Brex

Founded Year

2017Stage

Unattributed VC - II | AliveTotal Raised

$1.49BRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-37 points in the past 30 days

About Brex

Brex is a financial technology company that specializes in AI-powered spend management for businesses. The company offers corporate credit cards, automated expense management, and bill payment software, as well as banking and treasury services that include high-yield deposits and FDIC-insured accounts. Brex primarily serves startups, mid-size companies, and enterprises, providing them with tools to control and track company spending in real-time. Brex was formerly known as Veyond. It was founded in 2017 and is based in San Francisco, California.

Loading...

ESPs containing Brex

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The spend management market enable businesses to efficiently manage and control their expenditures through a suite of integrated software solutions, including virtual corporate cards, expense management systems, procurement software, budget tracking tools, and supplier management platforms. Vendors use APIs and cloud-based platforms to integrate these solutions into existing financial and operatio…

Brex named as Leader among 15 other companies, including Coupa, Ramp, and Tipalti.

Loading...

Research containing Brex

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Brex in 29 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

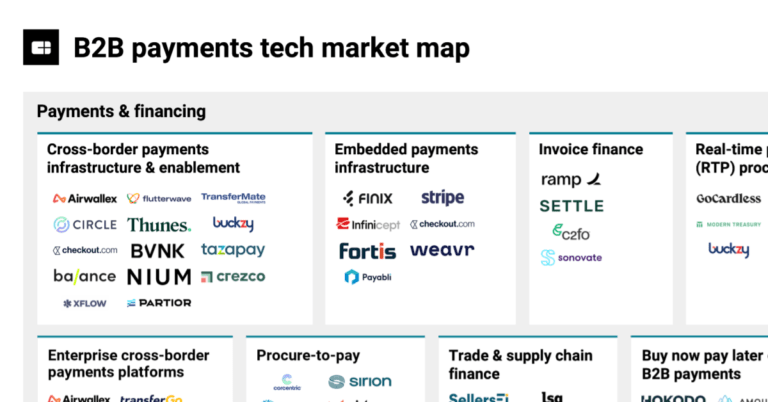

The B2B payments tech market map

Oct 26, 2023

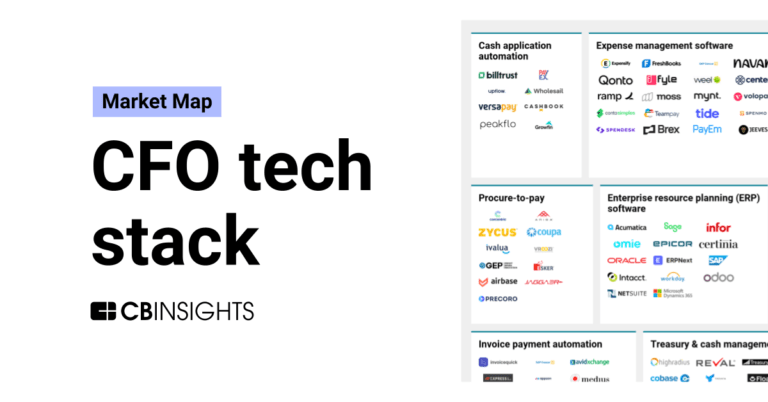

The CFO tech stack market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Brex

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Brex is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Digital Lending

2,271 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

1,099 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

825 items

SMB Fintech

355 items

Brex Patents

Brex has filed 23 patents.

The 3 most popular patent topics include:

- payment systems

- data management

- payment service providers

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/29/2021 | 8/20/2024 | Access control, Computer security, Computer network security, Mobile payments, Parallel computing | Grant |

Application Date | 12/29/2021 |

|---|---|

Grant Date | 8/20/2024 |

Title | |

Related Topics | Access control, Computer security, Computer network security, Mobile payments, Parallel computing |

Status | Grant |

Latest Brex News

Sep 19, 2024

Thursday 19 September 2024 11:31 CET | News US-based corporate card and spend management platform Brex has launched Brex Embedded, which is set to unlock global transactions for customers across the globe. Following this launch, B2B software vendors will have the possibility to easily embed Brex virtual cards into financial workflows and generate new, risk-free revenue streams on a global scale. This process will be backed by an expanded partnership with Mastercard. The newly released product is an API-driven payment solution and, by integrating with providers across categories like travel, procurement, and enterprise resource planning (ARP), the tool will enable Brex to expand its enterprise footprint. More insights on the Brex Embedded launch As global B2B payment volume has grown over the past decade, firms around the world are increasingly embedding payments into their products in order to help their client’s workflows to generate new revenue streams. At the same time, building financial solution capabilities in-house is costly, time-consuming, and develops a significant regulatory and financial risk. With this in mind, Brex Embedded leveraged proprietary APIs and issued integrations in order to enable any software vendor to integrate Brex’s worldwide corporate card and payment offerings directly into their platform, without the need for underwriting, onboarding, and credit risk processes. In addition, for Brex Embedded partners, their clients will make fast, secure, and worldwide payments in virtually any currency, all while also automating their existing financial workflows and payment reconciliation. Brex Embedded payments give software vendors a single point of integration, which allows them to embed Brex virtual cards with up to 40x higher limits, as well as rewards and local currency payments in 50+ countries, aiming to save end-users time, money, and resources. These software vendors will also have the possibility to onboard global customers in days and ensure all spending conducted on their platforms is automatically reconciled for accounting. The financial institution will continue to focus on meeting the needs, preferences, and demands of clients and users in an ever-evolving market, while also prioritising the process of remaining compliant with the regulatory requirements and laws of the industry.

Brex Frequently Asked Questions (FAQ)

When was Brex founded?

Brex was founded in 2017.

Where is Brex's headquarters?

Brex's headquarters is located at 50 West Broadway Street 333, San Francisco.

What is Brex's latest funding round?

Brex's latest funding round is Unattributed VC - II.

How much did Brex raise?

Brex raised a total of $1.49B.

Who are the investors of Brex?

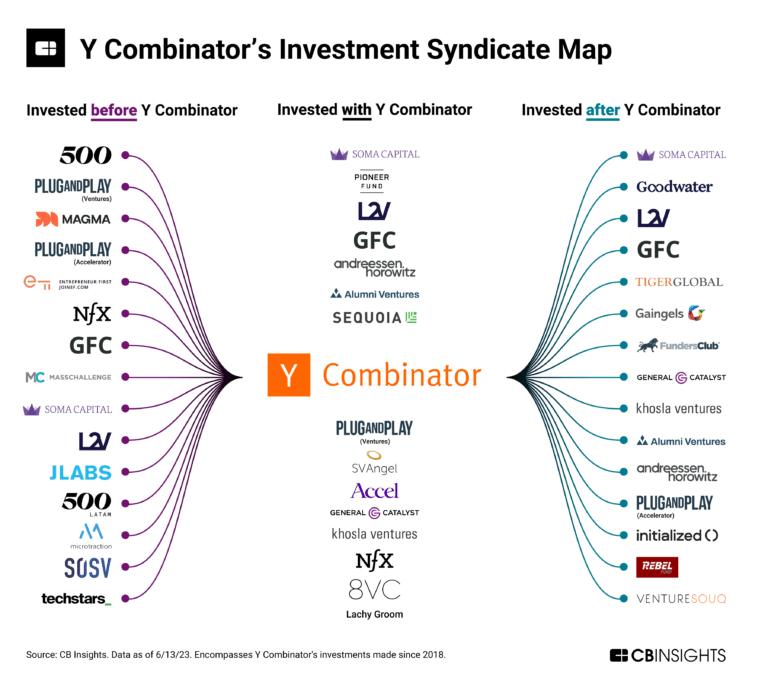

Investors of Brex include Bossa Invest, Pioneer Fund, Liquid 2 Ventures, Greenoaks Capital Management, Technology Crossover Ventures and 30 more.

Who are Brex's competitors?

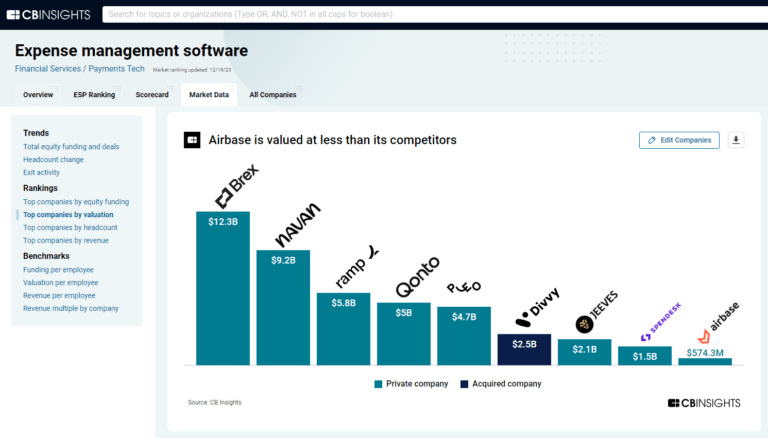

Competitors of Brex include Airbase, Moss, Jeeves, Inbanx, Pleo and 7 more.

Loading...

Compare Brex to Competitors

Ramp specializes in spend management solutions within the financial technology sector. The company offers a suite of products that include corporate cards, expense management, and accounts payable automation designed to streamline finance operations and improve efficiency for businesses. Ramp's platform also provides features such as automated procurement, vendor management, and working capital solutions, catering to a diverse range of customer needs from startups to large enterprises. It was founded in 2019 and is based in New York, New York.

Pleo operates as a business spend management platform. It provides virtual cards, expenses, automated expense reports for employees, invoices, and more. It serves industries such as retail, healthcare, technology, and more. It was founded in 2015 and is based in Kobenhavn N, Denmark.

Fyle focuses on intelligent expense management. Its main services include tracking receipts, reporting expenses, managing credit card reconciliation, and providing analytics on company spending. The company primarily sells to sectors such as construction, non-profit, technology, and legal services. It was founded in 2016 and is based in Bengaluru, India.

Center specializes in expense management solutions within the financial technology sector. The company offers a connected corporate card and expense management software that provides visibility into employee spending and streamlines the expense reporting process. Center was formerly known as Touchstone ID. It was founded in 2017 and is based in Bellevue, Washington. In April 2024, Center was acquired by Direct Travel.

Soldo operates as a financial services and software company in the financial technology industry. The company offers a spend management platform that automates business and employee spending, along with prepaid company cards that provide real-time tracking and control over expenses. It primarily serves businesses across various sectors, with a focus on reducing financial administrative burdens. It was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Jeeves operates a financial platform providing payment and expense management solutions within the financial services industry. The company offers a suite of tools that streamline global finance operations, including multi-currency accounts, corporate card issuance, cross-border payments, and integrated expense management. Jeeves primarily serves businesses looking to manage their financial operations across multiple countries. It was founded in 2019 and is based in Orlando, Florida.

Loading...