Next Insurance

Founded Year

2016Stage

Series F | AliveTotal Raised

$1.146BLast Raised

$265M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+30 points in the past 30 days

About Next Insurance

Next Insurance focuses on providing insurance services, specifically tailored to the needs of small businesses. The company offers a range of insurance products including general liability insurance, workers’ compensation insurance, professional liability insurance, commercial auto insurance, and commercial property insurance among others. The company primarily serves sectors such as retail, food and beverage, construction, consulting, education, entertainment, fitness, financial services, real estate, and more. It was founded in 2016 and is based in Palo Alto, California.

Loading...

ESPs containing Next Insurance

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

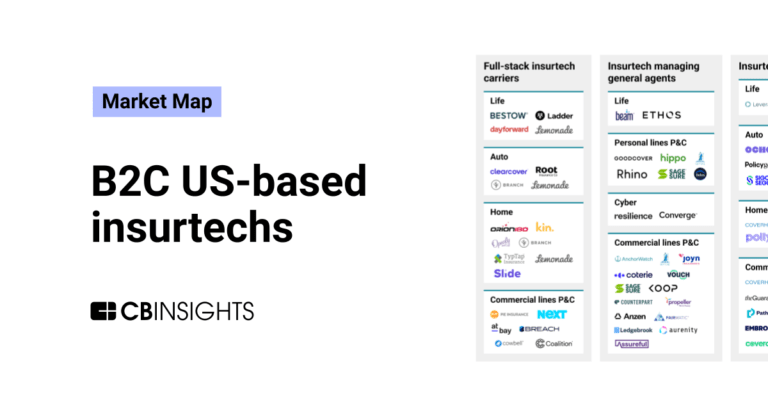

The full-stack insurtech carriers — commercial lines property & casualty market comprises insurtech carriers that underwrite commercial property & casualty (P&C) insurance. These lines of business may include (but are not limited to) cyber, errors & omissions, general liability, property, and workers’ compensation. As with established carriers, insurtech carriers will typically also be licensed by…

Next Insurance named as Leader among 6 other companies, including Coalition, Cowbell Cyber, and At-Bay.

Next Insurance's Products & Differentiators

General Liability

General liability insurance, also known as commercial general liability (CGL), covers the risks that affect almost every business, no matter what your industry. It is the most common insurance for small businesses and self-employed professionals, and it’s typically the first policy purchased by new businesses.

Loading...

Research containing Next Insurance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Next Insurance in 8 CB Insights research briefs, most recently on Aug 28, 2024.

Aug 28, 2024 report

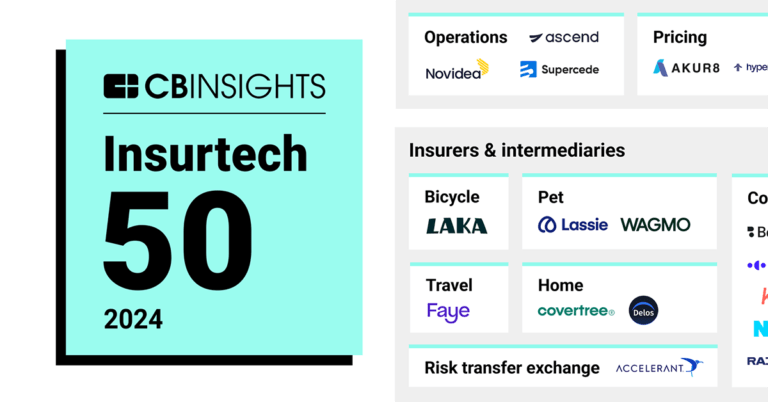

Insurtech 50: The most promising insurtech startups of 2024

Feb 23, 2024

The B2C US insurtech market map

Feb 9, 2024 report

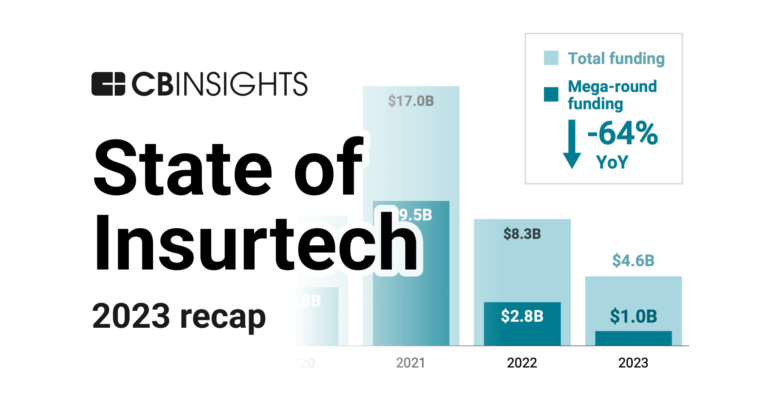

State of Insurtech 2023 Report

Oct 4, 2022 report

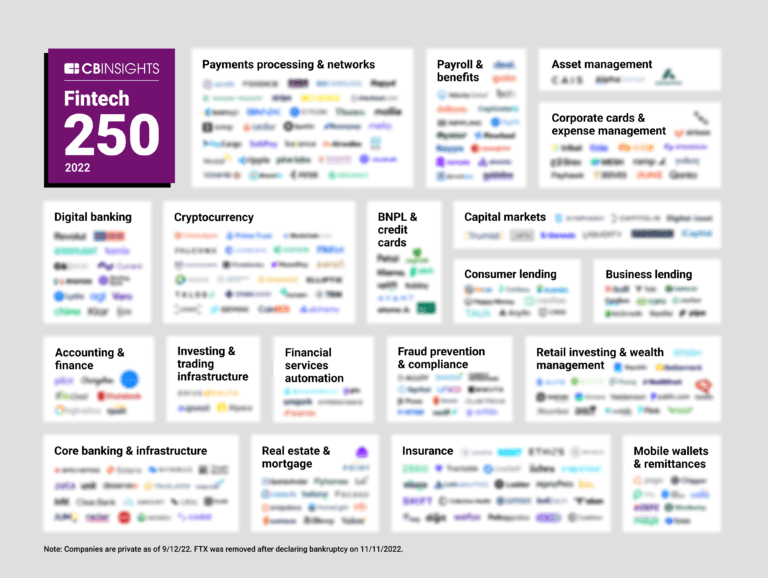

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Next Insurance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Next Insurance is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

1,586 items

Insurtech

4,352 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Tech IPO Pipeline

282 items

Track and capture company information and workflow.

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Latest Next Insurance News

Aug 21, 2024

The company intends to use the funds to accelerate growth, innovation, and product development. Led by CEO Ran Harpaz, Lettuce Financial offers a comprehensive system that empowers solopreneurs to effectively navigate the tax system and implement strategies used to their business needs. Since its launch, Lettuce has signed partnerships with industry leaders Upwork, a work marketplace, connecting businesses with independent contractors, and NEXT Insurance, a digital insurer providing tailored policies and embedded insurance solutions for small business owners. It has also partnered with A.Team, The Female Quotient, Fractionals United, Entrepenista, and Freelancing Females, among others. The funding follows Lettuce’s launch and seed funding announcement in March and a major product release in June of LettuceHead AI, a free AI-chat bot specialized to answer solopreneurs tax and accounting questions. FinSMEs

Next Insurance Frequently Asked Questions (FAQ)

When was Next Insurance founded?

Next Insurance was founded in 2016.

Where is Next Insurance's headquarters?

Next Insurance's headquarters is located at 975 California Avenue, Palo Alto.

What is Next Insurance's latest funding round?

Next Insurance's latest funding round is Series F.

How much did Next Insurance raise?

Next Insurance raised a total of $1.146B.

Who are the investors of Next Insurance?

Investors of Next Insurance include Allstate Strategic Ventures, Allianz X, Mitsui Sumitomo Insurance, Group 11, Zeev Ventures and 16 more.

Who are Next Insurance's competitors?

Competitors of Next Insurance include Amwins, Vouch, Thimble, Superscript, Pie Insurance and 7 more.

What products does Next Insurance offer?

Next Insurance's products include General Liability and 4 more.

Loading...

Compare Next Insurance to Competitors

Liberty Mutual Insurance specializes in property and casualty insurance, providing a wide range of personal and commercial insurance products. The company offers insurance coverage for vehicles, homes, businesses, and lives, as well as protection against identity theft and for pets. Liberty Mutual Insurance primarily serves individual consumers and businesses across various industries with their insurance needs. Liberty Mutual Insurance was formerly known as Massachusetts Employees Insurance Association. It was founded in 1912 and is based in Boston, Massachusetts.

Nationwide Mutual Insurance Company operates as a diversified insurance and financial services organization. The company offers a range of insurance products including vehicle, property, personal, and business insurance, as well as financial services such as retirement plans, annuities, and mutual funds. Nationwide primarily serves individuals and businesses seeking insurance and financial planning solutions. Nationwide Mutual Insurance Company was formerly known as Farm Bureau Mutual Automobile Insurance Company. It was founded in 1926 and is based in Columbus, Ohio.

Frontline Insurance focuses on providing insurance services, specifically in the home and commercial property insurance sector. The company offers a range of insurance policies to cover home, liability, and property needs, providing protection for homeowners and commercial properties. It primarily serves the insurance industry, with a focus on coastal homeowners. It was founded in 1998 and is based in Lake Mary, Florida.

Embroker is a digital insurance brokerage firm specializing in business insurance solutions across various industries. The company offers a range of commercial insurance packages, including professional liability, cybersecurity, and directors and officers insurance, tailored to meet the specific needs of businesses. Embroker primarily serves sectors such as startups, law firms, tech companies, and financial services. It was founded in 2015 and is based in San Francisco, California.

Hiscox USA specializes in small business insurance across various industries, offering a range of specialty risk solutions. The company provides essential coverage such as general liability, professional liability, and business owner policies, as well as cyber security and workers' compensation insurance. Hiscox USA caters to a diverse clientele, including professions in architecture, engineering, health and wellness, consulting, and artisan subcontracting. It was founded in 1901 and is based in Atlanta, Georgia.

AmTrust Financial Services is a multinational property and casualty insurance company with a focus on small commercial business insurance, specialty risk and extended warranty, and specialty middle-market property and casualty program insurance. The company offers a range of insurance products including workers' compensation, businessowners policy, commercial package, cyber insurance, and general liability. AmTrust serves various industries such as auto repair, contractors, financial institutions, healthcare, and retail, among others. It was founded in 1998 and is based in New York, New York.

Loading...