Mambu

Founded Year

2011Stage

Debt | AliveTotal Raised

$445.51MValuation

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-30 points in the past 30 days

About Mambu

Mambu is a software-as-a-service (SaaS) company focused on providing a cloud banking platform within the financial services industry. The company offers a composable banking infrastructure that enables clients to create and manage lending and deposit services, as well as integrate with various application programming interfaces (APIs) for a customizable financial experience. Mambu primarily serves sectors such as banks, credit unions, and retailers looking to offer digital financial products. It was founded in 2011 and is based in Amsterdam, Netherlands.

Loading...

Mambu's Product Videos

ESPs containing Mambu

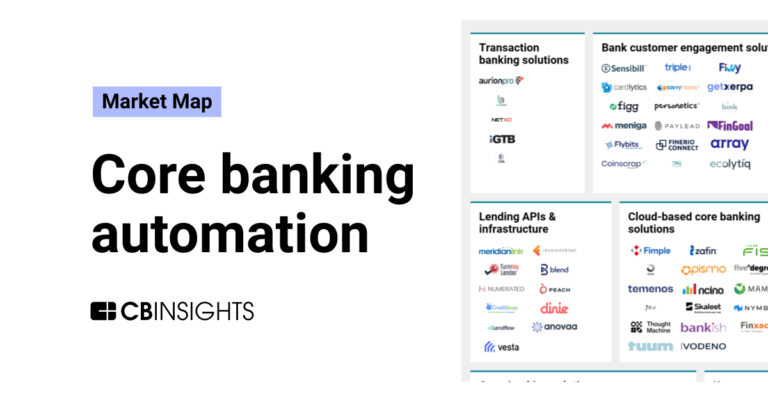

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

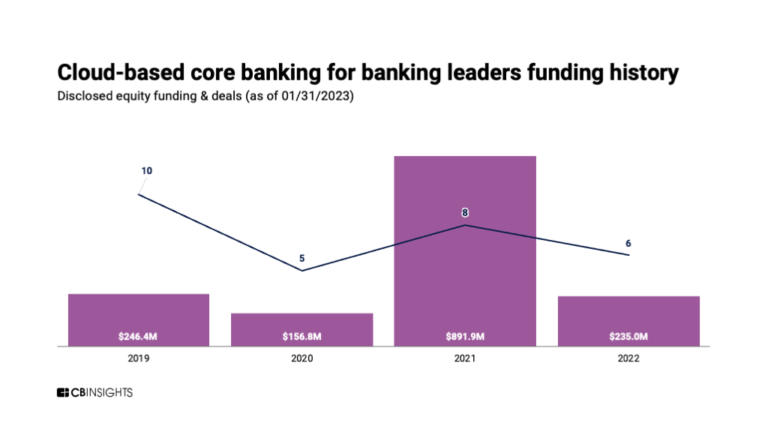

The cloud-based core banking solutions market offers financial institutions the opportunity to modernize outdated legacy systems and provide customers with personalized products and services. The market is competitive, with vendors offering cloud-native solutions that are scalable, secure, and cost-effective. The use of APIs and microservices architecture allows for quick integration with other sy…

Mambu named as Outperformer among 15 other companies, including Temenos, Oracle, and Fiserv.

Mambu's Products & Differentiators

Mambu platform

A SaaS and cloud-native core banking platfrom

Loading...

Research containing Mambu

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mambu in 6 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Mambu

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mambu is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Digital Lending

2,376 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

13,398 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

979 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Mambu News

Sep 10, 2024

By Gloria Mathias Share Amazon Web Services (AWS), an Amazon.com, Inc. Company, has announced that PT Krom Bank Indonesia Tbk (Krom Bank ), a member of Kredivo Group, has built on AWS services since it launched the Krom digital banking service. Krom Bank’s vision is to serve underbanked customers with personalised services through its application and empower the younger generation to achieve financial independence through responsible saving and intelligent financial planning . The bank offers customers deposits with attractive interest rates, accessible within its fast application and protected with robust security measures enabled by AWS. The bank gains agility to rapidly experiment and iterate, producing innovative new services for underbanked Indonesians to improve their financial well-being using managed services and generative artificial intelligence (Gen AI), including e-KYC, facial recognition, and personalised services. “AWS provides the flexibility we need to rapidly evolve our suite of financially inclusive mobile banking services, making them engaging and easy to use,” said Anton Hermawan, President and Director of Krom Bank. “Cloud technology helps us deliver innovative and secure financial services to Indonesia’s youth and previously underserved parts of Indonesia’s population. Krom Bank benefits from being hosted in the AWS Asia Pacific (Jakarta) region, enabling us to meet local regulatory requirements while serving end-users with lower latency. We look forward to continued robust growth with AWS.” Krom Bank plans to continue innovating to enhance its customer experience, including chatbot and virtual assistance, by exploring AWS’s generative AI services, including Amazon Bedrock. To further accelerate its digital transformation journey, Krom Bank leverages Mambu, a SaaS cloud banking platform and AWS Advanced Technology Partner. Mambu acts as the core ledger, powering Krom Bank’s lending products. By operating on Mambu, underpinned by AWS, Krom Bank has an agile, scalable, and secure infrastructure to support its present needs and future growth. “The financial services industry in Indonesia is evolving to serve a growing population of new, previously underbanked users with cloud technology, which lies at the heart of any digital transformation program,” said Anthony Amni, Country Leader, Indonesia, AWS. “Krom Bank innovates at a rapid pace to develop intuitive banking services on AWS that make managing finances easy and engaging. Removing the complexity from banking is critical for many mobile app users in Indonesia, and the bank achieves this with the agility, security, and availability of the cloud.” Previous Article Digital monthly issue Global coverage

Mambu Frequently Asked Questions (FAQ)

When was Mambu founded?

Mambu was founded in 2011.

Where is Mambu's headquarters?

Mambu's headquarters is located at Piet Heinkade 55, Amsterdam.

What is Mambu's latest funding round?

Mambu's latest funding round is Debt.

How much did Mambu raise?

Mambu raised a total of $445.51M.

Who are the investors of Mambu?

Investors of Mambu include 4G Capital, EQT, Runa Capital, Acton Capital, Bessemer Venture Partners and 10 more.

Who are Mambu's competitors?

Competitors of Mambu include M2P, FlexM, Sopra Banking Software, Zafin, Volante and 7 more.

What products does Mambu offer?

Mambu's products include Mambu platform.

Who are Mambu's customers?

Customers of Mambu include ABN Amro - New10, N26 and Cake bank.

Loading...

Compare Mambu to Competitors

Business Alliance Financial Services (BAFS) specializes in providing commercial lending software and services to financial institutions. Their main offerings include a cloud-based lending platform known as BLAST, along with a suite of services that support client onboarding, credit administration, and regulatory compliance. They also offer financial statement analysis, credit risk rating systems, and data analytics solutions to enhance the commercial lending process. It was founded in 2009 and is based in Monroe, Louisiana.

Volante Technologies specializes in cloud-native payments processing and financial messaging solutions within the financial technology sector. The company offers a suite of services including real-time payments processing, payments as a service, and tools for ISO 20022 migration, aimed at modernizing and streamlining financial transactions for institutions. Volante's low-code platform facilitates rapid development and integration of financial services, enabling businesses to adapt and innovate quickly. It was founded in 2001 and is based in Jersey City, New Jersey.

Finastra provides a range of financial services, treasury, lending, and banking software solutions. The company offers a wide range of services including lending and corporate banking, payments, treasury and capital markets, universal banking, and investment management. It primarily serves the financial technology industry. It was founded in 2017 and is based in London, United Kingdom.

BrightFi is a financial technology company that provides digital banking services that help financial institutions and non-banks of all sizes who want to launch banking products, configure, test and deploy new products or digital brands at a fraction of the time and cost.

Abrigo focuses on providing software solutions in the financial sector. The company offers a range of products that help in lending, financial crime detection, risk management, and analytics. These products are designed to assist in various aspects such as commercial lending, consumer lending, anti-money laundering, fraud detection, and portfolio risk management. Abrigo was formerly known as Sageworks. It was founded in 2000 and is based in Austin, Texas.

FintechOS specializes in financial technology and insurance, focusing on streamlining the creation and management of banking and insurance products. It offers a platform that enables businesses to design, launch, and service financial and insurance products. It serves the banking and insurance sectors, offering solutions that cater to retail banking, small business banking, general insurance, and embedded finance, among others. It was founded in 2016 and is based in London, United Kingdom.

Loading...