Chainalysis

Founded Year

2014Stage

Unattributed VC | AliveTotal Raised

$536.72MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-15 points in the past 30 days

About Chainalysis

Chainalysis is a blockchain data platform that operates in the cryptocurrency sector, providing insights and analytics to support various industries. The company offers solutions for crypto investigations, regulatory compliance, and market intelligence, enabling businesses, financial institutions, and government agencies to engage with digital assets securely and effectively. Chainalysis primarily serves law enforcement agencies, financial institutions, and regulatory bodies seeking to understand and leverage blockchain technology for security and compliance purposes. It was founded in 2014 and is based in New York, New York.

Loading...

Chainalysis's Product Videos

ESPs containing Chainalysis

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

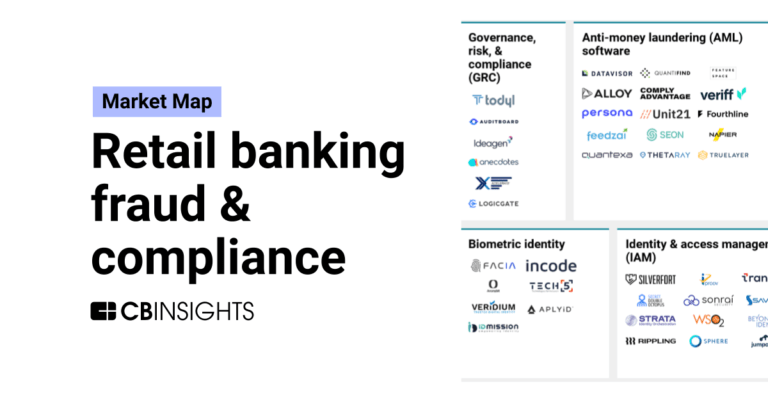

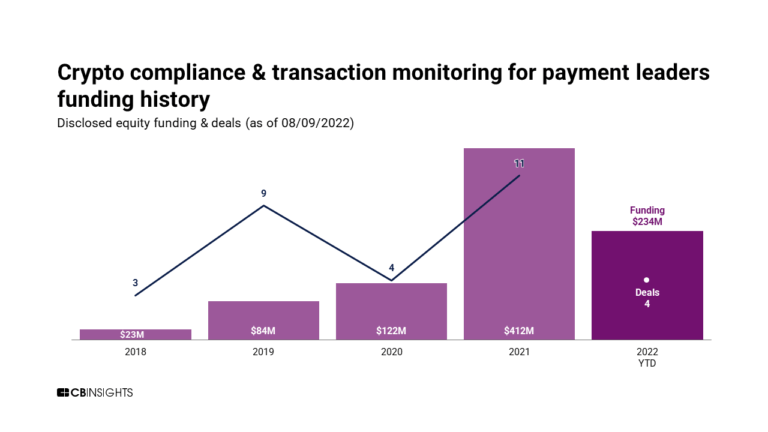

The crypto compliance & transaction monitoring market helps organizations comply with regulatory requirements in the cryptocurrency industry, including anti-money laundering (AML) and counter-terrorism financing (CTF) standards. These solutions leverage blockchain technology and proprietary risk algorithms to monitor transactions for potential illicit activity, such as money laundering, terrorism …

Chainalysis named as Leader among 15 other companies, including CertiK, Coinfirm, and CipherTrace.

Chainalysis's Products & Differentiators

Chainalysis KYT

Chainalysis KYT (Know Your Transaction) combines industry-leading blockchain intelligence, an easy-to-use interface, and a real-time API. It helps organizations reduce manual workflows, stay compliant with local and global regulations, and safely interact with emerging technologies such as DeFi.

Loading...

Research containing Chainalysis

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Chainalysis in 13 CB Insights research briefs, most recently on Mar 14, 2024.

Expert Collections containing Chainalysis

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Chainalysis is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Regtech

1,921 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Blockchain

8,556 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

9,227 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Chainalysis Patents

Chainalysis has filed 9 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/27/2022 | 8/6/2024 | Grant |

Application Date | 5/27/2022 |

|---|---|

Grant Date | 8/6/2024 |

Title | |

Related Topics | |

Status | Grant |

Latest Chainalysis News

Sep 16, 2024

By PYMNTS | September 15, 2024 | Efforts to regulate the cryptocurrency sector have not hurt India’s adoption of the digital currency. In fact, the country now leads the world on the 2024 “Global Adoption Index” from blockchain research firm Chainalysis . “Last year, we noted that India remained a top global cryptocurrency market, amid evolving regulatory and tax environments,” the company said in a recent blog post . “The country’s comparatively high crypto capital gains tax (at 30%) and 1% tax on all transactions — also known as a tax deducted at source (TDS) — may have drawn some Indian investors to explore international exchanges without such stringent regulatory requirements. Regardless, these developments didn’t seem to hinder crypto’s overall growth in the country, and it is the same this year.” Last December, India’s Financial Intelligence Unit (FIU) notified nine offshore exchanges — among them giants like Binance and Kraken — that they weren’t in compliance with the country’s India’s anti-money laundering laws, and asked the Ministry of Electronics and Information Technology to block their URLs for India-based customers. “However, contacts in the region explained to us that users were still able to access these exchanges if they had previously downloaded the apps and that certain apps were still accessible for new downloads,” Chainalysis said. “Interestingly, the Indian think tank Esya Center analyzed the impact of blocking of the URLs on the digital asset market and found it to be short-lived.” The report also quotes Vikram Rangala , executive director of ZebPay , an India-based cryptocurrency exchange and wallet provider, who said that he did not think the FIU order would last long, and expressed hope that the country’s crypto sector would benefit from added regulatory clarity. “Now we’re seeing that offshore exchanges will soon be brought into this emerging ecosystem. Earlier, we had a flight of investors away from Indian exchanges to global exchanges because of high taxes,” Rangala said. “I hope that, with regulatory clarity , we’ll also get a more workable tax arrangement that promotes innovation, and brings all aspects of crypto and Web3 into the economy in a sustainable way.” Chainalysis argued that India’s path to crypto adoption has become clearer, because of ongoing engagement between the industry and regulators. The company’s data on India is part of its 2024 Geography of Cryptocurrency Report, and comes on the heels of new findings from Chainalysis showing Singapore’s increasing use of stablecoins for payments . Payments with the digital assets during the second quarter reached a record high of nearly $1 billion in the city state, the research found.

Chainalysis Frequently Asked Questions (FAQ)

When was Chainalysis founded?

Chainalysis was founded in 2014.

Where is Chainalysis's headquarters?

Chainalysis's headquarters is located at 114 5th Avenue, New York.

What is Chainalysis's latest funding round?

Chainalysis's latest funding round is Unattributed VC.

How much did Chainalysis raise?

Chainalysis raised a total of $536.72M.

Who are the investors of Chainalysis?

Investors of Chainalysis include Haun Ventures, Plug and Play Crypto & Digital Assets, Accel, FundersClub, Blackstone and 31 more.

Who are Chainalysis's competitors?

Competitors of Chainalysis include Allium, Coinfirm, Gray Wolf, Four Pillars, Ospree and 7 more.

What products does Chainalysis offer?

Chainalysis's products include Chainalysis KYT and 4 more.

Loading...

Compare Chainalysis to Competitors

Elliptic is a company specializing in blockchain analytics and crypto compliance solutions within the financial technology sector. The company offers products and services designed to prevent financial crime in cryptoassets, including real-time wallet screening, automated transaction monitoring, and cross-chain investigations. Elliptic primarily serves financial institutions, crypto businesses, regulators, and law enforcement agencies. Elliptic was formerly known as Bitxchange. It was founded in 2013 and is based in London, England.

TRM is a blockchain intelligence company focused on detecting and investigating crypto-related financial crime and fraud. The company offers a suite of services including transaction monitoring, wallet screening, and know-your-entity solutions, as well as training programs for digital forensics and crypto compliance. TRM primarily serves financial institutions, crypto businesses, and the public sector. It was founded in 2018 and is based in San Francisco, California.

Merkle Science offers predictive transaction monitoring and forensics advanced solutions in blockchain monitoring. The company provides the infrastructure to help blockchain companies, cryptocurrency exchanges, investment funds, banks, and regulators perform due diligence on the blockchain. It was founded in 2018 and is based in Manhattan, New York.

Crystal Blockchain operates as a blockchain intelligence firm specializing in the financial sector. The company offers real-time blockchain analysis, investigative, and compliance solutions to help institutions adhere to anti-money laundering regulations and support law enforcement in crypto investigations. It was founded in 2018 and is based in Amsterdam, Netherlands.

Notabene provides pre-transaction compliance solutions in cryptocurrency. The company's main service is its SafeTransact platform, which offers a holistic view of crypto transactions, enabling customers to automate real-time decision-making, perform counterparty sanctions screening, identify self-hosted wallets, and ensure compliance with global regulations. It primarily serves financial institutions and virtual asset service providers (VASPs). It was founded in 2020 and is based in Brooklyn, New York.

Glassnode is a leading blockchain data and intelligence platform operating in the digital asset markets. The company provides a wide range of services including on-chain and financial market data analysis, wallet tracking, exchange data coverage, and market research. Their primary customers are institutions and individuals involved in trading, risk management, and research within the digital asset markets. It was founded in 2017 and is based in Zug, Switzerland.

Loading...