Clara

Founded Year

2020Stage

Series B - III | AliveTotal Raised

$470MLast Raised

$60M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-114 points in the past 30 days

About Clara

Clara operates a management platform in the business payments sector. It offers corporate credit cards, bill pay services, cross-border payments, and a software platform for expense management and financial operations. Clara primarily serves large and growing companies across various industries. The company was founded in 2020 and is based in Sao Paulo, Brazil.

Loading...

Clara's Product Videos

Clara's Products & Differentiators

Card

Clara-issued charge card (have premium, business, and virtual offerings)

Loading...

Research containing Clara

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Clara in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

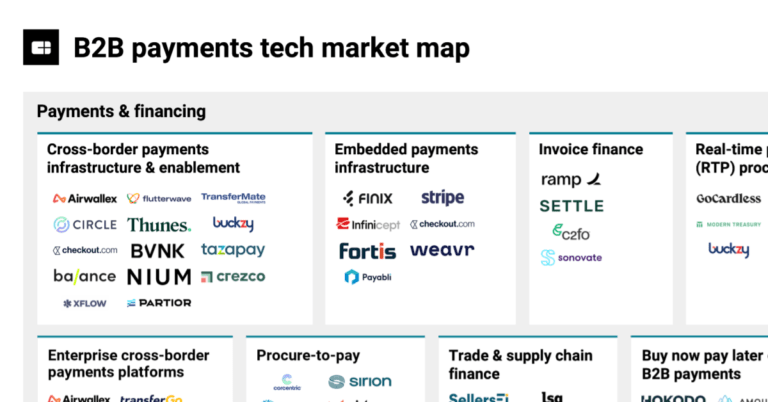

The B2B payments tech market map

Oct 5, 2023 report

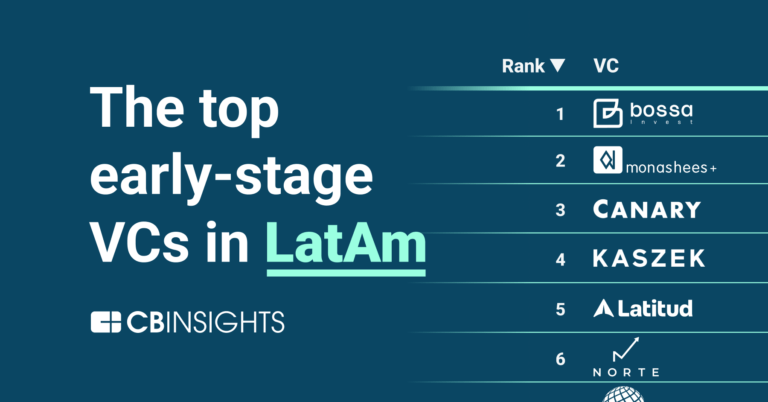

The top 25 early-stage LatAm VCs

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Clara

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Clara is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

100 items

Latest Clara News

Aug 22, 2023

Shreyashi Chakraborty / Representational image.Pixabay. Latin American fintech company Clara is debuting its cross-border transactional services in its home country of Mexico, paving the way for smoother international fund transfers. The corporate card provider has also set its sight on Colombia and Brazil as part of its expansion plan, it told Reuters . However, the company didn't specify a timeframe. Clara said it expects $100 million in payments facilitated through the service by year-end. With the service, Clara's valued customers can easily pay their bills using different foreign currencies. Customers will pay in pesos in Mexico, whilst the recipient will receive the payment in the currency of their chosen destination. The company's move into Mexico is tied to the U.S. government's push for a nearshoring ecosystem, backed by President Joe Biden's call for industry collaboration in Central America to drive mutual growth. The nearshoring efforts led to clients seeking services and materials from various global locations, which necessitated transactions in multiple currencies, prompting Clara to announce its service. Clara had earlier announced the relocation of its headquarters to Brazil, betting on the South American country becoming its largest market by 2024. © 2023 Latin Times. All rights reserved. Do not reproduce without permission. Tags:

Clara Frequently Asked Questions (FAQ)

When was Clara founded?

Clara was founded in 2020.

Where is Clara's headquarters?

Clara's headquarters is located at R. Dr. Renato Paes de Barros. 33, Sao Paulo.

What is Clara's latest funding round?

Clara's latest funding round is Series B - III.

How much did Clara raise?

Clara raised a total of $470M.

Who are the investors of Clara?

Investors of Clara include General Catalyst, Monashees+, Picus Capital, DST Global, Alter Global and 30 more.

Who are Clara's competitors?

Competitors of Clara include Jeeves and 6 more.

What products does Clara offer?

Clara's products include Card and 2 more.

Who are Clara's customers?

Customers of Clara include Banco Sabadell, Enseña por México, OnFly and Gulf.

Loading...

Compare Clara to Competitors

Tribal Credit operates as a financial solutions company operating in the business services sector. It provides corporate cards and financial tools designed to manage expenses. Its tools include features for controlling spending, managing international transactions, and handling online advertising and digital subscriptions. It was formerly known as Aingel. The company was founded in 2016 and is based in San Jose, California.

Mendel is a technology company focused on streamlining and optimizing financial management for large enterprises in the finance and technology sectors. The company offers an integrated solution for intelligent expense management and control, providing real-time reporting, automated workflows, and smart corporate Visa cards. Mendel primarily serves large corporations seeking to digitize their financial processes and increase payment transparency. It was founded in 2021 and is based in Mexico City, Mexico.

Jeeves operates a financial platform providing payment and expense management solutions within the financial services industry. The company offers a suite of tools that streamline global finance operations, including multi-currency accounts, corporate card issuance, cross-border payments, and integrated expense management. Jeeves primarily serves businesses looking to manage their financial operations across multiple countries. It was founded in 2019 and is based in Orlando, Florida.

Brex is a financial technology company that specializes in AI-powered spend management for businesses. The company offers corporate credit cards, automated expense management, and bill payment software, as well as banking and treasury services that include high-yield deposits and FDIC-insured accounts. Brex primarily serves startups, mid-size companies, and enterprises, providing them with tools to control and track company spending in real-time. Brex was formerly known as Veyond. It was founded in 2017 and is based in San Francisco, California.

Ramp specializes in spend management solutions within the financial technology sector. The company offers a suite of products that include corporate cards, expense management, and accounts payable automation designed to streamline finance operations and improve efficiency for businesses. Ramp's platform also provides features such as automated procurement, vendor management, and working capital solutions, catering to a diverse range of customer needs from startups to large enterprises. It was founded in 2019 and is based in New York, New York.

Pluto develops a finance workflow automation and spend management platform. The company offers a suite of tools including smart corporate cards, employee reimbursement systems, petty cash management solutions, procurement and account payables automation, as well as accounting integration capabilities. It primarily serves businesses ranging from small to medium-sized enterprises to large corporations across various sectors, including retail, electronic commerce, agencies, truck and fleet operations, consulting firms, and more. The company was founded in 2021 and is based in Dubai, United Arab Emirates.

Loading...