Kin

Founded Year

2016Stage

Series D - IV | AliveTotal Raised

$453.09MLast Raised

$15M | 8 mos agoAbout Kin

Kin provides a digital insurance service platform. It offers various insurance plans to buy homeowners insurance over the phone without any physical visits. Kin was formerly known as Bright Policy. The company was founded in 2016 and is based in Chicago, Illinois.

Loading...

Kin's Product Videos

ESPs containing Kin

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

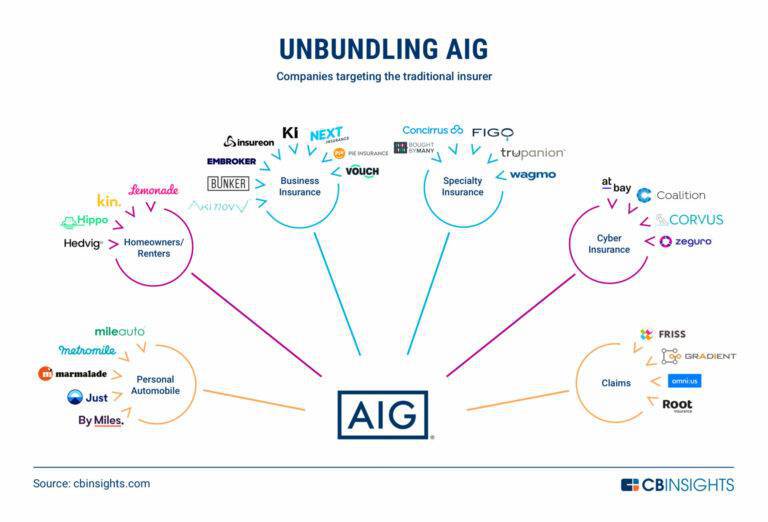

The full-stack insurtech carriers — home market comprises insurtech carriers that underwrite homeowners and renters insurance. These insurtech carriers were founded as startups with tech-centered operating models and are typically backed by venture capital, unlike most established carriers with which they compete. As with established carriers, insurtech carriers will typically also be licensed by …

Kin named as Leader among 12 other companies, including Lemonade, Branch, and Acko.

Kin's Products & Differentiators

Homeowners Insurance

When users visit Kin’s website, email its support staff, or call its hotline to obtain quotes on home, flood, hurricane, landlord, or mobile home insurance policies, they simply provide their home address, at which point Kin’s algorithms consider thousands of publicly available data points to assess their property. Then it offers a few suggested coverage recommendations, at which point the homeowner chooses the policy they want and arranges payment. Kin offers insurance through the Kin Interinsurance Network (KIN), a reciprocal exchange owned by our customers who share in the underwriting profit. Because of our efficient tech and direct-to-consumer model, we provide affordable pricing without compromising coverage.

Loading...

Research containing Kin

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Kin in 7 CB Insights research briefs, most recently on Oct 18, 2023.

Oct 18, 2023 report

State of Fintech Q3’23 Report

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023

Apr 5, 2022 report

What is a SPAC?

Expert Collections containing Kin

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

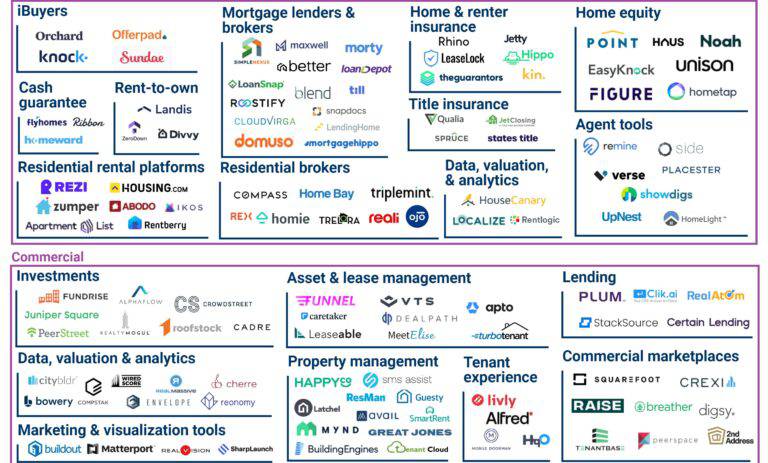

Kin is included in 6 Expert Collections, including Real Estate Tech.

Real Estate Tech

2,485 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Unicorns- Billion Dollar Startups

1,229 items

Insurtech

4,178 items

Companies and startups that use of technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

8,122 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech 50

50 items

Latest Kin News

Sep 11, 2023

Share toX NEW YORK, Sept. 10, 2023 /PRNewswire/ -- The InsurTech Market by deployment (On-premise and Cloud), management (marketing and distribution, IT support, policy administration and management, claim management, and others), and geography (North America, Europe, APAC, Middle East and Africa, and South America) - Forecast and Analysis 2023-2027" report has been added to technavio offering. With ISO 9001:2015 certification, Technavio has proudly partnered with more than 100 Fortune 500 companies for over 16 years. The potential growth difference for the insurtech market between 2022 and 2027 is USD 61.75 billion. The need to improve business efficiency is notably driving the global insurtech market growth. The expansion of connected devices within the financial industry has resulted in the generation of vast volumes of data. Insurance companies have recognized the potential of this data to optimize their expenses, enhance service delivery, and increase their revenues. Nevertheless, as the insurance sector undergoes digitization and embraces innovative financial technologies, collecting and analyzing consumer data through the InsurTech platform has become a straightforward process. Leading insurance firms are facing intense competition as they strive to establish a dominant position and expand their market presence. Additionally, the widespread availability of application programming interfaces (APIs), improved online information resources, and adherence to financial standards like eXtensible Business Reporting Language (XBRL) have enabled companies to create solutions catering to diverse and niche markets. Consequently, InsurTech has emerged as a strategic priority for numerous insurance organizations. Get deeper insights into the market size, current market scenario, future growth opportunities, major growth driving factors, the latest trends, and much more. Buy full report here Market Challenge The high cost of investments is a major challenge impeding the global insurtech market growth. Selling insurance products using cutting-edge technology poses a new and complex challenge for insurance companies. Specialized training is essential for their employees to effectively utilize advanced technology, and ongoing retraining is necessary to gain a deep understanding of insurance products, enabling the staff to offer tailored solutions to clients. Consequently, insurance firms must allocate resources to hire trainers who can educate their staff and brokers. Many insurance companies are now integrating a variety of products and services with advanced technologies, often partnering with banks and brokers/agents to do so. For startups or vendors, it's crucial to have a clear vision of the expected outcomes of their research projects before making investments. However, it's often challenging to predict both the results and the path to success at the project's outset. Furthermore, a significant hurdle lies in the commercialization of technology. Despite having advanced technology and perfect product plans, many companies struggle to meet customer demand, which can impede market growth in the forecasted period. Learn about additional key drivers, trends, and challenges available with Technavio. Read Sample PDF Report Now The insurtech market has segmented by deployment (On-premise and Cloud), management (marketing and distribution, IT support, policy administration and management, claim management, and others), and geography (North America, Europe, APAC, Middle East and Africa, and South America). The market share growth by the marketing and distribution segment will be significant during the forecast period. The marketing and distribution segment is poised for exponential growth, surpassing the global average growth rate in the forecast period. This surge is primarily driven by the widespread adoption of smartphones and the easy accessibility of the internet through these devices, which have propelled digital marketing and the digital distribution of insurance policies through advanced technologies. Mobile point-of-sale solutions are gaining increasing acceptance within the e-retail sector, enabling insurance companies to identify significant opportunities to cater to the needs of a large customer base with busy lifestyles, tailoring their offerings to suit their preferences and behaviours. Europe is estimated to contribute 50% to the growth of the global market during the forecast period. View Sample Report for insights into the contribution of all the segments and regional opportunities in the report. Key Companies in the InsurTech Market: Acko General Insurance Ltd., Alan SA, Anywhere 2 go Co. Ltd., Clover Health, Cytora Ltd., Damco Group, DXC Technology Co., Friendsurance, Haven Life Insurance Agency LLC, iCarbonX, Insurance Technology Services, Jetty National Inc., Kin Insurance Technology Hub LLC, Milvik AB, Oscar Insurance Corp., Quantemplate Technologies Inc., Shift Technology, simplesurance GmbH, Slice Insurance Technologies Inc., and ZhongAn Online Property Insurance Co. Ltd. Related Reports: The insurance market size is estimated to grow at a CAGR of 4.5% between 2022 and 2027. The insurance market size is forecast to increase by USD 1,429.64 billion. This report extensively covers market segmentation by distribution channel (sales personnel and insurance agencies), type (life and non-life), and geography (North America, APAC, Europe, South America, and Middle East and Africa). The increasing government regulations on mandatory insurance coverage in developing countries is the key factor driving the growth of the global insurance market. The insurtech market share in the UK is expected to increase by USD 4.20 billion from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 43.74%. This report extensively covers insurtech market in the UK segmentation by deployment (on-premises and cloud) and value chain positioning (marketing and distribution, IT support, policy administration and management, claim management, and others). The need to improve business efficiency is one of the key drivers supporting the insurtech market growth in the UK. InsurTech Market Scope Key companies profiled Acko General Insurance Ltd., Alan SA, Anywhere 2 go Co. Ltd., Clover Health, Cytora Ltd., Damco Group, DXC Technology Co., Friendsurance, Haven Life Insurance Agency LLC, iCarbonX, Insurance Technology Services, Jetty National Inc., Kin Insurance Technology Hub LLC, Milvik AB, Oscar Insurance Corp., Quantemplate Technologies Inc., Shift Technology, simplesurance GmbH, Slice Insurance Technologies Inc., and ZhongAn Online Property Insurance Co. Ltd. Market dynamics Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. Customization purview If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. ToC: About Technavio Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios. Contacts

Kin Frequently Asked Questions (FAQ)

When was Kin founded?

Kin was founded in 2016.

Where is Kin's headquarters?

Kin's headquarters is located at 222 Merchandise Mart Plaza, Chicago.

What is Kin's latest funding round?

Kin's latest funding round is Series D - IV.

How much did Kin raise?

Kin raised a total of $453.09M.

Who are the investors of Kin?

Investors of Kin include Commerce Ventures, QED Investors, SemperVirens, Hudson Structured Capital Management, Alpha Edison and 27 more.

Who are Kin's competitors?

Competitors of Kin include Dale Underwriting Partners and 3 more.

What products does Kin offer?

Kin's products include Homeowners Insurance.

Loading...

Compare Kin to Competitors

Swyfft is a company that focuses on the insurance industry, specifically homeowners insurance. The company uses unique data sources and analytics to provide homeowners insurance quotes in a quick and efficient manner. Swyfft primarily serves the insurance industry. It is based in Morristown, New Jersey.

Branch focuses on providing insurance services in the financial sector. The company offers home, auto, and umbrella insurance services that are designed to be simple to purchase and built for savings. The primary sectors that Branch caters to include the automotive and real estate industries. It was founded in 2017 and is based in Columbus, Ohio.

Amwins distributes specialty insurance products and services. It specializes in property, casualty, and group benefits products. It also offers value-added services to support these products, including product development, underwriting, premium and claims administration, and actuarial services. Amwins operates in four divisions: brokerage, underwriting, group benefits, and international. It was founded in 1998 and is based in Charlotte, North Carolina.

Openly provides a homeowner insurance platform. It offers home insurance coverage to consumers through independent agents. Openly was founded in 2017 and is based in Boston, Massachusetts.

Assivo is a global business process outsourcing (BPO) company. The company offers services such as data entry and processing, research and data collection, lead generation and CRM management, data cleansing and data enrichment, data and content moderation, and more. It was founded in 2016 and is based in Naperville, Illinois.

Modern Life is a tech-enabled life insurance brokerage that operates in the insurance technology sector. The company offers a platform that combines advanced technology and expert support to streamline the process of purchasing life insurance, providing solutions that are fast, transparent, and intuitive. Modern Life primarily serves the insurance industry. It was founded in 2021 and is based in New York, New York.

Loading...