Commure

Founded Year

2017Stage

Series E | AliveTotal Raised

$813.89MValuation

$0000Last Raised

$70M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+12 points in the past 30 days

About Commure

Commure provides a healthcare technology platform. It helps to boost its users' clinical and financial performance with applications designed to streamline care delivery ensuring revenue integrity and also keep its users' workforce safe from violence with a discreet badge designed to call for help. Commure was formerly known as PatientKeeper. The company was founded in 2017 and is based in San Francisco, California.

Loading...

ESPs containing Commure

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The healthcare developer toolkits market provides developers with software tools, libraries, and resources designed to help developers build healthcare applications, platforms, and systems. These toolkits provide developers with a range of components, such as APIs, SDKs, and frameworks, to simplify the process of creating healthcare software and to ensure that it complies with relevant industry st…

Commure named as Highflier among 11 other companies, including Redox, Health Gorilla, and Particle Health.

Loading...

Research containing Commure

Get data-driven expert analysis from the CB Insights Intelligence Unit.

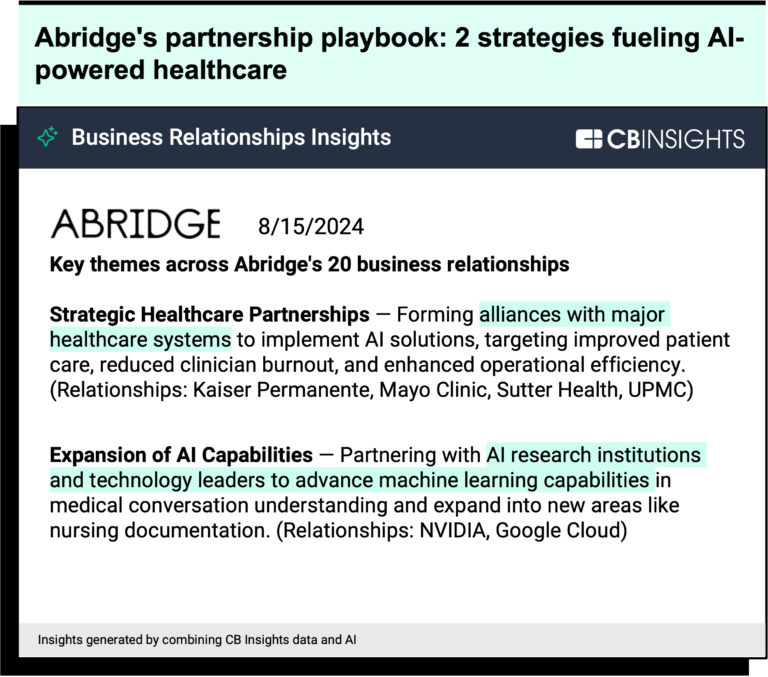

CB Insights Intelligence Analysts have mentioned Commure in 3 CB Insights research briefs, most recently on Sep 13, 2024.

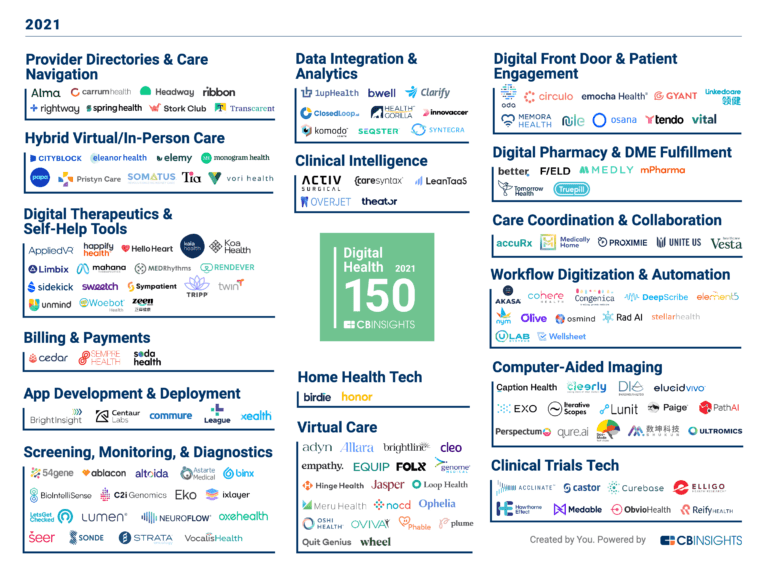

Dec 8, 2021 report

The Digital Health 150: The Top Digital Health Companies Of 2021Expert Collections containing Commure

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Commure is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Digital Health

11,072 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Digital Health 50

150 items

The winners of the third annual CB Insights Digital Health 150.

Commure Patents

Commure has filed 3 patents.

The 3 most popular patent topics include:

- electronic health records

- health informatics

- health standards

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/10/2018 | 10/31/2023 | Grant |

Application Date | 9/10/2018 |

|---|---|

Grant Date | 10/31/2023 |

Title | |

Related Topics | |

Status | Grant |

Latest Commure News

Sep 17, 2024

Sign up By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy . You can opt-out at any time by visiting our Preferences page or by clicking "unsubscribe" at the bottom of the email. Advertisement Healthtech startup Fabric launched out of stealth in March 2023 to help patients get care faster and automate administrative work for providers. Since then, it's been on a dealmaking spree. In June, Fabric bought Walmart's virtual care business, MeMD, after the retailer announced it would shutter its 51 health clinics . MeMD was Fabric's third acquisition — the startup previously bought asynchronous virtual care platform Zipnosis from Bright Health, as well as generative AI startup Gyant. This story is available exclusively to Business Insider subscribers. Become an Insider and start reading now.Have an account? Log in . Now, Fabric is pushing even further into telehealth with yet another buy. The startup has acquired TeamHealth VirtualCare, the virtual care business inside giant physician practice group TeamHealth, Business Insider has learned exclusively. Advertisement Fabric's four acquisitions have been powered by handfuls of cash from top investors such as Google Ventures, Thrive Capital, and Salesforce Ventures. The startup has raised $80 million to date, including a $60 million Series A round in February led by General Catalyst. Fabric is leaning into telehealth at a time when many others are leaning out. While virtual care saw a tsunami of VC interest during the pandemic, investors and healthcare companies alike are now pulling back. UnitedHealth Group's Optum also shut down its virtual care business earlier this year, and telehealth companies Amwell and Teladoc have seen their stocks plummet from pandemic highs. But Fabric's founder and CEO Aniq Rahman is still bullish on virtual care's future. "There are a lot of people that are a little gun-shy about doubling down on their convictions. For us, virtual care is not going away," Rahman said. "We want to go deeper in virtual care, and there are some amazing teams and technologies we've been able to amass as a result." Advertisement Getting care anywhere While Fabric's M&A-heavy strategy is unusual for an early-stage startup, it isn't unfamiliar to General Catalyst's portfolio. Related stories Commure, the $6 billion startup cofounded by General Catalyst CEO Hemant Taneja, has made six acquisitions in the four years since its launch and has relied on those acquisitions to drive its growth , a September BI investigation found. Where Commure has stumbled in developing tech in-house, though, Fabric maintains its buys are building on top of its own products. Fabric, formerly known as Florence, launched last year with software for emergency rooms to help manage patients before, during, and after their visits. But emergency rooms are frequently overcrowded , including with patients with nonemergent medical conditions who might be better off seeking care elsewhere, Rahman said. Advertisement By buying Zipnosis from Bright Health, Fabric could offer telehealth capabilities to those patients. "That really accelerated our business, and we had such a good experience with the Zipnosis deal that we've just been on an acquisition spree," Rahman said. Next, Fabric acquired Gyant , a generative AI platform that automates patient scheduling and directs patients to the right type of care. Rahman said the startup continues to build and improve its products that speed up patient intake in the ER, automatically record health data in the hospital's electronic medical record, and follow up with patients after their visits. Advertisement By buying MeMD from Walmart earlier this year, Fabric acquired the retailer's virtual care technology platform and expanded into contracting with payers, employers, and providers. Now, in combination with the TeamHealth acquisition, Fabric has a 50-state network of clinicians and access to over 100 million lives in managed care contracts with payers. The startup says it serves 30,000 employers, payers, and healthcare organizations, including large health insurer Highmark and health system Intermountain. Signs of life in the M&A market Rahman said Fabric's position as an early-stage startup has been surprisingly beneficial for dealmaking. Advertisement "It's allowed us to be very nimble and agile. We've been able to guarantee speed and certainty to the sellers, and we've also been able to construct very creative deals that have allowed us to align interests for the teams and the shareholders," he said. The strategy is new for Rahman, a long-time entrepreneur and investor at Vast Ventures. The last company he led, an advertising analytics company called Moat, sold to Oracle in 2017 for $850 million . In the years before the sale, Rahman said Moat "flirted" with the idea of M&A, but it was never a priority for the company. Now, Fabric is looking at bigger and bigger acquisition targets, Rahman said, across the spectrum of private equity-backed and venture-backed startups as well as public companies. And with the IPO window still closed, many startups looking for liquidity have come knocking. Advertisement "A lot of the companies that are struggling to go raise capital right now, or some of these larger businesses that are reevaluating their position in the market, are creating opportunities for us as well," Rahman said. "Pretty much every week, there's inbound coming in from investors that are like, we have assets in our portfolio that may be accretive to what you're doing with Fabric." Read next

Commure Frequently Asked Questions (FAQ)

When was Commure founded?

Commure was founded in 2017.

Where is Commure's headquarters?

Commure's headquarters is located at 2261 Market Street, San Francisco.

What is Commure's latest funding round?

Commure's latest funding round is Series E.

How much did Commure raise?

Commure raised a total of $813.89M.

Who are the investors of Commure?

Investors of Commure include General Catalyst, Liquid 2 Ventures, HCA Healthcare, Lux Capital, 8VC and 3 more.

Who are Commure's competitors?

Competitors of Commure include Zus Health, iLLUMEAi, Bridge Connector, Corepoint Health, HiChina Web Solutions and 7 more.

Loading...

Compare Commure to Competitors

iNTERFACEWARE specializes in healthcare data integration, providing solutions within the healthcare technology sector. The company offers the Iguana Integration Engine, a platform designed to connect electronic medical records (EMRs), electronic health records (EHRs), and various healthcare systems, devices, and applications, facilitating the exchange of healthcare data in multiple formats and protocols. iNTERFACEWARE primarily serves the healthcare industry, offering integration services, training, and resources to healthcare providers and software companies. It is based in Toronto, Ontario.

Eversolve specializes in application integration within the healthcare sector, focusing on interoperability and standard-based solutions. The company offers tools, services, and expertise to enable healthcare vendors and providers to integrate their applications and devices, ensuring efficient data exchange and communication. Eversolve primarily serves healthcare vendors, providers, and government agencies seeking to implement Electronic Health Record Systems and Personal Electronic Health Records. It is based in New Hampshire, United States.

Caristix is a company that focuses on healthcare IT, specifically in the domain of data flow and interoperability for hospitals and other healthcare partners. The company offers software solutions that automate tasks related to interoperability and data flow, such as scoping, testing, and maintenance, with the aim of simplifying the integration of complex IT systems in healthcare settings. The primary sectors that Caristix serves are the healthcare and IT industries. It is based in Quebec City, Quebec.

Linkmed specializes in healthcare information system integration. It focuses on interface solutions for the healthcare industry. It offers HL7 and DICOM interface software that enables seamless integration of medical devices and systems with healthcare information systems. It primarily serves the healthcare technology sector. It was founded in 2019 and is based in Boston, Massachusetts.

Redox offers an application program interface technology. It provides a modern application programming interface (API) for healthcare, allowing software to easily and securely interoperate with electronic health records (EHRs) in a health system infrastructure. The company offers various products such as Nova which has real-time data in the cloud, Chroma which patient identity records, and more. It was founded in 2014 and is based in Madison, Wisconsin.

Zus Health specializes in healthcare data interoperability. The company offers a shared health data platform that provides patient data at the point of care through application program interface (API), embedded components, and direct electronic health records (EHR) integrations. The platform is primarily used by healthcare organizations to understand patient history, streamline intake processes, and monitor patient medication adherence. It was formerly known as Zeus Healthcare Technologies. It was founded in 2020 and is based in Boston, Massachusetts.

Loading...