Data

In God we trust.

All others must bring data.

The quickest way to completely understand technology markets and companies with facts – not feelings.

Get a demo No Credit Card Required

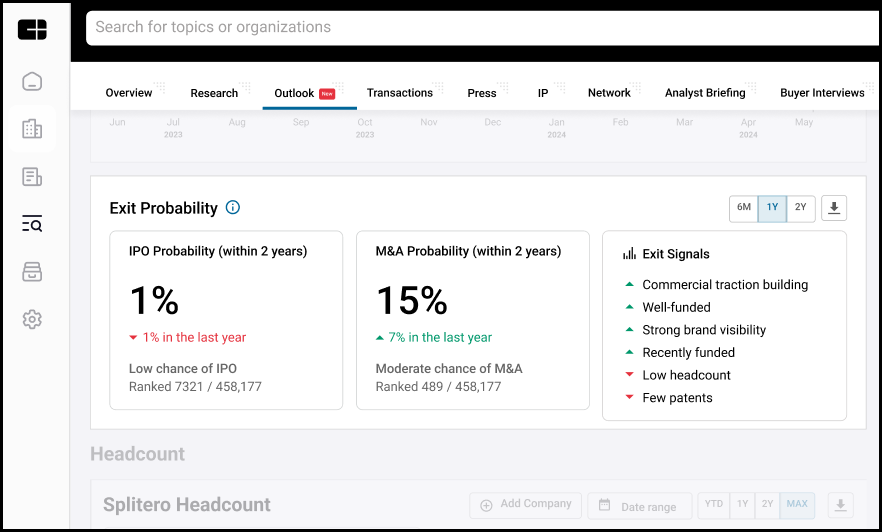

Exit Probability

Timely and reliable insights into a company’s IPO and M&A probabilities within the next 2 years.

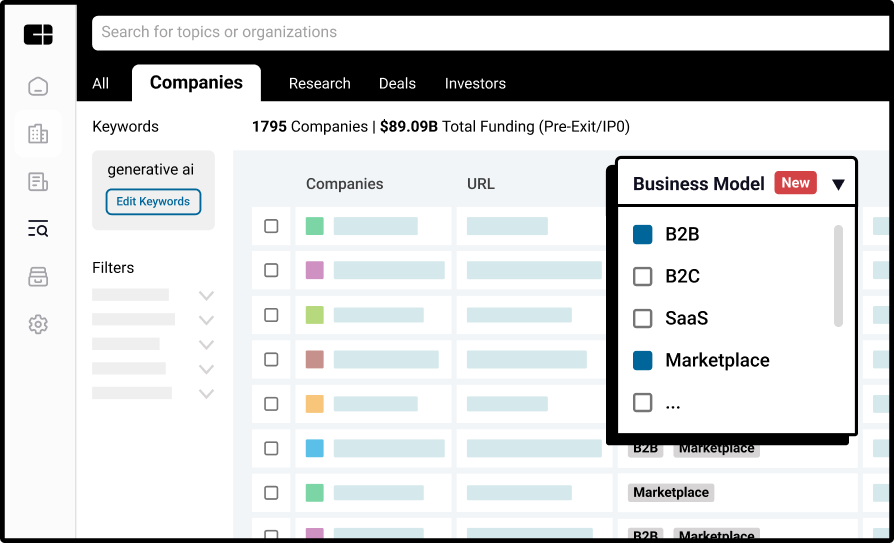

Business Models

Instantly reveal core company attributes like B2C, B2B, SaaS, marketplace, usage-based pricing, and more.

Commercial Maturity

Assess a company by using a metric which analyzes +25 data points including partnerships, patents, news, funding, web traffic and more.

Public Company Data

Identify strategy and performance with public company data and tie it directly to activity rivals are making in the private market.

Financing

Get an up-to-date view of a company with its latest financing rounds and valuation.

Valuations

Review our comprehensive database of valuation and revenue multiples.

M&A Exits

Know when the companies you’re watching get acquired, right when it happens.

IPO Exits

Find out when a company makes an exit, no matter the avenue (including SPAC).

Business Relationships

Know every competitor’s partnerships, acquisitions and clientele to understand priorities, strategies, and areas of expansion.

Proprietary Company Data

Analyst Briefings conducted with tech companies give us unique proprietary data unavailable anywhere else.

Private Company Ratings (Mosaic)

Mosaic score lets you compare private companies at the click of a button – and predict which ones will be successful, or not.

Management Team Ratings

Management Mosaic is our proprietary algorithm that analyzes thousands of data points to score founding and management teams.

Customer References

Get reviews directly from a company’s customers so you know you’re evaluating the ones with the most market potential.

Patent Analytics

Uncover product strategy and track technology momentum. Anyone can get you a list of patents, but only ours is visualized and searchable for you to see big picture trends.

Earnings Transcripts

Gain insight into corporate strategy, executive confidence and expectations for the future.

Market Sizings

Search through the largest Market Sizing estimate database to identify the best markets for expansion and investment.

Key People

Instantly access the names, titles, work history and even contact information of the people behind any private company you search for.

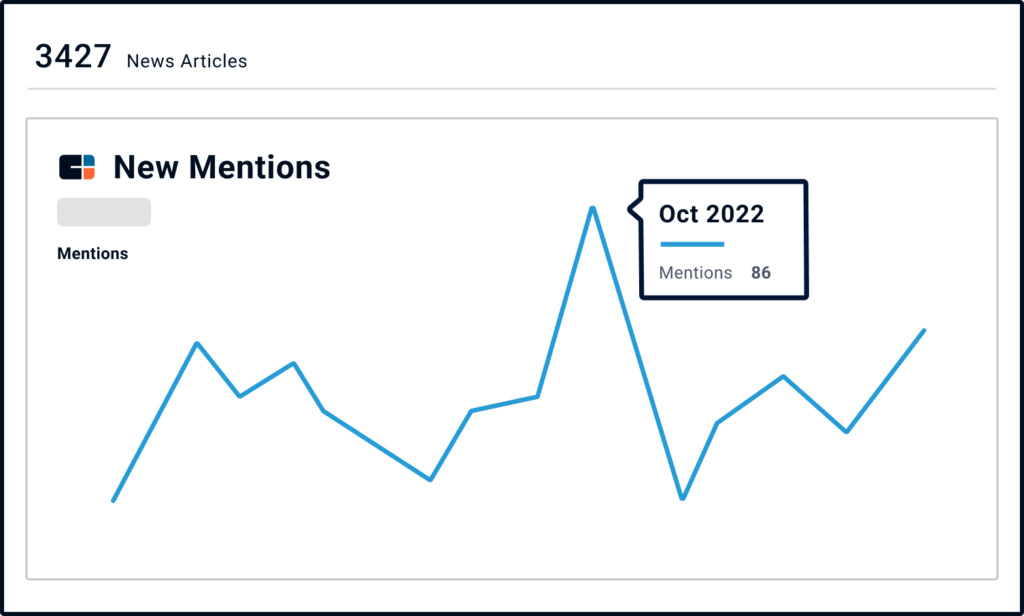

News Mentions

Find out when a company is mentioned automatically, with links to press and media that’s collected and analyzed in one place, in real time.

Analyst Insights

Use proprietary information our analysts have gathered to compare tech vendors.

How we get our data

Our data gives our clients peace of mind – and the ability to source the best deals, choose the right partners, find the right vendors and more.

Machine Learning

10+ years developing and improving scalable and reliable machine learning to crawl, classify and extract millions of insights from unstructured documents.

Analyst Briefings

Tech companies submit proprietary data on who they work with, what their product does and more through our Analyst Briefing program.

Connect with the best companies in tech. In a single click.

Our latest feature lets you go from researching a company to connecting with them directly in just one click.

The industry standard for technology data

Learn more about our platform

Ready to get started?

Let’s talk.

Request a demo