Global insurtech funding and deals slide to 6-year lows in 2023.

Insurtech startups had a brutal 2023, with funding and deals reaching 6-year lows — in line with the broader venture slowdown. Nevertheless, early-stage insurtechs have shown some resilience, with the median early-stage deal size holding steady in 2023 vs. 2022.

Furthermore, despite the funding headwinds, insurtechs continue to see demand from strategic investors and acquirers. In Q4’23, for instance:

- Allianz and Allstate‘s venture arms invested a combined $265M in Next Insurance

- Travelers acquired Corvus Insurance for $435M

- Sumitomo Life took a majority stake in Singlife (which had previously merged with Aviva Singapore) at a $3.4B valuation

Based on our deep dive below, here is the TLDR on the state of insurtech:

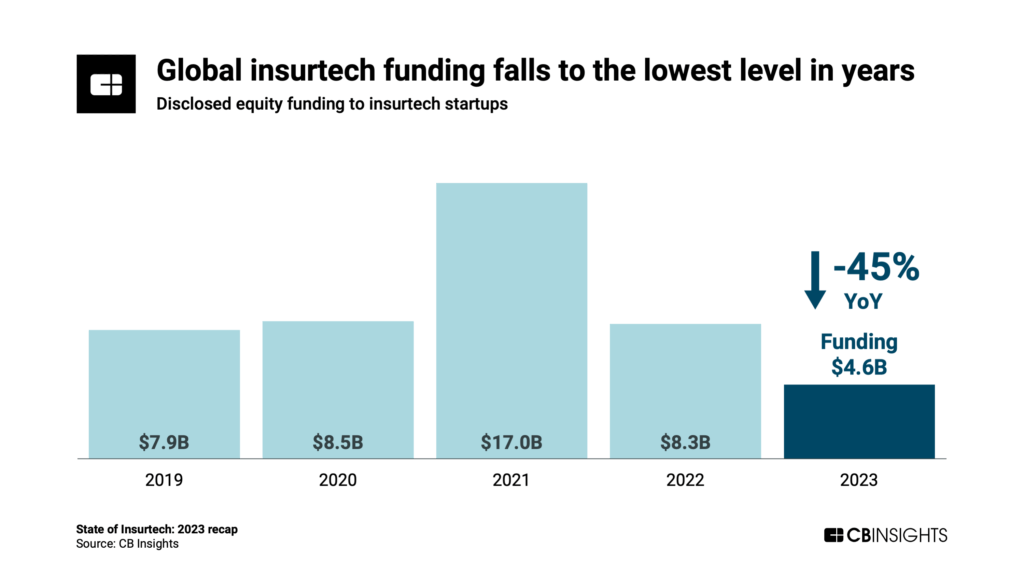

- Global insurtech funding fell to $4.6B in 2023, the lowest level since 2017. Total insurtech funding fell 45% YoY, from $8.3B in 2022.

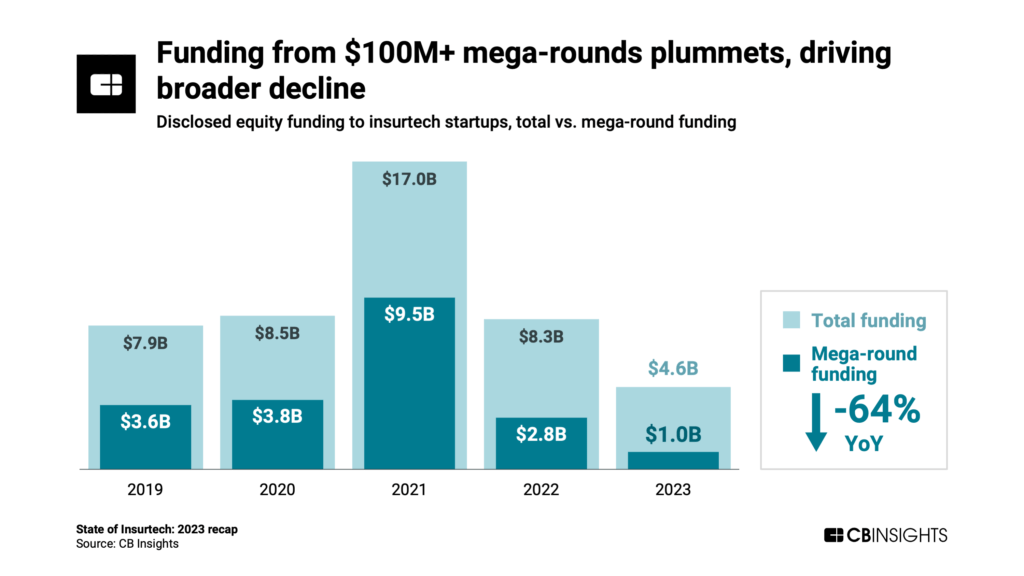

- A dearth of $100M+ mega-rounds drove the funding drop. Insurtech mega-round funding and deals fell by 64% and 63%, respectively, between 2022 and 2023.

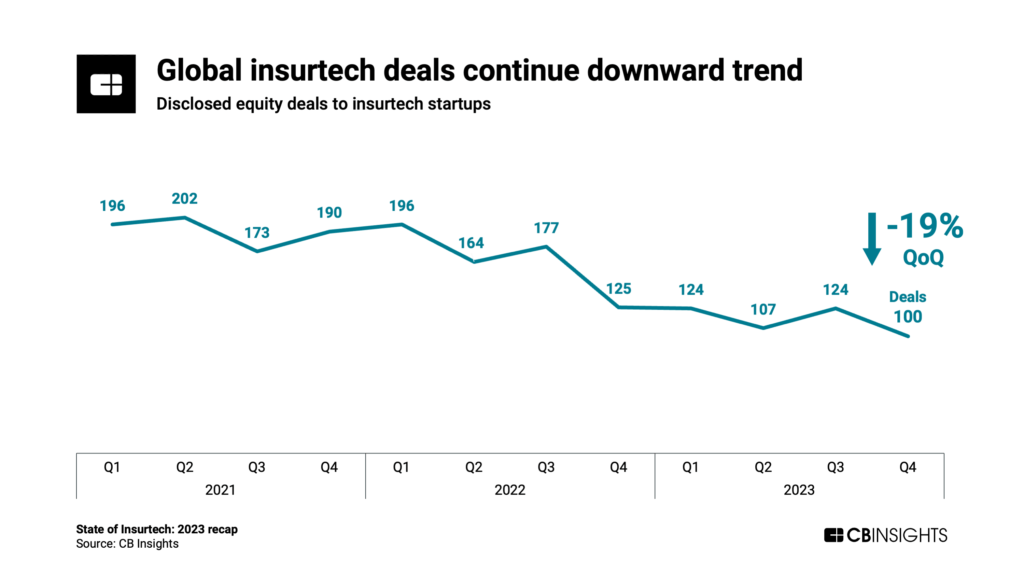

- Quarterly insurtech deals have fallen by over 50% from their record high in Q2’21. Q4’23 saw just 100 global insurtech deals — a significant decline from mid-2021, when the sector saw over 200 deals in one quarter.

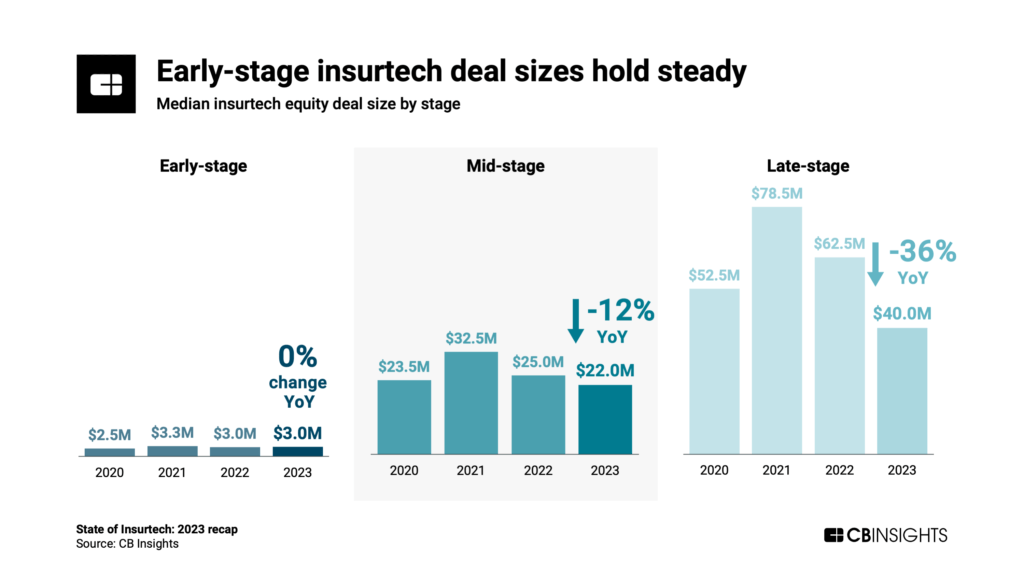

- Early-stage insurtech deal sizes held steady YoY at $3M in 2023. 62% of insurtech deals were early-stage in 2023 — a 5-year low in deal share after a spike to 70% in 2022.

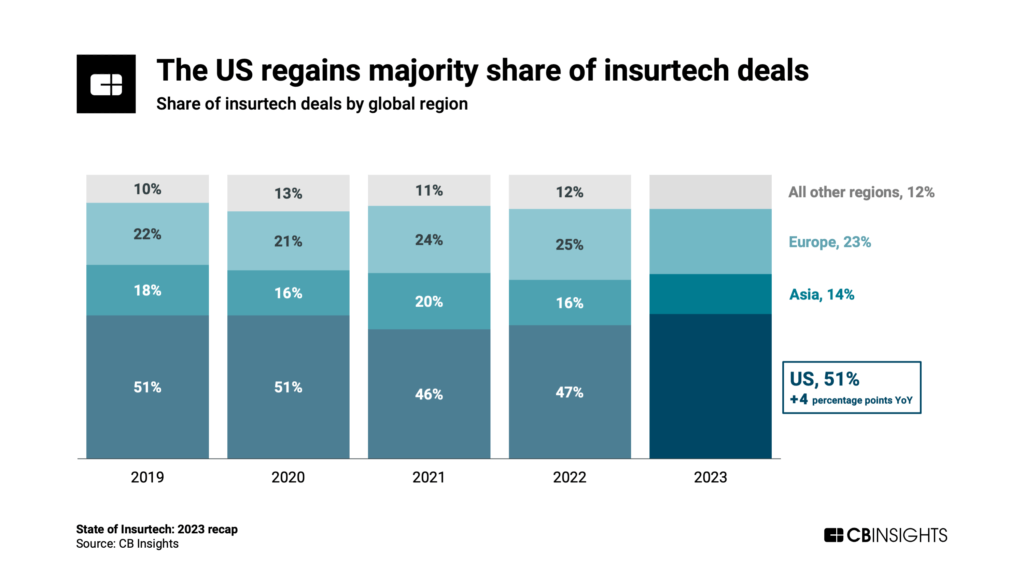

- The US regained majority share of insurtech deals among global regions in 2023. US insurtech deal share ticked up to 51%, surpassing the 50% mark for the first time since 2020.

Below, we’ll explore these themes across 5 charts.

Global funding to insurtech startups fell 45% YoY to $4.6B in 2023, the lowest level since 2017 ($3.0B). The percentage drop in insurtech funding was greater than the decline in the broader venture environment (-42% YoY), although smaller than the drop in fintech funding (-50% YoY).

The funding declines were spread unevenly between insurance coverage areas:

- Funding to property and casualty (P&C) insurtechs fell 39% YoY, from $5.6B in 2022 to $3.4B in 2023.

- Life and health (L&H) insurtech funding fell by a greater degree — down 58% YoY, from $2.6B in 2022 to $1.1B in 2023.

The insurtech funding drop was driven by a decline in $100M+ mega-round activity. In 2023, insurtech mega-round funding fell 64% YoY to $1B, spread across just 6 deals:

- Next Insurance — $265M Series G

- Gravie — $179M Series F

- Devoted Health — $175M Series E

- Accelerant — $150M Series B

- Openly — $100M Series D

- Resilience — $100M Series D

This represented the fewest annual insurtech mega-rounds since 2017, when there were 5.

Global insurtech deals fell 19% QoQ to 100 in Q4’23, continuing a steady downward trend since Q2’21’s record high of 202. On an annual basis, 2023 saw 455 insurtech deals globally, a 6-year low. Broader venture and fintech deal counts also fell to the lowest levels since 2017.

Both P&C and L&H insurtech saw drops in the number of deals YoY, though P&C was less affected:

- P&C insurtech deals fell 25% YoY, from 451 in 2022 to 339 in 2023.

- L&H insurtech deals declined by 45% YoY, from 210 in 2022 to 115 in 2023.

2023 saw just 1 insurtech unicorn birth: Kin, a full-stack insurtech carrier focused on homeowners insurance, reached a $1B valuation in its $33M Series D round in September.

Insurtech exit activity fell 30% YoY, with 2023 seeing no insurtech IPOs for the first time in years. However, Q4’23 was notable for Travelers’ acquisition of Corvus Insurance — an insurtech managing general agent in cyber insurance — at a valuation of $435M.

Average insurtech deal size continued to decrease from 2021’s high, falling 24% from $15.9M in 2022 to $12.1M in 2023. The drop was driven by a downward trend in mid- and late-stage deal sizes.

Meanwhile, early-stage insurtech deals — which represented 62% of all insurtech deals in 2023 — saw no change in median deal size between 2022 and 2023.

US insurtech deal share rose 4 percentage points YoY in 2023 to 51%, once again giving the US a majority position in global deal share.

Even so, US insurtech deal count fell 31% QoQ to 48 deals in Q4’23 — the lowest quarterly level in years. Funding, on the other hand, ticked up to a 3-quarter high — largely due to mega-rounds for Next Insurance and Devoted Health.

If you aren’t already a client, sign up for a free trial to learn more about our platform.