WeRide

Founded Year

2017Stage

Series D | AliveTotal Raised

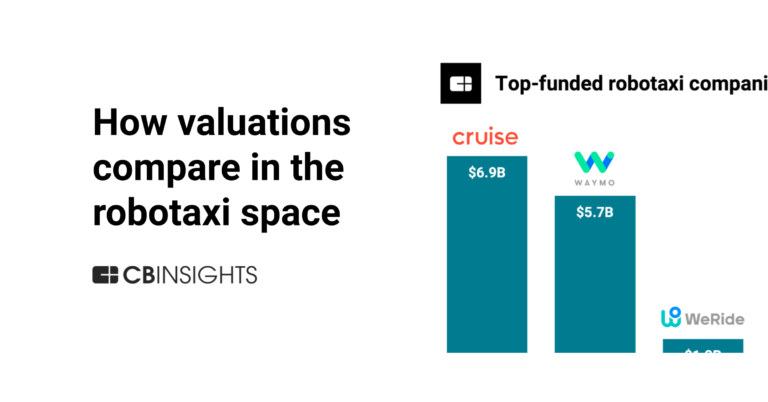

$1.442BValuation

$0000Last Raised

$120M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-15 points in the past 30 days

About WeRide

WeRide is a global leader in the development of autonomous driving technologies, focusing on Level 2 to Level 4 automation within the smart transportation and mobility sector. The company offers a suite of services including robotaxis, robobuses, robovans, robosweepers, and advanced driving solutions aimed at enhancing urban mobility and logistics. WeRide primarily serves sectors such as online ride-hailing, on-demand transport, urban logistics, and environmental sanitation. It was founded in 2017 and is based in Guangzhou, Guangdong.

Loading...

WeRide's Product Videos

ESPs containing WeRide

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The autonomous driving systems market refers to technologies that enable vehicles to operate without (or with very little) human intervention, with solutions incorporating the necessary software and hardware (e.g. sensors, AI chips) that allow vehicles to perceive their surroundings, localize themselves, and plan accordingly. Autonomous driving systems are used for advanced driver assistance syste…

WeRide named as Challenger among 15 other companies, including Mobileye, Waymo, and Aurora.

WeRide's Products & Differentiators

Robotaxi

Equipped with WeRide’s full-stack L4 autonomous driving solutions to provide safe and stable self-driving rides on open urban roads, highways, tunnels and even in the “Villages in the City” with very congested streets.

Loading...

Research containing WeRide

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned WeRide in 4 CB Insights research briefs, most recently on May 2, 2023.

Expert Collections containing WeRide

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

WeRide is included in 5 Expert Collections, including Auto Tech.

Auto Tech

2,550 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Unicorns- Billion Dollar Startups

1,244 items

Smart Cities

2,135 items

Mobility-as-a-Service

615 items

Companies developing solutions to streamline the way people move themselves. Includes companies providing on-demand access to passenger vehicles and micromobility solutions as well as companies integrating multiple modes of transport, including public transit, into one service.

Artificial Intelligence

14,767 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

WeRide Patents

WeRide has filed 18 patents.

The 3 most popular patent topics include:

- autonomous cars

- automotive technologies

- lidar

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/11/2020 | 8/6/2024 | Autonomous cars, Traffic signals, Automotive technologies, Robotics, Intelligent transportation systems | Grant |

Application Date | 6/11/2020 |

|---|---|

Grant Date | 8/6/2024 |

Title | |

Related Topics | Autonomous cars, Traffic signals, Automotive technologies, Robotics, Intelligent transportation systems |

Status | Grant |

Latest WeRide News

Sep 20, 2024

7 To embed, copy and paste the code into your website or blog: <iframe frameborder="1" height="620" scrolling="auto" src="//www.jdsupra.com/post/contentViewerEmbed.aspx?fid=7d9ca1f4-af62-45ef-b521-599a82b9d701" style="border: 2px solid #ccc; overflow-x:hidden !important; overflow:hidden;" width="100%"></iframe> Editor’s Note Welcome to our September, 2024 edition of Plugged In, DW's monthly newsletter addressing the industry's transformative transition to EVs. Over the next few months, Plugged In will turn its focus to the accelerating influence of technology, particularly AI, in the automotive sector. There are few segments of the automotive industry that are not being materially impacted, if not transformed, by the integration of AI, from enhancing manufacturing capabilities, improving battery efficiency, to cutting edge software for autonomous driving. With these extraordinary advancements come significant operational and legal risks. Over the next three issues, we will examine the role of technology in the automotive sector, the benefits and risks of its various applications, and the associated legal issues/risks inherent in its widespread adoption. I hope you will join us on this journey as we uncover the milestones, innovations, and challenges that are defining the intersection of electrification, autonomous driving and AI in the automotive world. Our journey will culminate in an in-person program to be held in November entitled, "The Intersection of Electrification/Autonomous Driving and AI – The Evolving and Uncharted Legal Landscape". Details to follow. In this edition, we cover a lot of ground, from an opinion piece by Mark Heusel contemplating the potential impact of the forthcoming presidential election on the scope and pace of transition to electric vehicles; Bob Weiss' recurring column focusing on recent selections from the general and industry press relating to AI, autonomous driving and the challenges facing legacy OEMs in competing with Chinese manufacturers in the Chinese domestic market and globally; and an article by Scott McBain and Joe Pytel highlighting the current technological challenges confronting the auto industry as it navigates the uncharted territory of electrification. I hope you will find this edition thought provoking and an enjoyable read. Robert Weiss | Of Counsel | Co-Chair, EV Initiative and How the Candidates View the Future of EVs in the U.S. In August 2021, President Biden signed Executive Order 14037, setting forth the Administration’s public policy towards “strengthening American leadership in clean cars and trucks.” This policy included a lofty goal that challenged domestic automakers to manufacture no less than 50% of all their new passenger cars and trucks as zero-emission vehicles by 2030. The Administration committed to supporting this goal by: i) prioritizing clear standards, ii) expanding key infrastructure, iii) spurring on critical innovation, and iv) investing in the American autoworker. At the time, the President’s engagement was historic. Never before had a U.S. President taken such a proactive position on such an important initiative for the U.S. auto industry. By the time the Executed Order was signed, however, the U.S. OEMS had already set their own aggressive goals and the industry found itself in the middle of the largest transition in decades. Three years in, and any honest assessment of the Administration’s success and, more importantly, the industry’s progress, is mixed. The Administration and its allies are quick to point to the Infrastructure Investment and Jobs Act and the Inflation Reduction Act (IRA), the two largest pieces of legislation in history, as game changers in the government’s support behind the EV transition. No doubt these laws paved the way for the U.S. OEMs to feel more comfortable about their own accelerated pace of transition, and hundreds of millions more dollars were allocated to nascent technologies and supply chains to support the transition. But, as the glow of a new emerging technology dimmed with the reality of headwinds facing OEMs, including skepticism from the public, the naysayers (and dare say the Republican Party, including its current leader, former President Trump) were quick to pounce on the fragile transition and what the Republicans have characterized as wasteful spending by Democrats and tax incentives that help no one but the Chinese. Like many issues in the United States today, the amazingly inventive technologies that are being developed in Detroit and Silicon Valley (as well as many other American cities) to drive forward the EV transition have become political. President Biden has continued to remain “all in” on government spending to drive forward the transition. Most recently, he introduced severe new protectionist tariffs to disincentive Chinese OEMs from entering the U.S. market (a move recently followed by Canada). Behind this, the Administration has aligned its commitment to other more “traditional” planks in its campaign platform: American Jobs, American Innovation, and winning the battle for American supremacy in automobile manufacturing. In a foregone day, these same planks rested squarely in the Republican platform. For a kid growing up in the 1970s and 80s, I still remember when cutting off oil dependency from the Middle East was a shared goal for both parties. In the U.S. today, however, Republicans tend to prioritize policies that support the oil industry, with former President Trump famously saying: “Drill, baby, drill.” Before July, when it appeared to many that Mr. Trump was bound for a return to the White House, some said this could be catastrophic for the EV transition, as the former President had promised to roll back legislation that incentivized the industry. Just eight weeks later, the Democrats have a new candidate in Vice President Kamala Harris, and former President Trump has softened on EVs (at least Teslas) after he received the endorsement of Elon Musk. So, let’s have a quick check to see where each of the candidates stand on EVs, as of Labor Day 2024. First up, Vice President Harris. This is what we know about her record: VP Harris has been supportive of President Biden’s push to expand access and manufacturing of EVs in the U.S. She has doubled down on supporting the UAW, and the Administration’s labor-focused agenda will likely remain at the center of a Harris Administration. In May, VP Harris traveled to Detroit, where she announced $100 million for small and medium-sized auto manufacturers to upgrade their facilities for EV production. As early as the 2020 presidential campaign, VP Harris promoted ambitious climate policies, including production of EVs consistent with Biden’s later Executive Order. VP Harris, however, went even further by proposing that the industry be 100% EV by 2035, and advocating for heavy duty vehicles to join the EV ranks much quicker. In fact, in 2019, then Senator Harris cosponsored the Zero-Emission Vehicles Act, which proposed aggressive EV goals for vehicle adoption. As Vice President, Ms. Harris took an active role in passage of the IRA and continues to be a fervent advocate of its end goals. If elected President, Ms. Harris should be expected to stay largely aligned with Biden’s commitment to labor, but her past history on environmental issues could be construed as even more robust when it comes to climate issues, and most would agree that EVs figure into that equation. Former President Trump, on the other hand, has become more of a chameleon when it comes to EVs. Way back in June, Mr. Trump easily cast EVs and their loyalists as leftist Green New Dealers, out to take everyone’s gas-propelled vehicle. Stirring his supporters, much like he did with guns, immigration, and national security, Mr. Trump claimed that the Democrats were forcing inferior products on consumers and promoting a failed technology that was too expensive and controlled by China. Fast forward, and after Elon Musk endorses former President Trump for President, Mr. Trump has pivoted ever so slightly (maybe). Recently, Mr. Trump told a crowd in Atlanta that, “[Kamala Harris] wants to get rid of gas-powered cars and replace them with all electric,” “They don’t go far, they cost too much, they’re all made in China; other than that they’re fantastic, and I’m for electric cars.” “I have to be, you know, because Elon [Musk] endorsed me very strongly, Elon. So I have no choice.” Mr. Trump went on to say that, he’s for “a very small slice” of cars being electric, which is not exactly a ringing endorsement and certainly should not comfort Detroit. Could Mr. Trump, however, be persuaded to remain, at least, neutral on the transition? Since the Musk endorsement, Mr. Trump has gone out of his way to ingratiate himself to Musk and his products, but it has hardly been an about face on EVs, and Mr. Trump still seems willing to gut the federal legislation that U.S. OEMs are counting on to help make EVs more affordable in the future. And, he can continue to remain critical of tax incentives without angering Musk, who has also been critical of such government support, likely because it benefits his U.S. competitors. The biggest take away for November is that we can expect a Harris Administration to continue a robust agenda for EVs, while the Trump team and his allies in Congress say they are determined to roll back the Infrastructure Act and IRA. If this happens, it will only further delay an EV transition as it takes needed dollars away from consumers interested in buying their first EVs and, more importantly, undermines spending on infrastructure improvements, such as EV charging stations. Ironically, Mr. Trump’s “anti-government spend” position is at odds with the Big Three, who have pushed for this legislation as a means to facilitate their transition. The question is, however, whether Mr. Trump’s current rhetoric will become a longer term policy should he occupy the Oval Office in 2025, and could he really cause the entire transition to come to a screeching halt after the industry has committed billions of dollars to electrify their vehicles. Perhaps Mr. Trump has simply concluded that the U.S. auto industry will not catch China in the next 4 years and producing cheaper ICE vehicles for U.S. consumers in the short-term will be welcomed by his Base. Those in the industry will quickly point out, however, that this type of isolationism will be catastrophic for the U.S. auto industry as the rest of the world transitions to BEVs, leaving Chinese OEMs to only redouble their early successes in every other corner of the globe. ** Please Note: The content of this article is the author’s own opinion, and not necessarily that of DW. Mark Heusel | Member Partner | Chair, East Asia Practice Group In Case You Missed It Three of the hottest topics in the general and automotive press these days are: (1) Artificial Intelligence; (2) autonomous driving; and (3) the Chinese automotive domestic and global markets. Let's start with the Autonomy/Artificial Intelligence. (1) First is an article appearing in the August 15th edition of the New York Times entitled, "A Chinese Self-Driving Start-Up Is About To Go Public in the U.S." The author discusses the forthcoming public offering of WeRide, which is described as "One of China's leading autonomous driving startups." It is reported that one of the principal shareholders of WeRide is Alliance Ventures, the venture capital fund of Renault, Nissan and Mitsubishi Alliance. WeRide has registered to go public on the Nasdaq Stock Exchange in an attempt to raise $440 million. The list of risks disclosed in its prospectus is lengthy and intimidating for would be investors, including risks associated with the current geopolitical climate and Chinese government potential influence. The prospectus states that among risks is that the Chinese government "has substantial significant oversight and discretion over the conduct of our business, and may intervene or influence our operations". Apparently, raising capital in China is greatly constrained for start-ups like WeRide. It may prove to be in the U.S. as well. Artificial intelligence (2) The rivalry among nations to lead in the development and application of AI is explored in an article appearing in the August 14th edition of the New York Times entitled, "The Global Race to Control A.I. : We explore who is winning — and what could come next." The premise of the article is summed up in its opening sentence – "As artificial intelligence advances, many nations are worried about being left behind." The consensus is that AI could soon reshape the global economy and nations want the security of knowing that companies based on their soil are taking the lead and will not be dependent for critical technology based in other countries. New laws, regulations and alliances are being created as a result. (3) A thought provoking article from the Wall Street Journal regarding the ethical challenges facing the participants in the development of autonomous vehicles. In an article appearing in the August 28th edition of the Wall Street Journal entitled, "How will Self-Driving Cars Learn to Make Life-and- Death Choices? ", the authors explore a number of the questions that engineers, programmers and bioethicists are struggling with as AI-driven vehicles approach greater adoption. In one section entitled, "The good trip" the author poses the question, "Is taking the fastest route the core metric that should guide autonomous vehicles, or are other factors just as relevant", e.g., should safety be the prime motivation at the expense of causing slow and snarled traffic or in the case of commercial vehicles, less trips and less profit. A fascinating read from my perspective. Now let's shift to Chinese automotive domestic and global markets. (4) "China is Done with Global Automakers: “Thanks for Coming". Michael Dunne's recent article in Dunne’s Insights about the precipitous decline of sales by foreign manufacturers in China's domestic auto market is aptly summed up in the subtitle to his article –"Dwindling Sales and Vanishing Profits". His article contains some staggering statistics. For example, GM's sales in 2017 in China were 4.1 million vehicles in comparison with a projected 1.8 million sales in 2024, and that it sustained more than $200 million in losses so far in 2024. He asserts that Ford has lost more than $5 billion in China since 2020 and its sales are down 70% since its peak. At the conclusion of his analysis, he states in reference to foreign manufacturers, "Most of them will be shown the door within the next five years. Some will find the exit sooner". (5) Japan Built Thailand's Car Industry. Now China is Gunning for It. Japan manufacturers have long dominated Thailand's domestic car market. However, recently the Chinese have made impressive gains. In an article appearing in the July 30th edition of the New York Times, the authors cite the reason for China's ascension as the Japanese manufacturers "unwillingness to fully embrace electric vehicles, which are popular in Thailand...." The authors cite to data compiled by MarkLines, an automotive information provider, as reflecting a 25% decline in Japanese OEM sales, while overall sales declined 9%. Although Japanese sales still represent 75% of new car sales in Thailand, Chinese manufacturers are making significant inroads in that dominance. Thailand (6) Chinese EV Makers Rush In and Upend a Country's Entire Auto Market In the above article appearing in the July 31st edition of the New York Times, the authors report on how China's automakers "...ambition and competitiveness are reshaping Thailand's car industry". Facing significant tariffs being imposed in Europe and the U.S., Chinese manufacturers are focusing on Southeast Asia, where it enjoys strong trade ties and proximity. Its strategy appears to be working. The authors report signs of a "changing of the guard" in that Japanese auto sales accounted for 86% of all new car sales in 2022 as compared to 75% in 2023. The combination of government subsidies and tax breaks and Chinese manufacturer’s openness to price cutting makes an attractive sales environment for Chinese manufacturers. Europe (7) BYD Has Its Eyes Set On Conquering Europe Notwithstanding imposition of protectionist tariffs, China is far from abandoning the European market. In a July, 2024 edition of Benzinga Financial News and Data, the authors report on BYD's increasing manufacturing footprint outside of China, with plants under construction in Hungary and Turkey. Robert Weiss | Of Counsel | Co-Chair, EV Initiative As OEMs Pull Back on Electric Vehicle Targets, Vehicle Electrification Continues For years, the focus of OEMs around the world has been the transition to Electric Vehicles (EVs) and away from internal combustion engine vehicles. Generally, the term “EV” refers to vehicles where the vehicle powertrain is powered by one or more batteries, rather than traditional fossil fuels, such as gasoline or diesel fuel. Increasingly, OEMs have been heavily investing in “EVs” and setting targets for increasing EV vehicle production. Today, many OEMs are pausing their plans. However, even in view of the OEMs pausing their EV plans, the industry is not stopping innovation efforts in vehicle electrification. The foundation of the transition to an electrified vehicle was started long ago with electrification building blocks, making possible a transition to an all-electric vehicle powertrain. Indeed, by way of example, electric power windows in automobiles were imagined and patented as early as 1931 (see here ). Ever since, automotive OEMs, and their suppliers, have been innovating with electrification to improve the driver experience, reduce the weight of vehicle components, and reduce manufacturing and operating costs. For example, the latest technology for steering and braking systems, which remain necessary in a battery-powered vehicle, is more important than ever due to the size and weight of these mechanical components located on the chassis of the vehicle. EVs have heavier load requirements for the chassis when compared to traditional vehicles due to the weight of their batteries. Noise vibration and harshness (NVH) requirements are more important too, as normal road noise is no longer masked by an internal combustion engine. Steering technologies have advanced from purely mechanical systems, to electric power steering assist, to Steer-by-wire steering systems, giving rise to new questions about the driver’s experience and interaction with the vehicle. Steer-by-wire eliminates the mechanical connection between the driver input (e.g., at the steering wheel) and the road wheels, and replaces the traditional, heavy, mechanical connection with an electronic connection. What should the driver feel at the steering wheel now that it is disconnected from the road wheels? What happens when the electronic signal fails, or is late? How will that be prevented? The answers lead us to all sorts of new innovations in steering technology. It is similar in braking technologies. The hydraulic braking of the past (e.g., the fluids, fluid lines, and pumps associated therewith) is being replaced by an electronic connection between the driver’s foot pedal and the brake caliper, which is controlling actuation of the brake caliper. What will that feel like to the driver? What happens when the signal to the brake caliper fails? Is there a back-up system? The transition to EVs is a blank slate for suppliers and their OEM customers. There are new problems to address and there is significant innovation opportunity to completely rethink the electronic architecture of the vehicles. This isn’t just a transition, it is a revolution. Indeed, continued vehicle electrification paves the way for software driven vehicle control, which is increasingly trending toward the use of artificial intelligence. Our vehicles of the future will significantly differ from existing legacy designs. OEMs, and more importantly their suppliers, will need to adapt, innovate and protect their ideas, and understand the technological and legal challenges facing them now - if they are going to participate in the revolution. and

WeRide Frequently Asked Questions (FAQ)

When was WeRide founded?

WeRide was founded in 2017.

Where is WeRide's headquarters?

WeRide's headquarters is located at 21st Floor, Guanzhou Life Science Innovation Center, 51 Luoxuan Rd., Guangzhou.

What is WeRide's latest funding round?

WeRide's latest funding round is Series D.

How much did WeRide raise?

WeRide raised a total of $1.442B.

Who are the investors of WeRide?

Investors of WeRide include China Development Bank, Bosch, GAC Group, Carlyle, China-Arab Investment Funds and 33 more.

Who are WeRide's competitors?

Competitors of WeRide include Waymo and 8 more.

What products does WeRide offer?

WeRide's products include Robotaxi and 3 more.

Loading...

Compare WeRide to Competitors

Pony.ai operates as a technology company. The company's main offerings include autonomous driving solutions for everyday travel and commercial logistics. Its technology facilitates localization and mapping, perception, prediction, planning and control, autonomous driving infrastructure, and more. It primarily serves the mobility and logistics industries. It was founded in 2016 and is based in Fremont, California.

Waymo operates as a technology company focused on autonomous driving in the transportation industry. The company offers a ride-hailing service that uses self-driving cars. Its primary customers are individuals in urban areas who require transportation services. It was founded in 2009 and is based in Mountain View, California.

DeepRoute.ai is a self-driving technology company. It provides L4 self-driving solutions and develops sensors, high-precision mapping, control, hardware, infrastructure, cloud computing and storage, and other self-driving technologies. The company was founded in 2019 and is based in Shenzhen, China.

Vay is a company focused on revolutionizing mobility through teledriving technology in the transportation industry. The company offers a service where customers order an electric vehicle via an app, and a teledriver remotely controls the vehicle to bring it to the customer's location. After the customer's journey, the teledriver takes over the vehicle again, eliminating the need for the customer to find a parking spot. It was founded in 2018 and is based in Berlin, Germany.

Comma specializes in enhancing driving experiences through advanced driver assistance systems and is active in the automotive technology sector. The company offers openpilot, an open source software that provides automated highway driving and driver monitoring features, compatible with a wide range of car models. Comma's hardware product, the comma 3X, supports over 250 car models and is designed to be easily installed by the user without permanent modifications to the vehicle. It was founded in 2016 and is based in San Diego, California.

UISEE Technology specializes in artificial intelligence and autonomous driving within the transportation and logistics sectors. The company offers a range of autonomous vehicles including unmanned logistics vehicles, autonomous buses, and light trucks, as well as AI-driven services for passenger cars such as RoboTaxi and U-Pilot. UISEE Technology's solutions cater to various industries requiring smart logistics and transportation services, such as the automotive and chemical sectors, and airport autonomous driving systems. It was founded in 2016 and is based in Beijing, Beijing.

Loading...