PolicyGenius

Founded Year

2014Stage

Acquired | AcquiredTotal Raised

$276.05MRevenue

$0000About PolicyGenius

PolicyGenius is an online insurance platform. The company provides a place to shop online for life, long-term disability, renters, and pet insurance through its quoting engines that offer comparisons of tailored policies. It was formerly known as KnowltOwl. The company was founded in 2014 and is based in New York, New York. In April 2023, PolicyGenius was acquired by Zinnia. The terms of the transaction were not disclosed.

Loading...

ESPs containing PolicyGenius

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurtech producers — auto market comprises insurtech agents, brokers, distributors, and other intermediaries that provide automotive insurance. Customer experience initiatives — particularly those focused on improving the ease of insurance sales and policy management for insureds — are often a focus of these companies. This market excludes managing general agents.

PolicyGenius named as Highflier among 15 other companies, including Qover, Insurify, and PolicyStreet.

PolicyGenius's Products & Differentiators

Life Insurance

Life insurance is an affordable way to provide financial support to the people you love after you die.

Loading...

Research containing PolicyGenius

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned PolicyGenius in 6 CB Insights research briefs, most recently on Mar 29, 2024.

Feb 23, 2024

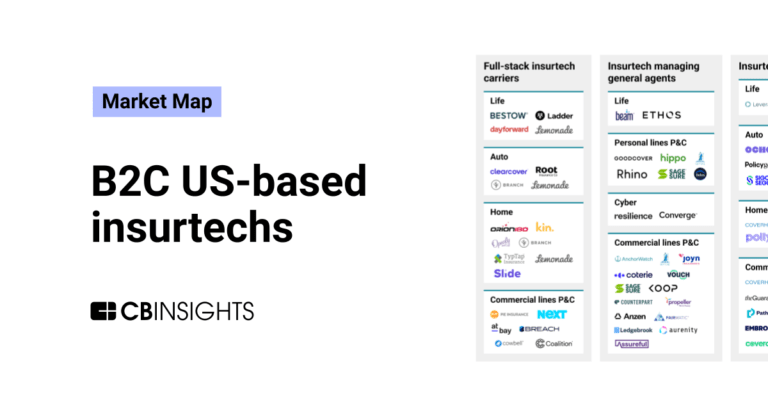

The B2C US insurtech market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023

Aug 8, 2023 report

State of Insurtech Q2’23 ReportExpert Collections containing PolicyGenius

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

PolicyGenius is included in 4 Expert Collections, including Fintech 100.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

3,168 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,228 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

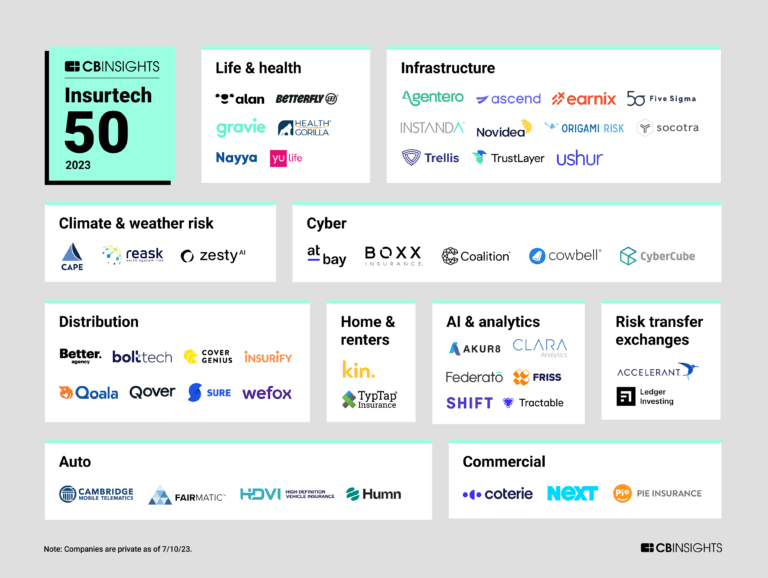

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Latest PolicyGenius News

Jun 18, 2024

News provided by Share this article New Policygenius survey shows stark differences in where Americans turn when they need money advice NEW YORK, June 18, 2024 /PRNewswire/ -- Americans have plenty of choices when it comes to where they get financial advice, from websites and social media influencers to professional experts like CFPs, CFAs, and CPAs. New data released today shows that more than a quarter (26%) of Americans would turn to financial professionals first, but that's not the first source for younger generations. Adult members of Generation Z are 65% less likely to turn to a financial professional first with a question about their finances compared to baby boomers. Plus, Gen Z are nine times more likely than boomers to turn to social media first. 39% of baby boomers (age 59 to 77 at the time of the survey) would turn to a financial professional first when they have a question about their finances, compared to just 14% of Gen Z (age 18 to 26). Americans who would turn to financial professionals first with money questions are 86% more likely to own real estate than those who would turn to other sources of financial advice (or who don't know where they would turn). Even Americans earning less than $40,000 a year who would use financial professionals are 61% more likely to own real estate. 22% of Americans would ask friends, siblings, peers, parents, or older relatives first when they have a question about their finances. Of the 5% of Americans who would turn to social media first with questions about their finances, 47% are millennials. Americans who would turn to financial professionals first are more likely to view life insurance mainly as a way to provide for dependents in the event of their death (87% vs. 73% of those who would turn elsewhere or don't know) and less likely to view it as mainly an investment (8% vs. 17%). "These findings highlight a stark divide between where each generation gets their financial advice. Some financial advisors can come with costs , but getting unbiased financial guidance from a trusted expert can be invaluable in helping you understand your finances, including complicated products like life insurance, and reach your goals," Patrick Hanzel, certified financial planner at Policygenius, said. "If you prefer to start with a method like social media, make sure you vet your sources to be mindful of any biases or scams." Policygenius commissioned YouGov to poll 4,063 Americans 18 or older. The survey was carried out online from Oct. 16 through Oct. 19, 2023. The results have been weighted to be representative of all U.S. adults. The average margin of error was +/- 2%. About Policygenius Policygenius , a Zinnia company, is a one-stop insurance platform that makes it easy to compare and buy policies, get unbiased expert advice, and manage an insurance portfolio in one seamless digital experience. Alongside the intuitive enterprise technology solutions and insights offered by parent company Zinnia, an Eldridge business, Policygenius is helping create better end-to-end insurance experiences for shoppers, advisors, and insurers alike — and enabling more people to protect their financial futures along the way. For more information:

PolicyGenius Frequently Asked Questions (FAQ)

When was PolicyGenius founded?

PolicyGenius was founded in 2014.

Where is PolicyGenius's headquarters?

PolicyGenius's headquarters is located at 32 Old Slip, 30th Floor, New York.

What is PolicyGenius's latest funding round?

PolicyGenius's latest funding round is Acquired.

How much did PolicyGenius raise?

PolicyGenius raised a total of $276.05M.

Who are the investors of PolicyGenius?

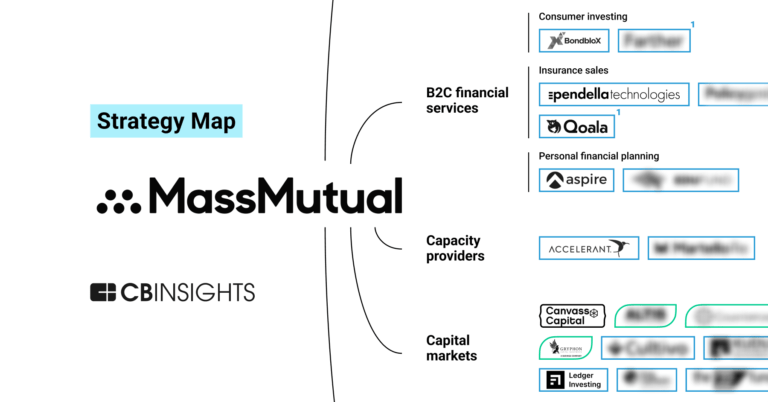

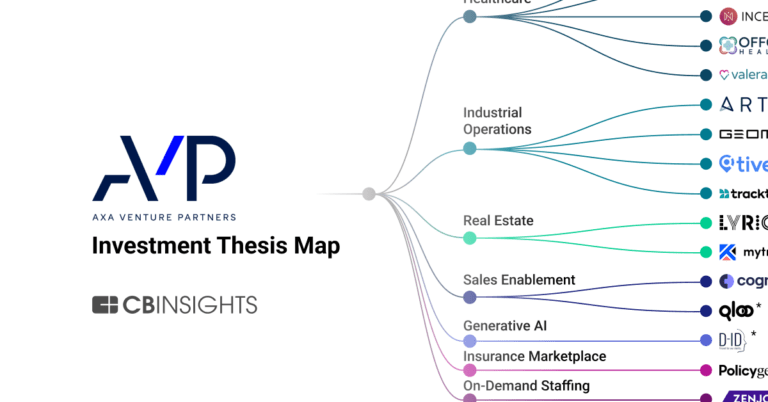

Investors of PolicyGenius include Zinnia, AXA Venture Partners, MassMutual Ventures, Norwest Venture Partners, KKR and 19 more.

Who are PolicyGenius's competitors?

Competitors of PolicyGenius include Digit Insurance, Next Insurance, Bima Milvik, Spruce, Jerry and 7 more.

What products does PolicyGenius offer?

PolicyGenius's products include Life Insurance and 2 more.

Loading...

Compare PolicyGenius to Competitors

Snapsheet specializes in insurance technology solutions. It enables a claim process starting with virtual estimations all the way to final repairs and payment, by generating communication between consumers, shops, and carriers. The company offers a range of services including appraisals, claims management, and payments, all aimed at managing the insurance claims process. It primarily serves the insurance industry. It was founded in 2011 and is based in Chicago, Illinois.

Bima Milvik provides digital health solutions in the healthcare industry. The company offers services such as telemedicine, discounts on medicines and lab tests, hospital cashback, and a health wallet with points. BIMA primarily serves underserved families across South Asia, Southeast Asia, and Africa. It was founded in 2010 and is based in Stockholm, Sweden. In October 2023, CapitalSG and LeapFrog Investments acquired a majority stake in Bima Milvik.

Alan focuses on health and wellness, operating in the insurance industry. It offers health insurance services, providing solutions tailored to the needs of different types of businesses, from startups and small businesses to large corporations, as well as independent workers. The company was founded in 2016 and is based in Paris, France.

Ladder is a company that specializes in providing term life insurance through a digital platform within the insurtech industry. The company offers affordable term life insurance policies with the flexibility to adjust coverage as the policyholder's life circumstances change. Ladder's services are designed to be accessible online, with a paperless application process and tools like an insurance calculator to help customers determine their coverage needs. It was founded in 2015 and is based in Menlo Park, California.

Bestow operates as an insurance technology company and develops products and software for insurance companies. It provides an application programming interface (API) enabling partners to offer life insurance coverage to customers. The company was formerly known as Coverlife. It was founded in 2017 and is based in Dallas, Texas.

Ethos provides life insurance solutions. It offers predictive analytics and data science technologies for life insurance policies. It covers expenses such as a home mortgage, debt, college tuition, and more. It was founded in 2016 and is based in Austin, Texas.

Loading...