Ro

Founded Year

2017Stage

Series D - II | AliveTotal Raised

$1.027BValuation

$0000Last Raised

$150M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-43 points in the past 30 days

About Ro

Ro operates as a direct-to-patient healthcare company. The company offers a range of healthcare services including telehealth consultations, in-home care, diagnostics, labs, and pharmacy services, all facilitated through its integrated platform. Ro primarily serves the healthcare industry. Ro was formerly known as Roman. It was founded in 2017 and is based in New York, New York.

Loading...

Ro's Products & Differentiators

Roman / Rory / Plenity / Zero

Ro first started with three digital health clinics to offer patients end-to-end telehealth treatment for over 20 conditions. Roman which offers treatments for men’s health conditions from sexual health, to hair loss to daily vitamin supplements. Rory, a clinic for women offering treatments for conditions from skincare to menopause to sexual wellness. And Zero, a clinic to help patients quit smoking. Ro also offers Plenity, an offering that provides patients with safe and effective options to manage their weight and tackle obesity.

Loading...

Research containing Ro

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ro in 6 CB Insights research briefs, most recently on Mar 28, 2024.

Mar 28, 2024

The femtech market map

Jan 3, 2024

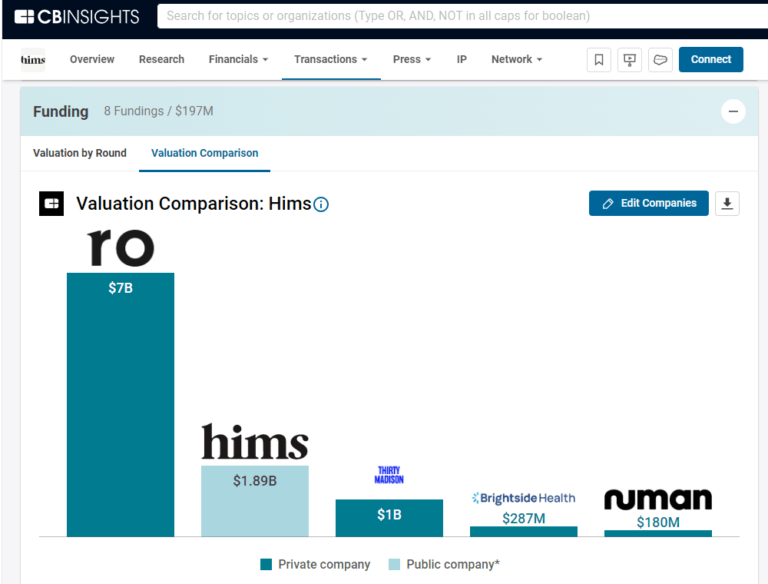

2024 prediction: Hims merges with Ro

Nov 11, 2022 report

How tech is making women’s healthcare more equitable and accessible

Aug 22, 2022 report

State of Biopharma Tech Q2’22 ReportExpert Collections containing Ro

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ro is included in 7 Expert Collections, including E-Commerce.

E-Commerce

11,032 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,244 items

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Tech IPO Pipeline

539 items

Track and capture company information and workflow.

Digital Health

11,067 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

2,916 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Ro Patents

Ro has filed 8 patents.

The 3 most popular patent topics include:

- eyewear

- eyewear brands

- geometrical optics

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/3/2023 | 9/10/2024 | CAD file formats, Engineered wood, Packaging machinery, Welding, Fossil fuels | Grant |

Application Date | 11/3/2023 |

|---|---|

Grant Date | 9/10/2024 |

Title | |

Related Topics | CAD file formats, Engineered wood, Packaging machinery, Welding, Fossil fuels |

Status | Grant |

Latest Ro News

Sep 10, 2024

News provided by Share this article Share toX In the last 10 days, WELL has closed the acquisition of 3 primary care clinics in BC and executed definitive agreements to acquire 4 diagnostic imaging clinics in Alberta with combined revenues of $17M at 7% operating margins, not including post transaction synergies. WELL acquired or absorbed 21 clinics in Q4 2023 inclusive of legacy MCI OneHealth and MB Clinic networks and 10 clinics from Shoppers Drug Mart in June 2024 which are now all operating profitably on an Adjusted EBITDA basis. WELL's acquisition and absorption pipeline has grown to 5 signed LOIs representing $11.8M in revenues at 5% operating margins and more than 50 clinics in pre-LOI review. WELL's Canadian Clinics Business operates at a Pre-Tax Unlevered ROIC1 or "Return on Invested Capital" of approximately 14%. This figure is ~25% for Primary Care and ~11% for WELL Health Diagnostics. VANCOUVER, BC and TORONTO, Sept. 10, 2024 /CNW/ - WELL Health Technologies Corp. (TSX: WELL ) (OTCQX: WHTCF) ("WELL" or the "Company"), a digital healthcare company focused on positively impacting health outcomes by leveraging technology to empower healthcare practitioners and their patients globally, is pleased to announce several important updates to its Canadian clinics business. Hamed Shahbazi, Founder and CEO of WELL, commented "Our historical ROIC1 in the Canadian clinics Business has been strong at 14% with our primary care network achieving figures of approximately 25%, demonstrating our ability to consistently create value. Looking ahead, we are very excited about the opportunities before us. With an obtainable market that exceeds ten times the size of our existing business, we see significant room for growth and are finding opportunities to reinvest at rates of return higher than our historical averages. This environment supports our expansion efforts and allows us to deliver greater long-term value for our shareholders." Strong Pre-Tax Unlevered ROIC1 Performance Across Canadian Clinics WELL Health 14 % WELL's Canadian Clinics business continues to deliver a solid Pre-Tax Unlevered Return on Invested Capital1 (ROIC) of 14%. This strong Pre-Tax Unlevered ROIC reflects WELL's ability to efficiently generate value from its investments in healthcare services. A 14% Pre-Tax Unlevered ROIC indicates that WELL is consistently creating returns well above its cost of capital, demonstrating the Company's disciplined approach to capital allocation and operational execution. With a large addressable market and a robust pipeline of additional targets, WELL continues to see a compelling opportunity to allocate incremental capital into its Canadian clinic Business unit. WELL expects ROIC to rise over time, driven by high-return tuck-in acquisitions, organic growth, and clinic transformation efforts using its latest generation of AI-enabled technology tools. New Canadian Clinical Acquisitions In the past 10 days, WELL has completed the acquisition of three primary care clinics in British Columbia and executed definitive agreements to acquire four diagnostic imaging clinics in Alberta, representing combined annual revenues of $17.8 million at 7% operating margins not including post transaction synergies. These tuck-in acquisitions were all financed from cash on hand at4 times Adj EBITDA upfront and approximately 5.6x EBITDA with fully paid earnouts and further advance WELL's goal of building a nationwide healthcare platform that integrates primary care and diagnostics across multiple provinces. By enhancing its presence in British Columbia and Alberta, WELL is positioned to capture more market share and strengthen its ecosystem of patient services. WELL plans to apply its proven expertise in operational management and clinic transformation to these newly acquired clinics, aiming to improve operating margins by an average of 1000 basis points within the next 1-2 years. This focus on operational optimization will help these clinics generate enhanced long-term profitability and improve the overall patient experience. 2023 and Early 2024 Clinic Cohort Update: Significant Progress in Transformation In Q4 2023, WELL acquired or absorbed 21 clinics, inclusive of legacy MCI OneHealth and MB Clinic networks, followed by 10 clinics from Shoppers Drug Mart in June 2024. These clinics were all originally operating with negative adjusted EBITDA margins but have since made notable progress in their margin profile, demonstrating the effectiveness of WELL's clinic transformation team. This cohort of clinics are now operating profitably, with mid-single digit operating margins for the legacy MCI OneHealth and MB Clinic, and slightly lower margins for the newly acquired Shoppers Drug Mart clinics. WELL's purposeful application of technology and operational support has provided a substantial amount of support to physicians and their practices, such as Dr. Macdonald in Vancouver, BC who joined the WELL Health network two years ago as part of WELL's first absorbed clinic in the Fairview Vancouver area. Dr. Stephen Macdonald commented, "Before having WELL absorb my practice into their network, I was overburdened with the day to day operating of my clinic - leases, HR, and bill payments. I was running a small business while taking care of my patients. Having WELL come in and manage the day to day running of the clinic has allowed me to focus solely on the thing I love, being a physician to my patients, and I could not be happier." WELL's clinic transformation team is making progress across the country and has now doubled its clinic transformation team to 6 core members from last year not including the rest of WELL's shared services team and is expected to continue ramping up. WELL's Growing Clinic Pipeline WELL's Canadian clinic acquisition and absorption pipeline has grown to 5 signed LOIs representing $11.8M in revenues at 5% operating margins and more than 50 clinics in pre-LOI review. As WELL looks to seek liquidity from certain US assets, it continues to expand its Canadian clinic pipeline where it enjoys superior rates of ROIC. Footnotes: 1. WELL defines Pre-Tax Unlevered ROIC for its Canadian clinics business as the Adjusted EBITDA of the business unit divided by the total M&A consideration, including upfront cash, share consideration, and realized and future earn-out payments. The Total M&A consideration used in the Pre-Tax Unlevered ROIC calculation excludes any allocation of corporate overhead, Property, Plant & Equipment, and Working Capital. The non-GAAP financial measures included in this non-GAAP ratio include Adjusted EBITDA. This non-GAAP ratio is not a standardized financial measure used to prepare the Company's financial statements and may not be a comparable to similar financial measures disclosed by other issuers. The Company uses these non-GAAP standardized measures as supplemental indicators of its financial and operating performance which the Company believes allows for meaningful analysis of trends in its clinic business. WELL HEALTH TECHNOLOGIES CORP. About WELL Health Technologies Corp. WELL's mission is to tech-enable healthcare providers. We do this by developing the best technologies, services, and support available, which ensures healthcare providers are empowered to positively impact patient outcomes. WELL's comprehensive healthcare and digital platform includes extensive front and back-office management software applications that help physicians run and secure their practices. WELL's solutions enable more than 37,000 healthcare providers between the US and Canada and power the largest owned and operated healthcare ecosystem in Canada with more than 180 clinics supporting primary care, specialized care, and diagnostic services. In the United States WELL's solutions are focused on specialized markets such as the gastrointestinal market, women's health, primary care, and mental health. WELL is publicly traded on the Toronto Stock Exchange under the symbol "WELL" and on the OTC Exchange under the symbol "WHTCF". To learn more about WELL, please visit: www.well.company. Forward-Looking Statements This news release may contain "Forward-Looking Information" within the meaning of applicable Canadian securities laws, including, without limitation: information regarding the Company's goals, strategies and growth plans; expectations regarding continued revenue, growth and expected revenue and operating margins; the expected benefits and synergies of completed acquisitions; capital allocation plans in the form of more acquisitions; and the expected financial performance of recent and planned acquisitions. Forward-Looking Information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, and contingencies. Forward-Looking Information generally can be identified by the use of forward-looking words such as "may", "should", "will", "could", "intend", "estimate", "plan", "anticipate", "expect", "believe" or "continue", or the negative thereof or similar variations. Forward-Looking Information involve known and unknown risks, uncertainties and other factors that may cause future results, performance, or achievements to be materially different from the estimated future results, performance or achievements expressed or implied by the Forward-Looking Information and the Forward-Looking Information are not guarantees of future performance. WELL's comments expressed or implied by such Forward-Looking Information are subject to a number of risks, uncertainties, and conditions, many of which are outside of WELL 's control, and undue reliance should not be placed on such information. Forward-Looking Information are qualified in their entirety by inherent risks and uncertainties, including: direct and indirect material adverse effects from adverse market conditions; risks inherent in the primary healthcare sector in general; regulatory and legislative changes; that future results may vary from historical results; an inability to realize the expected benefits and synergies of acquisitions; that market competition may affect the business, results and financial condition of WELL and other risk factors identified in documents filed by WELL under its profile at www.sedar.com , including its most recent Annual Information Form and its most recent Management, Discussion and Analysis. Except as required by securities law, WELL does not assume any obligation to update or revise any forward-looking information, whether as a result of new information, events or otherwise. This news release contains financial outlook information about Pre-Tax Unlevered ROIC or "Return on Invested Capital", annual run-rate revenues, and expected improvements in profitability, all of which are subject to the same assumptions, risk factors, limitations, and qualifications as set out in the above paragraph. The actual financial results of WELL may vary from the amounts set out herein and such variation may be material. WELL and its management believe that the financial outlook information has been prepared on a reasonable basis, reflecting management's best estimates and judgments. However, because this information is subjective and subject to numerous risks, it should not be relied on as necessarily indicative of future results. Except as required by applicable securities laws, WELL undertakes no obligation to update such financial outlook information. Financial outlook information contained in this news release was made as of the date hereof and was provided for the purpose of providing further information about WELL's anticipated future business operations. Readers are cautioned that the financial outlook information contained in this news release should not be used for purposes other than for which it is disclosed herein. SOURCE WELL Health Technologies Corp. For more information: Tyler Baba, Investor Relations, Manager, WELL Health Technologies, [email protected] , 604-628-7266 ×

Ro Frequently Asked Questions (FAQ)

When was Ro founded?

Ro was founded in 2017.

Where is Ro's headquarters?

Ro's headquarters is located at 116 West 23rd Street, New York.

What is Ro's latest funding round?

Ro's latest funding round is Series D - II.

How much did Ro raise?

Ro raised a total of $1.027B.

Who are the investors of Ro?

Investors of Ro include General Catalyst, FirstMark Capital, Initialized Capital, TQ Ventures, BoxGroup and 28 more.

Who are Ro's competitors?

Competitors of Ro include Piction Health, Simple Health, Redesign Health, Hone Health, Thirty Madison and 7 more.

What products does Ro offer?

Ro's products include Roman / Rory / Plenity / Zero and 4 more.

Loading...

Compare Ro to Competitors

Maven is a virtual clinic specializing in women's and family health within the healthcare industry. The company offers a range of services including fertility and family building support, maternity and newborn care, parenting and pediatrics, and menopause management, all delivered through a digital health platform. Maven primarily serves the healthcare industry, with a focus on employers, health plans, and individuals seeking inclusive and comprehensive health benefits. It was founded in 2014 and is based in New York, New York.

Thirty Madison focuses on providing virtual-first specialized healthcare services. The company offers accessible and effective treatments for people with ongoing conditions, emphasizing a lifetime of care without the need for in-person visits. It was founded in 2017 and is based in New York, New York.

HealthTap is a digital health company. It offers a mobile application that connect doctors with patients, giving patients access to medical experts and health advice anytime and anywhere. It was founded in 2010 and is based in Sunnyvale, California.

DoctorBox is a digital health platform operating in the healthcare industry. The company offers an application that centralizes all important health data, providing various digital services for diagnostics, pharmaceuticals, and therapy. It primarily serves individuals seeking to manage their daily health. It was founded in 2016 and is based in Berlin, Germany.

Rezilient provides healthcare services. It combines telehealth services with in-person care capabilities. The company offers primary and urgent care services, accessible through both virtual and physical examinations, including labs and imaging. It provides individuals and families with convenient healthcare solutions. Rezilient was formerly known as DynamicSurgical. It was founded in 2016 and is based in Saint Louis, Missouri.

98point6 Technologies specializes in digital health solutions, focusing on telehealth and healthcare technology. The company offers a virtual care platform that provides asynchronous and real-time telehealth services, designed to streamline administrative tasks for clinicians and enhance patient-provider interactions. Their platform serves the healthcare industry by increasing provider efficiency and patient satisfaction through technology that supports various care modalities. 98point6 Technologies was formerly known as 98point6. It was founded in 2015 and is based in Seattle, Washington. 98point6 Technologies operates as a subsidiary of Transcarent.

Loading...