Aspire

Founded Year

2018Stage

Series C | AliveTotal Raised

$300.18MLast Raised

$100M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-34 points in the past 30 days

About Aspire

Aspire develops a full-stack operating financial operation system. It enables accounting, payment, lending, expense management, and more. It provides business credit lines to help solve their working capital needs. It offers users access to funding and financial tools to manage bank accounts, credit cards, invoicing, and expenses among others. The company was founded in 2018 and is based in Singapore.

Loading...

Aspire's Products & Differentiators

Incorporation

Simple and 100% digital incorporation

Loading...

Research containing Aspire

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Aspire in 3 CB Insights research briefs, most recently on Mar 29, 2024.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Aspire

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Aspire is included in 4 Expert Collections, including Digital Lending.

Digital Lending

2,231 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

1,231 items

Fintech

13,228 items

Excludes US-based companies

Fintech 100

100 items

Latest Aspire News

Jul 30, 2024

get one of these certificates each year, while holders of the Hilton Honors American Express Surpass® Card can earn one by spending $15,000 on the card in a calendar year. My husband and I each carry both the Aspire and the Surpass, allowing us to rack up four certificates each year. When I spotted three consecutive nights available at standard rates at Pedregal this past May, I quickly applied three certificates to maximize their value. Doing so allowed me to hang onto 360,000 Hilton points — which I figured I could use in part for two more nights at a less-expensive Hilton property — and book a room that would have cost over $5,700 for three nights in cash. Instead of going ahead and locking in the last two nights elsewhere, though, I took a gamble. Knowing that many Hilton hotels — Pedregal included — tend to make rooms available at standard rates at the last minute, I decided to hold off on booking anything and instead checked Pedregal's availability daily. My persistence paid off: On the flight to Mexico, the last two nights finally opened up at standard rates, and I was able to use our last certificate and 120,000 points to grab them. By the time we arrived at the hotel, we were all set for a free five-night stay. 2. We used credits to cover airfare, taxes and fees We chose United flights to and from Mexico, and in order to pay as little for them out of pocket as possible, we got creative. For the way down, we chose to use 20,000 United MileagePlus miles — discounted from 24,900 because I hold United Premier Gold status — and pay $48 in taxes for award tickets instead of paying $304 for revenue tickets. Advertisement I already had 10,000 MileagePlus miles in my account. To get to 20,000 for my husband's ticket, we transferred 10,000 Bilt Rewards points earned with the Bilt Mastercard® to my United account so that I could book at the reduced rate. I then transferred 20,000 Chase Ultimate Rewards points earned through a combination of spending on the Chase Sapphire Preferred® Card and Ink Business Preferred® Credit Card to United to book my own ticket. The Hilton Honors Aspire has a great new perk that helped us cover the $48 per person in award ticket fees. Each quarter, cardholders receive up to $50 in statement credits for eligible flight purchases made directly with an airline or through amextravel.com, so we each used our own card to trigger the credit. After running down our points balances for the outbound flight, I decided to leverage other credits for the $334-per-person return leg, also on United. I'm a Capital One Venture X Rewards cardholder, meaning I get a $300 annual credit for bookings made through Capital One Travel. The credit covered all but $34 of the ticket price, but since it was a travel charge, it was eligible for removal with Capital One's "Purchase Eraser" feature; I used 3,400 Capital One miles to wipe the remaining balance off my statement. My husband had about $130 in travel credits with United already from a previously canceled ticket, so he applied those toward his ticket home from Cabo. I charged the remaining balance to my United Quest℠ Card to earn three miles per dollar; at the time, I was also working toward a spending bonus on the card to earn extra Premier Qualifying Points, which help secure elite status for the following year. Business Insider's Pick for the Best travel credit card Chase Sapphire Preferred® Card Carly Helfand is a points and miles blogger and coach who's been using points to travel to 52 cities in every calendar year since 2011. She’s also a full-time financial journalist who got her start in the business reporting world while earning her master's at Northwestern University's Medill School of Journalism. In 2017, she founded a blog and online course devoted to sharing the strategies she’s used to see the cherry blossoms in Tokyo, trek to Machu Picchu, sundown in the Maldives and more without spending a dime on airfare.When not traveling, Carly prefers watching pro hockey to nearly everything. She also plays the Irish fiddle. You can connect with her at 52citiesblog.com or on Instagram at @carlyhelfand. Read more Read less My husband and I both have two Hilton cards, which we used to get free nights at a resort. I took a gamble on standard rate rooms opening up last minute at the resort, and it paid off. By transferring points and being strategic about how we paid, our flights were also covered. Sign up to get the inside scoop on today’s biggest stories in markets, tech, and business — delivered daily. Read preview Thanks for signing up!

Aspire Frequently Asked Questions (FAQ)

When was Aspire founded?

Aspire was founded in 2018.

Where is Aspire's headquarters?

Aspire's headquarters is located at 158 Cecil Street, Singapore.

What is Aspire's latest funding round?

Aspire's latest funding round is Series C.

How much did Aspire raise?

Aspire raised a total of $300.18M.

Who are the investors of Aspire?

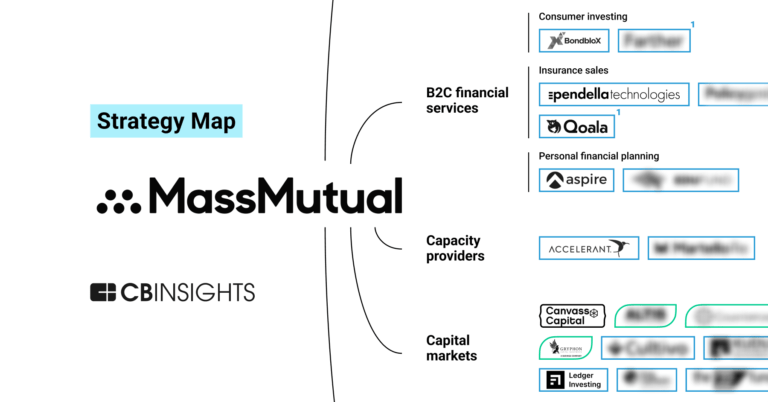

Investors of Aspire include Picus Capital, MassMutual Ventures, LGT Capital Partners, Lightspeed Venture Partners, PayPal Ventures and 24 more.

Who are Aspire's competitors?

Competitors of Aspire include Funding Societies and 4 more.

What products does Aspire offer?

Aspire's products include Incorporation and 4 more.

Loading...

Compare Aspire to Competitors

InvoiceInterchange is a company that focuses on providing invoice finance solutions, operating within the financial services industry. The company offers services that allow businesses to unlock cash flow by advancing the funds owed to them in outstanding invoices, providing options for selective invoice financing, contract financing, and whole ledger financing. Primarily, InvoiceInterchange caters to small and medium-sized enterprises (SMEs) in need of flexible and simple invoice financing solutions. It is based in Singapore.

RABC is a high-tech enterprise specializing in R&D, production, manufacturing, sales, and service of various solid-state power lithium batteries.

CrediLinq.Ai develops a credit lending platform powered by its proprietary artificial intelligence and machine learning algorithms. It aims to create a digital platform for businesses to get quicker access to growth capital. It primarily caters to the e-commerce industry, providing tools for both buyers and sellers. It was founded in 2020 and is based in Singapore.

Investree is a marketplace lending platform that provides digital business solutions and financing options for small and medium enterprises (SMEs). The company offers working capital loans and investment opportunities with measured risks to both borrowers and lenders, focusing on supply chain finance products without the need for fixed asset collateral. Investree primarily serves the financial technology sector, with a mission to foster financial inclusion for SMEs. It was founded in 2015 and is based in Jakarta Selatan, Indonesia.

C2FO focuses on providing working capital solutions in the financial sector. The company offers services that allow businesses to get their invoices paid early, providing fast and flexible access to low-cost capital. This is achieved through their patented name-your-rate technology, which eliminates the need for loans, paperwork, or other hassles, allowing businesses to control their cash flow and unlock potential in their balance sheets. C2FO was formerly known as Pollenware. It was founded in 2008 and is based in Leawood, Kansas.

Behalf is a financing provider that facilitates commerce between business to business vendors and their small and medium business customers. Driven by data and technology, Behalf allows vendor partners to offer business customers instant credit and flexible payment terms at the point of sale.

Loading...