Blockchain

Founded Year

2011Stage

Series E | AliveTotal Raised

$600.5MValuation

$0000Last Raised

$110M | 10 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+28 points in the past 30 days

About Blockchain

Blockchain specializes in blockchain technology and cryptocurrency-related solutions. The company offers a platform where users can buy, sell, and swap cryptocurrencies like Bitcoin and Ethereum, as well as earn rewards on their cryptocurrency assets. It also provides a cryptocurrency wallet for self-custody of digital assets, and an exchange for trading in fiat currencies. It was founded in 2011 and is based in London, United Kingdom.

Loading...

ESPs containing Blockchain

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

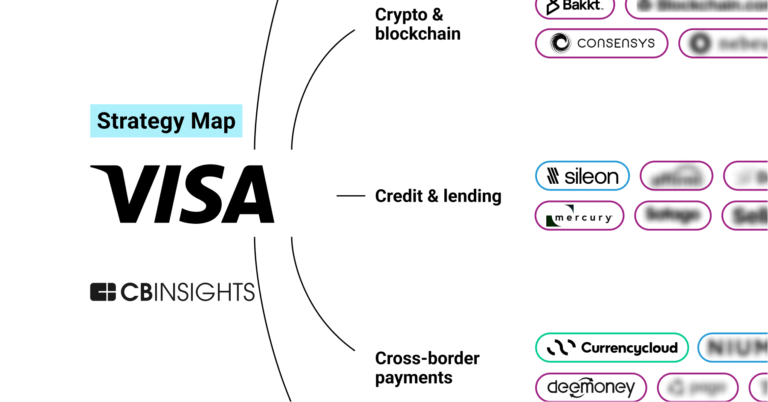

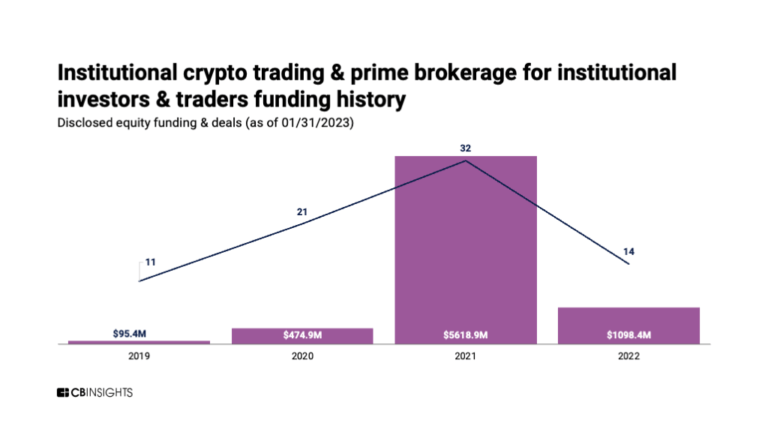

The institutional crypto trading & prime brokerage market is a complex and fragmented market that requires secure and reliable platforms to manage the operational complexity, security, and scale of trading cryptocurrencies. Vendors in this market offer built-in-house proprietary solutions that promise to combine prime brokerage, trade execution, and custody seamlessly. The market aims to unlock th…

Blockchain named as Challenger among 15 other companies, including Coinbase, BitGo, and HTX.

Loading...

Research containing Blockchain

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Blockchain in 6 CB Insights research briefs, most recently on Feb 23, 2024.

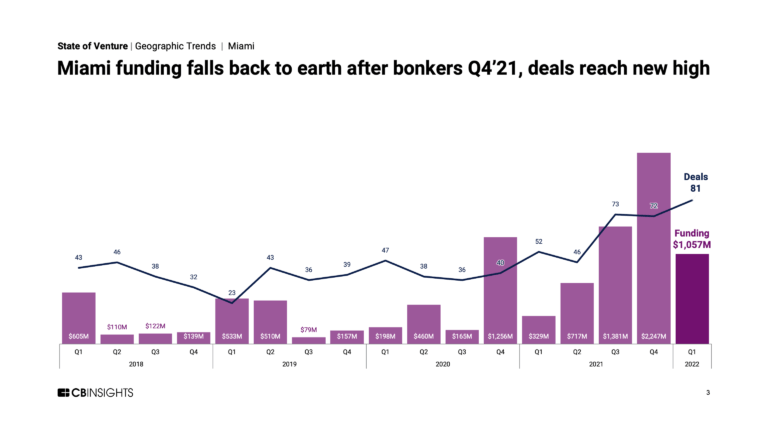

May 26, 2022

Where are the next US tech hubs?

Oct 19, 2021 report

Coinbase Strategy Teardown: How Coinbase Grew Into The King Midas Of CryptoExpert Collections containing Blockchain

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Blockchain is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Blockchain

9,723 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

13,396 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Blockchain 50

100 items

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Blockchain Patents

Blockchain has filed 33 patents.

The 3 most popular patent topics include:

- cryptocurrencies

- alternative currencies

- cryptographic hash functions

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/28/2022 | 3/12/2024 | Wireless networking, Parallel computing, Network protocols, Network topology, Ethernet | Grant |

Application Date | 9/28/2022 |

|---|---|

Grant Date | 3/12/2024 |

Title | |

Related Topics | Wireless networking, Parallel computing, Network protocols, Network topology, Ethernet |

Status | Grant |

Latest Blockchain News

Sep 21, 2024

Share This Article Binance Labs, Breyer Capital, and Big Brain Holdings lead founding investment round to propel blockchain interoperability, scaling, and security. Key Facts • Binance Labs, Breyer Capital, and Big Brain Holdings led the investment round. • Binance Labs continues to showcase its commitment to supporting dedicated teams building technical innovations that have the potential to propel the growth of the crypto industry. • Breyer Capital was an early investor in Facebook, Circle, and Spotify. Big Brain Holdings is a leading Web3 fund with investments in Solana, The Graph, and Arweave. • The round included participation from Crypto.com, Web3 Ventures, HyperChain Capital, Alchemy, SALT Fund, Kelly Investments, Sunflower Capital, DNA Fund, Gate Ventures, Quantstamp, TRGC, BTC INC, Artichoke Capital, Cypher Capital, SNZ Holding, C6E, IBG Capital, Protein Capital, MON Ventures, SV5, Impossible Finance, Jihan Wu (Bitdeer), George Burke (Portal), Sonny Singh (Beluga), amongst others. • Hemi is a modular blockchain network designed for superior scaling, security, and interoperability, unifying Bitcoin and Ethereum as components of a single supernetwork. • Hemi was founded by renowned early Bitcoin developer Jeff Garzik, and blockchain security pioneer Max Sanchez. CHICAGO, September 18, 2024-- Hemi Labs has announced a $15 million investment round to develop and launch the Hemi Network (“Hemi”). Hemi is a modular blockchain network built on Bitcoin and Ethereum, designed to deliver superior scaling, security, and interoperability. The Hemi incentivized testnet is now live, and its mainnet launch is targeted for Q4 2024. “We look forward to supporting Hemi Labs as they work on important infrastructure that connects Bitcoin and Ethereum in a modular and scalable way. Hemi's approach aligns with our commitment to backing projects that are focused on building practical, decentralized solutions with long-term potential," said Alex Odagiu, Investment Director at Binance Labs. “The Hemi team has a clear and compelling vision for unlocking the programmability, portability, and potential of Web3. With a distinguished track record, they are uniquely positioned to deliver,” said Ted Breyer at Breyer Capital. “Hemi is transforming how Bitcoin and Ethereum interact, and not merely providing a bridge between the two largest networks in the blockchain ecosystem, but a supernetwork that most elegantly marries the capabilities of both,” said Sam Kim at Big Brain Holdings. "Watching Hemi build its testnet and progress towards mainnet has given me confidence in the team's skills and abilities," said Stelian Balta, Founder of HyperChain Capital. "Their product is well-engineered, technically impressive, and most importantly, it works." Uniting the King and Queen of Crypto Attempts to integrate and scale Bitcoin and Ethereum have tended to address the problem within their respective communities, resulting in a fractured ecosystem. Hemi instead approaches Bitcoin and Ethereum as components of a larger supernetwork. This surfaces the best capabilities of both networks and, in turn, enables a new class of previously unattainable blockchain applications. Hemi’s core features include: • Hemi Virtual Machine (hVM): Integrates a full Bitcoin node within an Ethereum Virtual Machine (EVM), allowing developers to use familiar tools to build smart contracts that work with both Bitcoin and Ethereum, while maintaining full backwards-compatibility with existing EVM dApps and wallets. • Bitcoin Programmability: The Hemi Bitcoin Kit (hBK) unlocks direct smart contract access to granular Bitcoin state, enabling truly trustless Bitcoin-native applications like staking, lending markets, and MEV marketplaces, which were previously impractical. • Superfinality: Hemi’s Proof-of-Proof (PoP) consensus inherits Bitcoin’s full security in an entirely decentralized and permissionless manner, and efficiently provides Bitcoin-security-as-a-Service to other blockchain networks. • Trustless Cross-Chain Portability: Hemi’s Tunnels provide a secure way to move assets between chains, vastly improving upon traditional bridge methods. • Asset Programmability: Features include on-chain routing, time-lock, password protection, and gasless transfers, enabling seamless asset movement without requiring native chain currency. “The excitement for what we are building is reflected in the quality and enthusiasm of our investors and ecosystem partners," said Jeff Garzik, an early Bitcoin developer and co-founder of Hemi Labs. “They understand the uniqueness and value of Hemi’s approach to scaling and integrating the two leading blockchain networks, adding to the phenomenal growth and energy in this particular area.” To Learn More

Blockchain Frequently Asked Questions (FAQ)

When was Blockchain founded?

Blockchain was founded in 2011.

Where is Blockchain's headquarters?

Blockchain's headquarters is located at 145-157 St John Street, London.

What is Blockchain's latest funding round?

Blockchain's latest funding round is Series E.

How much did Blockchain raise?

Blockchain raised a total of $600.5M.

Who are the investors of Blockchain?

Investors of Blockchain include Lightspeed Venture Partners, Scottish Mortgage Investment Trust, Lakestar, Prudence Venture Capital, Google Ventures and 26 more.

Who are Blockchain's competitors?

Competitors of Blockchain include BlockFi and 5 more.

Loading...

Compare Blockchain to Competitors

Circle provides a financial technology solution for users to send and receive funds globally. It offers crypto treasury management solutions for businesses to manage digital assets. The company serves asset managers, financial technology companies, and financial institutions. It was founded in 2013 and is based in Boston, Massachusetts.

CoinZoom is a company that focuses on providing cryptocurrency services in the financial technology sector. The company offers a platform for buying, selling, and trading top cryptocurrencies, as well as a Visa card that allows customers to spend their cryptocurrencies like cash. CoinZoom primarily serves the financial technology industry. It was founded in 2018 and is based in Salt Lake City, Utah.

Crypto.com operates as a platform in the cryptocurrency industry. The company offers services that allow users to buy, sell, and trade a wide range of cryptocurrencies including Bitcoin and Ethereum. It primarily serves the financial technology sector. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

BitPay is a company focused on bitcoin payments and cryptocurrency transaction services within the financial technology sector. The company provides solutions for buying, storing, swapping, and spending cryptocurrencies, as well as services for businesses to accept crypto payments and manage crypto payroll. BitPay's offerings cater to both individual consumers and businesses, with a range of tools designed to facilitate the use of cryptocurrencies in various transactions. It was founded in 2011 and is based in Alpharetta, Georgia.

Abra offers a mobile application platform for buying, selling, trading, storing, and borrowing cryptocurrency. Its platform enables users to store digital cash on smartphones and send it to other users. The company was founded in 2014 and is based in Mountain View, California.

Payscript is a cryptocurrency payment platform operating in the financial technology sector. The company provides services that allow both consumers and merchants to manage and transact with cryptocurrencies, including buying, selling, swapping, and spending. It primarily caters to the ecommerce industry, enabling businesses to accept cryptocurrencies as payments on their online stores, point-of-sale systems, or mobile apps. It was founded in 2019 and is based in Melbourne, Victoria.

Loading...