Ramp

Founded Year

2019Stage

Series D - II | AliveTotal Raised

$1.827BValuation

$0000Last Raised

$150M | 5 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-22 points in the past 30 days

About Ramp

Ramp specializes in spend management solutions within the financial technology sector. The company offers a suite of products that include corporate cards, expense management, and accounts payable automation designed to streamline finance operations and improve efficiency for businesses. Ramp's platform also provides features such as automated procurement, vendor management, and working capital solutions, catering to a diverse range of customer needs from startups to large enterprises. It was founded in 2019 and is based in New York, New York.

Loading...

ESPs containing Ramp

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

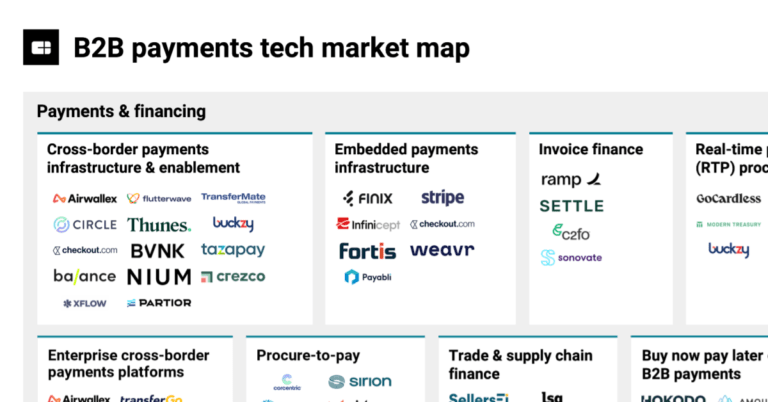

The invoice finance market allows businesses to access funds associated with unpaid invoices. Through APIs and user-friendly software, these platforms connect companies needing immediate cash flow with investors or financial institutions willing to advance funds against outstanding invoices. This technology-driven approach simplifies invoice processing, enhances transparency, and speeds up funding…

Ramp named as Leader among 15 other companies, including C2FO, Kriya, and Funding Xchange.

Ramp's Products & Differentiators

Ramp Card

Smart corporate cards - both physical and virtual - with embedded software controls.

Loading...

Research containing Ramp

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ramp in 23 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Oct 26, 2023

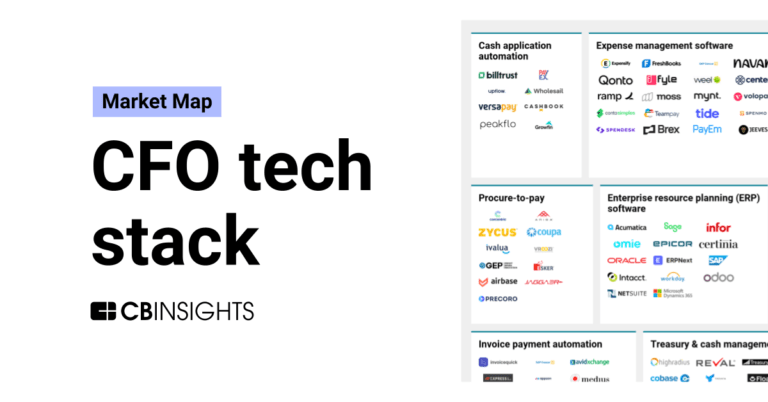

The CFO tech stack market map

Oct 18, 2023 report

State of Fintech Q3’23 Report

Oct 12, 2023

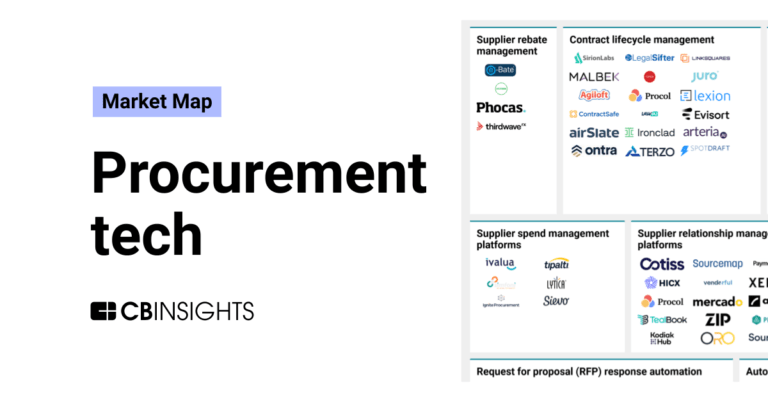

The procurement tech market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Ramp

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ramp is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

SMB Fintech

2,003 items

Payments

3,034 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,295 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

599 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Ramp News

Jun 4, 2024

News provided by Share this article Share toX Ramp Travel combines Ramp's policy controls, expense automations, and spend analytics with Priceline's global inventory and exceptional deals – saving businesses time and money from booking to book-close Leading finance operations platform Ramp introduces new way to book business travel using AI, automation, and integration with Priceline. Travel & entertainment (T&E) spend accounts for 20% of annual purchases made on Ramp, and is poised to grow as demand returns to pre-pandemic levels. Represents Ramp's second major category expansion this year, following Procurement for managing software vendors. Follows Ramp's $150 million raise in April as company accelerates platform expansion and place in the AI economy. NEW YORK, June 4, 2024 /PRNewswire/ -- Ramp , the finance operations platform designed to save businesses time and money, today announced the launch of Ramp Travel – a solution designed to make booking travel and automating expenses easy, low cost, and intuitive. The news marks Ramp's entrance into the business travel booking category, and is a significant step in Ramp's journey to help companies automate non-strategic work and make smarter decisions about every dollar spent. Today, over 25,000+ businesses choose Ramp to consolidate spend, control costs, and simplify their financial operations. Already these businesses are allocating more of their budgets towards travel– representing 20% of annual card spend on Ramp, up from ~10% in 2021. This is expected to scale as demand for corporate travel rebounds . As part of the launch, Ramp is partnering with Priceline Partner Solutions to give Ramp customers streamlined access to Priceline's global network of airline partners, extensive accommodation inventory, and industry leading rates. The tool is deeply integrated with Ramp's powerful expense management and workflow automations to eliminate the busywork and hassle typically associated with traveling for work– like expense reports, cumbersome approval processes to book travel, and delayed visibility into how employees are spending on trips as they happen. "Ramp already makes companies' finances more efficient by streamlining expenses and automating busywork," says Eric Glyman, CEO, Ramp. "By integrating travel booking, which has traditionally been a pain point for busywork and bloat, organizations have more time and resources to focus on what really matters: their business." A new model for business travel Ramp Travel departs from conventional corporate travel offerings that profit off of high fees in exchange for guaranteed control over how and where employees spend. These traditional systems force businesses to choose between low prices and low controls – or high prices and better controls, are frustrating and manual to use for employees and accountants alike, and keep companies in the dark about the real-time flow of T&E spend across the business. Ramp believes companies deserve better, and built Ramp Travel to: Eliminate the financial compromise between friendly rates and precise controls by pairing Ramp's customizable policy guardrails with access to exceptional deals on flights and hotels globally- powered by Priceline Partner Solutions. Simplify how employees book, with an intuitive interface to find in-policy flights and hotels in one place, all without extra booking fees. Automate everything from collecting receipts to coding transactions, so employees on the ground can focus on making the most of their trip and finance teams can focus on their business, not busywork. Give real-time insights into T&E spend, so companies can prevent non-compliant activity and uncover negative trends as they happen. Preserve flexibility and choice in how companies book travel, by integrating with external providers like Corporate Traveler, TravelPerk, and more. No matter where businesses book, Ramp AI will effortlessly route expenses to the right trip, show compliance against policies- down to per diems- and streamline accounting. Ramp is uniquely able to realign incentives in business travel because it's approaching the space as a software and workflows company designed to help businesses spend less time on manual work and less money across their expenses, rather than a travel solution with specific interests. Instead of inflating rates, adding booking fees, or creating friction with external providers, Ramp is leveraging its technology and expertise to make traveling for work more simple and compliant. "I've used so many systems for travel, and Ramp really knows how to take the best parts of each and make it so seamless and efficient," says Staci Robinson, AP Manager, Pair Eyewear. "Employees don't have to navigate to three different places just to book travel, and all their spend when they actually take the trip is all in Ramp, too. From approvals, to coding, to automatically attaching receipts to each trip – it's brilliant." Through the new relationship with Priceline Partner Solutions, Ramp customers now have access to Priceline's full breadth of global travel products spanning over 116 countries worldwide. "Priceline's extensive inventory and highly competitive rates will help users seamlessly find the right travel offering to suit their needs," says Matthew Shutt, Vice President and General Manager, Priceline Partner Solutions. "We're excited to partner with Ramp to help take the friction out of business travel for corporate customers, and improve the experience for both employees and employers." Ramp Travel is available now for existing customers to experience a smarter, better way to travel. About Ramp Ramp is the ultimate platform for modern finance teams. From spend management and expense management software, to bill payments , vendor management , and procurement , Ramp's all-in-one solution is designed to automate finance operations and build healthier businesses. Over 25,000 businesses have switched to Ramp to cut their expenses by an average of 5% and close their books 8x faster. To date, the company has saved its customers over $1 billion and 10 million hours. Learn more at ramp.com . About Priceline Priceline, part of Booking Holdings Inc. [NASDAQ: BKNG ], has been a leader in online travel for twenty-five years. Priceline's proprietary deals technology pairs negotiation with innovation to analyze billions of data points to generate deep discounts for customers they can't find anywhere else. Travelers have access to millions of hotels, flights, alternative accommodations, rental cars, cruises, vacation packages and experiences from trusted brands in over 116 countries around the world, 24/7 customer service and incremental savings when becoming a Priceline VIP. By making affordable travel within reach for all, Priceline helps millions of customers each year be there for the moments that matter to them. Because where your happy place meets your happy price, that place is Priceline. Media Contact

Ramp Frequently Asked Questions (FAQ)

When was Ramp founded?

Ramp was founded in 2019.

Where is Ramp's headquarters?

Ramp's headquarters is located at 28 West 23rd Street, New York.

What is Ramp's latest funding round?

Ramp's latest funding round is Series D - II.

How much did Ramp raise?

Ramp raised a total of $1.827B.

Who are the investors of Ramp?

Investors of Ramp include Founders Fund, D1 Capital Partners, Thrive Capital, ICONIQ Capital, General Catalyst and 32 more.

Who are Ramp's competitors?

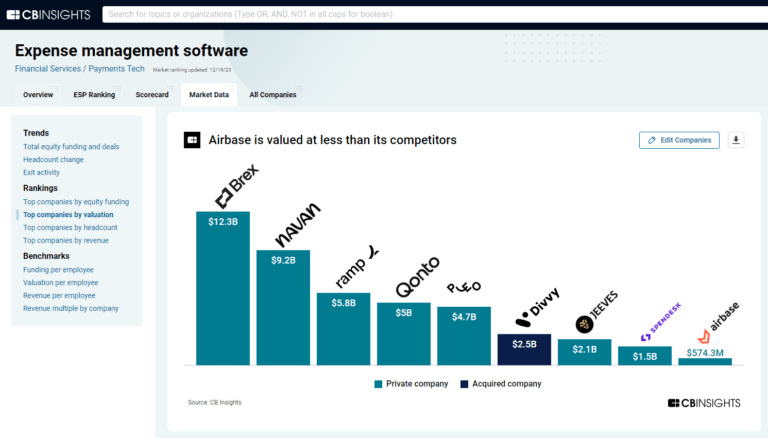

Competitors of Ramp include Finally, Airbase, Moss, Jeeves, Inbanx and 7 more.

What products does Ramp offer?

Ramp's products include Ramp Card and 4 more.

Who are Ramp's customers?

Customers of Ramp include Mode Analytics.

Loading...

Compare Ramp to Competitors

Brex is a financial technology company that specializes in AI-powered spend management for businesses. The company offers corporate credit cards, automated expense management, and bill payment software, as well as banking and treasury services that include high-yield deposits and FDIC-insured accounts. Brex primarily serves startups, mid-size companies, and enterprises, providing them with tools to control and track company spending in real-time. Brex was formerly known as Veyond. It was founded in 2017 and is based in San Francisco, California.

Pleo operates as a business spend management platform. It provides virtual cards, expenses, automated expense reports for employees, invoices, and more. It serves industries such as retail, healthcare, technology, and more. It was founded in 2015 and is based in Kobenhavn N, Denmark.

Spendesk is a spend management platform that offers a comprehensive solution for modern finance teams in various business sectors. The company provides corporate cards, invoice payments, expense reimbursements, budgets, approvals, reporting, compliance, and pre-accounting in one integrated system. Spendesk's platform is designed to give businesses complete visibility and control over their spending, with features such as built-in automation and an easily adopted approval process. It was founded in 2016 and is based in Paris, France.

Soldo operates as a financial services and software company in the financial technology industry. The company offers a spend management platform that automates business and employee spending, along with prepaid company cards that provide real-time tracking and control over expenses. It primarily serves businesses across various sectors, with a focus on reducing financial administrative burdens. It was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Fyle focuses on intelligent expense management. Its main services include tracking receipts, reporting expenses, managing credit card reconciliation, and providing analytics on company spending. The company primarily sells to sectors such as construction, non-profit, technology, and legal services. It was founded in 2016 and is based in Bengaluru, India.

Archa is a company that focuses on providing business credit cards and spend management solutions, operating in the financial technology sector. The company offers business credit cards that help streamline company spending, along with a spend management platform that reduces administrative time and allows businesses to focus on broader objectives. Archa primarily serves the small and medium-sized business sector. It was founded in 2016 and is based in Docklands, Victoria.

Loading...