbent fintech industry with a profitable global revenue source, bringing unrivalled value to customers and marketers alike. Today Zilch is revolutionising the $50 trillion advertising and payments industries by merging the very best of debit, credit, and savings. Co-founded by Philip Belamant, Sean O’Connor, and Serge Belamant, Zilch provides millions of customers the freedom to go anywhere in the world (online or offline) and, when they pay, earn up to 5% cashback & rewards on debit payments (‘Pay Now’) or spread interest-free credit repayments over six weeks or three months. In the process, Zilch helps customers build their credit profiles with the major credit agencies. Within 44 months of launch in 2020, Zilch amassed more than 4 million registered customers. In September 2024, four years after its public launch, Zilch announced that in July 2024 it had achieved first-month profitability in record time while surpassing $130 million of revenue run rate, keeping pace with European fintech giants like Revolut, Starling Bank, and Monzo. In 2023, Zilch launched its proprietary ASPN service, which allows merchants worldwide instant connection with Zilch’s first-party-data, closed-loop network of millions of high-intent customers, while offering customers personalised savings, deals, and discounts codified to their habitual daily spend. In January 2023, Zilch struck a ground-breaking reporting agreement with the UK’s prime credit reference agencies, transforming the UK lending ecosystem by enabling all adults to build their credit records using interest-free credit rather than high-cost revolving credit products. Since April 2020, Zilch has been regulated by the Financial Conduct Authority (FCA), obtaining a consumer credit licence through the Regulatory Sandbox Programme. Driven by innovation and a commitment to excellence, Zilch is setting new benchmarks in the industry to create a more inclusive and efficient ecosystem, empowering millions of users to budget and manage their financial lives more effectively and transparently. For more information, visit: www.zilch.com . Contacts For any Press & Media enquiries, please contact: zilch@hawthornadvisors.com

Zilch Frequently Asked Questions (FAQ)

When was Zilch founded?

Zilch was founded in 2018.

Where is Zilch's headquarters?

Zilch's headquarters is located at 111 Buckingham Palace Road, London.

What is Zilch's latest funding round?

Zilch's latest funding round is Debt - II.

How much did Zilch raise?

Zilch raised a total of $516.56M.

Who are the investors of Zilch?

Investors of Zilch include Deutsche Bank, eBay Ventures, Gauss Ventures, Ventura Capital, Goldman Sachs Asset Management and 6 more.

Who are Zilch's competitors?

Competitors of Zilch include Klarna and 7 more.

What products does Zilch offer?

Zilch's products include Pay in 1 and 2 more.

Loading...

Compare Zilch to Competitors

Klarna specializes in providing payment solutions and services within the e-commerce sector. The company offers a platform for online shopping that includes price comparisons, deals, and various payment options to facilitate purchases for consumers. Klarna primarily serves the e-commerce industry by enabling a seamless shopping experience through its payment and financing services. It was founded in 2005 and is based in Stockholm, Sweden.

SplitIt operates as a buy now pay later (BNPL) payments company. It provides a merchant-branded, installments-as-a-service platform that allows merchants to offer their customers the option to pay for purchases over a fixed number of installments, with no interest or fees. It serves industries such as automotive, education, travel, and more. The company was formerly known as PayItSimple. It was founded in 2009 and is based in Atlanta, Georgia.

PayItLater is a financial services company specializing in deferred payment solutions for the e-commerce sector. The company offers consumers the ability to make online purchases and pay for them over time through interest-free installment plans, with instant credit approvals and no impact on credit scores. PayItLater also provides merchants with plugins for major e-commerce platforms, enabling them to offer live deferred payments to customers. It is based in New South Wales, Australia.

Butter is a company that focuses on financial services in the ecommerce sector. It offers a service that allows customers to make online purchases and pay for them over time, including for items such as travel, fashion, tech, and home goods. The company primarily serves the ecommerce industry. Butter was formerly known as Awaymo. It was founded in 2017 and is based in London, England.

Payl8r specializes in providing flexible payment options for customers, operating in the financial services sector with a focus on buy now, pay later (BNPL) solutions. The company offers a range of financing products that allow consumers to make purchases online and in-store and pay over time, including short-term interest-free loans and longer-term financing plans. Payl8r serves various industries, including eCommerce, beauty and aesthetics, fitness, and professional services, by offering tailored finance solutions. It was founded in 2014 and is based in Manchester, England.

GenoaPay was a financial services company specializing in payment solutions within the consumer finance sector. The company offered a payment plan service that allowed customers to make purchases and spread the cost over 10 weekly installments without incurring fees or interest. GenoaPay primarily served the retail sector, providing merchants with tools to increase sales and customer acquisition by offering flexible payment options. It is based in Auckland, New Zealand.

Loading...