Melio

Founded Year

2018Stage

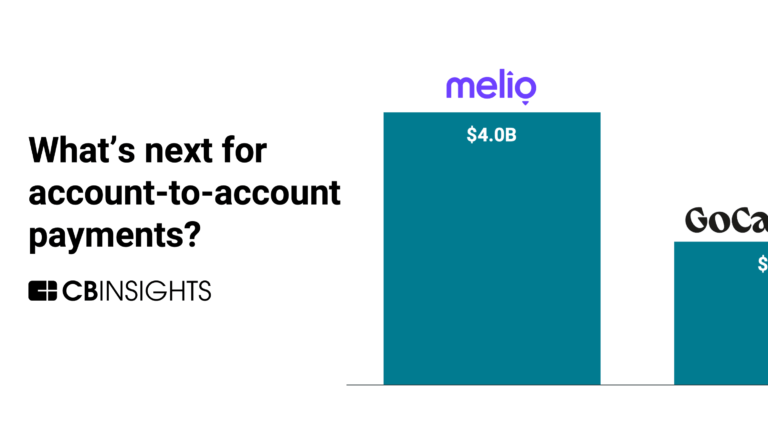

Series D | AliveTotal Raised

$504MValuation

$0000Last Raised

$250M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-24 points in the past 30 days

About Melio

Melio develops accounts payable solutions. The company offers services that allow businesses to pay their bills, send invoices, and receive payments online, as well as make international payments and automate their bill pay process. Its accountant dashboard enables integrations, team management, easy bill capture, and more. It primarily serves the business-to-business (B2B) payments in logistics, healthcare, construction, non-profit, and retail industries. It was founded in 2018 and is based in New York, New York.

Loading...

Melio's Products & Differentiators

Melio Pay

Pay any invoice with a bank transfer for FREE, or use your credit card to defer payment and earn rewards (2.9% fee). Vendors receive a check or a bank deposit.

Loading...

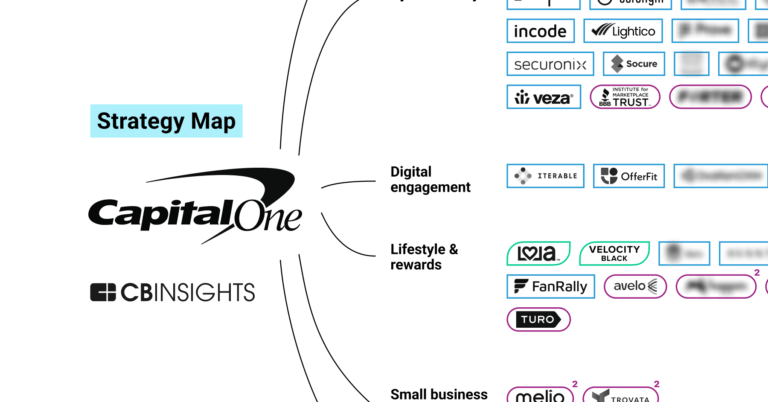

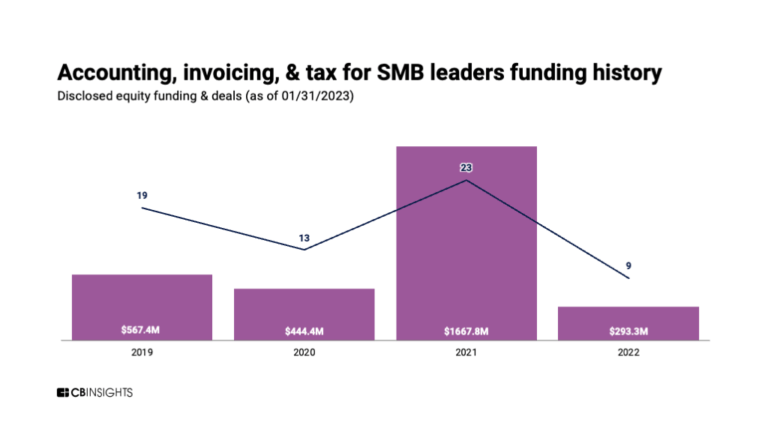

Research containing Melio

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Melio in 6 CB Insights research briefs, most recently on Mar 18, 2024.

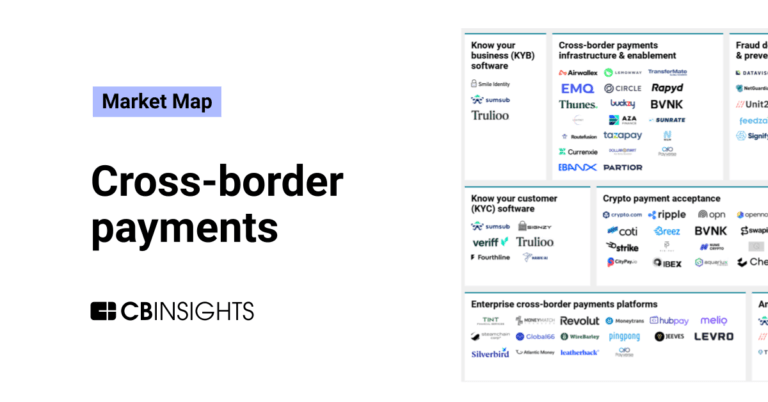

Dec 14, 2023

Cross-border payments market mapExpert Collections containing Melio

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Melio is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

SMB Fintech

1,648 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Melio Patents

Melio has filed 5 patents.

The 3 most popular patent topics include:

- antibiotics

- autoimmune diseases

- biotechnology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/14/2021 | 10/17/2023 | Molecular biology, Yeasts, Biotechnology, Antibiotics, Lactobacillales | Grant |

Application Date | 6/14/2021 |

|---|---|

Grant Date | 10/17/2023 |

Title | |

Related Topics | Molecular biology, Yeasts, Biotechnology, Antibiotics, Lactobacillales |

Status | Grant |

Latest Melio News

Sep 10, 2024

NEW YORK--(BUSINESS WIRE)--Melio, a leading B2B payments platform for small businesses, today announced an integration with the Amazon Business Reconciliation API to synchronize Amazon Business invoices in a single payment processing system, helping to save business owners valuable time. New York-based Melio is a payments platform reinventing how businesses pay each other to optimize cash flow and minimize admin work. Melio offers businesses more payment choices so that they have the flexibilit

Melio Frequently Asked Questions (FAQ)

When was Melio founded?

Melio was founded in 2018.

Where is Melio's headquarters?

Melio's headquarters is located at 124 East 14th Street, New York.

What is Melio's latest funding round?

Melio's latest funding round is Series D.

How much did Melio raise?

Melio raised a total of $504M.

Who are the investors of Melio?

Investors of Melio include Accel, General Catalyst, Bessemer Venture Partners, Corner Ventures, Coatue and 15 more.

Who are Melio's competitors?

Competitors of Melio include SumUp, Crezco, Denario, Plastiq, Tipalti and 7 more.

What products does Melio offer?

Melio's products include Melio Pay and 2 more.

Who are Melio's customers?

Customers of Melio include Joe Hill, Pecorino Cheese Shop and Theresa Pittman.

Loading...

Compare Melio to Competitors

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Tipalti is a global payables automation company that specializes in streamlining all phases of the accounts payable and payment management workflow. The company offers a cloud-based platform that simplifies the management of supplier payments, encompassing supplier onboarding, tax and regulatory compliance, invoice processing, and payments to suppliers worldwide in various methods and currencies. Tipalti's solutions are designed to reduce the workload for accounts payable departments and enhance financial and compliance controls. It was founded in 2010 and is based in San Mateo, California.

Paystand specializes in Business-to-business (B2B) payments, leveraging software as a service (SaaS) and blockchain technology within the financial services industry. The company offers a suite of products designed to automate and digitize the entire cash cycle, including accounts receivable and payment processing, while eliminating transaction fees. Its solutions cater to various sectors such as construction, food and beverage, insurance, manufacturing, medical suppliers, and environmental industries. It was founded in 2013 and is based in Scotts Valley, California.

Billtrust focuses on automating accounts receivable and order-to-cash processes for businesses. Its main offerings include artificial intelligence (AI)-powered invoicing, payment processing, cash application, and collections, designed to streamline financial operations and enhance cash flow. Billtrust's solutions cater to a variety of industries, providing tailored automation to meet specific sector needs. It was founded in 2001 and is based in Hamilton, New Jersey.

Chargezoom is a company that focuses on providing billing and payment solutions, operating in the financial technology sector. The company offers a range of services including online payment terminals, invoicing, customer portals, surcharging, and recurring payments, all designed to streamline and automate accounts receivable processes. Chargezoom primarily serves early and growth stage startups, entrepreneurs, and service businesses. It was founded in 2019 and is based in Irvine, California.

CHERRY is a B2B payment processing solution that specializes in integrating accounting software with bank payment platforms. The company offers a plugin that automates payments, streamlines approvals, and facilitates reconciliation, thereby reducing manual processes for businesses. CHERRY primarily serves businesses looking to enhance their accounting and financial workflows through automation. It was founded in 2018 and is based in Brooklyn, New York.

Loading...