Swiggy

Founded Year

2014Stage

Secondary Market - II | AliveTotal Raised

$3.572BLast Raised

$360K | 7 days agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+41 points in the past 30 days

About Swiggy

Swiggy operates as an on-demand delivery platform in the food service industry. Its main service is providing a platform for customers to order food online from various restaurants. Swiggy primarily serves the food delivery industry. It was founded in 2014 and is based in Bengaluru, India.

Loading...

ESPs containing Swiggy

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The on-demand restaurant delivery market facilitates flexible delivery of restaurant meals to customers using a mobile application or website. These services enable restaurants to deliver food directly to customers’ doorsteps. Common features for customers include order tracking, the ability to see customer reviews, and the ability to select from various restaurants.

Swiggy named as Leader among 15 other companies, including Uber, DoorDash, and Deliveroo.

Loading...

Research containing Swiggy

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Swiggy in 5 CB Insights research briefs, most recently on Dec 22, 2023.

Dec 22, 2023

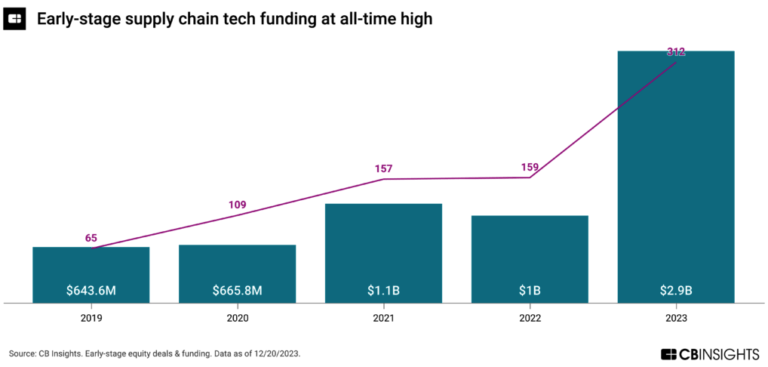

5 supply chain markets gaining momentum in 2024Expert Collections containing Swiggy

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Swiggy is included in 6 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

5,629 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,244 items

Grocery Retail Tech

648 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

On-Demand

1,244 items

Food & Meal Delivery

1,531 items

Startups and tech companies offering online grocery, food, beverage, and meal delivery services.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Swiggy News

Sep 24, 2024

SHARE SUMMARY Modern Insulators will acquire 1.38 Lakh shares of Swiggy for INR 360 apiece, translating to a total value of INR 4.99 Cr Earlier this month, Hindustan Composites said it would acquire 1.5 Lakh shares, or a 0.01% stake, of Swiggy for a cash consideration of INR 5.17 Cr This comes at a time when Swiggy is looking to file its DRHP with SEBI for an over $1 Bn IPO FOLLOW US as the foodtech major prepares for its $1.25 Bn initial public offering (IPO). In an exchange filing on September 17 (Tuesday), the company said it has secured approval from its board to acquire over 1.38 Lakh unlisted shares of Swiggy for INR 360 apiece for INR 4.99 Cr in an all-cash deal. The transaction is expected to be completed in the next 30-45 days, the filing showed. Swiggy’s unlisted shares that will be lapped up by Modern Insulators will translate to a 0.007% stake in the IPO-bound startup. Founded in 1985, Modern Insulators claims to be India’s biggest manufacturer and exporter of porcelain insulators used in electric and electronics appliances, as well as railway lines. The company posted a consolidated net profit of INR 36 Cr in the financial year 2023-24 (FY24), up 28% from INR 28.12 Cr in the previous year. Revenue from operations rose nearly 3% to INR 443.30 Cr during the year under review from INR 430.96 Cr in FY23. Investors have been flocking to buy the unlisted shares of Swiggy ahead of its IPO, driven by a rally in the Indian equities market and rising interest in the public listings of new-age tech startups. RECOMMENDED FOR yOU 23rd September, 2024 Earlier this month, Hindustan Composites said it would acquire 1.5 Lakh shares, or a 0.01% stake, of Swiggy for a cash consideration of INR 5.17 Cr. Actor Amitabh Bachchan’s family office also picked up a minority stake in the IPO-bound company. The development comes on the heels of reports saying that Swiggy is looking to file its draft red herring prospectus (DRHP) with market regulator SEBI this week for an over $1 Bn IPO. Earlier this month, it was also reported that Swiggy is planning to get shareholders’ nod to raise INR 5,000 Cr (about $600 Mn) through fresh issuance of shares in its IPO as against the previously planned amount of INR 3,750 Cr (around $450 Mn). The Swiggy IPO also comprises an offer for sale component worth INR 6,664 Cr (around $799 Mn). As per multiple reports, Swiggy is eyeing a valuation of $15 Bn for its IPO. The food delivery and quick commerce startup was last valued at $10.7 Bn. Swiggy is looking to go public even as it continues to be a loss-making entity. Its revenue grew 36% year-on-year (YoY) to INR 11,247 Cr in FY24, while net loss narrowed 44% YoY to INR 2,350 Cr. Last week, Inc42 reported that Swiggy has launched ‘Cafe’ to deliver snacks and beverages in 15 minutes in select parts of Bengaluru. In an effort to win market share back from its rival Zomato, Swiggy has launched a slew of features in recent months, including group ordering option, ‘incognito mode’ for private ordering, 10-minute food delivery, among others. Earlier this month, it also rolled out a pilot for a larger order fleet in the Delhi NCR region.

Swiggy Frequently Asked Questions (FAQ)

When was Swiggy founded?

Swiggy was founded in 2014.

Where is Swiggy's headquarters?

Swiggy's headquarters is located at Outer Ring Road Devarbisanahalli Varthur, Bengaluru.

What is Swiggy's latest funding round?

Swiggy's latest funding round is Secondary Market - II.

How much did Swiggy raise?

Swiggy raised a total of $3.572B.

Who are the investors of Swiggy?

Investors of Swiggy include Ritesh Malik, Madhuri Dixit Nene, Modern Insulators, Hindustan Composites, Bachchan family office and 39 more.

Who are Swiggy's competitors?

Competitors of Swiggy include Zepto, Rebel Foods, Eatigo, Dunzo, Dot and 7 more.

Loading...

Compare Swiggy to Competitors

Rappi operates as a tech company focusing on digital commerce and delivery services. The company offers a platform for ordering food, supermarket goods, and pharmacy products online, with a delivery service to customers' locations. Rappi partners with restaurants and stores to facilitate their access to a wider customer base through its app. It was founded in 2015 and is based in Mexico City, Mexico.

Dunzo is an all-in-one 24X7 delivery platform operating in the quick urban logistics sector. The company offers a wide range of services including the delivery of groceries, food, medicines, pet supplies, and couriering packages across the city. Dunzo primarily serves the ecommerce industry, facilitating instant delivery services for various consumer needs. It was founded in 2015 and is based in Bengaluru, India.

FreshMenu is a food delivery company operating in the food and beverage industry. The company offers a variety of cuisines for home delivery, including Chinese, Continental, and Mexican food. The food is prepared by in-house chefs and delivered fresh to customers' doorsteps. It was founded in 2014 and is based in Bengaluru, India.

EatClub Brands is a technology-driven company specializing in cloud kitchen operations within the food delivery industry. The company manages a network of 250+ kitchens, offering services that encompass the entire food preparation and delivery process, ensuring high-quality ingredients, consistent food quality, and a superior customer experience. EatClub Brands operates popular food brands and provides an online ordering platform, the EatClub App, which offers benefits like discounts and no delivery or packaging fees. It was founded in 2012 and is based in Mumbai, India.

Rebel Foods focuses on operating a global chain of internet restaurants and a multi-brand cloud kitchen model. The company offers a proprietary operating system for building and scaling a diverse portfolio of own and partner food brands, leveraging culinary craft and technology infrastructure. Rebel Foods primarily serves the food delivery industry with a variety of cuisine offerings designed to cater to different consumer food patterns. Rebel Foods was formerly known as Faasos. It was founded in 2011 and is based in Mumbai, India.

BigBasket is an online supermarket focusing on grocery delivery services. The company offers a wide range of products including fresh produce, dairy, meat, household essentials, and branded food items, catering to the daily needs of customers. BigBasket serves a broad consumer base with services like scheduled slotted deliveries and an expedited delivery option called bbnow for immediate needs. It was founded in 2011 and is based in Bangalore, India. BigBasket operates as a subsidiary of Tata Group.

Loading...