Consensys

Founded Year

2014Stage

Secondary Market | AliveTotal Raised

$732.5MLast Raised

$14M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-30 points in the past 30 days

About Consensys

Consensys operates as a blockchain and web3 software company to specializes in decentralized web technologies. The company offers a suite of products including a self-custodial wallet, development tools for Ethereum, smart contract auditing, and Ethereum scaling solutions. It primarily serves developers and organizations within the blockchain and cryptocurrency sectors. Consensys was formerly known as Capital Platinum Systems. It was founded in 2014 and is based in Brooklyn, New York.

Loading...

Consensys's Product Videos

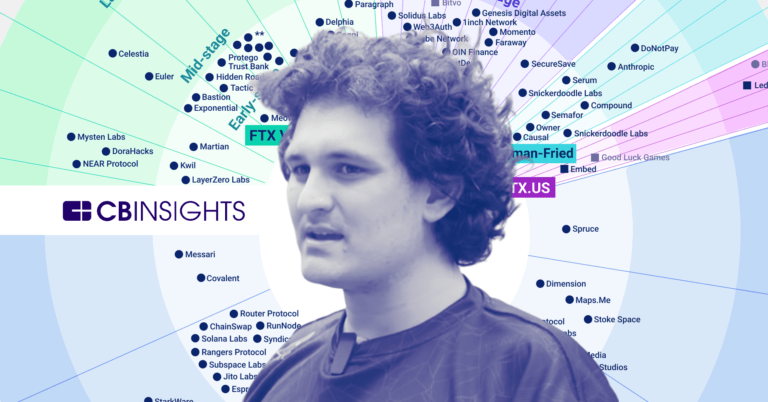

ESPs containing Consensys

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

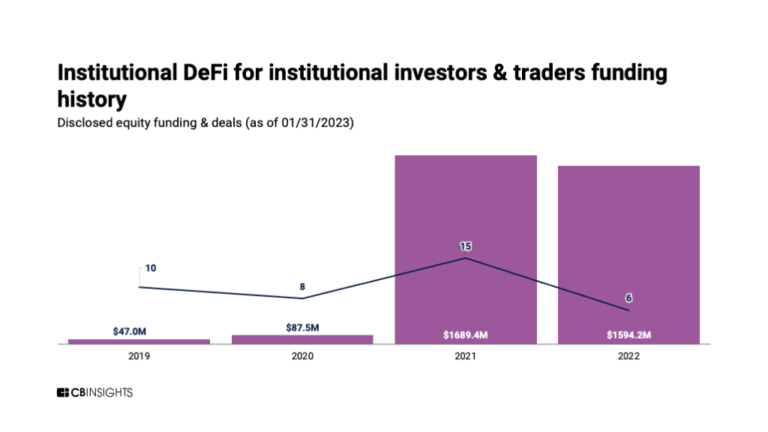

The institutional decentralized finance (DeFi) market refers to the use of decentralized finance protocols and platforms by institutional investors, such as hedge funds, asset managers, and corporations, to access DeFi services and generate returns. Technology vendors in this market offer end-to-end software solutions. These solutions provide secure access to top distributed networks, offering sec…

Consensys named as Leader among 15 other companies, including Circle, BitGo, and Fireblocks.

Consensys's Products & Differentiators

MetaMask

Mobile Wallet and Browser Extension

Loading...

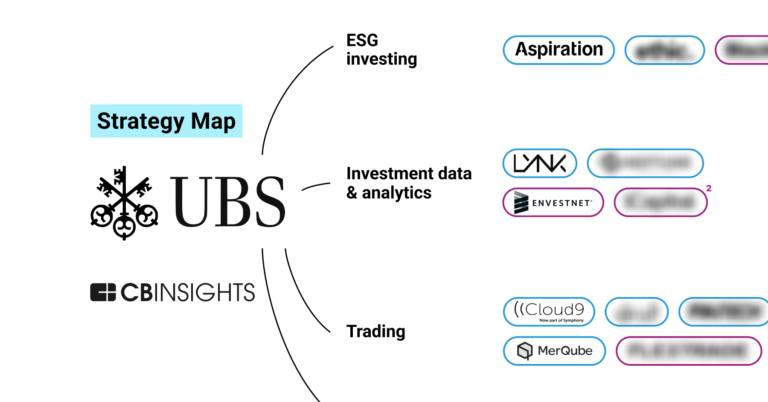

Research containing Consensys

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Consensys in 20 CB Insights research briefs, most recently on Jul 6, 2023.

Dec 14, 2022

What L’Oréal, Nike, and LVMH are doing in Web3

Nov 19, 2022

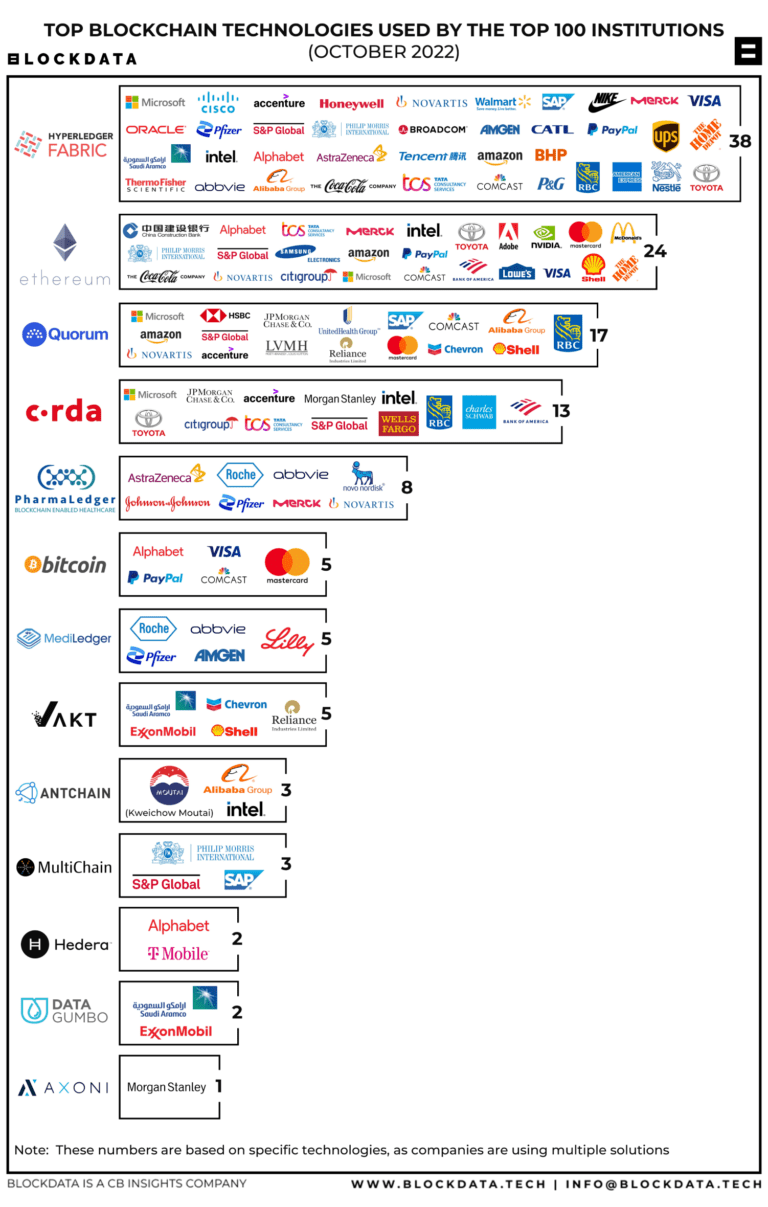

State of Enterprise Blockchain 2022Expert Collections containing Consensys

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Consensys is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Blockchain

14,431 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Conference Exhibitors

5,302 items

Fintech

9,260 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

349 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Consensys Patents

Consensys has filed 5 patents.

The 3 most popular patent topics include:

- alternative currencies

- cryptocurrencies

- blockchains

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/28/2021 | 12/20/2022 | Cryptocurrencies, Blockchains, Alternative currencies, Distributed data storage, Payment systems | Grant |

Application Date | 5/28/2021 |

|---|---|

Grant Date | 12/20/2022 |

Title | |

Related Topics | Cryptocurrencies, Blockchains, Alternative currencies, Distributed data storage, Payment systems |

Status | Grant |

Latest Consensys News

Sep 16, 2024

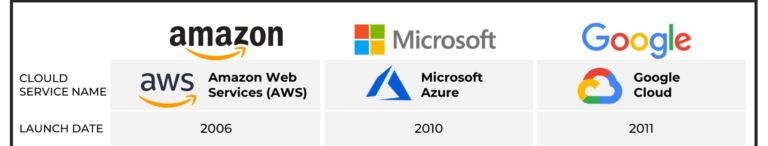

Posted on IBM (US), Amazon Web Services, Inc. (AWS) (US), Thales (France), Oracle (US), Infosys Limited (India), Infineon Technologies (Germany), Kudelski Security (Switzerland), ScienceSoft (US), Kaspersky Lab (Switzerland), Aujas Cybersecurity (US), Chainalysis (US), CertiK (US), Consensys (US). Blockchain Security Market by Solution (Key Management, Smart Contract Security, Penetration Testing, IAM, and Audits), Services (Development & Integration, Technology Advisory & Consulting, Incident and Response) – Global Forecast to 2029 The global Blockchain Security market is projected to grow from USD 3.0 billion in 2024 to USD 37.4 billion by 2029, with a Compound Annual Growth Rate (CAGR) of 65.5% during the forecast period. The rising incidence of cyber threats and data breaches has significantly increased the demand for advanced security solutions to safeguard blockchain networks from complex threats, driving market expansion. As blockchain technology is increasingly adopted across sectors like finance, healthcare, and supply chain management, the need for secure infrastructure to protect sensitive data and transactions is becoming more critical. Additionally, blockchain’s integral role in decentralized finance (DeFi) platforms has revealed new security risks, leading to a heightened demand for specialized security protocols, such as smart contract audits and vulnerability assessments. The blockchain security market is expanding due to integration with emerging technologies like AI and IoT, which enhance threat detection and data security. The rising demand for third-party security audits helps organizations identify vulnerabilities and build trust. Additionally, blockchain applications are growing across diverse sectors, such as healthcare and supply chain management, necessitating robust security measures. The increasing use of smart contracts also drives the need for advanced security solutions to prevent unauthorized access and exploitation. Based on the services, technology advisory and consulting to account for the largest market size during the forecast period. When segmenting the blockchain security market by services, the technology, advisory, and consulting services acquire the largest market size for several compelling reasons. This dominance is driven by the increasing need for expert guidance to navigate the complexities of blockchain technology and ensure robust security measures. As organizations adopt blockchain for various applications, they seek specialized services to assess risks, design secure infrastructures, and implement compliance strategies. The demand for advisory and consulting services is further fueled by the rapid evolution of blockchain technology and its integration with other emerging technologies, necessitating continuous expertise and updated security frameworks. By Vertical, retail & eCommerce accounts for the highest CAGR during the forecast period. The retail & eCommerce vertical is growing at the highest CAGR in the blockchain security market, and there are many factors contributing to it. Such growth is primarily driven by the increasing adoption of blockchain technology to enhance transaction security, prevent fraud, and improve supply chain transparency. Retail and e-commerce businesses are leveraging blockchain for secure payment processing, data privacy, and protection against cyber threats. As these sectors continue to expand their digital operations and customer interactions, the demand for robust blockchain security solutions is expected to grow significantly, leading to a higher CAGR compared to other verticals. Unique Features in the Blockchain Security Market Blockchain security relies heavily on advanced cryptographic techniques to protect data, ensuring secure transactions and preventing unauthorized access. These encryption methods make blockchain data nearly impossible to alter, adding a critical layer of security to the system. One of blockchain’s unique security features is its decentralized nature. Unlike traditional systems that rely on a central authority, blockchain distributes data across multiple nodes, reducing the risk of single-point failures or breaches. This makes it much harder for hackers to compromise the entire system. Once data is recorded on a blockchain, it cannot be easily modified or deleted, ensuring the integrity of transactions. The transparent nature of blockchain also allows all participants to verify and audit transactions, adding an additional layer of trust and security. As smart contracts automate and enforce agreements without intermediaries, ensuring their security is essential. The market is increasingly focusing on smart contract audits, vulnerability assessments, and robust coding practices to prevent flaws or exploits that could lead to significant losses. Blockchain security is reinforced by consensus mechanisms, such as Proof of Work (PoW) or Proof of Stake (PoS), that ensure only validated transactions are added to the chain. These mechanisms prevent fraudulent activity and uphold the integrity of the network. Major Highlights of the Blockchain Security Market With the growing number of cyberattacks, data breaches, and security vulnerabilities targeting blockchain networks, there is a heightened demand for advanced security solutions. These solutions are essential to safeguard critical infrastructure, digital assets, and sensitive information within blockchain ecosystems. Blockchain technology is being rapidly adopted across various industries, including finance, healthcare, supply chain management, and government services. This widespread use of blockchain has increased the need for reliable security measures to protect sensitive transactions, records, and data from unauthorized access or tampering. Decentralized Finance (DeFi) has emerged as one of the most prominent applications of blockchain technology, but it also comes with its own set of security challenges. As a result, there is growing demand for specialized security protocols, including smart contract audits, vulnerability assessments, and real-time monitoring to address risks specific to DeFi platforms. Smart contracts, which are self-executing contracts with predefined rules, are integral to many blockchain applications. Ensuring their security is a top priority, leading to the rise of specialized services focused on auditing and securing these contracts to prevent potential exploits and financial losses. As blockchain technology continues to evolve, governments and regulatory bodies around the world are introducing guidelines and compliance requirements to ensure that blockchain systems adhere to industry standards for security and privacy. This regulatory landscape is expected to further drive demand for compliant and secure blockchain solutions. Top Companies in the Blockchain Security Market Some of the globally established players which lead the blockchain security market are IBM (US), Amazon Web Services, Inc. (AWS) (US), Thales (France), Oracle (US), Infosys Limited (India), Infineon Technologies (Germany), Kudelski Security (Switzerland), ScienceSoft (US), Kaspersky Lab (Switzerland), and Aujas Cybersecurity (US). Partnerships, agreements, collaborations, acquisitions, and product developments are some of the various growth strategies these players use to increase their market presence. Oracle (US) Oracle is a key player in the blockchain security market, offering solutions like the Oracle Blockchain Platform Cloud Service and Oracle Blockchain Platform Enterprise Edition. These platforms provide secure, permissioned blockchain networks that enhance data integrity, streamline transactions, and ensure regulatory compliance, with flexible deployment options across cloud, on-premises, and hybrid models. Oracle focuses on tamper-proof data records, utilizing innovations like blockchain tables in Oracle Database 21c to bolster data security. The platform supports diverse smart contracts and integrates with multiple ledgers, catering to various business needs across industries such as finance, retail, manufacturing, and healthcare. Oracle’s blockchain solutions are integral to its broader cloud services and enterprise applications, promoting secure, decentralized data management for global enterprises across multiple regions. Thales (France) Thales Group is a leader in advanced technologies, providing robust blockchain security solutions to protect digital assets and transactions. Their offerings, like Luna Cloud HSM via the Data Protection on Demand (DPoD) platform, enable secure, cloud-based encryption key management, enhancing flexibility and scalability for blockchain environments. Thales also offers the SafeNet Authentication Service, ensuring secure, automated authentication for blockchain applications. Strategic partnerships with industry players like IBM, R3, and Hyperledger strengthen Thales’ capability to deliver enterprise-grade security solutions across various blockchain applications. With a global presence in over 56 countries, Thales serves diverse sectors, including finance, healthcare, and telecommunications, ensuring secure blockchain integration worldwide. Apart from prominent vendors, other players include Chainalysis (US), CertiK (US), Consensys (US), Bitfury Group Limited (Netherlands), LeewayHertz (India), Fortanix (US), Utimaco (Germany), Hacken (Estonia), Bit Sentinel (Romania), Astra IT, Inc (India), Kaleido, Inc (US), Microminder Cybersecurity (UK), Arridae Infosec (India), OVHcloud (France), and CryptoSec (US) which are also evolving in the blockchain security market. Chainalysis (US) Chainalysis is a global provider of blockchain data and analysis solutions, specializing in enhancing security and compliance within blockchain ecosystems. The company offers a range of solutions, including blockchain intelligence that leverages machine learning and forensic expertise to map real-world entities to on-chain activity. It enables organizations to gain insights into wallet ownership, detect suspicious transactions, and analyze complex blockchain interactions. Chainalysis also supports investigations by providing advanced tools that assist law enforcement and regulatory agencies in tracing illicit activities and resolving cybersecurity breaches. The company’s compliance solutions deliver real-time analytics and risk assessments, helping organizations maintain regulatory standards and prevent illegal activities. Serving over 1,300 clients worldwide, including law enforcement, financial institutions, and centralized exchanges, Chainalysis is recognized for its comprehensive security measures and deep insights. Operating in more than 70 countries, it utilizes a global intelligence network to offer localized support and gather critical data, reinforcing its leadership in the blockchain security market. Media Contact

Consensys Frequently Asked Questions (FAQ)

When was Consensys founded?

Consensys was founded in 2014.

Where is Consensys's headquarters?

Consensys's headquarters is located at 5049 Edwards Ranch Road, Fort Worth.

What is Consensys's latest funding round?

Consensys's latest funding round is Secondary Market.

How much did Consensys raise?

Consensys raised a total of $732.5M.

Who are the investors of Consensys?

Investors of Consensys include Fabrica Ventures, Mindrock Capital, ParaFi Capital, Third Point, Marshall Wace Asset Management and 34 more.

Who are Consensys's competitors?

Competitors of Consensys include Emtech, Fireblocks, Securitize, Tokeny Solutions, Quantstamp and 7 more.

What products does Consensys offer?

Consensys's products include MetaMask and 4 more.

Loading...

Compare Consensys to Competitors

Hyperledger is a company that focuses on advancing blockchain technology across various industries. The company offers enterprise-grade blockchain technologies that are used to transform the way business transactions are conducted. These technologies are primarily used in the financial sector, among others. It was founded in 2015 and is based in San Francisco, California.

R3 is a company focused on the digitization of financial services within the enterprise technology sector. It offers a private, permissioned distributed ledger technology (DLT) platform named Corda, designed to enable secure and direct digital collaboration among regulated institutions. R3's solutions cater to various sectors including banks, central banks, corporates, exchanges, central counterparties, and fintechs, providing services such as tokenization of digital assets and currencies, streamlined inter-bank transactions, and modernization of legacy workflows. It was founded in 2015 and is based in New York, New York.

Ripple focuses on providing cryptocurrency and blockchain solutions. It offers services such as cross-border payments, cryptocurrency liquidity, central bank digital currency, and more solutions. It primarily serves financial institutions, enterprises, and governments. Ripple was formerly known as OpenCoin. The company was founded in 2012 and is based in San Francisco, California.

SettleMint is a Blockchain-Platform-as-a-Service company that operates in the technology sector. The company's main service is to provide a platform that simplifies the integration of blockchain technologies into applications, offering a suite of APIs, developer tools, and frameworks. This service primarily caters to the needs of businesses across various sectors, including banking and financial services, supply chain management, insurance, and healthcare. It was founded in 2016 and is based in Leuven, Belgium.

Digital Asset specializes in blockchain and tokenization solutions within the financial and capital markets sector. The company provides software and services that enable the synchronization of data and transactions across organizational boundaries, facilitating the creation of regulatory-grade digital assets and solutions that streamline reconciliation processes, reduce settlement risks, and support real-time operations. Digital Asset's offerings primarily cater to financial institutions, market infrastructure providers, and technology companies seeking to leverage blockchain technology for capital market applications. It was founded in 2014 and is based in New York, New York.

BlockInvest focuses on the tokenization of real-world assets within the financial technology sector. The company offers a platform for creating digital securities, enabling the digitization and management of asset sales and investments on the blockchain. It serves financial institutions and market participants looking to optimize alternative asset transactions. It was founded in 2019 and is based in Milano, Italy.

Loading...