Toss

Founded Year

2013Stage

Series G - III | AliveTotal Raised

$1.653BValuation

$0000Last Raised

$405M | 2 yrs agoAbout Toss

Toss operates as a digital financial platform. It offers a range of financial services, including bank accounts, money transfers, a financial dashboard, credit score management, customized loans, insurance plans, and multiple investment services. It was founded in 2013 and is based in Seoul, South Korea.

Loading...

Loading...

Research containing Toss

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Toss in 2 CB Insights research briefs, most recently on Oct 5, 2021.

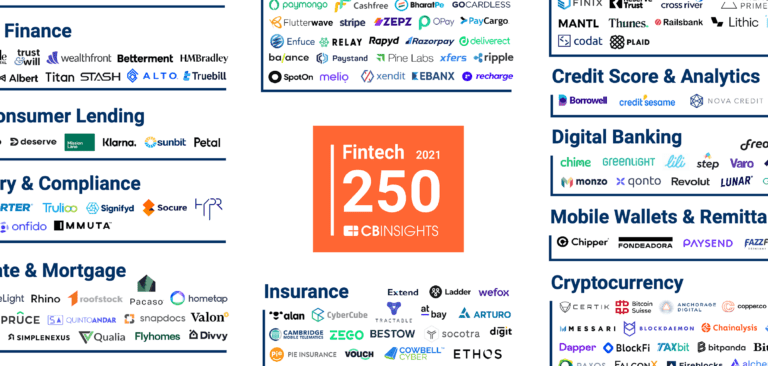

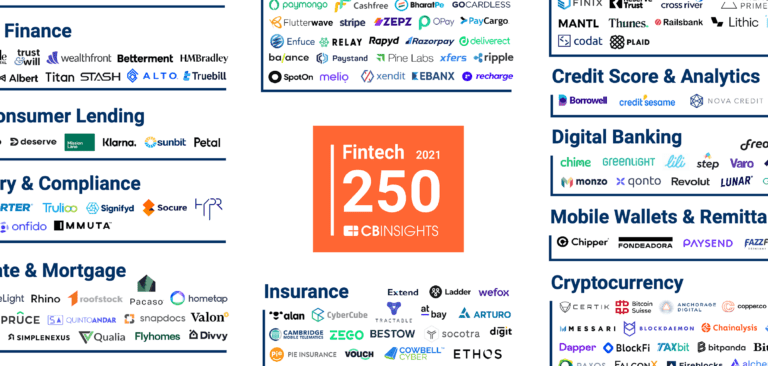

Oct 5, 2021 report

The Fintech 250: The Top Fintech Companies Of 2021

Oct 5, 2021 report

The Fintech 250: The top fintech companies of 2021Expert Collections containing Toss

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Toss is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Wealth Tech

2,294 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Payments

3,232 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,396 items

Excludes US-based companies

Digital Banking

1,008 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Toss Patents

Toss has filed 4 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/18/2018 | 3/24/2020 | Technical drawing, House types, Honeycombs (geometry), Mass spectrometry, Graphical projections | Grant |

Application Date | 5/18/2018 |

|---|---|

Grant Date | 3/24/2020 |

Title | |

Related Topics | Technical drawing, House types, Honeycombs (geometry), Mass spectrometry, Graphical projections |

Status | Grant |

Latest Toss News

Sep 10, 2024

Viva Republica's Lee Seung-gun Counters Criticisms of Korean Fintech Market Print Editor Yoon Young-sil 닫기 On August 27, Lee Seung-gun (left), CEO of Viva Republica, is explaining the service of face verification Illegal ticket prevention to Kim Byeong-hwan, chairman of the Financial Services Commission (FSC). (Photo courtesy of Toss) On September 10, Lee Seung-gun, CEO of Viva Republica, presented his counterarguments to criticisms regarding the Korean fintech market at the "Korea Investment Week (KIW) 2024" event held at the Conrad Hotel in Yeouido, Seoul. He stated, "The Korean fintech market is broadly the fourth largest after the U.S., China, and Japan," and added, "Even on a smaller scale, it ranks 12th globally, comparable to the UK, so it is by no means a small market." The Korean fintech market was estimated to be worth 58 trillion won last year and is projected to grow by 44.8% to nearly 84 trillion won (approximately $62 billion) by 2028. Lee Seung-gun delivered a keynote speech on "Toss's Strategy for Sustainable Financial Innovation" during the "Deep Tech and Entertainment" session on the same day. He highlighted that Toss has 19 million monthly active users (MAU), the highest among domestic financial apps, with a particularly high proportion of users in their 20s to 40s. Among them, about 5.61 million users are in their 20s, accounting for 93% of the entire 20s population in Korea. He also mentioned that most new subscribers are in their 50s and that Toss is expanding its user base to include minors aged 7 to 18. Toss initially focused on acquiring customers through fast and convenient remittance services. It then expanded its business to include Toss Pay, loan brokerage, and securities trading. The company is also looking to generate additional revenue through commerce and advertising. It is explained that 90% of its total revenue comes from business-to-business (B2B) transactions. Toss achieved a record of 2 million securities accounts opened within a month of launching Toss Securities. Toss Bank also attracted 7 trillion won in deposits within three weeks of its launch. Lee Seung-gun stated that Toss is preparing for an initial public offering (IPO). Toss's corporate value is known to be between 15 and 20 trillion won. Last year, Toss recorded 1.3 trillion won in revenue. He added, "Although 30% of the population uses Toss, its market share is only about 3%," indicating potential for tenfold growth in the future. Among the world's top 100 unicorn companies, 21 are fintech firms. Viva Republica, which operates the financial super app "Toss," is the only fintech unicorn in South Korea. Lee emphasized, "Korea is a market where fintech companies can build their foundational strength for overseas expansion," and added, "Toss will also enter overseas markets after establishing a solid profit structure domestically." Lee also praised the supportive regulatory environment in South Korea, stating, "There is no country where the government leads financial innovation as much as Korea," and "It is hard to say that Korea's financial regulations necessarily lower corporate value." He noted that Toss is evolving into an essential service for the nation, expanding its user base to include minors aged 7 to 18. "Every time we introduce a new service, we achieve results at a speed unseen in existing industries," he remarked, highlighting the success of their super app strategy.

Toss Frequently Asked Questions (FAQ)

When was Toss founded?

Toss was founded in 2013.

Where is Toss's headquarters?

Toss's headquarters is located at Arc Place, 12F, Seoul.

What is Toss's latest funding round?

Toss's latest funding round is Series G - III.

How much did Toss raise?

Toss raised a total of $1.653B.

Who are the investors of Toss?

Investors of Toss include Goodwater Capital, Greyhound Capital, Korea Development Bank, Aspex Management, Alameda Ventures and 22 more.

Who are Toss's competitors?

Competitors of Toss include BitGo, December., Airwallex, MobiKwik, Lianlian Pay and 7 more.

Loading...

Compare Toss to Competitors

Paga is a mobile money company focused on facilitating digital financial transactions. The company offers services that allow users to send and receive money, pay bills, and top-up airtime and data. Paga primarily serves the financial technology sector by simplifying access to financial services for individuals. It was founded in 2009 and is based in Lagos, Nigeria.

ZEPZ focuses on providing digital payment solutions. The company offers services enabling users to send money securely with options for bank deposit, cash collection, mobile airtime top-up, and mobile money. ZEPZ primarily serves the global payments industry. Zepz was formerly known as WorldRemit. It was founded in 2010 and is based in London, United Kingdom.

MobiKwik serves as a financial platform operating in the financial services industry. It offers a wide range of financial products for consumers and merchants, including payment services, digital credit, and investment opportunities. It primarily serves the e-commerce industry, with services designed to facilitate payments for everyday needs such as utility bills, food delivery, and shopping. It was founded in 2009 and is based in Gurugram, India.

AZA Finance specializes in cross-border payment solutions and foreign exchange services for the B2B sector. The company offers a robust online payment platform that facilitates multi-currency transactions, treasury management, and payment collections, designed to support businesses operating in Africa. AZA Finance primarily serves enterprises requiring financial services across multiple African and global markets. AZA Finance was formerly known as BitPesa. It was founded in 2013 and is based in Grand Duchy of Luxembourg, Luxembourg.

MoMo is a financial technology company specializing in digital payment solutions and super application development. The company offers a comprehensive ecosystem that allows users to perform various daily activities through their platform, as well as leveraging data analytics and AI to enhance user experience and merchant services. MoMo's products cater to various sectors including financial services, e-commerce, and more. It was founded in 2007 and is based in Ho Chi Minh City, Vietnam.

Coins.ph provides a blockchain-based platform. It offers consumers access to basic financial services, such as remittances, bill payments, and mobile airtime. The company was founded in 2014 and is based in Pasig City, Philippines. In April 2022, Coins.ph was acquired by Wei Zhou.

Loading...