Ripple

Founded Year

2012Stage

Unattributed VC | AliveTotal Raised

$293.91MLast Raised

$10K | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-61 points in the past 30 days

About Ripple

Ripple focuses on providing cryptocurrency and blockchain solutions. It offers services such as cross-border payments, cryptocurrency liquidity, central bank digital currency, and more solutions. It primarily serves financial institutions, enterprises, and governments. Ripple was formerly known as OpenCoin. The company was founded in 2012 and is based in San Francisco, California.

Loading...

Ripple's Product Videos

ESPs containing Ripple

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

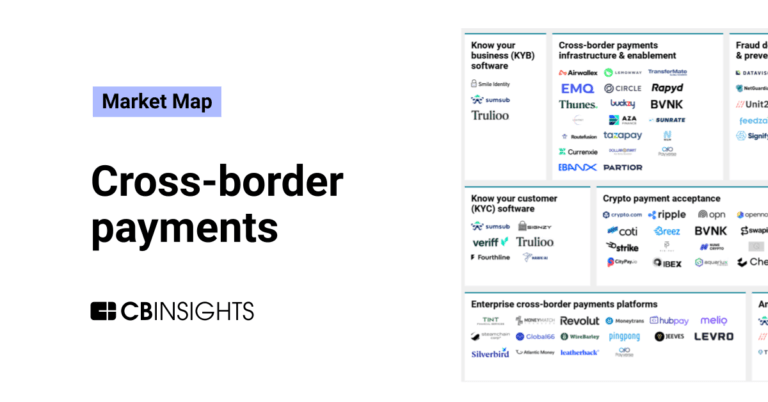

The crypto payment acceptance market offers solutions to help businesses and consumers process and convert cryptocurrency payments. The tools are especially useful for cross-border payments, where using fiat currencies might still be slow or expensive. Some of the solutions also enable users to buy or sell cryptocurrencies.

Ripple named as Leader among 15 other companies, including Coinbase, Nuvei, and PayPal.

Ripple's Products & Differentiators

Ripple Payments

Ripple Payments is the first enterprise-grade solution to address and eliminate the pain points associated with cross-border payments using digital assets at scale. As it has evolved, Ripple Payments has expanded from a cross-border payments network to a platform providing tokenized services that will bring crypto capabilities to enterprises – paving the way for a future where digital assets are front and center.

Loading...

Research containing Ripple

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ripple in 12 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market map

Oct 18, 2022

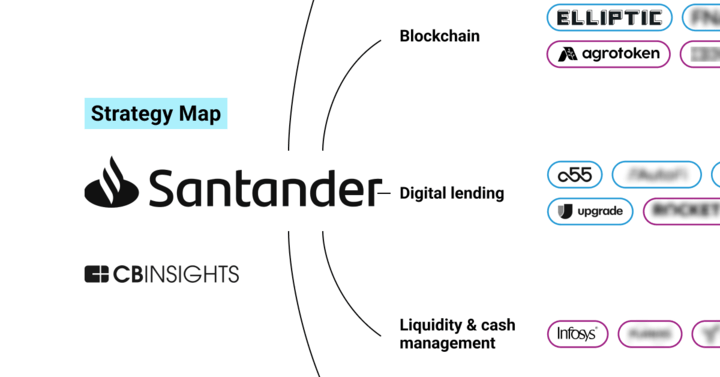

How blockchain could disrupt bankingExpert Collections containing Ripple

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ripple is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Blockchain

9,641 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

1,097 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Conference Exhibitors

5,302 items

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Ripple Patents

Ripple has filed 100 patents.

The 3 most popular patent topics include:

- payment systems

- cryptocurrencies

- project management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/19/2022 | 9/10/2024 | Payment systems, Project management, Banking technology, Interbank networks, Domain name system | Grant |

Application Date | 7/19/2022 |

|---|---|

Grant Date | 9/10/2024 |

Title | |

Related Topics | Payment systems, Project management, Banking technology, Interbank networks, Domain name system |

Status | Grant |

Latest Ripple News

Sep 21, 2024

3 Total Readers All through the Ripple vs SEC case XRP has been struggling between $0.52 and $0.60 since mid-July, holding a hefty fully diluted valuation of $58.6 billion. Despite an impressive daily trading volume of $1.5 billion, the large-cap altcoin continues to face tough resistance from a stubborn macro falling logarithmic trendline. Notably, XRP has been making notable moves, climbing 0.82% in the last 24 hours to hit $0.588, with a weekly gain of 4.16%. This uptick comes as the broader crypto market shows signs of optimism, with XRP benefiting from renewed interest in cross-border payments and recent developments, such as the launch of the Grayscale XRP Trust. The Trust, open to accredited investors, signals a strong endorsement for XRP’s use case as it powers the XRP Ledger, a distributed network designed for efficient international money transfers. Can XRP break through and rally higher? Ripple CTO David Schwartz Speaks Out on XRP Price Ripple’s CTO, David Schwartz, recently shared his thoughts on XRP’s price trajectory. In response to an X user who suggested that Ripple was suppressing XRP’s value, Schwartz confirmed his holdings and expressed a clear desire to see the price rise. “I hold XRP,” he emphasized, adding that he certainly would if he could push the price higher. Schwartz highlighted an often-overlooked consequence of lower XRP prices: higher payment costs. Using Bitcoin as an example, he explained that lower prices make it less practical for payments, stating, “Lower prices for XRP make XRP payments more expensive.” His point reinforces the importance of XRP’s value in making cross-border payments cost-effective, underlining its critical role in the payments ecosystem. The “Dirt Cheap” Debate Continues This conversation reignites a long-standing debate, stemming from a 2017 tweet by Schwartz. In the tweet, he remarked that XRP couldn’t stay “dirt cheap” if it were to facilitate large transactions. Despite current price frustrations voiced by some users, Schwartz maintains his belief that XRP will eventually reach the valuation necessary to power massive payments efficiently. XRP Price Breakout Possible, If? XRP has been in a sideways pattern, but a potential breakout is on the horizon as Bitcoin targets the $100K-$150K range. A run to $2 by 2025 seems possible, particularly with the SEC case nearing its end and whales accumulating 380 million XRP in the last 10 days. With Bitcoin rallying and market sentiment turning positive, XRP could see significant gains as smart money positions itself for a major move. Is this the moment for XRP to break and silence the haters? We have to wait and watch XRP’s next move. Tags

Ripple Frequently Asked Questions (FAQ)

When was Ripple founded?

Ripple was founded in 2012.

Where is Ripple's headquarters?

Ripple's headquarters is located at 315 Montgomery Street, San Francisco.

What is Ripple's latest funding round?

Ripple's latest funding round is Unattributed VC.

How much did Ripple raise?

Ripple raised a total of $293.91M.

Who are the investors of Ripple?

Investors of Ripple include Tokentus, Tetragon Financial Group, Ripple, Route 66 Ventures, SBI Group and 34 more.

Who are Ripple's competitors?

Competitors of Ripple include Fireblocks, Arf, Airwallex, MobiKwik, Circle and 7 more.

What products does Ripple offer?

Ripple's products include Ripple Payments and 2 more.

Who are Ripple's customers?

Customers of Ripple include Hai Ha, Travelex, Instarem and DBS Bank.

Loading...

Compare Ripple to Competitors

BitGo focuses on providing secure and solutions for the digital asset economy. The company offers a range of services including regulated custody, financial services, and core infrastructure. BitGo primarily serves investors and builders in the digital asset economy, including exchanges, retail platforms, crypto-native firms, and institutional investors. It was founded in 2013 and is based in Palo Alto, California.

ZEPZ focuses on providing digital payment solutions. The company offers services enabling users to send money securely with options for bank deposit, cash collection, mobile airtime top-up, and mobile money. ZEPZ primarily serves the global payments industry. Zepz was formerly known as WorldRemit. It was founded in 2010 and is based in London, United Kingdom.

Ledger specializes in secure hardware wallets and digital asset management solutions within the cryptocurrency sector. The company offers products that store private keys for cryptocurrencies and NFTs, enabling secure transactions and asset management. Ledger's hardware wallets are designed to work with the Ledger Live app, which facilitates the buying, selling, swapping, and staking of various cryptocurrencies. It was founded in 2014 and is based in Paris, France.

Lianlian Pay, operated by Lianlian Group, is a mobile and micropayment service provider. The company operates a network of agents in China where consumers can convert cash into mobile-phone minutes. It allows customers to purchase airline tickets, video gaming credits, and utility bills with its network. It was founded in 2003 and is based in Hangzhou, China.

Airwallex develops a global financial platform focusing on providing business payment solutions within the financial technology domain. The company offers an array of services including global business accounts for managing finances, international transfers, multi-currency corporate cards, and online payment processing capabilities. It primarily serves the payment industry. The company was founded in 2015 and is based in Melbourne, Australia.

Xapo Bank operates as a financial institution integrating traditional banking with cryptocurrency. The company offers banking services that allow customers to manage both US Dollar and Bitcoin accounts, providing a platform for transactions and wealth growth. The bank primarily serves individuals interested in blending traditional finance with the cryptocurrency economy. It was founded in 2014 and is based in Gibraltar, England.

Loading...