Kavak

Founded Year

2016Stage

Line of Credit - II | AliveTotal Raised

$3.102BLast Raised

$704M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-61 points in the past 30 days

About Kavak

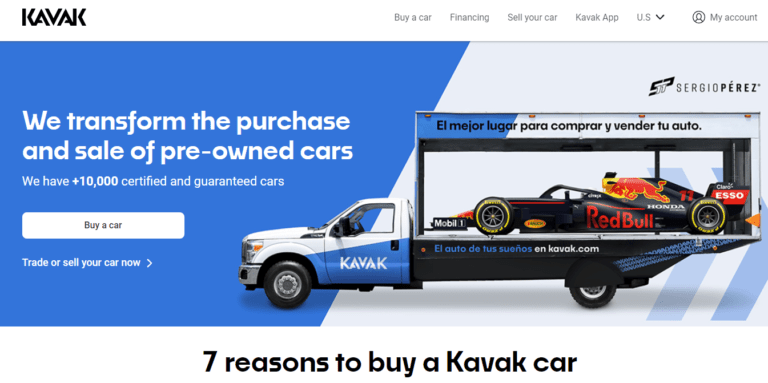

Kavak is a company that specializes in the buying, selling, and financing of pre-owned cars within the automotive industry. They provide a platform for customers to purchase certified and guaranteed vehicles, offer vehicle inspection services, and facilitate car financing and after-sales support. Kavak primarily serves individuals looking for a reliable and convenient way to buy or sell used cars. It was founded in 2016 and is based in Mexico City, Mexico.

Loading...

Loading...

Research containing Kavak

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Kavak in 4 CB Insights research briefs, most recently on Mar 30, 2022.

Mar 30, 2022

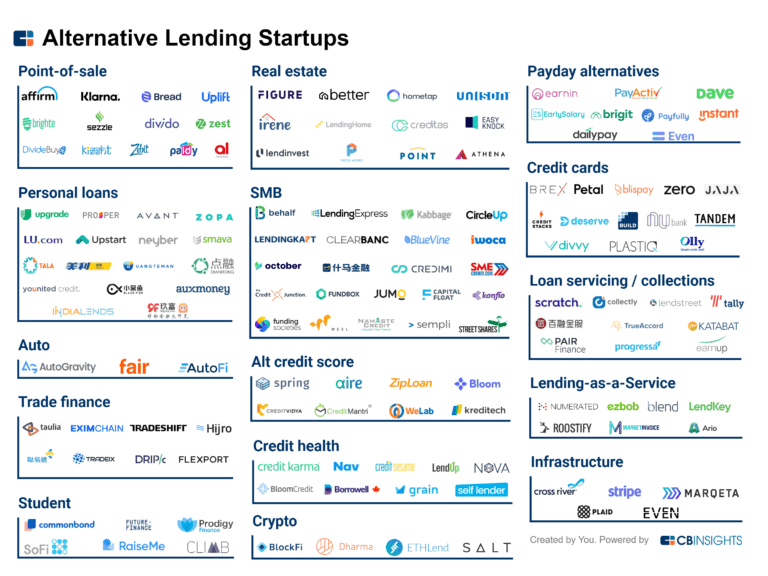

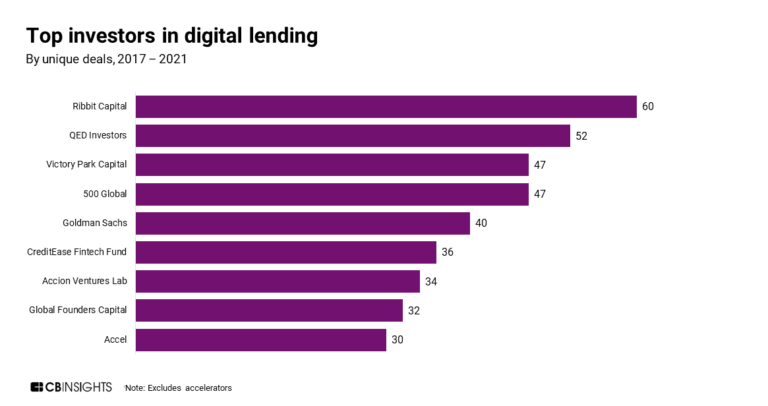

140+ startups shaping the digital lending space

Expert Collections containing Kavak

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Kavak is included in 5 Expert Collections, including E-Commerce.

E-Commerce

11,033 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,244 items

Digital Lending

2,271 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Auto Commerce

700 items

Companies involved in the rental, selling, trading, or purchasing of cars, RVs, trucks, and fleets, including auto financing companies, vehicle auction services, online classified advertising companies with a focus on auto, and dealership software platforms.

Fintech

13,396 items

Excludes US-based companies

Latest Kavak News

Jul 7, 2024

Welcome to Latam Insights, a compendium of Latin America’s most relevant crypto and economic news during the last week. In this issue: Paraguay raises bitcoin mining power fees, Bolivia talks about the utility of stablecoins as dollar alternatives, and Kavak tokenizes debt in Brazil. Paraguay Raises Bitcoin Mining Power Fees by 14%, Companies Mull Stopping […]

Kavak Frequently Asked Questions (FAQ)

When was Kavak founded?

Kavak was founded in 2016.

Where is Kavak's headquarters?

Kavak's headquarters is located at Carretera Amomolulco - Capulhuac, No. 1 Col. El Panteón, Mexico City.

What is Kavak's latest funding round?

Kavak's latest funding round is Line of Credit - II.

How much did Kavak raise?

Kavak raised a total of $3.102B.

Who are the investors of Kavak?

Investors of Kavak include HSBC, Goldman Sachs, Santander Bank, Wollef, SoftBank Latin America Fund and 19 more.

Who are Kavak's competitors?

Competitors of Kavak include VavaCars and 3 more.

Loading...

Compare Kavak to Competitors

Spinny is a full-stack used car trading platform that specializes in offering high-quality, thoroughly inspected second-hand cars. The company provides a transparent and seamless car buying and selling experience, featuring a rigorous 200-point quality check and a 5-day money-back guarantee for all vehicles. Spinny also offers additional services such as car financing, a one-year comprehensive warranty, and buyback options to enhance customer satisfaction. It was founded in 2015 and is based in Gurugram, India.

Carsome provides an e-commerce platform, specializing in the online buying and selling of used cars. The company offers a comprehensive service that includes car inspection, valuation, an online bidding portal for dealers, and logistics support, ensuring a seamless selling experience for customers. It was founded in 2015 and is based in Petaling Jaya, Malaysia.

Ualá operates in the financial technology sector, focusing on providing digital financial services. The company offers a prepaid Mastercard and an application that allows users to manage their money, make purchases, access loans, invest, and pay bills. Ualá primarily serves the financial services industry. It was founded in 2017 and is based in Buenos Aires, Argentina.

Cinch is a company that operates in the automotive industry with a focus on online car services. The company offers a platform for buying and selling cars, providing services such as home delivery, part exchange, and car finance. Additionally, Cinch provides car care services, including a 90-day warranty, breakdown assistance, and optional lifetime warranty and servicing. It was founded in 2018 and is based in Farnham, England.

YoFio focuses on providing financial solutions to support merchants and micro-entrepreneurs. The company offers loans to help businesses manage cash flow, pay suppliers, and restock inventory without interest. YoFio primarily serves the small business sector with its credit app. It was founded in 2019 and is based in Mexico City, Mexico.

IBANCAR is a fintech company specializing in asset-based lending within the financial services industry. The company offers a unique lending model that uses a borrower's car as collateral, enabling loans to be processed remotely and without physical contact, providing quick access to funds. IBANCAR's services cater to a wide range of customers, including those with limited credit history, by offering ethical and inclusive loan options. It was founded in 2017 and is based in Malaga, Spain.

Loading...