iCapital Network

Founded Year

2013Stage

Corporate Minority | AliveTotal Raised

$729.22MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+159 points in the past 30 days

About iCapital Network

iCapital Network is a company that operates in the financial technology sector, focusing on the alternative investment marketplace. It provides a digital platform that offers access to private market investments, hedge funds, and defined outcome solutions, along with educational resources and analytics for financial advisors and their clients. The platform is designed to streamline the investment process and integrate with clients' existing infrastructure. It was founded in 2013 and is based in New York, New York.

Loading...

ESPs containing iCapital Network

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The alternative investment product platforms market provides the infrastructure through which wealth managers, independent broker-dealers, RIA aggregators, financial advisors, banks, and trust companies can provide accredited investors and qualified purchasers access to alternative asset classes, strategies, and investment products. These include private equity, private credit, hedge funds, real e…

iCapital Network named as Leader among 9 other companies, including CAIS, Securitize, and Alto.

Loading...

Research containing iCapital Network

Get data-driven expert analysis from the CB Insights Intelligence Unit.

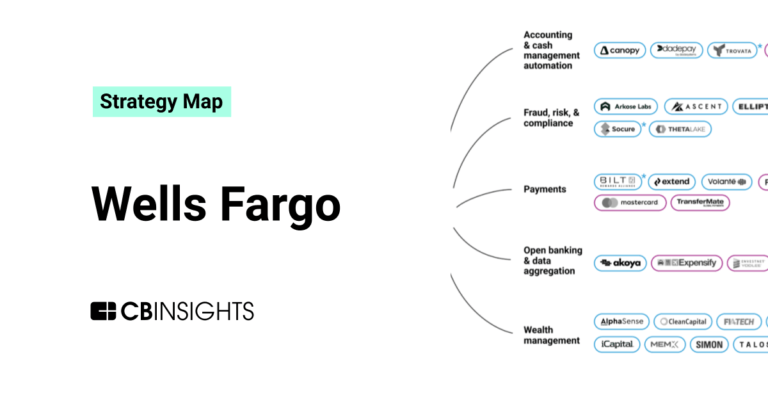

CB Insights Intelligence Analysts have mentioned iCapital Network in 4 CB Insights research briefs, most recently on Jul 6, 2023.

Expert Collections containing iCapital Network

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

iCapital Network is included in 6 Expert Collections, including Real Estate Tech.

Real Estate Tech

2,486 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Unicorns- Billion Dollar Startups

1,244 items

Wealth Tech

2,528 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Capital Markets Tech

1,119 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

9,297 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest iCapital Network News

Sep 12, 2024

News provided by Share this article https://icapital.com/ Alternative investment fund focused on providing capital solutions to sports teams, owners and leagues is now available on iCapital Marketplace for wealth managers and advisors MONUMENT, Colo. and NEW YORK, Sept. 12, 2024 /PRNewswire/ -- Advisors Asset Management (AAM), a leading investment solutions provider, and iCapital 1, the global fintech platform driving the world's alternative investment marketplace for the wealth management industry, announced today that the Avenue Sports Opportunities Fund (Avenue Sports Fund), managed by Avenue Capital Group (Avenue), is available on iCapital Marketplace . "AAM is happy to collaborate with Avenue Capital Group and iCapital to expand distribution for the Avenue Sports Fund," said Cliff Corso , President and CIO at AAM. "This initiative embodies our commitment to innovation within the alternatives space and strategic growth, designed to recognize the evolving needs of investors and capitalize on the emergence of sports as an investment opportunity." The Avenue Sports Fund seeks to produce attractive, risk-adjusted returns by providing capital solutions to a wide variety of sports teams, owners and leagues predominantly in North America and Europe. It also will provide growth capital to emerging sports with significant growth potential, as well as invest in equity and debt opportunities within women's sports. "By partnering with AAM and iCapital, we are providing advisors access to the Avenue Sports Fund, which offers a compelling and unique opportunity to invest in sports," said Marc Lasry , Chairman, CEO and Co-Founder of Avenue Capital Group. "There are strong fundamentals across the sports landscape, and scarcity value and other qualities are expected to create favorable entry points for investments in this asset class moving forward." The core areas of investment focus within the Avenue Sports Fund include debt and preferred equity, minority stakes in established leagues and sports businesses, and control ownership opportunities in emerging leagues, in women's sports and in other sports properties. Some of the investments the Avenue Sports Fund has made to date include an investment in SailGP's Team USA ; the acquisition of San Francisco-based The Bay Golf Club in TGL , a new golf league formed by Tiger Woods and Rory McIlroy with backing from the PGA Tour; the acquisition of the New York Mavericks of the Professional Bull Riders Team Series league; a significant minority stake in Trackhouse Entertainment Group , a motor sports business that owns a NASCAR Cup Series team and a MotoGP team; debt and equity investments in Cosm , an immersive technology, media and entertainment company, which includes key partners in Sports; debt and equity investments in Ipswich Town Football Club , which competes in the English Premier League; and an investment in PGA Tour Enterprises, the for-profit commercial arm of the PGA Tour. "We are excited to partner with AAM and Avenue Capital Group and provide the technology platform to enable greater access to their sports fund for a larger set of wealth managers and private investors," said Dan Vene , Co-Founder and Managing Partner of iCapital. "Appetite is growing for alternative investments in the rapidly evolving sports asset class. With this partnership, advisors and their high-net-worth clients will have proper educational tools to better understand this asset class and a simplified client experience when investing in these products." About Advisors Asset Management For 45 years, AAM has been a trusted resource for financial professionals. The firm offers access to alternatives, exchange-traded funds, the fixed income markets, managed accounts, mutual funds, structured products, and unit investment trusts. AAM is a part of SLC Management, the institutional alternatives and traditional asset management business of Sun Life. For more information, visit www.aamlive.com . In 2023, AAM facilitated over $36 billion in combined sales and investments through 16,700 financial professionals industry-wide who accessed AAM's investment solutions platform. * *Of the $36 billion, approximately $9 billion were Exchange-Traded Fund (ETF), Managed Account (SMA), Mutual Fund, and Unit Investment Trust (UIT) assets, while $27 billion was in Fixed Income securities, including bonds and Structured Products. Advisors Asset Management, Inc. (AAM) is a SEC-registered investment advisor and member FINRA/SIPC. | Registration does not imply a certain level of skill or training. | 18925 Base Camp Road | Monument, CO 80132 For more information, visit www.aamlive.com | X (Twitter): @aamlive | LinkedIn: https://www.linkedin.com/company/advisors-asset-management-inc-/ About Avenue Capital Group Avenue Capital Group is a global investment firm primarily focused on making specialty lending, opportunistic credit and other special situation investments across the United States, Europe, and Asia. The firm, founded in 1995 by Marc Lasry and Sonia Gardner, draws on the skills and experience of over 70 investment professionals and more than 185 employees operating from its headquarters in New York and offices in Europe, Asia and Abu Dhabi. Avenue has assets under management of approximately $12.2 billion. About iCapital iCapital powers the world's alternative investment marketplace offering a complete suite of tools, end-to-end enterprise solutions, data management and distribution capabilities and an innovative operating system. iCapital is the trusted technology partner to independent financial advisors, wealth managers, and asset managers, offering unrivaled access, technology, and education to incorporate alternative assets into the core portfolio strategies for their clients. At the forefront of the digital transformation in alternative investing, iCapital's secure platform delivers a complete portfolio of management capabilities for education, transactions, data flows, analytics, and client support throughout the investment lifecycle. With $194.3 billion2 in global platform assets, the iCapital operating system automates and streamlines the complex process of private market investing and seamlessly integrates with clients' existing infrastructure platform and tools. iCapital employs more than 1,500 people globally, and has 17 offices worldwide including New York, Greenwich, Zurich, Lisbon, London, Hong Kong, Singapore, Tokyo, and Toronto. iCapital has consistently been recognized for its outstanding innovation, fintech industry leadership, and performance including Forbes Fintech 50 for 2018, 2019, 2020, 2021, 2022, 2023, and 2024 and MMI/Barron's Industry Awards as Solutions Provider of the Year for 2020, 2021, 2022, and 2023. For more information, visit icapital.com | X (Twitter): @icapitalnetwork | LinkedIn: https://www.linkedin.com/company/icapital-network-inc Disclosures This material has been provided to you for informational purposes only by iCapital, Inc. and/or one of its affiliates including Institutional Capital Network, Inc. (collectively, "iCapital"). This material is the property of iCapital and may not be shared without its written permission. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation to employ a specific investment strategy, or as an offer to sell, a solicitation of an offer to purchase, or a recommendation of any interest in any fund or security. Security products and services are offered through iCapital Markets LLC, a registered broker/dealer, member FINRA and SIPC. Financial products made available by iCapital Markets LLC may be complex and/or speculative and are not suitable for all investors. iCapital Advisors, LLC is an investment adviser registered with the Securities and Exchange Commission and acts as an adviser to certain privately offered investment funds. "iCapital" and "iCapital Network" are registered trademarks of Institutional Capital Network, Inc. © 2024 Institutional Capital Network, Inc. All Rights Reserved. CRN: 2024-0905-11962 R

iCapital Network Frequently Asked Questions (FAQ)

When was iCapital Network founded?

iCapital Network was founded in 2013.

Where is iCapital Network's headquarters?

iCapital Network's headquarters is located at 60 East 42nd Street, New York.

What is iCapital Network's latest funding round?

iCapital Network's latest funding round is Corporate Minority.

How much did iCapital Network raise?

iCapital Network raised a total of $729.22M.

Who are the investors of iCapital Network?

Investors of iCapital Network include Bank of America, WestCap, Temasek, Apollo Global Management, Blackstone and 27 more.

Who are iCapital Network's competitors?

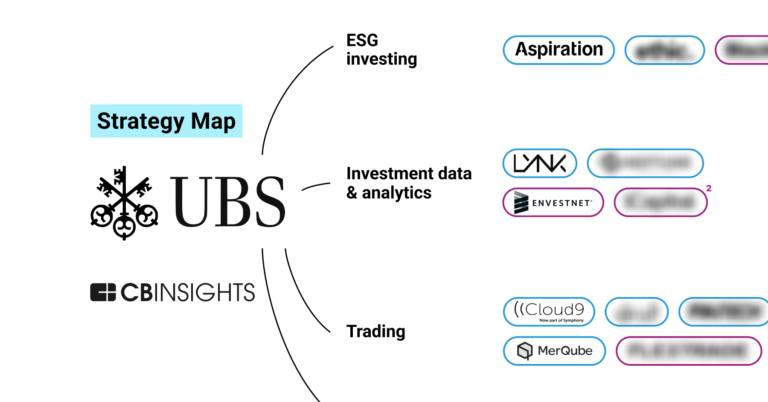

Competitors of iCapital Network include Carbon Equity, AirFund, Opto Investments, Private Markets Alpha, Lynk and 7 more.

Loading...

Compare iCapital Network to Competitors

Moonfare is a company that specializes in providing access to private equity investments through its digital platform. The company offers a range of services including the ability to invest in individual funds, a diversified portfolio of funds, a private markets ELTIF strategy for suitable investors, and a secondary market for buying and selling allocations before maturity. It was founded in 2016 and is based in Berlin, Germany.

CAIS is a fintech company focused on transforming the world of alternative investing. The company provides a platform that connects independent financial advisors with leading alternative asset managers, enabling them to transact alternative investments and structured notes at a large scale. The company primarily serves the financial advisory sector and the alternative asset management industry. It was founded in 2009 and is based in New York, New York.

Canoe focuses on alternative investment technology, particularly on automating document and data workflows for the financial sector. The company offers cloud-based machine learning solutions for document collection, data extraction, and data science initiatives, transforming complex documents into actionable intelligence. Canoe primarily serves institutional investors, asset servicers, capital allocators, and wealth managers with its technology. It was founded in 2017 and is based in New York, New York.

Titanbay is a company that focuses on facilitating investment in private markets. The company's main service is to identify and provide access to top-tier private market funds, enabling investors to build diversified private market portfolios on their platform. Titanbay primarily sells to sectors such as private banks and wealth managers, individual professional investors, and institutional and family office investors. It was founded in 2019 and is based in Luxembourg.

Orion Advisor Technology specializes in providing comprehensive software solutions for financial advisors within the wealth management sector. The company offers a suite of products that facilitate portfolio accounting, client relationship management, and trading, as well as tools for risk assessment, regulatory compliance, and financial planning. Orion Advisor Technology was formerly known as Orion Advisor Services. It was founded in 1999 and is based in Omaha, Nebraska. Orion Advisor Technology operates as a subsidiary of Orion.

BridgeFT focuses on Wealth Technology (WealthTech) infrastructure, providing services within the financial technology sector. The company offers a WealthTech-as-a-Service platform that includes financial data aggregation, advanced analytics, and applications essential for wealth management. BridgeFT primarily serves FinTech companies, registered investment advisors (RIAs), turnkey asset management platforms (TAMPs), and other financial institutions. It was founded in 2015 and is based in Chicago, Illinois.

Loading...