SESAMm

Founded Year

2014Stage

Series B - II | AliveTotal Raised

$55.21MLast Raised

$37.37M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-102 points in the past 30 days

About SESAMm

SESAMm is a leading artificial intelligence company that specializes in the analysis of over 20 billion documents to generate insights for investment firms and corporations. The company's main offerings include real-time monitoring of ESG controversies, risk assessment, and the provision of ESG and positive impact scores. SESAMm's solutions are primarily utilized by the private equity, asset management, and corporate sectors. It was founded in 2014 and is based in Metz, France.

Loading...

SESAMm's Product Videos

ESPs containing SESAMm

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The ESG (Environmental, Social, and Governance) data, analytics, and ratings market refers to solutions that provide investors with insights into the sustainability and social responsibility practices of companies. These solutions offer investors tools to evaluate and compare the ESG risks and opportunities of different companies. ESG ratings providers offer assessments, scores, or rankings of com…

SESAMm named as Leader among 15 other companies, including Bloomberg, MSCI, and Moody's.

SESAMm's Products & Differentiators

TextReveal Alerts, Monitoring and Dashboards

SESAMm enables monitoring of sentiment on topics of interest, including ESG and SDG events on the web through its NLP platform. We analyze over 20 billion articles on 5 million companies daily in more than 100 languages. With flexible delivery methods, you can receive alerts via email, monitor portfolio-dedicated dashboards, or receive insights directly in your CRM.

Loading...

Research containing SESAMm

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SESAMm in 2 CB Insights research briefs, most recently on Oct 6, 2023.

Oct 6, 2023

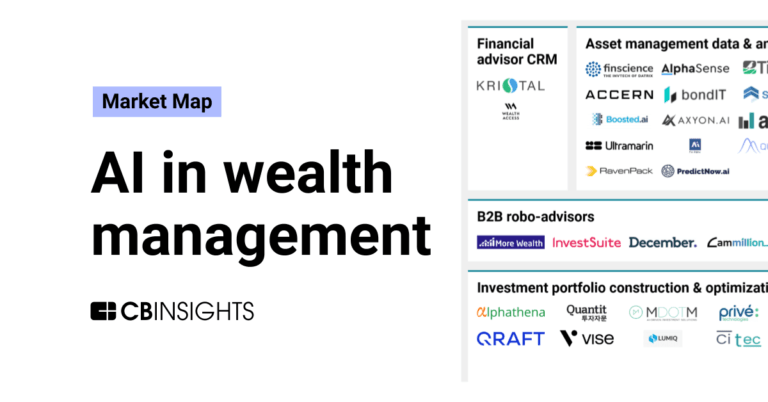

The AI in wealth management market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing SESAMm

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

SESAMm is included in 6 Expert Collections, including Wealth Tech.

Wealth Tech

2,294 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Capital Markets Tech

1,118 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Artificial Intelligence

14,767 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

13,396 items

Excludes US-based companies

Decarbonization Tech

2,372 items

Companies in the Decarbonization & ESG space, including those working on enterprise and cross-industry decarbonization and emissions monitoring solutions, as well as ESG monitoring and carbon accounting.

Fintech 100

100 items

Latest SESAMm News

Aug 12, 2024

Sustainable Fitch Integrates with SESAMm to Enhance its ESG Scores and Ratings Offering Sustainable Fitch will integrate AI-powered text analysis from SESAMm into its ESG Scores and Ratings solution. The integration will help Sustainable Fitch offer a more comprehensive ESG insights to asset owners and asset managers. SESAMm won Best of Show in its Finovate debut at FinovateEurope 2022 in London. ESG data and analysis provider Sustainable Fitch will integrate AI-powered text analysis from SESAMm into its ESG Scores and Ratings solution. The integration will enable Sustainable Fitch to provide more comprehensive ESG insights to its asset owner and manager clientele. The addition of SESAMm’s analysis will improve decision-making and help guide investment and due diligence. The partnership will also help provide broader data coverage for both public and private market data analysis. “Working with SESAMm’s technology allows us to leverage their advanced solutions to enhance our ESG Scores and Ratings offering,” Sustainable Fitch Global Head of ESG Analytics Gianluca Spinetti said. “By integrating SESAMm’s extensive data coverage, we can offer our clients more comprehensive ESG insights.” Headquartered in New York, Sustainable Fitch is a research firm that provides data, tools, analysis, and insights for the fixed-income market. The company provides ESG ratings, Second Party Opinions, thought leadership, and more to help individuals and institutions make informed decisions when it comes to ESG impact. Launched in 2022, Sustainable Fitch has been recognized by Environmental Finance as one of the top five largest global Second Party Opinion providers. This year, the company won “Best Specialist ESG Ratings Provider” at the ESG Investing Awards and “Best ESG Data Provider/Vendor” at the Inside Market Data Awards & Inside Reference Data Awards. “We are excited that a recognized leader in ESG analysis is using our insights for their ESG analysis,” SESAMm CEO Sylvain Forté said. “Our AI-powered text analysis will provide deeper insights and broader coverage, helping Sustainable Fitch to deliver high-quality ESG data and ratings.” SESAMm won Best of Show in its Finovate debut at FinovateEurope in London in 2022. The company most recently demoed its technology at FinovateFall 2023 , where the French AI firm showed an integration of ChatReveal, its proprietary generative AI solution. Bringing advanced chatbot technology to the SESAMm platform, ChatReveal examines more than 23 billion articles on five million public and private companies. The technology identifies if the company is the subject of ESG controversies or issues to help private equity firms and financial institutions better understand the potential risk of companies in their portfolios. Last month, SESAMm unveiled its ESG Controversy Risk Exposure Heatmap. The solution delivers an overview of environmental, social, and governance risks to provide an easy way to visualize and assess a company’s reputational profile. This enables users to focus on particular areas of concern and prioritize next steps. Headquartered in Paris, France, SESAMm was founded in 2014. The company has raised more than €50 million in funding and includes Elaia, Opera Tech Ventures, The Carlyle Group, and NewAlpha Asset Management VC among its investors.

SESAMm Frequently Asked Questions (FAQ)

When was SESAMm founded?

SESAMm was founded in 2014.

Where is SESAMm's headquarters?

SESAMm's headquarters is located at 11 Rempart Saint Thiebault, Metz.

What is SESAMm's latest funding round?

SESAMm's latest funding round is Series B - II.

How much did SESAMm raise?

SESAMm raised a total of $55.21M.

Who are the investors of SESAMm?

Investors of SESAMm include Carlyle, NewAlpha, Elaia Partners, Unigestion, AFG Partners and 17 more.

Who are SESAMm's competitors?

Competitors of SESAMm include Wequity, RavenPack, AlphaSense, Auquan, INVYO and 7 more.

What products does SESAMm offer?

SESAMm's products include TextReveal Alerts, Monitoring and Dashboards and 2 more.

Who are SESAMm's customers?

Customers of SESAMm include Crédit Mutuel Arkéa, Oddo Bhf, Raiffeisen Bank International and The Carlyle Group.

Loading...

Compare SESAMm to Competitors

Auquan operates in the financial services sector, with a focus on leveraging advanced artificial intelligence. The company offers services that transform unstructured data into actionable insights for financial services, providing deep insights into private companies, equities, and associated risks. Auquan primarily serves sectors such as asset management, hedge funds, investment banks, and insurance providers. It was founded in 2017 and is based in London, United Kingdom.

Owlin provides third-party risk management and market intelligence. The company offers services that help businesses structure news and integrate risk and market insights that may affect their operations into daily workflows. It primarily sells to sectors such as the financial services industry and the risk management industry. It was founded in 2012 and is based in Amsterdam, Netherlands.

RavenPack serves as a provider of big data analytics in the financial services industry. The company offers products that analyze unstructured content to help financial professionals return, reduce risk, and increase efficiency. RavenPack primarily serves hedge funds, banks, and asset managers. It was founded in 2003 and is based in Malaga, Spain.

Briink specializes in artificial intelligence (AI) powered document analysis for environmental, social, and governance (ESG) teams within the sustainability and governance sector. The company offers solutions such as ESG questionnaire assistance, governance policy screening, and ESG data extraction and verification. It was founded in 2021 and is based in Berlin, Germany.

Yewno leverages computational semantics, graph theory, and machine learning to enable the connection of concepts and information directly to content presentation. Through Yewno's knowledge discovery platform, concepts are searched and chained to resemble a human inferential cognitive process. Yewno was founded in 2015 and is based in Redwood City, California.

Fitch Solutions operates as a company focusing on providing data, research, and analytics in the credit risk and strategy sector. The company offers insights, robust data, and powerful analytics to help clients navigate credit markets, credit risk, environmental, social, and corporate governance (ESG), and both developed and emerging markets across various industries, sectors, entities, and transactions. It primarily serves the financial services industry. The company was founded in 2014 and is based in New York, New York.

Loading...