Airwallex

Founded Year

2015Stage

Incubator/Accelerator - III | AliveTotal Raised

$902MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+13 points in the past 30 days

About Airwallex

Airwallex develops a global financial platform focusing on providing business payment solutions within the financial technology domain. The company offers an array of services including global business accounts for managing finances, international transfers, multi-currency corporate cards, and online payment processing capabilities. It primarily serves the payment industry. The company was founded in 2015 and is based in Melbourne, Australia.

Loading...

ESPs containing Airwallex

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The enterprise cross-border payments platforms market enables businesses to send and collect payments globally. Companies in this market offer currency exchange solutions that help users monitor exchange rates and hedge currency risk. Some companies also provide specialized solutions for different industries. In addition to enterprise solutions, many providers in this market also offer consumer-sp…

Airwallex named as Leader among 15 other companies, including Payoneer, Wise, and Revolut.

Airwallex's Products & Differentiators

SME

Our multi-currency payments platform helps small and medium-sized enterprises (SMEs) move money around the world quickly, affordably, and safely. With this platform, SMEs can send and receive funds in multiple currencies through Airwallex’s online platform or bank transfer, settle in a number of currencies, hold their funds in their Airwallex Global Account, and reconcile expenses, create online payment links that are connected to their account, or spend directly through a Airwallex Borderless Card.

Loading...

Research containing Airwallex

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Airwallex in 9 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

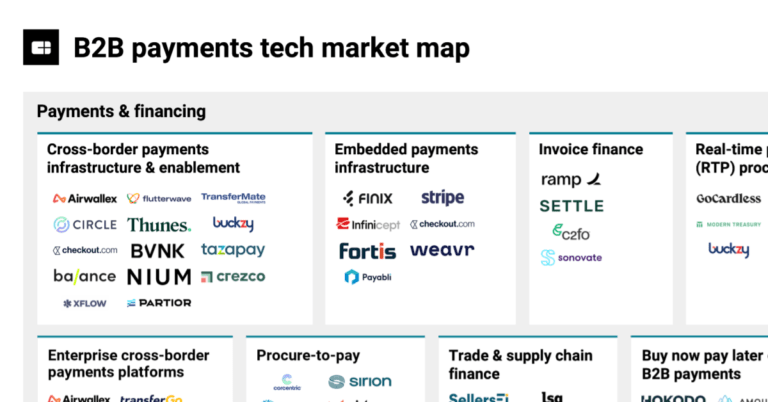

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

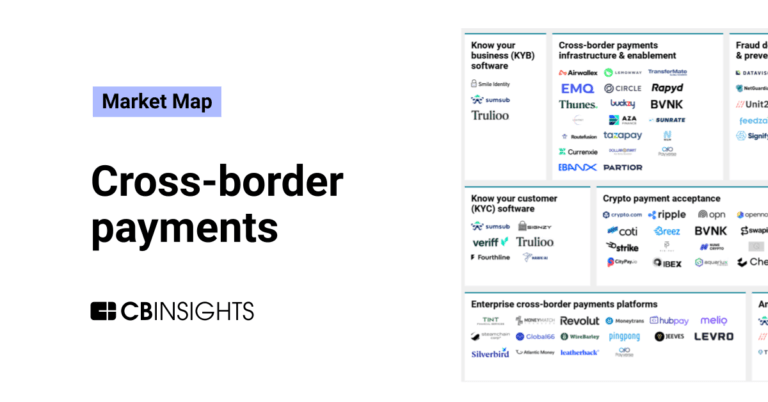

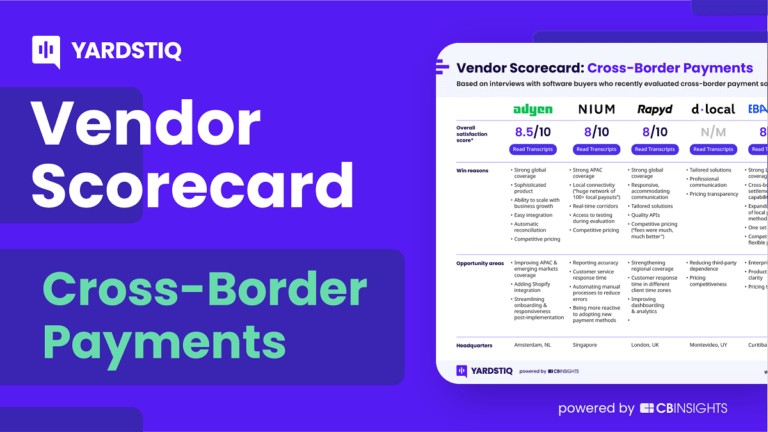

Cross-border payments market map

Jan 23, 2023 report

Top cross-border payments companies — and why customers chose them

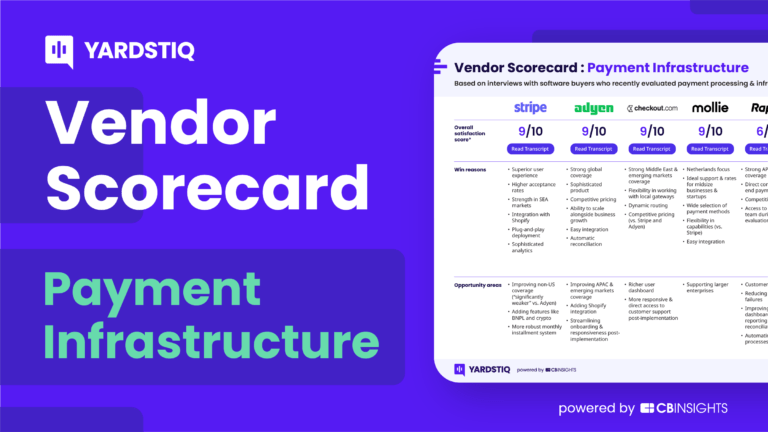

Sep 21, 2022 report

Top payment infrastructure companies — and why customers chose themExpert Collections containing Airwallex

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Airwallex is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

1,648 items

Payments

2,986 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Future Unicorns 2019

50 items

Fintech

13,228 items

Excludes US-based companies

Latest Airwallex News

Sep 12, 2024

The payments software provider is making “immediate bets” on the Brazil and Mexico markets, a company executive said. Published Sept. 12, 2024 First published on After seeing annual processing volumes spike to exceed $100 billion, global payments provider Airwallex is hoping to keep up the momentum of its current “hyper growth” phase, said Ravi Adusumilli, the company’s executive general manager for the Americas. The company, originally founded in Australia, has yet to enter some countries with the largest global economies, such as Korea and India, Adusumilli said. However, it has rapidly expanded into new and emerging markets across North and Latin America over the past several years. For example, Airwallex announced plans to enter Mexico in 2023 with the acquisition of payment provider MexPago , and brought its payment acceptance solution to U.S. merchants this past April, according to company press releases. The provider of payments, treasury and embedded finance solutions is now eyeing further expansion in key markets such as Brazil, Adusumilli said. “Our strategy is now centered on organic licensing in Brazil,” he said in an interview. “We'll be investing a lot more headcount there next year, and in Mexico City. Those are the two immediate bets we're making.” Creating a CFO-focused operating system International expansion has been a top focus for the privately-held fintech over the past few years, with the company focusing on creating the “financial operating system that the CFO needs to be able to…look at everything,” Adusumilli said. Its product development and expansion strategies are crafted with that in mind. “What else is the CFO looking at in his or her financial stack that we need to help build the software for?” he said. Airwallex approaches new markets with that lens in mind, seeking out key players and looking to establish money transfer and payment licenses to ensure a more direct connection to its customers, the business-to-business payment provider said in an August press release. The company has inked partnerships with businesses such as Intuit’s Quickbooks and BILL, a financial operations platform, and has secured money transmitter licenses, or exemptions, in 49 U.S. states and territories, according to the August release. When it comes to Brazil, Airwallex is “in the super early ground floor stage of getting a license to operate,” Adusumilli said. “Our strategy there is to go through the licensing process ourselves, organically,” he said. “We already have boots on the ground in the country to help us with that licensing process.” Real-time, embedded payments growth When it comes to further expansion in its established markets, Airwallex is keeping a careful eye on emerging payment trends such as embedded finance and real-time payments. The company has entrenched itself further in North America this year by establishing a permanent U.S. headquarters in San Francisco and opening offices in Austin and New York, according to its August press release. Its growth in North America has skyrocketed — with revenue for the region growing by 300% — due to several trends, including a surge in interest in embedded finance across businesses of all sizes. Embedded finance describes products which bring digital banking or payments services directly to a business’ platform, eliminating the need for customers to jump to another platform or service. Such solutions have seen a rapid rise in markets such as Europe, where embedded finance solutions generated between €20 billion to €30 billion in revenues, according to McKinsey estimates — representing about 3% of total banking revenues. Even small and medium-size enterprised “are looking to integrate more and more financial services into their set of products,” Adusumilli said. “So it's these trends we see apply to both small, medium businesses and large enterprises.” The company has partnered with several other fintechs to better integrate its embedded finance products. Those partners include Canadian business Float to expand its bill pay offering, and financial technology company Brex. In addition to embedded finance, the company is closely watching the development of real-time payments in the U.S., Adusumilli said. The U.S. has seen “a slower start than other countries that not only have provided a great network for consumers to pay, but [are] now taking those networks outside" of their countries , he said. Still, Airwallex is “excited about the real-time payments potential in the medium to long term,” he said. Recommended Reading

Airwallex Frequently Asked Questions (FAQ)

When was Airwallex founded?

Airwallex was founded in 2015.

Where is Airwallex's headquarters?

Airwallex's headquarters is located at 15 William Street, Melbourne.

What is Airwallex's latest funding round?

Airwallex's latest funding round is Incubator/Accelerator - III.

How much did Airwallex raise?

Airwallex raised a total of $902M.

Who are the investors of Airwallex?

Investors of Airwallex include Plug and Play Silicon Valley summit, HongShan, Tencent, Square Peg Capital, 1835i and 26 more.

Who are Airwallex's competitors?

Competitors of Airwallex include BitGo, TerraPay, Stripe, MobiKwik, Lianlian Pay and 7 more.

What products does Airwallex offer?

Airwallex's products include SME and 2 more.

Who are Airwallex's customers?

Customers of Airwallex include Qantas and Stake.

Loading...

Compare Airwallex to Competitors

ZEPZ focuses on providing digital payment solutions. The company offers services enabling users to send money securely with options for bank deposit, cash collection, mobile airtime top-up, and mobile money. ZEPZ primarily serves the global payments industry. Zepz was formerly known as WorldRemit. It was founded in 2010 and is based in London, United Kingdom.

AZA Finance specializes in cross-border payment solutions and foreign exchange services for the B2B sector. The company offers a robust online payment platform that facilitates multi-currency transactions, treasury management, and payment collections, designed to support businesses operating in Africa. AZA Finance primarily serves enterprises requiring financial services across multiple African and global markets. AZA Finance was formerly known as BitPesa. It was founded in 2013 and is based in Grand Duchy of Luxembourg, Luxembourg.

Coins.ph provides a blockchain-based platform. It offers consumers access to basic financial services, such as remittances, bill payments, and mobile airtime. The company was founded in 2014 and is based in Pasig City, Philippines. In April 2022, Coins.ph was acquired by Wei Zhou.

MoMo is a financial technology company specializing in digital payment solutions and super application development. The company offers a comprehensive ecosystem that allows users to perform various daily activities through their platform, as well as leveraging data analytics and AI to enhance user experience and merchant services. MoMo's products cater to various sectors including financial services, e-commerce, and more. It was founded in 2007 and is based in Ho Chi Minh City, Vietnam.

Paga is a mobile money company focused on facilitating digital financial transactions. The company offers services that allow users to send and receive money, pay bills, and top-up airtime and data. Paga primarily serves the financial technology sector by simplifying access to financial services for individuals. It was founded in 2009 and is based in Lagos, Nigeria.

Toss operates as a digital financial platform. It offers a range of financial services, including bank accounts, money transfers, a financial dashboard, credit score management, customized loans, insurance plans, and multiple investment services. It was founded in 2013 and is based in Seoul, South Korea.

Loading...