Zopa

Founded Year

2005Stage

Debt | AliveTotal Raised

$857.33MLast Raised

$93M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-14 points in the past 30 days

About Zopa

Zopa is a financial services company focused on providing fair and honest financial products. The company offers peer-to-peer lending, intelligent investments, fixed-term savings, and credit cards designed to empower customers to take control of their finances. Zopa primarily serves individuals seeking to borrow or save money. It was founded in 2005 and is based in London, United Kingdom.

Loading...

Zopa's Products & Differentiators

a

a

Loading...

Research containing Zopa

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zopa in 2 CB Insights research briefs, most recently on Nov 17, 2022.

Expert Collections containing Zopa

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zopa is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Fintech 100

248 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

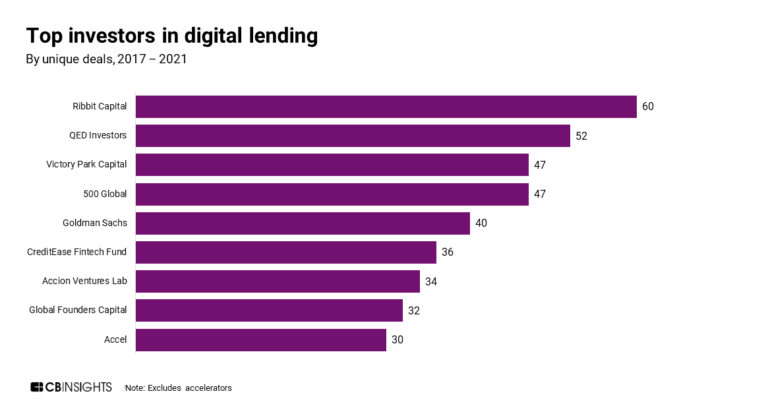

Digital Lending

2,273 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

13,396 items

Excludes US-based companies

Latest Zopa News

Sep 16, 2024

Share this post: The achievement reflects the convenience, accessibility and competitive rates offered with Zopa Bank’s award-winning savings accounts. Zopa Bank offers easy access, boosted pots (Smart Saver), fixed term savings, and ISA (Smart ISA) accounts that allow customers to choose the interest rate and access requirements that best suit their needs. Customers can build a savings habit by setting up Zopa’s auto-save functionality, choosing a regular date and amount to automatically transfer into their primary Zopa savings pot. Zopa Bank’s Smart ISA has been a key driver in achieving the £5bn deposits mark, notably taking a significant percentage of the £12.3 billion of inflows into ISA accounts in April 2024. This milestone comes after Zopa announced its first full year of profitability earlier this year. The bank now has 1.3 million users and continues to grow its customer base at 30% year-on-year. In May, Zopa partnered with Octopus Energy to enter the renewable energy market with a specialised BNPL offering for solar panels EV chargers. Zopa’s savings products have also won multiple awards in 2024, including: Best Savings App, Best Fixed Rate Cash ISA Provider, and Personal Savings Provider of the Year at the Moneynet Awards 2024 Best App Based Savings Provider at MoneyComms 2024 Highly Commended for Best Savings Provider at the British Bank Awards 2024 Commended for App Only Savings Provider of the Year at the Moneyfacts Consumer Awards 2024 Companies In This Post Fintech News Fintech Fintech Events

Zopa Frequently Asked Questions (FAQ)

When was Zopa founded?

Zopa was founded in 2005.

Where is Zopa's headquarters?

Zopa's headquarters is located at Tooley Street, London.

What is Zopa's latest funding round?

Zopa's latest funding round is Debt.

How much did Zopa raise?

Zopa raised a total of $857.33M.

Who are the investors of Zopa?

Investors of Zopa include Silverstripe, Augmentum Fintech, Davidson Kempner Capital Management, IAG Capital Partners, Northzone and 16 more.

Who are Zopa's competitors?

Competitors of Zopa include Prosper and 6 more.

What products does Zopa offer?

Zopa's products include a.

Loading...

Compare Zopa to Competitors

Avant is a financial technology company that specializes in providing personal loans and credit cards. The company offers a range of financial solutions designed to help individuals manage their finances and achieve their personal goals. Avant primarily serves consumers looking for credit and loan products to support their financial needs. It was founded in 2012 and is based in Chicago, Illinois.

Auxmoney offers a credit marketplace connecting borrowers and investors. Its platform is where private and institutional investors directly invest in approved borrowers of different score classes. It provides loans available to more people while enabling investors to benefit from risk-adjusted returns. The company was founded in 2007 and is based in Dusseldorf, Germany.

Zirtue offers a relationship-based lending application that aims to drive financial inclusion. It provides funds through relationship-based loans. It offers peer lending and borrowing. The company was founded in 2018 and is based in Dallas, Texas.

Achieve offers digital financial solutions. Its services include home equity loans, personal loans and debt resolution, and financial education. It caters to individuals and families. Achieve was formerly known as Freedom Financial Network. It was founded in 2002 and is based in Scottsdale, Arizona.

Lendable is a lending platform operating in the financial services industry. The company offers loans using technology to streamline the traditional loan application process, providing instant decisions, personalized rates, and fund transfers. It primarily serves individuals, including those with credit histories. Lendable was formerly known as Feather Media. It was founded in 2014 and is based in London, United Kingdom.

Prosper operates as a financial technology company. The company offers a range of financial solutions including personal loans, credit cards, and home equity lines of credit, which are designed to support customers in consolidating debt, financing home improvements, covering healthcare costs, and enhancing their financial well-being. Prosper primarily serves individuals across the credit spectrum, providing them with affordable financial solutions. Prosper was formerly known as Auto Quick Invest. It was founded in 2005 and is based in San Francisco, California.

Loading...