Pony.ai

Founded Year

2016Stage

Series D - II | AliveTotal Raised

$1.193BValuation

$0000Last Raised

$100M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+22 points in the past 30 days

About Pony.ai

Pony.ai operates as a technology company. The company's main offerings include autonomous driving solutions for everyday travel and commercial logistics. Its technology facilitates localization and mapping, perception, prediction, planning and control, autonomous driving infrastructure, and more. It primarily serves the mobility and logistics industries. It was founded in 2016 and is based in Fremont, California.

Loading...

ESPs containing Pony.ai

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

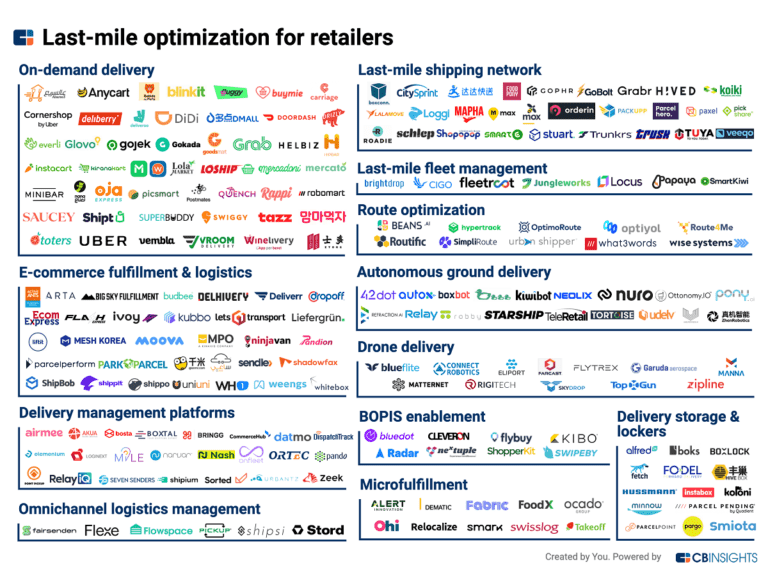

The autonomous food delivery market utilizes technology such as autonomous vehicles, robots, and drones to deliver food directly to customers. Vendors in this market aim to provide convenient, sustainable, timely, and low-cost deliveries to their customers. With the use of autonomous vehicles, these vendors are able to offer faster and more efficient delivery services compared to traditional metho…

Pony.ai named as Highflier among 13 other companies, including Starship, Yandex, and Nuro.

Loading...

Research containing Pony.ai

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Pony.ai in 11 CB Insights research briefs, most recently on Jun 3, 2024.

Expert Collections containing Pony.ai

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Pony.ai is included in 7 Expert Collections, including Auto Tech.

Auto Tech

2,550 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

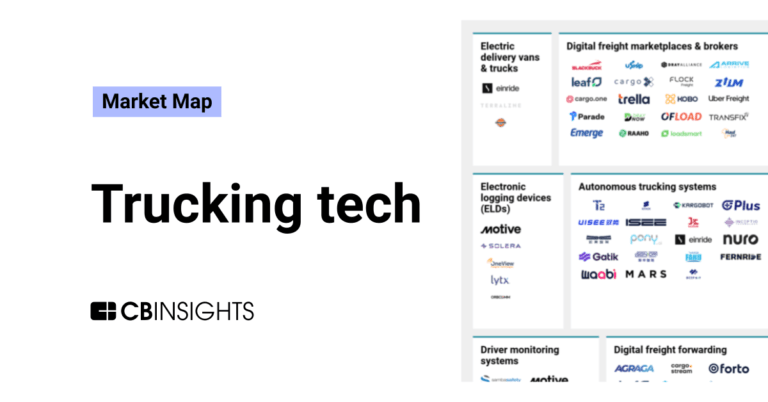

Supply Chain & Logistics Tech

5,051 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,244 items

Smart Cities

2,135 items

Grocery Retail Tech

648 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

AI 100

100 items

Pony.ai Patents

Pony.ai has filed 204 patents.

The 3 most popular patent topics include:

- autonomous cars

- sensors

- advanced driver assistance systems

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/11/2022 | 9/17/2024 | Autonomous cars, Steam road vehicle manufacturers, Robotics, Automotive technologies, Artificial intelligence | Grant |

Application Date | 1/11/2022 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Autonomous cars, Steam road vehicle manufacturers, Robotics, Automotive technologies, Artificial intelligence |

Status | Grant |

Latest Pony.ai News

Sep 9, 2024

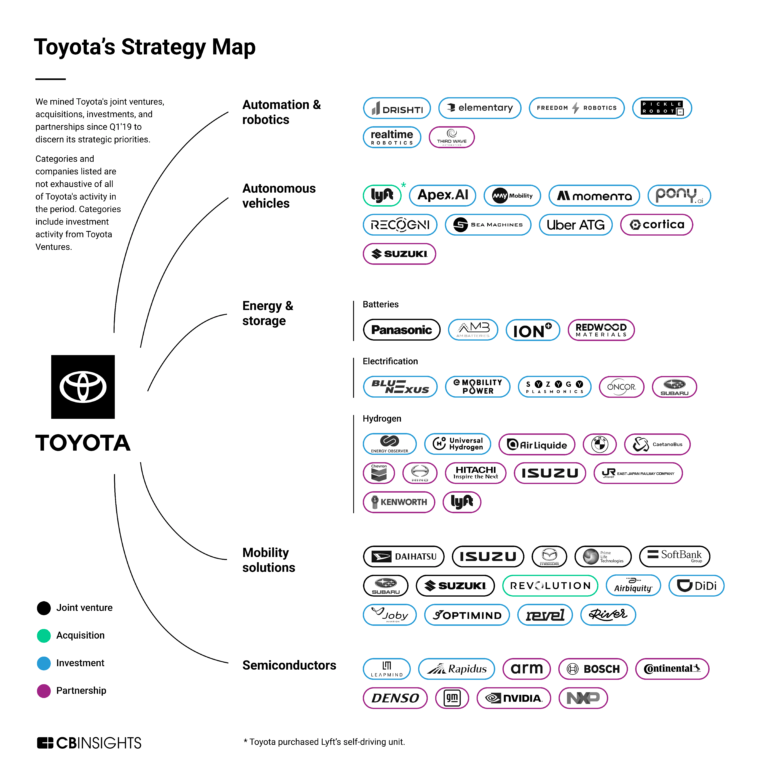

The robot cars and trucks market size has grown rapidly in recent years. It will grow from $0.79 billion in 2023 to $0.88 billion in 2024 at a compound annual growth rate (CAGR) of 10.7%. The robot cars and trucks market size is expected to see rapid growth in the next few years. It will grow to $1.32 billion in 2028 at a compound annual growth rate (CAGR) of 10.8%. The growth during the historic period can be credited to increased government funding for proper roadway controls, a rising urban population, ongoing research and development, heightened interest in contactless delivery and transportation solutions, and growing trust and acceptance of autonomous vehicle technology. The anticipated growth during the forecast period can be attributed to a stronger emphasis on sustainability, a reduction in traffic accidents and fatalities, the integration of autonomous vehicles in agricultural practices, infrastructure development, and the insurance industry's adaptation. Key trends in the forecast period include the merging of autonomous technology with electric vehicles, the integration of autonomous vehicles into smart cities, remote operation and monitoring, a focus on green technology, and the use of autonomous vehicles with drones. The growth of the robot cars and trucks market is anticipated to be driven by the increasing incidence of road accidents. Such accidents are often caused by factors such as speeding, distracted driving, impaired driving, poor road conditions, and inadequate enforcement of traffic laws. Autonomous cars and trucks contribute to accident reduction through advanced sensors and real-time decision-making capabilities, eliminating human error. They enhance road safety by consistently adhering to traffic laws and employing predictive analytics. Leading companies in the robot cars and trucks market are focusing on advancing autonomous driving technologies to improve safety, efficiency, and user experience, aiming to revolutionize transportation through cutting-edge innovations. Autonomous driving technologies enable vehicles to operate without human intervention, utilizing sensors and AI to perceive their surroundings and navigate autonomously. For instance, in April 2024, Horizon Robotics, a China-based vehicle manufacturer, introduced Horizon SuperDrive, a next-generation autonomous driving solution. This system is designed to deliver smooth, human-like driving experiences across urban, highway, and parking scenarios, integrating advanced ADAS and AD technologies to enhance safety, comfort, and convenience. It accelerates the adoption of smart driving systems in passenger vehicles. In August 2023, Toyota Motor Corporation, a Japanese automotive manufacturer, entered a partnership with Pony.ai for around $139.2 million. This collaboration between Toyota and Pony.ai is geared towards accelerating the production and rollout of fully autonomous taxis in China. It will leverage Pony.ai's seventh-generation autonomous driving kit (ADK) along with Toyota's electric bz4x platform to enhance solutions for driverless mobility. Pony.ai, headquartered in the United States, specializes in software development for autonomous driving technology, offering both hardware and software solutions tailored for self-driving vehicles. Competitive Landscape and Company Profiles Volkswagen AG Tesla Inc. AB Volvo 3. Robot Cars and Trucks Market Trends and Strategies 4. Robot Cars and Trucks Market - Macro Economic Scenario 4.1. Impact of High Inflation on the Market 4.2. Ukraine-Russia War Impact on the Market 4.3. COVID-19 Impact on the Market 5. Global Robot Cars and Trucks Market Size and Growth 5.1. Global Robot Cars and Trucks Market Drivers and Restraints 5.1.1. Drivers of the Market 5.1.2. Restraints of the Market 5.2. Global Robot Cars and Trucks Historic Market Size and Growth, 2018-2023, Value ($ Billion) 5.3. Global Robot Cars and Trucks Forecast Market Size and Growth, 2023-2028, 2033F, Value ($ Billion) 6. Robot Cars and Trucks Market Segmentation 6.1. Global Robot Cars and Trucks Market, Segmentation by Vehicle Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion Heavy Commercial Vehicles Passenger Vehicles 6.2. Global Robot Cars and Trucks Market, Segmentation by Classification, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion Level 0

Pony.ai Frequently Asked Questions (FAQ)

When was Pony.ai founded?

Pony.ai was founded in 2016.

Where is Pony.ai's headquarters?

Pony.ai's headquarters is located at 3501 Gateway Boulevard, Fremont.

What is Pony.ai's latest funding round?

Pony.ai's latest funding round is Series D - II.

How much did Pony.ai raise?

Pony.ai raised a total of $1.193B.

Who are the investors of Pony.ai?

Investors of Pony.ai include Abu Dhabi Investment Office, NEOM, FAW Group, CPE, Brunei Investment Agency and 25 more.

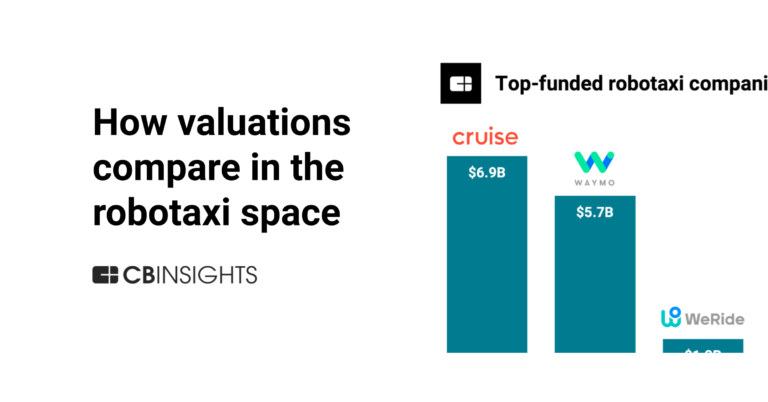

Who are Pony.ai's competitors?

Competitors of Pony.ai include Waymo, Cruise, HERE Technologies, DeepRoute.ai, Kodiak Robotics and 7 more.

Loading...

Compare Pony.ai to Competitors

Waymo operates as a technology company focused on autonomous driving in the transportation industry. The company offers a ride-hailing service that uses self-driving cars. Its primary customers are individuals in urban areas who require transportation services. It was founded in 2009 and is based in Mountain View, California.

Comma specializes in enhancing driving experiences through advanced driver assistance systems and is active in the automotive technology sector. The company offers openpilot, an open source software that provides automated highway driving and driver monitoring features, compatible with a wide range of car models. Comma's hardware product, the comma 3X, supports over 250 car models and is designed to be easily installed by the user without permanent modifications to the vehicle. It was founded in 2016 and is based in San Diego, California.

Vay is a company focused on revolutionizing mobility through teledriving technology in the transportation industry. The company offers a service where customers order an electric vehicle via an app, and a teledriver remotely controls the vehicle to bring it to the customer's location. After the customer's journey, the teledriver takes over the vehicle again, eliminating the need for the customer to find a parking spot. It was founded in 2018 and is based in Berlin, Germany.

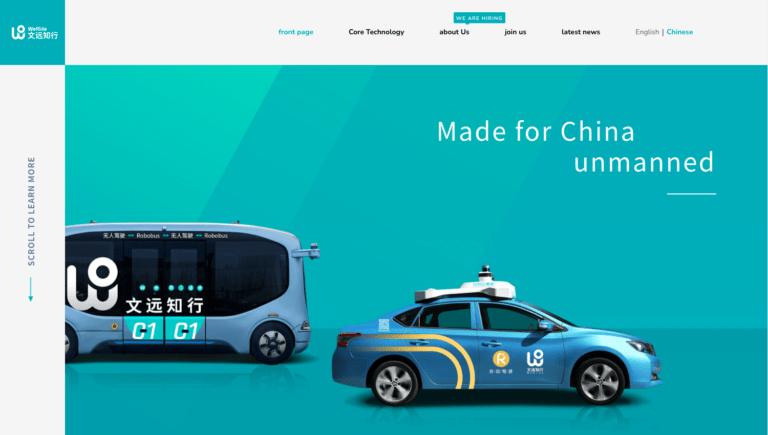

WeRide is a global leader in the development of autonomous driving technologies, focusing on Level 2 to Level 4 automation within the smart transportation and mobility sector. The company offers a suite of services including robotaxis, robobuses, robovans, robosweepers, and advanced driving solutions aimed at enhancing urban mobility and logistics. WeRide primarily serves sectors such as online ride-hailing, on-demand transport, urban logistics, and environmental sanitation. It was founded in 2017 and is based in Guangzhou, Guangdong.

Momenta is a leading company in the autonomous driving technology domain, focusing on developing software solutions for full vehicle autonomy. The company offers products such as MSD, a fully autonomous driving solution designed for taxis and private cars, and Mpilot, a mass-production-ready software for highly automated driving in private vehicles. Momenta's solutions are built on a unique 'flywheel approach' that combines a data-driven methodology with iterative algorithm enhancements to address complex driving scenarios. It was founded in 2016 and is based in Beijing, Beijing.

Mars Auto focuses on developing autonomous trucks for the commercial trucking industry. The company's main offerings include self-driving technology designed to fully automate long-haul truck operations, leveraging a data-driven approach for learning driving policies from actual driving data. Mars Auto primarily sells to the commercial trucking industry. It was founded in 2017 and is based in Seoul, South Korea.

Loading...