Zepto

Founded Year

2021Stage

Series G | AliveTotal Raised

$1.596BValuation

$0000Last Raised

$340M | 1 mo agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-2 points in the past 30 days

About Zepto

Zepto operates as a rapidly growing e-grocery company in the quick commerce sector. The company offers products including daily essentials, fresh fruits and vegetables, dairy, health and hygiene products, and more, all delivered to customers' doors. Zepto primarily serves the ecommerce industry, specifically in the grocery segment. Zepto was formerly known as KiranaKart. It was founded in 2021 and is based in Mumbai, India.

Loading...

ESPs containing Zepto

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The on-demand grocery delivery market caters to the busy lifestyles of modern consumers looking to purchase groceries without leaving their home. Platforms in this market offer convenience and prompt services, delivering everything customers need within a short timeframe. They bring local sellers online, provide a larger choice of products at competitive prices, and can offer discounts that are ex…

Zepto named as Outperformer among 15 other companies, including Amazon, Instacart, and DoorDash.

Loading...

Research containing Zepto

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zepto in 6 CB Insights research briefs, most recently on Jul 3, 2024.

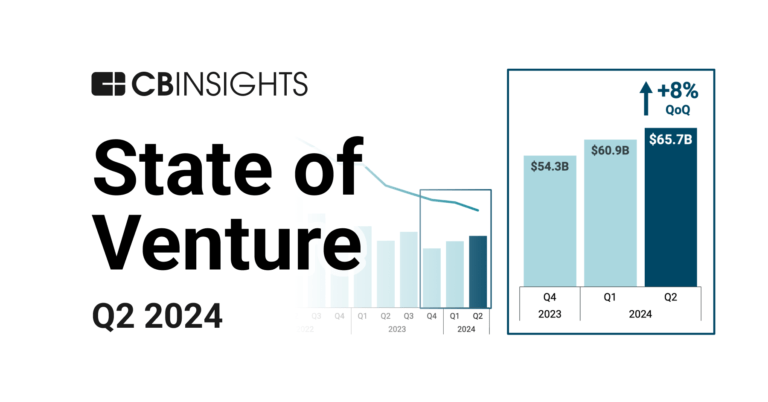

Jul 3, 2024 report

State of Venture Q2’24 ReportExpert Collections containing Zepto

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zepto is included in 4 Expert Collections, including Food & Meal Delivery.

Food & Meal Delivery

1,575 items

Startups and tech companies offering online grocery, food, beverage, and meal delivery services.

Supply Chain & Logistics Tech

583 items

Grocery Retail Tech

648 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

Unicorns- Billion Dollar Startups

1,244 items

Latest Zepto News

Sep 19, 2024

Synopsis Festive season sales, in terms of gross merchandise value (GMV), will likely reach $12 billion this year, rising 23% from the previous year’s $9.7 billion, according to data from market research company Datum Intelligence. Quick commerce may account for $1 billion of these ecommerce sales. ETtech Ecommerce companies and online sellers are expected to ship merchandise worth $12 billion to consumers in India this festive season, up 23% compared with about $9.7 billion last year, according to data from market research firm Datum Intelligence . Quick commerce may account for $1 billion of these ecommerce sales in terms of gross merchandise value (GMV), the report said. GMV is the total value of goods sold on ecommerce platforms, excluding discounts and returns. Ecommerce platforms, their sellers and major brands are preparing for robust sales during the festive season. This period of around two months, culminating with Diwali, typically brings a significant portion of revenue for ecommerce firms and other retailers. This year, quick-commerce platforms like Zomato-owned Blinkit, Swiggy Instamart, Mumbai-based Zepto and BigBasket’s BB Now are preparing for an action-packed Diwali, aiming to capture a greater market share. “Quick commerce is something which stands out this year. It's not that there will be a lot of non-grocery, non-BPC (beauty and personal care) purchases. But in this category, they will be the dominant player,” said Satish Meena, an advisor at Datum Intelligence. “And this is not only cutting into the sales from the marketplace of modern trade, but it will cut sales from the kirana stores also.” Zepto said its sellers have scaled up inventory with new categories like electrical appliances, beauty products, and even gifting options like plants for the festive season, alongside its core categories of kitchen appliances, personal care and gift packs. “We’re working closely with brands to craft festival-specific offers…,” a Zepto spokesperson said. Grocery and beauty and personal care are set to drive growth, with quick commerce expected to contribute 51% to online grocery sales compared with 37.6% last year, according to the report. Sale season For ecommerce platforms, sales of categories like smartphones and large appliances during the festive season bring up to a third of their annual revenue. Mobile and fashion categories will dominate festive spending, making up 50% of total sales, the Datum Intelligence report said. “The premiumisation trend which started last year will continue this year also. Last year premiumisation was seen in the category of smartphones,” said Meena. Ecommerce leaders Amazon India and Walmart-owned Flipkart are scheduled to start their annual festive season sale on September 27 , which will last for about a month. SoftBank-backed ecommerce firm Meesho will kick off its Meesho Mega Blockbuster Sale on the same day. Flipkart-owned fashion platform Myntra is set to begin its Big Fashion Festival a day earlier. “For the upcoming festive season, Flipkart customers can expect enhanced on-app experiences including video commerce, immersive technologies like AR and 3D try-ons, and an expanded product selection across a wide range of categories,” said Harsh Chaudhary, head of growth at the ecommerce firm. According to the Datum Intelligence report, shoppers in small cities are beginning their purchases earlier to ensure timely delivery of their products. Typically, during the rush of the festive season, delivery estimates in non-metro markets are longer than usual. In the run up to this year's festive season, Flipkart has launched 11 fulfilment centres while creating over 100,000 new temporary jobs in over 40 regions. It is also strengthening same-day and next-day deliveries across a growing network of cities. Amazon launched three new fulfilment centres in the National Capital Region, Guwahati and Patna to enhance delivery speeds, support over 250,000 sellers and create job opportunities. Amazon India didn't comment. “Millennials form 60% of our shopper base, significantly influencing shopping trends on our platform. Their preferred categories are fashion, home and kitchen, BPC, electronic accessories as well as office and stationery. Popular searches include smartwatch, water bottle, ready-to-wear sarees, shoe rack, nail polish and lunch bags,” said a spokesperson from Meesho. Brands in action Chaitanya Ramalingegowda, cofounder of Wakefit that sells mattresses and furniture, said consumer demand has steadily rebounded over the past 10 months, raising high expectations for the festive sales. He expects double-digit growth, with key days seeing sales up to 10 times the usual levels. According to industry experts, quick commerce is suitable for specific categories and is causing disruption in some areas of ecommerce. However, it doesn't apply to all categories; for example, electronics remains a major segment in ecommerce that quick commerce cannot replicate. Another is large items, like furniture. “Given the bulky nature of our core products like mattresses and furniture, quick commerce is not yet optimised to handle such items. However, smaller products like pillows and accessories are well-suited for quick commerce, and we expect a significant contribution from this segment during the festive season,” Ramalingegowda added. “We are seeing great traction on quick-commerce platforms and actively working with all the large quick-commerce platforms. Having said that, ecommerce remains the largest channel and critical to focus on these platforms to drive revenues,” said Gaurav Nayyar, chief operating officer at homegrown wearable and audio products brand Boat. Quick commerce is the third biggest channel for sales for the startup. Boat is expecting a surge in demand for premium products. While for snacking brand Farmley, quick commerce is expected to contribute significantly this season. “The platforms have been growing quite rapidly and along with that we are looking to grow our category share as well. It is unlocking market access for us,” said cofounder Abhishek Agarwal. "For the upcoming festive and travel season, Scapia is projecting a 50% growth in international travel. This surge will be further fuelled by a 5-6-fold increase in credit card spending on online festival shopping, through which customers will earn rewards redeemable for travel bookings on the app,” said Anil Goteti, founder of the travel-focused fintech firm. Read More News on

Zepto Frequently Asked Questions (FAQ)

When was Zepto founded?

Zepto was founded in 2021.

Where is Zepto's headquarters?

Zepto's headquarters is located at Jogeshwari Vikhroli Link Road, Raje Sambhaji Nagar, Marol, Andheri East, Mumbai.

What is Zepto's latest funding round?

Zepto's latest funding round is Series G.

How much did Zepto raise?

Zepto raised a total of $1.596B.

Who are the investors of Zepto?

Investors of Zepto include Contrary, Lightspeed Venture Partners, DST Global, Mars Growth Capital, General Catalyst and 23 more.

Who are Zepto's competitors?

Competitors of Zepto include Swiggy, Jumbotail, Shadowfax, Dunzo, BigBasket and 7 more.

Loading...

Compare Zepto to Competitors

BigBasket is an online supermarket focusing on grocery delivery services. The company offers a wide range of products including fresh produce, dairy, meat, household essentials, and branded food items, catering to the daily needs of customers. BigBasket serves a broad consumer base with services like scheduled slotted deliveries and an expedited delivery option called bbnow for immediate needs. It was founded in 2011 and is based in Bangalore, India. BigBasket operates as a subsidiary of Tata Group.

Dunzo is an all-in-one 24X7 delivery platform operating in the quick urban logistics sector. The company offers a wide range of services including the delivery of groceries, food, medicines, pet supplies, and couriering packages across the city. Dunzo primarily serves the ecommerce industry, facilitating instant delivery services for various consumer needs. It was founded in 2015 and is based in Bengaluru, India.

Freshtohome is a company focused on delivering fresh meat and seafood without the use of chemicals. They offer a variety of products including antibiotic-free chicken, fresh seafood, and halal-certified mutton. Their service caters to the convenience of home delivery, providing a range of ready-to-cook items, marinated meats, and meal combos. Freshtohome was formerly known as SeaToHome. It was founded in 2015 and is based in Bengaluru, India.

Chaldal serves as an online grocery shopping platform in the retail sector. The company offers doorstep delivery of daily necessities, aiming to save customers' time by avoiding traffic and long lines. Chaldal primarily serves the e-commerce industry. It was founded in 2013 and is based in Dhaka, Bangladesh.

Licious is a consumer food company specializing in the delivery of fresh meat and seafood products. The company offers a range of natural and healthy meat products, including chicken, mutton, and seafood, which are handpicked and maintained at specific temperatures to ensure freshness from procurement to delivery. Licious primarily serves the direct to consumer market with a focus on quality, hygiene, and convenience. It was founded in 2015 and is based in Bengaluru, India.

LetsTransport operates as a logistics solution provider focused on last-mile delivery within the urban logistics sector. The company aggregates light commercial vehicles to offer logistics services, including customized solutions for intra-state deliveries. LetsTransport primarily serves enterprises in sectors such as organized retail, FMCG, e-commerce, distribution, and third-party logistics. It was founded in 2015 and is based in Bengaluru, India.

Loading...