Fireblocks

Founded Year

2018Stage

Unattributed VC | AliveTotal Raised

$1.039BMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+17 points in the past 30 days

About Fireblocks

Fireblocks is an enterprise-grade platform specializing in secure infrastructure for moving, storing, and issuing digital assets within the blockchain and cryptocurrency sectors. The company offers a suite of applications for digital asset operations management and a comprehensive development platform for building blockchain-based businesses. Fireblocks' solutions cater to a variety of sectors including financial institutions, exchanges, and fintech startups. It was founded in 2018 and is based in New York, New York.

Loading...

ESPs containing Fireblocks

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The institutional staking market provides platforms to institutional investors, crypto platforms, and investment funds looking to earn yield on their digital assets through staking. Staking involves holding and locking up cryptocurrencies to support the network and validate transactions, earning rewards in return. The market offers solutions for managing and securing digital assets, as well as pro…

Fireblocks named as Leader among 15 other companies, including BitGo, Gemini, and Ledger.

Loading...

Research containing Fireblocks

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Fireblocks in 11 CB Insights research briefs, most recently on Feb 23, 2023.

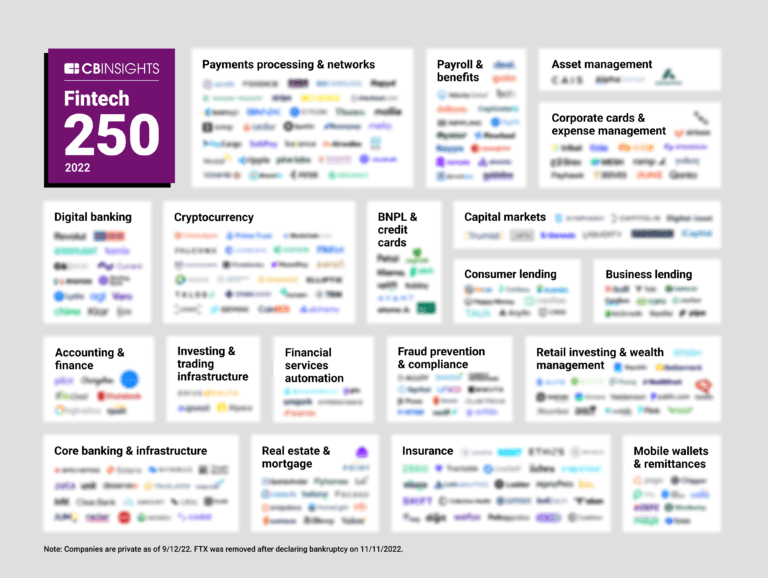

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Fireblocks

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Fireblocks is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Blockchain

12,563 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,295 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Fireblocks Patents

Fireblocks has filed 3 patents.

The 3 most popular patent topics include:

- alternative currencies

- bitcoin

- cryptocurrencies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/29/2021 | 8/20/2024 | Data security, Computer security, Cryptography, Computer network security, National security | Grant |

Application Date | 11/29/2021 |

|---|---|

Grant Date | 8/20/2024 |

Title | |

Related Topics | Data security, Computer security, Cryptography, Computer network security, National security |

Status | Grant |

Latest Fireblocks News

Sep 19, 2024

Polygon Price Fails to React Following POL Migration, Investors Chase RCOF’s 1000x Returns Polygon (POL) has failed to react positively to the recent migration from MATIC to POL as expected after such an upgrade. As POL stalls, investors are turning their attention to a new project on the Ethereum blockchain RCO Finance (RCOF) , which promises a potential thousand-fold profit. This shows the risk-reward ratios between established coins and emerging cryptocurrencies. Let’s find out why POL stalled and whether RCOF can deliver 1,000X returns. Price Remains Weak After MATIC Migrates To POL Polygon has yet to respond favorably to the completed migration from MATIC to POL, which was expected to spark a significant move upward. The upgrade, which took place on September 4, has left POL investors at a loss as opposed to what was anticipated. Instead of a positive trend, the blockchain was faced with dipping user activity and whale investors selling their tokens, resulting in the value of the newly minted POL tanking extensively. The 1:1 upgrade from MATIC to POL, the now gas and staking token, has been met with a stifled market retort. Meanwhile, the subsequent sell-off was followed by a 925% increase in trading volume, an indication of panic selling due to heightened uncertainty. The disparity between POL’s price and volume after the upgrade reflects a market burdened by sellers, likely driven by the negative market trend. POL’s daily transaction profit and loss ratio showed that many POL holders sold their tokens at a loss. The metric, currently at 0.51, denotes that for every profitable transaction, 1.96 transactions amounted to losses. Technical analysis of POL’s 12-hour chart reflects an unsettling short-term outlook for the asset. The primary line of the Moving Average Convergence/Divergence (MACD) indicator is reposing under the signal and zero lines, suggesting bearishness. Also, the Relative Strength Index (RSI) doubles down on this negative outlook, holding at 28.67 in the oversold region. Finally, POL is trading at $0.38, indicating a 6.23% decrease in Polygon’s price in the last 24 hours. RCO Finance Becomes Safe Haven To Investors:1,000X Profit Attainable? POL’s discouraging performance has redirected investors to RCO Finance, given its potential to deliver a 1,000X return. While Polygon’s price tumbled, RCO Finance maintained a steady ascent, inching closer to a new high every day. The drive behind its sustained bullish momentum can be attributed to the growing adoption of its innovative offerings and exploration of its automated services. At the core of RCO Finance is an AI-powered robo-advisor, a tool drawing investors’ attention to the Ethereum decentralized exchange due to its cutting-edge capabilities. The robo-advisor is a trading tool that investors can use to get significant gains from trading. By providing investment recommendations, the robo-advisor points users to lucrative investment opportunities in the growing crypto diaspora. Similar to a financial expert, the robo-advisor analyses trends, patterns, sentiments, and market data generally to draw up a thesis on the most lucrative assets to invest in and when. With over 120,000 digital assets on RCO Finance, the robo-advisor can pinpoint which asset will offer substantial returns, whether in the stocks market, crypto market, derivatives market, RWA sector, and the exchange-traded fund market. Developed with machine-learning algorithms, this tool can function without human supervision, performing roles like executing trade calls on the investor’s behalf and helping them to realize up to a thousand-fold returns from trading and investing. RCO Finance has been scrutinized for vulnerabilities by SolidProof, which did a complete audit of its smart contract. The platform further integrated Fireblocks to enhance user security and its integrity. Following RCO Finance’s public debut, the platform will be regulated by the European Union’s Market In Crypto-Asset (MiCA) regulatory standards. RCOF’s Offers Massive Gain Potential RCOF, the native token of RCO Finance, is demonstrating a tendency for astronomic growth. The token, now in Stage 2 of its ongoing presale, has already achieved impressive growth and is poised to replicate this result thirty-fold by the end of its presale. Early investors will realize up to 30X their initial capital when RCOF hits its final stage price, but those who join the presale now can still book up to a 16X windfall by then. At the current stage, RCOF is trading at $0.0343, selling at a 50% discount. In the coming days, the token is expected to gain 63% to $0.0558, entering Stage 3. Meanwhile, RCOF’s presale will end once the token reaches the $0.4 to $0.6 price range, translating to a 1,000% to 1,600% ROI. RCOF could also deliver a 1,000X profit to investors after it goes live on crypto exchanges. However, to maximize gains from its presale, now is the best time to accumulate RCOF. For more information about the RCO Finance Presale:

Fireblocks Frequently Asked Questions (FAQ)

When was Fireblocks founded?

Fireblocks was founded in 2018.

Where is Fireblocks's headquarters?

Fireblocks's headquarters is located at 500 Fashion Avenue, New York.

What is Fireblocks's latest funding round?

Fireblocks's latest funding round is Unattributed VC.

How much did Fireblocks raise?

Fireblocks raised a total of $1.039B.

Who are the investors of Fireblocks?

Investors of Fireblocks include Haun Ventures, Tenaya Capital, BAM Elevate, Coatue, Paradigm and 26 more.

Who are Fireblocks's competitors?

Competitors of Fireblocks include BitGo, CheckSig, Liminal, Fordefi, Qredo and 7 more.

Who are Fireblocks's customers?

Customers of Fireblocks include Customer Name: Revolut , Crypto.com and GMO Trust.

Loading...

Compare Fireblocks to Competitors

Copper is a technology company focused on providing secure digital asset services to institutional investors within the cryptocurrency sector. The company offers a suite of solutions including institutional custody, prime brokerage services, and collateral management, all designed to facilitate secure and efficient digital asset transactions. Copper primarily caters to hedge funds, trading firms, foundations, exchanges, ETP providers, venture capital funds, and miners seeking advanced infrastructure for managing digital assets. It was founded in 2018 and is based in Zug, Switzerland.

BitGo focuses on providing secure and solutions for the digital asset economy. The company offers a range of services including regulated custody, financial services, and core infrastructure. BitGo primarily serves investors and builders in the digital asset economy, including exchanges, retail platforms, crypto-native firms, and institutional investors. It was founded in 2013 and is based in Palo Alto, California.

Anchorage Digital offers a cryptocurrency platform providing institutions with digital asset financial services and infrastructure solutions. It offers a digital bank as a crypto-native bank and also offers crypto strategies for institutions. The company provides security and asset accessibility, including capturing yield from staking and inflation, voting, auditing proof of existence, and fast transactions. It primarily caters to the financial sector. The company was founded in 2017 and is based in San Francisco, California.

Ledger specializes in secure hardware wallets and digital asset management solutions within the cryptocurrency sector. The company offers products that store private keys for cryptocurrencies and NFTs, enabling secure transactions and asset management. Ledger's hardware wallets are designed to work with the Ledger Live app, which facilitates the buying, selling, swapping, and staking of various cryptocurrencies. It was founded in 2014 and is based in Paris, France.

Hex Trust is a fully licensed and insured provider of bank-grade custody for digital assets. The company offers Hex Safe, a bank-grade platform for securing and managing digital assets. It was founded in 2018 and is based in Hong Kong.

Fordefi operates as a financial technology company specializing in secure digital asset management for institutions. The company offers a multi-party computation (MPC) wallet platform and web3 gateway that allows users to self-custody private keys, connect to decentralized applications (dApps), and manage digital assets with enhanced security policies. Fordefi primarily serves funds and trading firms, market makers, and web3 companies, providing them with tools to scale their strategies and manage their digital asset operations securely. It was founded in 2021 and is based in Woodmere, New York.

Loading...