Akbank Success Story

Using Market Intelligence to Find and Connect with Innovative Partners at Akbank

Selim Yuksel

VP of Innovation, Akbank LAB

Key Results:

- An accelerated connection process with target technology vendors

- Stay on top of industry trends and company changes as they happen

- Streamline the partner selection process with CB Insights

CB Insights Products Mentioned:

- Collections →

- Market Maps →

- Connect

Innovation doesn’t happen on its own.

That’s especially true in banks that have a history of doing things a certain way. However, necessity and opportunity often spur change. Sometimes, a business unit must address a specific need, or a new fintech player launches a revolutionary product. In either case, pushing the envelope in banking requires careful deliberation to pair external innovators with internal stakeholders.

We embrace innovation at Akbank. Akbank is one of Turkey’s largest and most successful banks, offering personal and corporate banking services, including wealth management and expatriate banking in multiple currencies. In 2016, we launched Akbank LAB, an innovation center that updates the bank on technology trends and customer expectations. It serves as a bridge between business units and outside tech firms. Our work aims to provide innovative products and services to our customers in the fastest way, as well as embedding innovation in company culture.

As Vice President of the Innovation Center, I’m in charge of Akbank LAB and work closely with two of my colleagues, Merve Akgün and Meltem Kutlu. Together, we evaluate partnerships with promising Turkish and international fintechs and tech companies, while at the same time promoting innovation within the bank. We are matchmakers who try to find the best possible partners to solve pressing business problems within the bank, and to do so, we’re in close contact with local and global entrepreneurial ecosystems.

The Search for Projects, Partnerships, and POCs

Our work falls into three main categories:

- We run proofs of concept (POCs) with potential partners. We collaborate with third parties like fintechs to test the innovative products or services to respond to a need or solve a problem in three to six months with IT Acceleration and Sales Enablement. Internal operations are sped up, and legal and design processes are supported by external resources. The innovative projects that we chose to progress with POC and/or production are carried out in the shortest order.

- We manage the startup ecosystem. For us, supporting this ecosystem is crucial. We build and maintain close relationships with universities, technology offices and innovation hubs. We support accelerator programs such as Boost the Future with Endeavor, participate in different programs as mentors and juries to share our industry know-how like Visa Innovation Program and Microsoft GrowthX Program. We were in contact with more than 350 ecosystem players last year in Turkey and abroad. These players serve as our solution partners; we jointly work on visionary projects focused on fostering innovation and creating added value for the customers.

- We foster an internal culture of innovation through in-house initiatives like intrapreneurship programs and bi-weekly bulletins that feature news and trends.

Because my team is constantly searching for local and international fintechs partners for POCs, we have created a funnel to find suitable partners. Twice a year, we ask our business units to share their most pressing business problems and we suggest innovative ways to resolve them. We choose up to five of those ideas to develop as POCs. If any are successful, we put them into production and ultimately transition their operation back to the business unit that requested them. Out of hundreds of ideas produced and assessed to date, we have successfully led 31 projects through the POC stage, eight of which are still ongoing. 13 of these projects were taken live with careful evaluations after POC.

One of the main duties of Akbank LAB in this management model is scouting. An all rounded evaluation process is used to find the best partner that will cover the needs or solve the challenges of business units. We used to start our partner queries through a broad search, getting an overview of potential solutions for a specific business problem or business unit request. Then, we narrowed this down to the companies and organizations that can help us resolve the issue. We were already using the market intelligence platform CB Insights to learn more about potential partners’ investors, funding, management, and operations, but we soon realized we could lean on CB Insights even more.

CB Insights Helps Us Connect with the Best

In the past, when we found a company of interest, we would try to initiate contact through various means, including their websites, email, and LinkedIn. It often took weeks for people to respond to those messages, if at all. It was a laborious process that yielded suboptimal results.

CB Insights’ new Connect feature changed everything for us.

After our latest bi-annual conversation with our business units, we began working on a POC to be the first bank to offer a new service to our customers. We had already selected a potential partner, but the business unit wanted to discover other options. We found an alternate supplier and tried contacting them through the usual online channels, but they never got back to us.

More research led us to initiate discussions with an American tech company. We looked up their investor information on CB Insights and saw a new “Connect” button on the Company Profile page. Clicking that button set a series of events into motion and CB Insights facilitated the initial connection between Akbank LAB and our target. After that first meeting, their team flew to Turkey to discuss the project in person. Talks are ongoing, and that connection may never have happened without CB Insights’ Connect.

Using the Connect feature, CB Insights accelerated the connection process with target technology vendors and secured a meaningful meeting within days.

Leveraging Reliable, Up-to-Date Information

To choose the right partner, we need reliable, up-to-date information. We recently came across a promising tech company on CB Insights, but the “Connect” button was missing from their Company Profile page. We clicked on the News tab, where we discovered the company had just been acquired. That didn’t slow us down though—all we had to do was begin to research its new owner on CB Insights. We found out about the acquisition faster through CB Insights than we would have if only relying on search engines, and that speed matters.

When we propose a POC or new technology to our executive team, we’ve already done all the research, and our top managers only see our final recommendations. CB Insights enables us to stay on top of industry trends and company changes as they happen. Armed with this data, we are confident in presenting the correct, most current view of the market and the most promising partnerships to the business.

Innovating at Scale

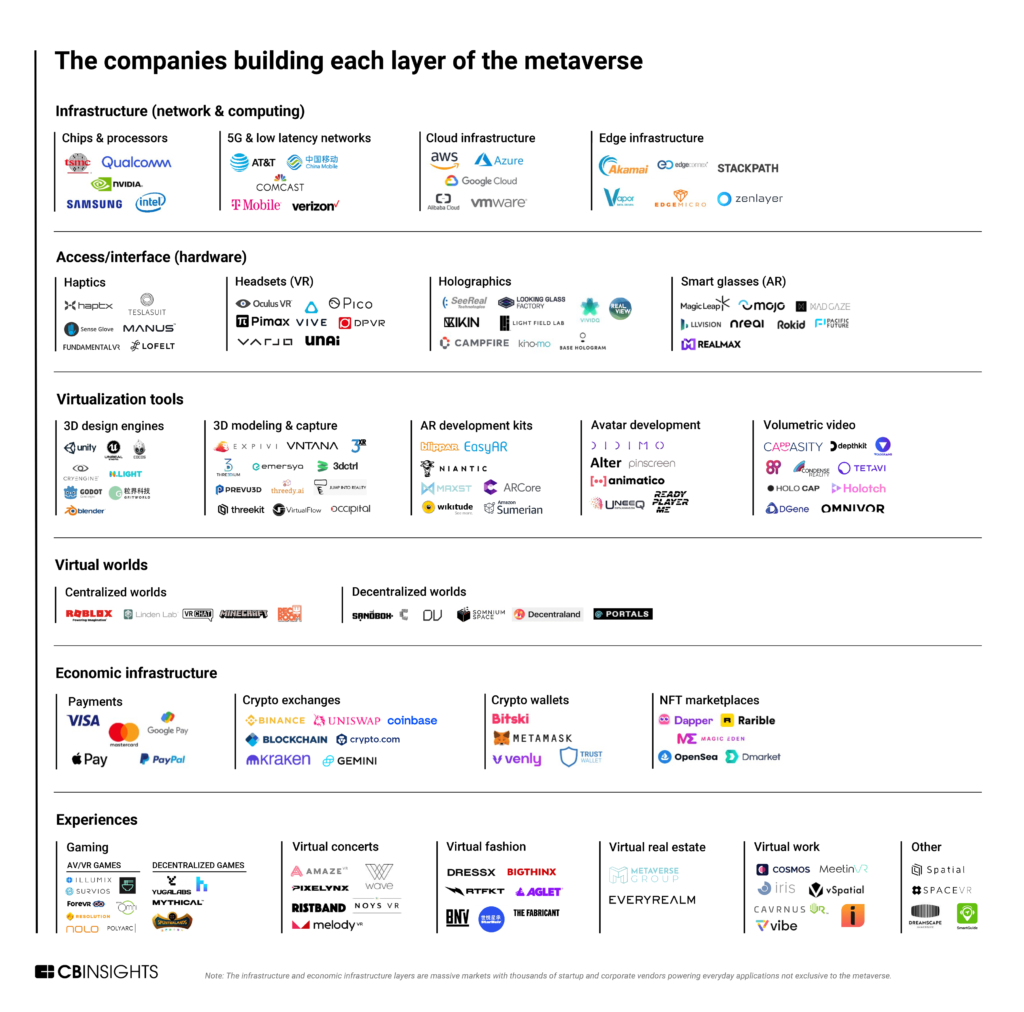

CB Insights has many great features that helps my team narrow our search for potential partners, especially Market Maps and Collections. For example, when Facebook rebranded as Meta, the Metaverse became a hot topic globally. We used the CB Insights’ Market Map to improve our understanding of other players in this emerging space and shared the data from CB Insights with the rest of the bank. We also use Market Maps to find relevant partners for our POCs, hackathons and we use Collections to create interactive, self-updating repositories of companies and organizations of interest.

We rely heavily on CB Insights to request references and learn about companies, their products, investors, and competitors. But it is more than an online resource. We’ve had incredible help from CB Insights’ expert advisors. Not only do they help broker introductions with key partners, but their analysts provide detailed company portfolios and other in-depth resources on requests that complement the intelligence found on their platform.

We’ve also reaped the benefits of having a dedicated Customer Service Manager (CSM). We meet with our CSM regularly to discuss hot topics or trends for our team. She keeps up-to-date with relevant research in our areas of interest, and she also ensures we benefit from all the features available on CB Insights. She’s been a great resource to our team, helping us continually move forward.

CB Insights helps my team innovate at scale. We have eight projects and four POCs in progress from the last two cycles and are preparing to approve up to five more in the next cycle. We have streamlined the partner selection process with CB Insights and can confidently recommend qualified fintechs to our business units.

With CB Insights, you find the right information in a matter of seconds. Analysts will also send further detailed portfolios, which is really valuable information.

Award-Winning Transformation and Innovation

Our projects are transforming Akbank, and the banking world has noticed. In 2020, we were named World’s Best Bank in the Emerging Markets at the prestigious Euromoney Awards for Excellence. This honor recognized our commitment to digital banking in Turkey and praised Akbank’s work with the fintech sector.

Akbank is proud to work with international partners to advance digital and traditional banking in Turkey. CB Insights opens the world to us through timely business intelligence about fintechs here and abroad. No matter what the business problem or business unit requests, our innovation team can quickly and easily find the perfect partner to help us architect a solution, run a POC, and make innovation a reality for our company.

Selim Yuksel

VP of Innovation, Akbank LAB

Selim has worked in product integration, strategy and business development areas in the telecom and finance sectors for system integration, digital transformation and advanced industry applications. He completed his undergraduate degree in Industrial Engineering at TOBB ETÜ. He started working as Akbank LAB Innovation Center Manager in May 2020 and now he is the Innovation Center Vice President since 2021. In addition, he actively supports tech startups both in domestic and foreign acceleration and investment programs.

Ready to get started?

Let’s talk.

Request a demo