Gopuff

Founded Year

2013Stage

Angel - II | AliveTotal Raised

$3.397BRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-3 points in the past 30 days

About Gopuff

Gopuff operates an instant commerce delivery platform for foods and beverages. The company also provides an application that allows customers to choose from the products such as alcohol delivery service, over-the-counter medications, groceries, snacks, drinks, and more. It was founded in 2013 and is based in Philadelphia, Pennsylvania.

Loading...

ESPs containing Gopuff

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The on-demand grocery delivery market caters to the busy lifestyles of modern consumers looking to purchase groceries without leaving their home. Platforms in this market offer convenience and prompt services, delivering everything customers need within a short timeframe. They bring local sellers online, provide a larger choice of products at competitive prices, and can offer discounts that are ex…

Gopuff named as Leader among 15 other companies, including Amazon, Instacart, and DoorDash.

Loading...

Research containing Gopuff

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Gopuff in 6 CB Insights research briefs, most recently on May 29, 2024.

May 29, 2024

483 startup failure post-mortems

Expert Collections containing Gopuff

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Gopuff is included in 6 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

4,625 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,244 items

Grocery Retail Tech

648 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

On-Demand

1,244 items

Food & Meal Delivery

1,575 items

Startups and tech companies offering online grocery, food, beverage, and meal delivery services.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Gopuff News

Sep 17, 2024

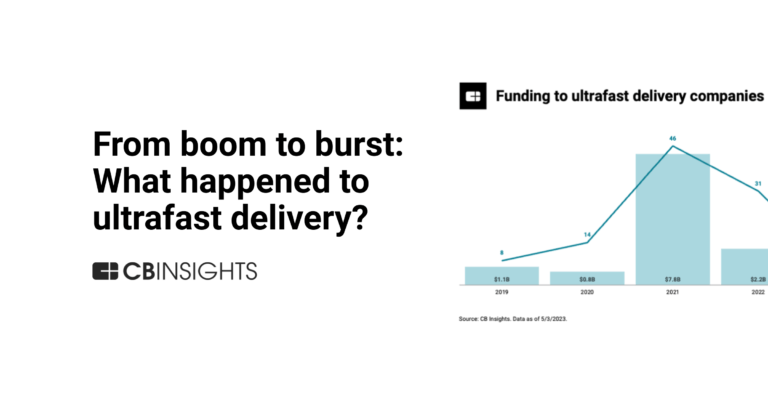

Flink , the quick commerce startup out of Berlin that was an acquisition target first of Gorillas, then Getir, and then Amazon, and then Gopuff, today made a move that spells out how it plans to go forth on its own. The company has confirmed a fresh fundraise of $150 million — $115 million in equity and $35 million in debt — money that it plans to use to double down on business in Germany and the Netherlands in partnership with another big player in delivery, Just Eat Takeaway.com. The funding is coming from a mix of existing and new investors. BOND, Mubadala, Northzone, supermarket giant REWE are all putting money into Flnk, along with two unnamed investors. The company would not not confirm nor deny whether Just Eat Takeaway is one of the unnamed investors. The Dutch company had also been interested in a merger with Flink, and it looks like, for now, they are working together in what Flink is describing as a “preferred partnership.” REWE was an existing preferred partner of Flink’s. “With the support of our investors, we are entering an exciting new phase of growth,” said Oliver Merkel, founder and managing director of Flink, in a statement. “This investment will enable us to further expand our footprint, improve operational efficiency, and continue delivering the fast, reliable service that our customers rely on.” Flink is not disclosing its valuation with this round but sources close to the company say that it is just under $1 billion. We have asked for comment from the investors and will update this post when we learn more. For some context, at the peak of interest for quick commerce, Flink was valued at close to $3 billion when it took an investment from DoorDash in December 2021, and just months later it raised more financing that put its valuation at close to $5 billion , according to sources. Some further context: in April this year, it was rumoured that Flink raised $106 million while exploring a sale to either Getir or Just Eat Takeaway. From what we understand that capital was a mixture of bridge financing and other commitments that dated as far back as 2022. And since then, the erstwhile aggressive Getir has seriously retreated . However, some of the report was accurate: Just Eat Takeaway indeed is in the mix today. (And today’s funding round, we are told, is a fresh deal.) The news of the new capital for Flink comes at the tail end of what has been a very tumultuous time in the so-called instant delivery market. This branch of e-commerce — in which the online retailers offer a typically smaller assortment of goods that they house in their own distributed “dark stores” and then offer for delivery in an hour or less to buyers — made a huge splash at the start of the Covid-19 pandemic, when they came in as a handy way for consumers who were either sheltering in place or interested in keeping more social distance to get items they might have quickly gone to buy themselves in the past. That gap in the market proved to be catnip to investors, who poured in billions to a plethora of startups, which took the same route as ride hailing companies with splashy and expensive marketing campaigns to lure users. (Notably some of Flink’s investors getting announced today were part of that rush.) It was all a house of cards, and many of them either collapsed or were scooped up by rivals. Flink itself was very much a part of that expansion, consolidation, and retreat: it acquired France’s Cajoo in 2022 — at the time seen as a saving-face move for the French operation. Now Flink has officially called it quits and has left France. Just as Getir has retreated to its home market of Turkey, Flink is also narrowing its focus in hopes of better unit economics, with any future ambitions of building coming from that more solid base. Today, it is all about Germany and the Netherlands. Flink said that it expects to make $600 million in gross revenues in 2024 in the two countries, up 20% compared to 2023. It also said it is now Ebitda-break-even in both markets and “targets” overall profitability by Q2 2025 with average orders (also called basket size) of $40. Overall it has 146 hubs in the two countries across some 80 cities, and it said it will be opening 30 more locations in the next year. It has 8,900 employees as of today. More TechCrunch

Gopuff Frequently Asked Questions (FAQ)

When was Gopuff founded?

Gopuff was founded in 2013.

Where is Gopuff's headquarters?

Gopuff's headquarters is located at 537 North 3rd Street, Philadelphia.

What is Gopuff's latest funding round?

Gopuff's latest funding round is Angel - II.

How much did Gopuff raise?

Gopuff raised a total of $3.397B.

Who are the investors of Gopuff?

Investors of Gopuff include Tom Brady, Bob Iger, SoftBank, Fidelity Investments, Eldridge Industries and 18 more.

Who are Gopuff's competitors?

Competitors of Gopuff include Getir, Foxtrot, Shadowfax, Jokr, Instacart and 7 more.

Loading...

Compare Gopuff to Competitors

Favo focuses on e-commerce in Latin America, operating within the e-commerce industry. The company provides a platform that facilitates economic transactions and convenience for new digital customers, as well as real opportunities for entrepreneurs to generate income without initial investment. It was founded in 2019 and is based in Lima, Peru.

Rappi operates as a tech company focusing on digital commerce and delivery services. The company offers a platform for ordering food, supermarket goods, and pharmacy products online, with a delivery service to customers' locations. Rappi partners with restaurants and stores to facilitate their access to a wider customer base through its app. It was founded in 2015 and is based in Mexico City, Mexico.

DRINKS is a company that focuses on alcohol technology and e-commerce enablement in the alcohol industry. The company offers a range of services including a platform for alcohol e-commerce, a Shopify app for tax and compliance, and a suite of data and analytics products that leverage artificial intelligence to aid in selling alcohol online. These services primarily cater to retailers, brands, marketplaces, and wineries in the alcohol industry. It was founded in 2013 and is based in Los Angeles, California.

Shadowfax caters logistics platform that operates in the hyper-local, on-demand delivery sector. The company provides a range of services including delivery, retail deliveries, and e-commerce solutions such as forward and reverse shipments. It primarily serves sectors such as e-commerce, food, pharma, and groceries. It was founded in 2015 and is based in Bengaluru, India.

Huolala is an internet logistics platform. It provides same-city and cross-city freight transportation, enterprise logistics services, less-than-truckload (LTL) transportation, car rental and after-sales services, and more. It was formerly known as EasyVan. The company was founded in 2013 and is based in Guangzhou, China.

Ninja Van is a tech-enabled logistics company specializing in e-commerce express logistics. The company offers a suite of solutions for parcel delivery, including digital and full-funnel marketing services to enhance shippers' sales. Ninja Van's network extends to various sectors, including e-commerce and business-to-business inventory restocking. It was founded in 2014 and is based in Singapore, Singapore.

Loading...