Data

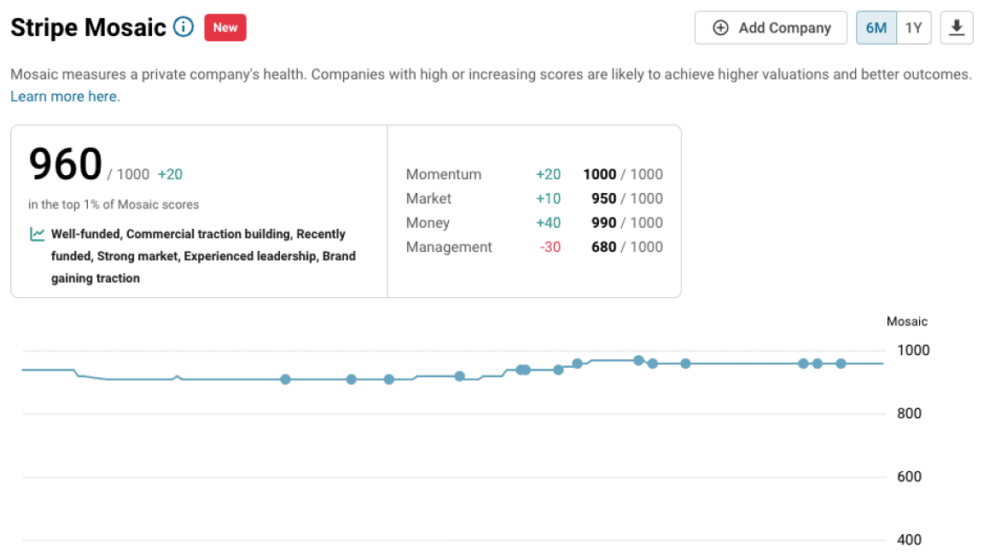

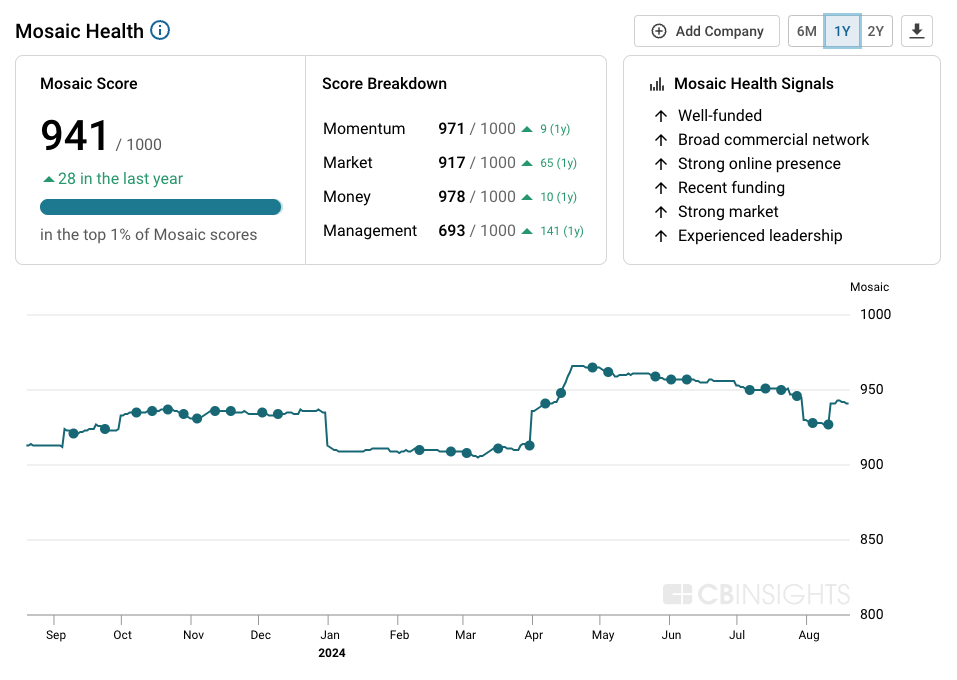

Private Company Ratings (Mosaic)

Predict a company’s success more accurately than top VCs. Chart and compare private companies like you do public companies.

Overview

CB Insights Mosaic Score lets you predict positive outcomes in the private market at an 83% probability rate — more accurately than some of the most powerful VCs in the world. Customers rely on mosaic as an investment screener for high potential emerging tech companies, which we define as companies with a score of 510 or higher.

CB Insights’ Mosaic Scores measures the overall health and growth potential of private companies using non-traditional signals.

Mosaic relies on four factors:

Momentum

measures the individual performance of a company relative to itself and peers using signals from social media, news sentiment, mobile and web traffic, and more

Money

assesses the financial strength and viability of a company based on financing history, burn rate, and investor quality

Market

quantifies the health (or lack thereof) of the industry in which a company participates based on funding, deals, industry sentiment, and exit activity, among other factors

Management

takes a data-driven look at a founding and management team’s prior accomplishments and scores the likelihood that the team can create a successful outcome for the company, such as an acquisition, IPO, etc

Each factor is scored on a 0-1,000 scale, then a weighted average calculation is applied to arrive at the overall score.

The individual scores from the 4 M’s, as well as the overall Mosaic score, are used by clients in a variety of ways to help them understand what’s coming next.

CB Insights clients use Mosaic to:

- Identify, prioritize, and nurture new business development opportunities

- See fast-growing markets and industries before competitors to inform strategic decisions

- Pinpoint fast-growing private companies to understand their business models, products, and technologies

Mosaic is applied in various ways across the CB Insights platform to enhance your insights into companies:

- On company profiles, you can see Mosaic signals provides historic context to Mosaic scores, differentiating insights and competitor comparisons so that you can understand a company’s change in success trajectory over time.

- Mosaic can also be applied at scale via Collections, Advanced Search, and Industry Analytics

- Within Collections, you can sort the universe of companies by Mosaic to identify either high-growth potential entities, or vice versa, highlighting those that aren’t doing as well and could be in need of funding, acquisitions, etc.

- Within Advanced Search, Mosaic can be added as a column to further the quantitative analysis being conducted through those reports.

- Then, for a more high-level and historical perspective, using Mosaic our Industry Analytics tool will lend a retrospective view.

Do all companies have a Mosaic score?

No, we only calculate scores for private companies in the tech space that have enough public information to determine the overall momentum, market, and financial health of the company.

Below are the sectors and industries that fall under tech:

- Internet

- Mobile & Telecommunications

- Software (non-internet/mobile)

- Electronics

- Computer Hardware & Services

- Consumer Products & Services > Consumer Electronics

- Industrial > Machinery & Equipment > Robotics

Not all companies are created equal. Mosaic enables you to see the best, most relevant companies exhibiting the health signals you care about.

Commercial Maturity, Mosaic Health, and Exit Probability, make up a company’s Outlook. Commercial Maturity represents past achievements, Mosaic Health represents the present state, and Exit Probability represents the future prospect of a company.