C6 Bank

Investments

2Portfolio Exits

4Partners & Customers

4About C6 Bank

C6 Bank is a mobile-only bank. Its services include checking and savings accounts, debit and credit cards, free toll tags, multi-currency global accounts, investments, and lending products. The company was founded in 2018 and is based in Sao Paulo, Brazil.

Research containing C6 Bank

Get data-driven expert analysis from the CB Insights Intelligence Unit.

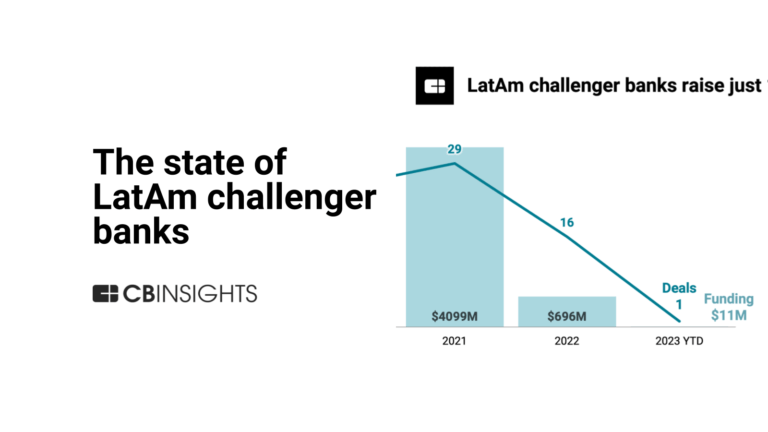

CB Insights Intelligence Analysts have mentioned C6 Bank in 2 CB Insights research briefs, most recently on Aug 7, 2023.

Latest C6 Bank News

Sep 10, 2024

September 10, 2024 C6 Bank, Brazil’s digital powerhouse backed by JPMorgan Chase, is soaring to new heights. The bank aims for a whopping R$2 billion ($400 million) profit in 2024, its first annual gain since 2019. Impressively, C6 Bank posted its maiden quarterly profit of R$461 million ($92.2 million) in Q1 2024. Then, it topped that with R$508 million ($101.6 million) in Q2, totaling R$969 million ($193.8 million) for half the year. By mid-2024, the bank’s loan portfolio swelled to R$47.95 billion ($9.59 billion), jumping 25% year-over-year. Vehicle financing and payroll loans are fueling this growth spurt. These two sectors now make up 23% and 48% of the loan portfolio, respectively. Notably, 78% of C6’s loans are now secured, up from 73% last year. This shift has boosted credit quality significantly. Non-performing loans plummeted from 5.3% in late 2022 to 3.1% in mid-2024. From Startup to Powerhouse: C6 Bank’s Remarkable Journey to Profitability. (Photo Internet reproduction) Customer deposits also surged, growing 54% year-over-year to reach R$57 billion ($11.4 billion). The bank now serves about 30 million customers with over 90 products and services. C6 Bank’s rapid growth is a testament to its innovative approach to digital banking. The bank has successfully carved out a niche in the competitive Brazilian market. Its focus on secured lending has paid off handsomely. This strategy has not only boosted profits but also improved the overall quality of its loan portfolio. The bank’s success in vehicle financing and payroll loans is particularly noteworthy. These sectors have become key drivers of growth for C6 Bank. Moreover, the reduction in non-performing loans showcases the bank’s improved risk management. This achievement is crucial for long-term sustainability and profitability. C6 Bank’s Growth Strategy C6 Bank is laser-focused on five key areas for growth: Expanding secured lending, especially in vehicles and payroll Cutting loan loss provisions through better risk management Tightening cost control and boosting operational efficiency Deepening customer engagement and wallet share Diversifying revenue streams, including insurance products The bank’s strategy revolves around sustainable growth and improved profitability. By focusing on secured lending, C6 Bank aims to minimize risk while maximizing returns. Improved risk management is another cornerstone of C6 Bank’s strategy. This approach has already yielded results, as seen in the reduced non-performing loan ratio. Cost control and operational efficiency are also high on the agenda. These measures will help the bank maintain its competitive edge in a crowded market. Customer engagement is crucial for C6 Bank ‘s continued success. The bank aims to become the primary financial institution for its customers. Diversification of revenue streams is another key focus. By expanding into areas like insurance, C6 Bank can reduce its reliance on traditional banking income. Competitive Landscape C6 Bank faces off against other neobanks like Nubank, Inter, and Neon. However, CFO Katz sees traditional banks as their main rivals. The digital banking space in Brazil is highly competitive. C6 Bank must continually innovate to stay ahead of its peers. Traditional banks pose a significant challenge due to their established customer base. However, C6 Bank’s digital-first approach gives it an edge in attracting younger customers. JPMorgan Chase’s partnership, now at 46% stake, gives C6 Bank a strategic edge. This alliance has helped skyrocket customer numbers from 8 million in 2021 to 25 million in 2023. The JPMorgan partnership provides C6 Bank with valuable expertise and financial backing. This support has been crucial in the bank’s rapid expansion. Financial Outlook C6 Bank is setting ambitious targets for the future. It expects to hit R$60 billion ($12 billion) in loans by the end of 2024. The bank’s ROE figures are impressive, reaching 58% in Q1 and 56% in Q2 2024. These numbers showcase the bank’s ability to generate returns for its shareholders. Service fee revenue also jumped from R$572 million ($114.4 million) to R$847 million ($169.4 million) year-over-year. This growth occurred despite the bank not charging account fees. The increase in service fee revenue highlights C6 Bank’s success in cross-selling products. It also demonstrates the bank’s ability to monetize its growing customer base. C6 Bank’s focus on secured lending and efficiency is clearly paying off. Its diverse offerings and JPMorgan partnership position it strongly in Brazil’s competitive digital banking scene. The bank’s transition from growth mode to profitability is well underway. If current trends continue, C6 Bank is poised for a bright future in the Brazilian financial sector. Check out our other content

C6 Bank Investments

2 Investments

C6 Bank has made 2 investments. Their latest investment was in Provi as part of their Corporate Minority on .

C6 Bank Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

Corporate Minority | Provi | Yes | 2 | |||

Other Investors |

Date | ||

|---|---|---|

Round | Corporate Minority | Other Investors |

Company | Provi | |

Amount | ||

New? | Yes | |

Co-Investors | ||

Sources | 2 |

C6 Bank Portfolio Exits

4 Portfolio Exits

C6 Bank has 4 portfolio exits. Their latest portfolio exit was Provi on August 24, 2023.

C6 Bank Acquisitions

3 Acquisitions

C6 Bank acquired 3 companies. Their latest acquisition was Banco FICSA on August 21, 2020.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

8/21/2020 | Acquired | 1 | ||||

10/15/2019 | ||||||

8/23/2019 |

Date | 8/21/2020 | 10/15/2019 | 8/23/2019 |

|---|---|---|---|

Investment Stage | |||

Companies | |||

Valuation | |||

Total Funding | |||

Note | Acquired | ||

Sources | 1 |

C6 Bank Partners & Customers

4 Partners and customers

C6 Bank has 4 strategic partners and customers. C6 Bank recently partnered with Thought Machine on December 12, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

12/9/2022 | Vendor | United Kingdom | Brazil’s C6 Bank taps Thought Machine for core banking technology Brazilian bank for individuals and businesses , C6 Bank , has partnered up with Thought Machine to utilise its core banking technology . | 2 | |

10/26/2022 | Vendor | ||||

1/1/2022 | Vendor | ||||

3/26/2020 | Partner |

Date | 12/9/2022 | 10/26/2022 | 1/1/2022 | 3/26/2020 |

|---|---|---|---|---|

Type | Vendor | Vendor | Vendor | Partner |

Business Partner | ||||

Country | United Kingdom | |||

News Snippet | Brazil’s C6 Bank taps Thought Machine for core banking technology Brazilian bank for individuals and businesses , C6 Bank , has partnered up with Thought Machine to utilise its core banking technology . | |||

Sources | 2 |

C6 Bank Team

7 Team Members

C6 Bank has 7 team members, including current Chief Executive Officer, Evilian Barreto Goes.

Name | Work History | Title | Status |

|---|---|---|---|

Evilian Barreto Goes | Chief Executive Officer | Current | |

Name | Evilian Barreto Goes | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Chief Executive Officer | ||||

Status | Current |

Compare C6 Bank to Competitors

Digio is a digital platform focused on financial services. The company offers a range of products and services including a digital account, credit card management through an application, personal loans, and a rewards club. These services are designed to simplify people's relationship with their money. It was founded in 2013 and is based in Barueri, Brazil.

Ualá operates in the financial technology sector, focusing on providing digital financial services. The company offers a prepaid Mastercard and an application that allows users to manage their money, make purchases, access loans, invest, and pay bills. Ualá primarily serves the financial services industry. It was founded in 2017 and is based in Buenos Aires, Argentina.

Sicredi is a financial cooperative that offers a range of banking and financial services across various sectors. The company provides personal, business, and agribusiness banking solutions, including accounts, credit, investments, and insurance, tailored to meet the needs of its members. Sicredi primarily serves individuals, businesses, and the agribusiness sector with its financial products and services. It was founded in 1995 and is based in Porto Alegre, Brazil.

Tribanco operates as a financial institution focusing on serving small and medium-sized retailers. The company offers a range of financial products and services including current accounts, credit and financing solutions, payment processing, and insurance. Tribanco primarily caters to the retail sector, providing tools and services to help manage and grow businesses. It was founded in 1990 and is based in Uberlandia, Brazil.

Klar is a financial services company offering credit card services, personal savings, and investment products. The company provides credit cards with no annual fees, savings accounts with daily growth, and flexible investment options with competitive returns. Klar's offerings are designed to cater to individuals seeking accessible financial products and tools for managing their finances. It was founded in 2019 and is based in Mexico City, Mexico.

Bnext operates as a financial technology company offering a range of financial management services. The company provides an online banking platform with features such as international money transfers, virtual cards, expense tracking, and a marketplace for various financial products. Bnext also supports cryptocurrency transactions and integrates with mobile payment services. It was founded in 2016 and is based in Madrid, Spain.

Loading...