Dapper Labs

Founded Year

2018Stage

Unattributed - III | AliveTotal Raised

$676.96MLast Raised

$5.06M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-85 points in the past 30 days

About Dapper Labs

Dapper Labs provides a blockchain-based collectibles and non-fungible token (NFT) platform. Its platform uses blockchain-enabled applications to bring its customers closer to the brands. It enables users to access new forms of digital engagement and track Its ownership securely. The company was founded in 2018 and is based in Vancouver, Canada.

Loading...

ESPs containing Dapper Labs

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The game development solutions market offers a range of technology solutions for game creators, studios, and publishers to develop and enhance their games. These solutions include game engines, development tools, middleware, and platforms that enable the creation of engaging and immersive gaming experiences. The market also caters to the growing demand for user-generated content (UGC) with platfor…

Dapper Labs named as Highflier among 10 other companies, including Epic Games, Immutable, and Niantic.

Loading...

Research containing Dapper Labs

Get data-driven expert analysis from the CB Insights Intelligence Unit.

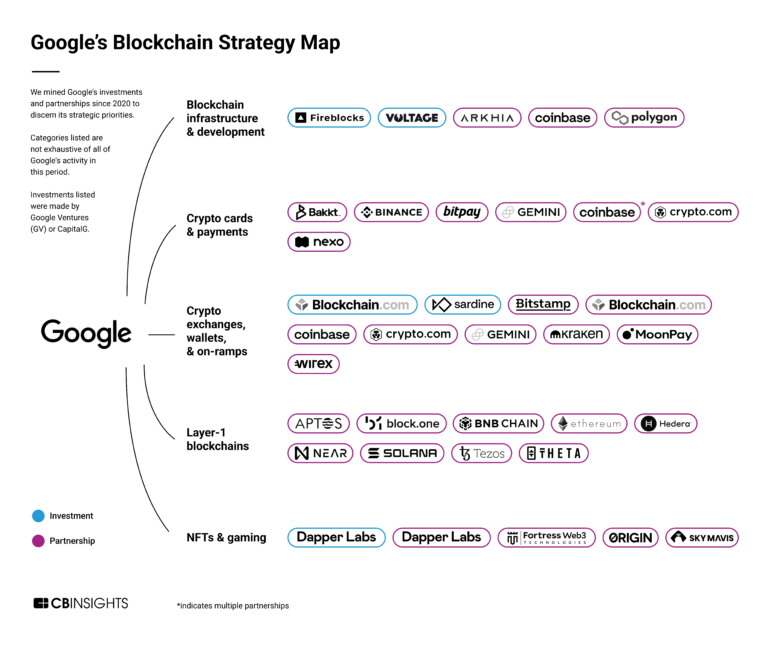

CB Insights Intelligence Analysts have mentioned Dapper Labs in 8 CB Insights research briefs, most recently on Dec 20, 2022.

Jul 29, 2022

Where a16z is investing in crypto and blockchainExpert Collections containing Dapper Labs

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Dapper Labs is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Blockchain

12,836 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Luxury Tech

419 items

Tech-enabled companies launching new luxury brands, as well as startups providing tech solutions to the luxury industry, including e-commerce tools, marketing, and more. While these companies may not exclusively target luxury companies, they have notable luxury partners.

Gaming

5,181 items

Gaming companies are defined as those developing technologies for the PC, console, mobile, and/or AR/VR video gaming market.

Influencer & Content Creator Tech

337 items

Companies that serve independent creators who want to monetize their own work, from content creation tools to administrative back-end platforms to financing solutions.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Dapper Labs Patents

Dapper Labs has filed 27 patents.

The 3 most popular patent topics include:

- digital collectible card games

- 3d imaging

- container formats

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/31/2022 | 5/14/2024 | Cryptocurrencies, Blockchains, Identifiers, Alternative currencies, Ethereum | Grant |

Application Date | 10/31/2022 |

|---|---|

Grant Date | 5/14/2024 |

Title | |

Related Topics | Cryptocurrencies, Blockchains, Identifiers, Alternative currencies, Ethereum |

Status | Grant |

Latest Dapper Labs News

Sep 20, 2024

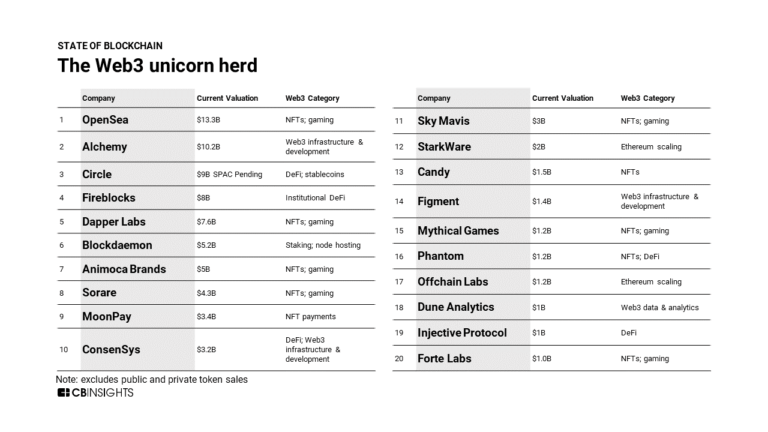

Top 8 Unicorns in Canada Gina MarrsSeptember 20, 2024 Canada is considered an excellent location for startups, due – in part – to its strong and thriving economy, supportive regulatory ecosystem and high standard of living and quality of life. The country is known for its skilled workforce which not only makes hiring staff easier for new companies, but it also serves as an attractive feature to potential investors. Furthermore, Canada has access to global markets as well as a whole lot of programs and incentives run by the government aimed at getting startups to succeed. This includes things like grants, tax incentives and funding programmes too. In addition to merely providing favourable regulations, however, the Canadian government is actively trying to attract successful entrepreneurs by offering foreigners access to the country by means of their startup visa programme Startups are centred on the ideas of uncertainty and risk, but with this risk comes the potential for great success too. Two of the top-valued businesses in Canada are the Royal Bank of Canada and Toronto Dominion Bank, worth $174 billion and $1112 billion respectively. These two businesses, along with Shopify which places third on the list, are all publicly owned companies. Recently, however, there has been an increasing number of businesses that have achieved incredible success all while sticking with private funding and ownership. There are plenty of companies that have achieved great success by means of private funding, but inviting public ownership via IPO or other men’s can help broaden the net in terms of inviting investment. That’s why the business world has come up with a special term for companies that are still operating under private ownership and have exceeded a $1 billion valuation. Of course, it’s impressive for any company to soar to such great heights, but it’s even more impressive for those who have managed to do so by means of “ private funding “. Of course, companies’ valuations change frequently, depending on new investments that they bring in, which means that businesses often drop in and out of unicorn lists. However, as of 2024, Canada is home to between 20 and 30 unicorns. These are the top 8 unicorns in Canada. Currently Canada’s highest-valued unicorn, Dapper Labs is a blockchain gaming platform that makes use of blockchain-enabled applications to help link fans to brands they really like and to help consumers delve into the world of content creation. Dapper Labs brings new forms of digital engagement to people all over the world. Founded in 2018, the startup is worth an impressive $7.6 billion and it’s based in Vancouver , British Columbia. It was launched by a team of three, including Roham Gharegozlou, Dieter Shirley, and Mik Naayem, and about six years later, Dapper Labs now has over 140 investors and nearly 200 employees. Hopper is a VC-backed startup that was founded in Montreal in 2007. The company launched a booking application that is limited to mobile use. Designed to help people revolutionise the way in which they plan their travel, it collects, organises and manages travel data in order to create an effective and trustworthy trip-planning platform. Users can find and book suitable flights and hotels by means of their cell phones, making the process significantly easier than before. It also offers users access to deals, giving them not only a convenient way to plan travel but save money too. The startup was founded by Frederic Lalonde, Sebastien Rainville and Dakota Smith, and nearly two decades later, Hopper is worth $5 billion, making it one of the highest-valued unicorns in Canada. Clearco, based in Ontario, Canada, is the developer of an online financial platform. The platform helps provide growth capital to e-commerce companies using proprietary software as well as data science-powered models. Essentially, this allows them to identify high-growth funding opportunities. From there, they offer allocation in exchange for a steady revenue share of earnings until the full amount has been repaid. Ultimately, the idea is to assist startups financially without them having to give away valuable equity. Clearco was founded by Michele Romanow and Pavel Melnichuk in 2015, and after having received $60 million worth of later-stage funding, the company is now valued at $2 billion.

Dapper Labs Frequently Asked Questions (FAQ)

When was Dapper Labs founded?

Dapper Labs was founded in 2018.

Where is Dapper Labs's headquarters?

Dapper Labs's headquarters is located at 565 Great Northern Way, 600, Vancouver.

What is Dapper Labs's latest funding round?

Dapper Labs's latest funding round is Unattributed - III.

How much did Dapper Labs raise?

Dapper Labs raised a total of $676.96M.

Who are the investors of Dapper Labs?

Investors of Dapper Labs include Delta Growth Fund, Andreessen Horowitz, Version One Ventures, Coatue, Google Ventures and 98 more.

Who are Dapper Labs's competitors?

Competitors of Dapper Labs include DappRadar, Liquid Marketplace, Mint Songs, Candy, Sorare and 7 more.

Loading...

Compare Dapper Labs to Competitors

DappRadar is a decentralized application store. The company offers a platform for managing crypto wallets, tokens, and non-fungible tokens (NFTs), as well as providing insights into the market with smart tools. DappRadar serves as a hub for dapp discovery and a distribution channel for developers to reach consumers, while also incorporating community governance through its decentralized autonomous organization (DAO). It was founded in 2018 and is based in Klaipeda, Lithuania.

Dibbs is a company specializing in the tokenization of physical collectibles, operating within the blockchain and NFT sectors. They provide a platform for brands and intellectual property holders to create and manage asset-backed NFTs, offering services such as regulated custody, proprietary 3D imaging, and minting of digital tokens. Dibbs primarily serves sectors that deal with consumer products in sports, music, entertainment, toys, and luxury goods. It was founded in 2020 and is based in El Segundo, California.

Candy operates as a digital asset content company. The company provides a platform that enables users to purchase, trade, and share sports non-fungible tokens (NFTs). It brings together designers, digital artists, and technologists to develop a broad range of official non-fungible tokens (NFTs). The company was founded in 2021 and is based in New York, New York.

Rally offers a platform specializing in alternative asset investment, offering a marketplace for buying and selling equity shares in collectible assets. The company enables investors to participate in initial offerings and secondary market trading of shares representing ownership in curated collectible items. Rally primarily serves individual investors interested in diversifying their portfolios with alternative investments. It was founded in 2016 and is based in New York, New York.

Big Time Studios operates as a company focusing on the development of multiplayer games. The company's main product is a free-to-play, multiplayer action role-playing game (RPG) that offers fast-action combat and adventure through time and space. The game also includes features such as crafting and upgrading weapons and armor, exploring new adventure instances, and the ability for players to control their virtual assets. The company was founded in 2020 and is based in Los Angeles, California.

Royal focuses on the intersection of music and crypto within the blockchain industry. The company offers a platform that enables individuals to own rights in songs using blockchain technology, allowing artists to maintain control over their work and fans to invest in music. Royal primarily serves the music industry, offering solutions that empower artists and engage fans by providing investment opportunities in music. It was founded in 2021 and is based in Austin, Texas.

Loading...