Rad AI

Founded Year

2018Stage

Series B | AliveTotal Raised

$83.25MLast Raised

$50M | 5 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+59 points in the past 30 days

About Rad AI

Rad AI provides artificial intelligence solutions for the radiology sector, focusing on helping physician workflows and patient care. It offers a suite of products that automate radiology reporting, impressions, worklist prioritization, and patient follow-ups, aiming to save time for radiologists and reduce burnout. It serves the healthcare sector. The company was founded in 2018 and is based in San Francisco, California.

Loading...

Rad AI's Product Videos

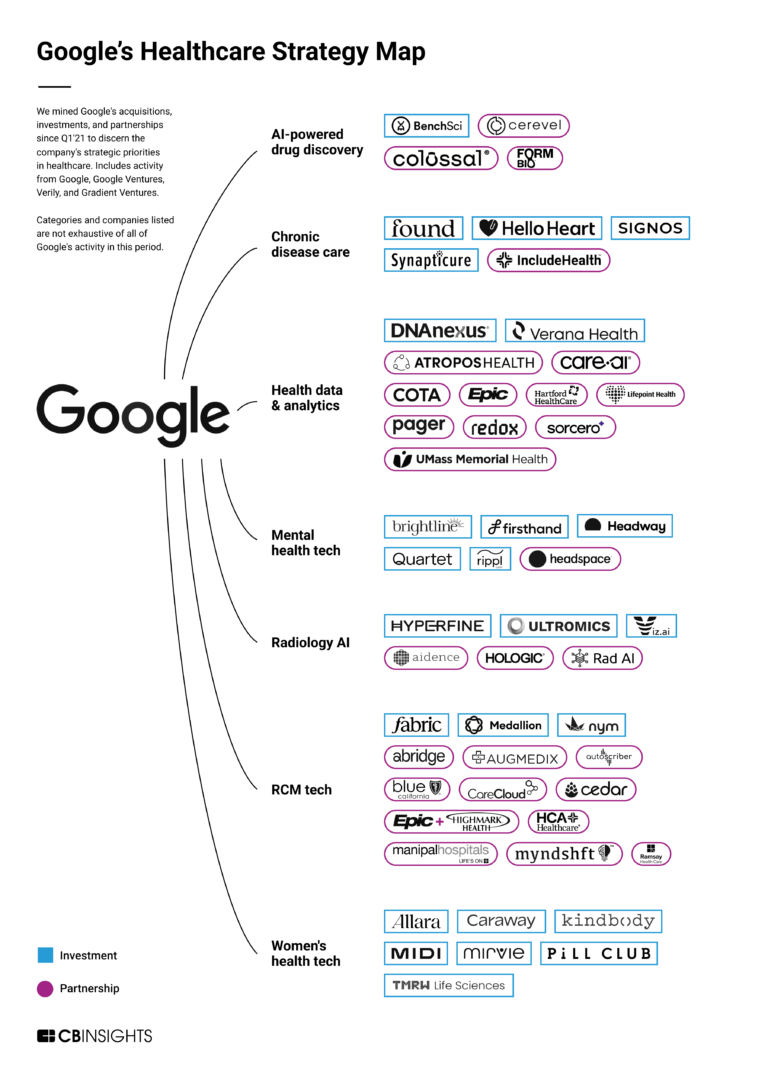

ESPs containing Rad AI

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

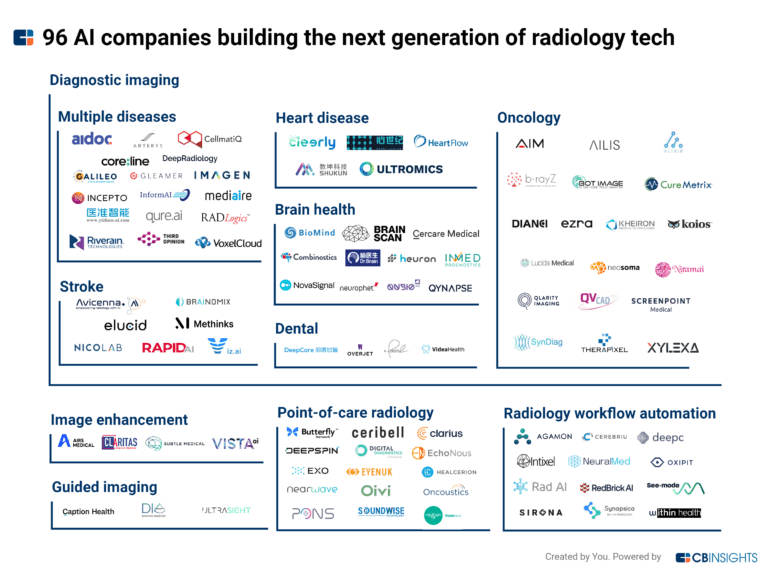

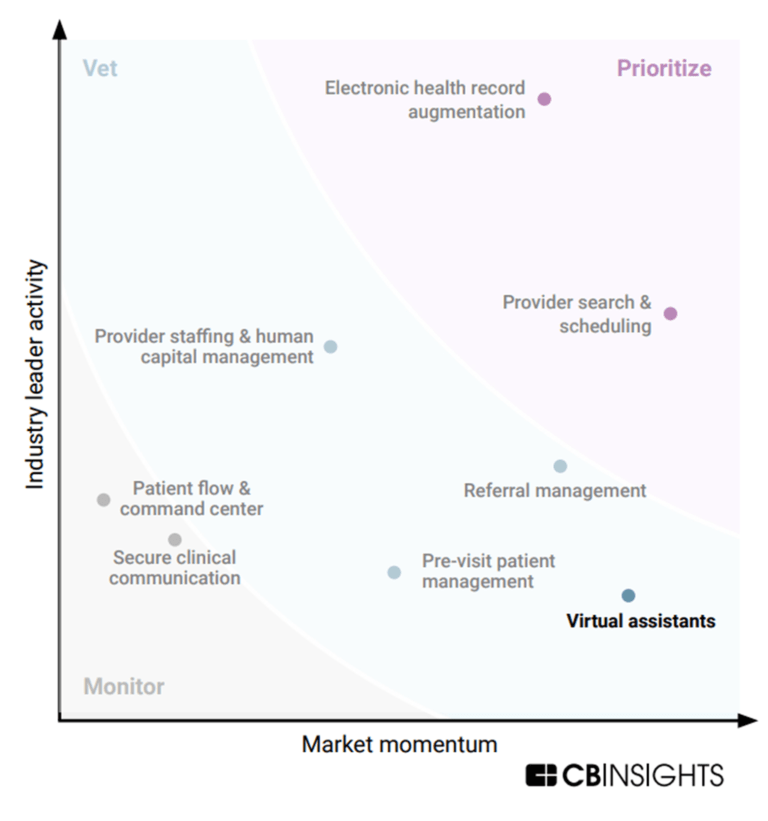

The radiology workflow automation market aims to improve the efficiency and accuracy of radiology processes through the use of technology. This includes tasks such as patient scheduling, exam and procedure ordering, patient document management, report generation, and communications. Additionally, the market encompasses various software solutions and platforms that integrate with radiology informat…

Rad AI named as Leader among 10 other companies, including Viz.ai, Sirona Medical, and PaxeraHealth.

Rad AI's Products & Differentiators

Omni

Automatically generates the last 1/3 of the radiology report (conclusions, summary and follow-up recommendations) using generative AI, customized to each individual radiologist's language and style. Integrates seamlessly with all major radiology voice recognition software on the market. Saves radiologists an average of 1 hour per 9-hour shift, while reducing fatigue and burnout, and improving radiologist productivity. Already in use by 8 of the 10 largest radiology groups in the US, as well as many health systems; customer groups comprise > 25% of all radiologists in the US.

Loading...

Research containing Rad AI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

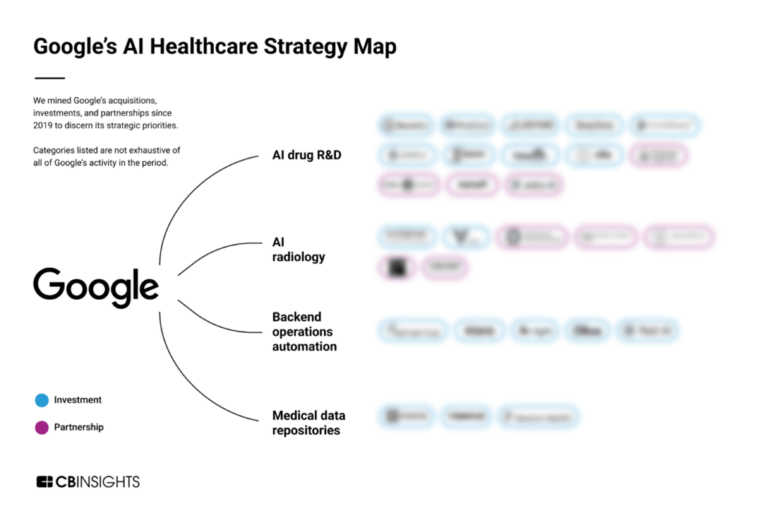

CB Insights Intelligence Analysts have mentioned Rad AI in 6 CB Insights research briefs, most recently on Apr 25, 2024.

Expert Collections containing Rad AI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Rad AI is included in 4 Expert Collections, including Artificial Intelligence.

Artificial Intelligence

14,767 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Digital Health

11,072 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Digital Health 50

200 items

The winners of the third annual CB Insights Digital Health 150.

AI 100

100 items

Rad AI Patents

Rad AI has filed 12 patents.

The 3 most popular patent topics include:

- health informatics

- machine learning

- medical imaging

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/9/2023 | 2/27/2024 | Machine learning, Audio codecs, Health informatics, Video codecs, Artificial intelligence | Grant |

Application Date | 6/9/2023 |

|---|---|

Grant Date | 2/27/2024 |

Title | |

Related Topics | Machine learning, Audio codecs, Health informatics, Video codecs, Artificial intelligence |

Status | Grant |

Latest Rad AI News

Sep 10, 2024

Growth equity firm Alpha Partners closes oversubscribed $153m third fund Published: 10-09-2024 11:10:00 | By: Pie Kamau | hits: 8 | Tags: Alpha Partners, a growth equity firm that invests in top-tier growth equity rounds, announced the final close of its oversubscribed third fund, Alpha Partners Fund III (Fund III) with $153 million in commitment. Alpha will continue the mission it pioneered in 2013, of investing in the best growth stage opportunities by partnering with over 1,000 early-stage venture firms who have insider access to their own top-returning portfolio companies. These early-stage funds often have the access to the best opportunities, but 5-10 years after their initial seed or early stage investment, lack existing fund capital to fund these companies' de-risked later rounds. Alpha estimates that the size of this emerging investment opportunity amounts to tens of billions annually. Alpha Fund III investors include returning investors and a diverse group of new backers, including prominent U.S. and international institutions, family offices, and registered investment advisors. This interest has propelled Alpha Fund III to become nearly three times larger than its previous fund, growing their assets under management to over $300 million. Steve Brotman , Managing Partner, Alpha Partners: "We are grateful that nearly all of our limited partners renewed their commitment with us. We're excited to add a number of institutions from around the world as new limited partners." With Fund III, Alpha Partners will continue to focus on the proven investment strategy that it pioneered in 2013. Alpha helps early-stage investment firms access fresh reserve capital to maximize their ownership in their best-performing companies. Alpha's collaborative approach enables it to invest with little competition into companies that attract over-subscribed rounds from the world's best investment firms. Recent investments include Pearl, an FDA approved AI platform that allows dental professionals to review dental x-rays more efficiently; Second Front, a software company that enables commercial software vendors to sell their products to the US government in a secure, cost-effective, and rapid manner; Shield AI, a developer of autonomous drone systems and AI piloting software; Rad AI, an AI platform for radiologists that streamlines their workflows; and Chainguard, a software supply chain cybersecurity firm that's protecting the integrity of open source code. Alpha's portfolio company exits by IPO include Coupang, Coursera, Rover, Udemy, Vroom, and Wish, as well as exits by acquisitions including HPE's acquisition of Cloud Technology Partners and by Uber's acquisition of Careem. Would you like to be featured on Startup Weekly for a free profile interview? Fill in this questionnaire here . You can also send your columns / opinions / thought leadership pieces / industry insights, survey and reports to info@startup-weekly.com . Publications by country. Africa

Rad AI Frequently Asked Questions (FAQ)

When was Rad AI founded?

Rad AI was founded in 2018.

Where is Rad AI's headquarters?

Rad AI's headquarters is located at 548 Market Street, San Francisco.

What is Rad AI's latest funding round?

Rad AI's latest funding round is Series B.

How much did Rad AI raise?

Rad AI raised a total of $83.25M.

Who are the investors of Rad AI?

Investors of Rad AI include Gradient Ventures, OCV Partners, Artis Ventures, Kickstart Fund, WiL and 16 more.

Who are Rad AI's competitors?

Competitors of Rad AI include Ferrum Health and 8 more.

What products does Rad AI offer?

Rad AI's products include Omni and 3 more.

Who are Rad AI's customers?

Customers of Rad AI include Kaiser Permanente, MedStar Health, Radiology Associates of North Texas (RANT), Radiology Partners and Cone Health.

Loading...

Compare Rad AI to Competitors

Agamon is a health-tech company that focuses on improving imaging patient workflow management within the healthcare industry. The company offers a platform that uses advanced Generative AI technology to automate the process of detecting actionable findings in radiology reports, notifying referring physicians, and tracking follow-up adherence. Agamon primarily serves healthcare systems and imaging centers. It was founded in 2017 and is based in Tel Aviv-Yafo, Israel.

Medicom specializes in healthcare interoperability and operates within the health information technology sector. The company offers a federated health information network that aggregates and facilitates the exchange of health data through a single interface, enabling healthcare providers to access and share clinical records. Medicom's primary customer segments include the healthcare industry, government health agencies, and life sciences organizations. It was founded in 2015 and is based in Raleigh, North Carolina.

Yellow.ai develops conversational artificial intelligence (AI) operating in the technology and artificial intelligence domain. The company offers a dynamic automation platform (DAP) that uses generative AI to automate and personalize customer support, commerce, and employee experiences. It primarily serves sectors such as banking, healthcare, utilities, and retail. Yellow.ai was formerly known as Yellow Messenger. The company was founded in 2016 and is based in San Mateo, California.

Covera Health supports providers, health plans, and employers with analytical insights delivered throughout the healthcare ecosystem. It provides health plans that include quality care collaborative and center-of-excellence programs. The company was founded in 2017 and is based in New York, New York.

Uniphore operates as an enterprise artificial intelligence (AI) and focuses on customer and employee experiences. The company offers various products such as conversational AI, emotion AI, generative AI, and workflow automation for interactions and processes. It caters to industries such as banking, healthcare, telecom, and more. The company was founded in 2008 and is based in Palo Alto, California.

Aidoc focuses on clinical artificial intelligence (AI) in the healthcare domain. The company offers AI solutions that analyze and aggregate medical data to increase hospital efficiency, improve patient outcomes, and enable better decision-making by healthcare teams. It primarily caters to the healthcare industry. It was founded in 2016 and is based in Tel Aviv, Israel.

Loading...