Coalition

Founded Year

2017Stage

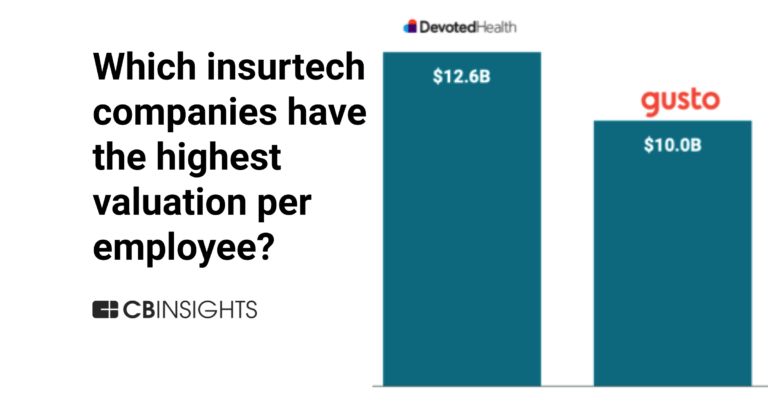

Series F | AliveTotal Raised

$770MValuation

$0000Last Raised

$250M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-30 points in the past 30 days

About Coalition

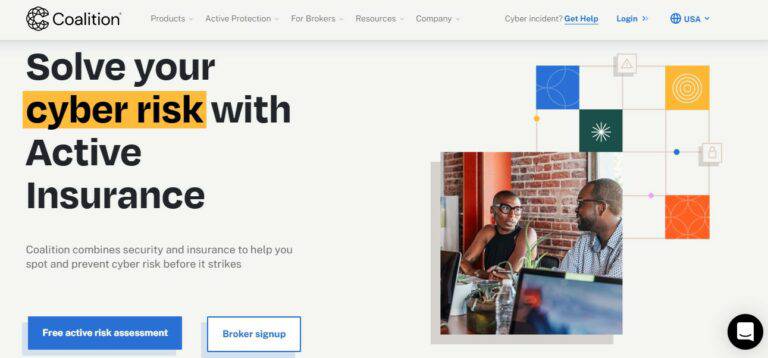

Coalition operates in the cyber insurance and cybersecurity sectors. The company offers comprehensive insurance coverage and cybersecurity tools designed to help businesses manage and mitigate digital risks. Coalition primarily serves businesses worldwide that are seeking resilience against cyber attacks. It was founded in 2017 and is based in San Francisco, California.

Loading...

Coalition's Product Videos

ESPs containing Coalition

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

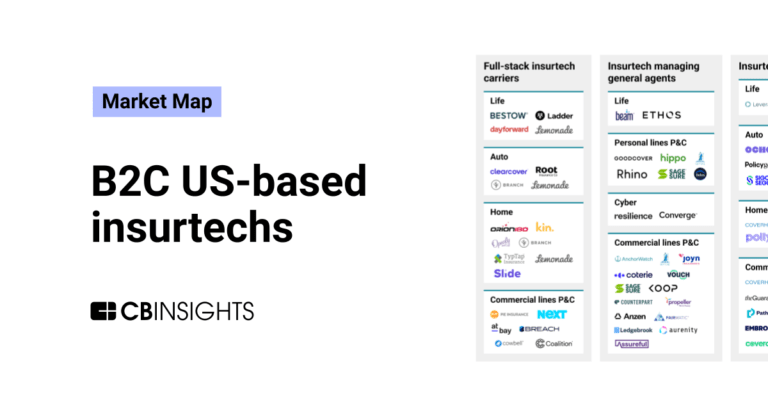

The full-stack insurtech carriers — commercial lines property & casualty market comprises insurtech carriers that underwrite commercial property & casualty (P&C) insurance. These lines of business may include (but are not limited to) cyber, errors & omissions, general liability, property, and workers’ compensation. As with established carriers, insurtech carriers will typically also be licensed by…

Coalition named as Leader among 6 other companies, including Next Insurance, Cowbell Cyber, and At-Bay.

Coalition's Products & Differentiators

Active Cyber Insurance

Coalition's Active Cyber Insurance provides comprehensive protection from fast-moving cyber and digital risks.

Loading...

Research containing Coalition

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Coalition in 7 CB Insights research briefs, most recently on Aug 28, 2024.

Aug 28, 2024 report

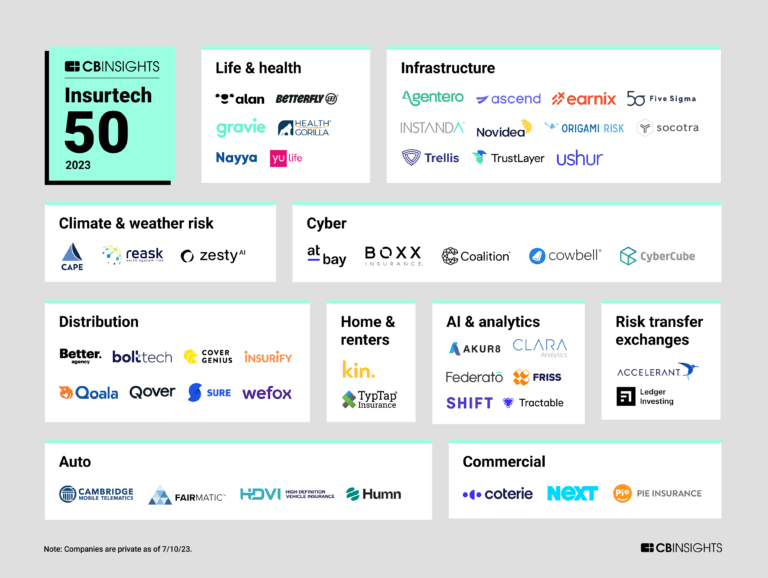

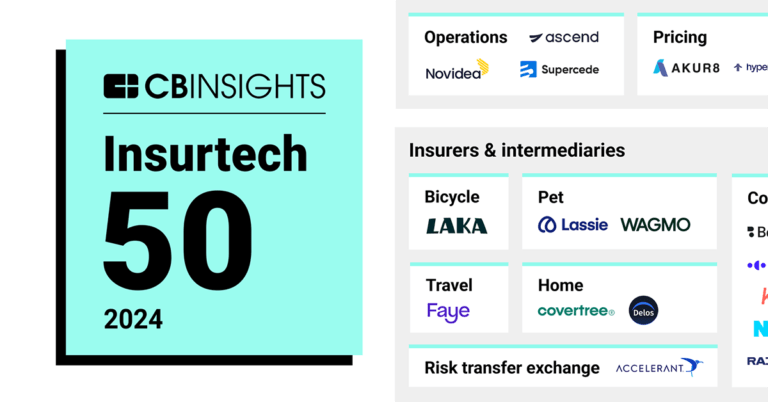

Insurtech 50: The most promising insurtech startups of 2024

Feb 23, 2024

The B2C US insurtech market map

May 24, 2023

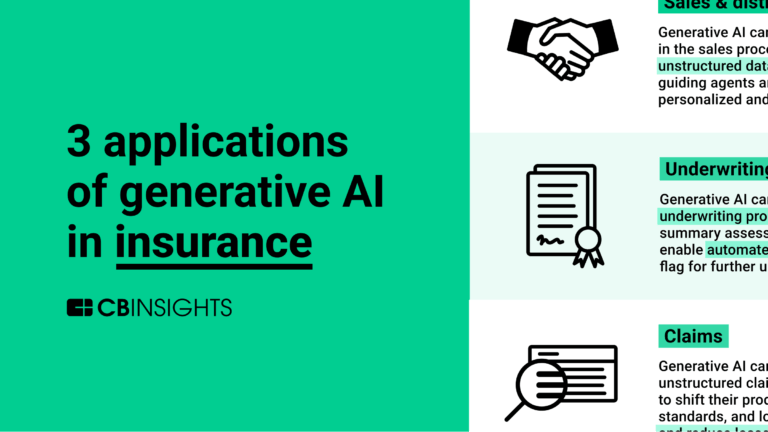

3 applications of generative AI in insuranceExpert Collections containing Coalition

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Coalition is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

SMB Fintech

1,586 items

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

4,352 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Cybersecurity

9,329 items

These companies protect organizations from digital threats.

Coalition Patents

Coalition has filed 1 patent.

The 3 most popular patent topics include:

- computer memory

- data management

- diagrams

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/25/2023 | 7/2/2024 | Computer memory, Rotating disc computer storage media, Data management, Diagrams, Parallel computing | Grant |

Application Date | 10/25/2023 |

|---|---|

Grant Date | 7/2/2024 |

Title | |

Related Topics | Computer memory, Rotating disc computer storage media, Data management, Diagrams, Parallel computing |

Status | Grant |

Latest Coalition News

Sep 13, 2024

'” said Werkheiser, who led a Coalition Against Insurance Fraud webinar this week on the growing trend of fake or exaggerated water-damage claims across the country. As director of special investigations for Command Investigations, based in Temecula, California, and Lake Mary, Florida, Werkheiser said a clogged toilet should rarely result in more than a few quarts of water overflowing in a property. But schemers continue to try and claim that such far-fetched scenarios have damaged entire structures, all in an effort to gain hefty insurance payouts, he said. And Werkheiser said his team has noticed a disturbing trend in recent years: Many water-damage claims appear to be linked to home flippers, including real estate investors, hoping to trick property insurers into paying for renovations before a property is sold. In some cases, insurance adjusters have been called to inspect claims on homes that were clearly in the midst of being remodeled or renovated. The property owner/policyholder had argued, though, that the polyethylene sheeting hung around the inside of the home was done to “dry out” or remediate the property after the massive water leak. In reality, Werkheiser said, the sheeting was probably installed by a contractor for dust control during the the renovation work. Investigators’ moisture meters also found widely varying moisture levels throughout the home, on walls far from the supposed source of the leak and no signs of water intrusion on the ceiling above. “All of that raises red flags,” he said. Werkheiser’s examples are similar to claims highlighted by a few Florida engineers and insurance adjusters. They have said in 2022 that they have seen a rise in HO policy claims blaming cast-iron drainage pipes in older homes for breaks, clogs and leakages. But in many cases, the pipes last for decades and are not the source of the water. In another case, an engineer said someone smeared what appeared to be tomato sauce on a ceiling to simulate a leak. In one California case Werkheiser related, the homeowners claimed that a 2-year-old child dropped something in the toilet then figured out how to flush the toilet just moments before the family left on vacation. The family said they returned home to find the place flooded, and filed a major claim. It turns out, the family didn’t go to Disneyland as they said they had. And investigators scoffed at the idea that a toddler was smart enough to flush a toilet. “We had a lot of problems with that,” Werkheiser said. He provided some other red flags for insurers to look for and how to handle them: Scour property records and building permit records to determine if connections exist between claimants, buyers, public adjusters and contractors. In some instances, he noted, renovation firms are owned by relatives of homeowners or adjusters. Some Florida insurance companies have raised similar accusations through the years. Verify living expenses. In other instances, insureds may claim additional living expenses are needed while a home is repaired. But in at least one case, the luxury AirB&B or rental property was owned by the brother-in-law of the claimant. In another example, the homeowner claimed living expenses – a lease on a bed and breakfast – but had never left the insured home. Check similar records on commercial property. “We’re seeing these types of claims seeping into commercial property now,” Werkheiser said, referring to business interruption claims. Beware of multiple claims on the same property in a short period of time, particularly within the first 90 days after a policy is written. Also, look for the same photographs submitted in different claims, or listings of the same contents. Verify invoices. Investigators have seen what appear to be legitimate bed bug extermination invoices from a vendor, replete with logos, addresses and invoice numbers. But when they checked, the exterminator explained that the documents were fake: They looked spot-on but no record could be found of the work performed. “They were A.I.-generated,” Werkheiser said. “So, we take no documents at face value.” Ask for the damaged equipment or photos of the water-damaged property and contents. Scammers are known to often claim that “all of that was thrown out.” If the parts are available, take them for examination and so they can’t be used again in a future claim. Another red flag: Insureds or public adjusters who stonewall or refuse to provide original photographs, which can be checked for metadata that show when the pictures were taken. Scrutinize “Category 3” water claims. Water damage claims come in three types: Category 1 includes water leaks from clean, potable water sources. Category 2 is grey water, usually from bath or kitchen drain lines. Category 3 is nasty sewage water from toilet drain lines, which elevates the severity of the claim due to contamination. Werkheiser said insurers and investigators should always ask why the claimant or adjuster believes the water damage is considered a Cat 3 claim.

Coalition Frequently Asked Questions (FAQ)

When was Coalition founded?

Coalition was founded in 2017.

Where is Coalition's headquarters?

Coalition's headquarters is located at 55 2nd Street, San Francisco.

What is Coalition's latest funding round?

Coalition's latest funding round is Series F.

How much did Coalition raise?

Coalition raised a total of $770M.

Who are the investors of Coalition?

Investors of Coalition include Valor Equity Partners, Kinetic Partners, Allianz X, Ribbit Capital, Hillhouse Capital Management and 13 more.

Who are Coalition's competitors?

Competitors of Coalition include Cowbell Cyber, Eye Security, Corvus Insurance, RiskQ, Trava and 7 more.

What products does Coalition offer?

Coalition's products include Active Cyber Insurance and 3 more.

Loading...

Compare Coalition to Competitors

Cowbell Cyber specializes in providing cyber insurance solutions within the insurance industry. The company offers cyber coverage tailored to small and medium-sized enterprises (SMEs), utilizing artificial intelligence for continuous risk assessment and underwriting. Cowbell Cyber's products are designed to assist businesses in managing cyber risks through a closed-loop approach, including risk prevention, mitigation, and incident response services. It was founded in 2019 and is based in Pleasanton, California.

At-Bay provides a digital insurance platform for cybersecurity. The company analyzes, models, and predicts cyber risks and offers risk management services along with insurance coverage. It offers cyber insurance, tech errors and omissions (E&O) insurance, and modern risk management solutions. It was formerly known as CyberJack. The company was founded in 2016 and is based in San Francisco, California.

Resilience specializes in cyber risk management and insurance solutions within the cybersecurity industry. The company offers cyber insurance, risk management services, and technology errors and omissions (E&O) insurance to help organizations mitigate and manage cyber threats. Resilience's solutions are designed to enhance cyber resilience by integrating risk mitigation, risk acceptance, and risk transfer strategies. It was founded in 2016 and is based in San Francisco, California.

Corax Cyber Security is a software company helping organizations and the insurance community make better decisions on cyber security actions and investments. Corax's Cyber Risk Analytics Platform quantifies cyber risk for organizations and their surrounding ecosystem and automatically shows how much insurance covers and what security measures offer the highest return on investment. This means customers get the right pricing and coverage for cyber insurance and can build a secure organization in the most cost-effective way. Corax was founded in 2013 and is based in Houston, Texas.

CyberCube specializes in cyber risk analytics for the insurance sector, leveraging a cloud-based technology platform to facilitate data-driven decision-making. The company offers a suite of products and services that enable insurance organizations to quantify cyber risk, optimize portfolio management, and manage cyber risk aggregation. CyberCube's solutions cater to various stakeholders within the insurance industry, including brokers, insurers, reinsurance brokers, and reinsurers. It was founded in 2015 and is based in San Francisco, California.

Vouch offers business insurance services to startups with the technology, advice, and risk-mitigating tools. It provides a wide range of proprietary coverages such as general liability, business property, fiduciary liability, media liability, and more. It serves life science, digital health, web three, hardware, consumer, and other sectors. It was formerly known as SV Instech. It was founded in 2018 and is based in San Francisco, California.

Loading...