Stripe

Founded Year

2010Stage

Valuation Change - III | AliveTotal Raised

$10.095BValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+16 points in the past 30 days

About Stripe

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Loading...

ESPs containing Stripe

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The virtual payment terminals market refers to a type of payment solution that allows merchants to accept payments through a web-based platform, without the need for a physical payment terminal. Virtual payment terminals are typically used by e-commerce businesses and other remote merchants who do not have a physical store or who need to accept payments from customers who are not present. The mark…

Stripe named as Leader among 15 other companies, including Fiserv, PayPal, and Worldpay.

Loading...

Research containing Stripe

Get data-driven expert analysis from the CB Insights Intelligence Unit.

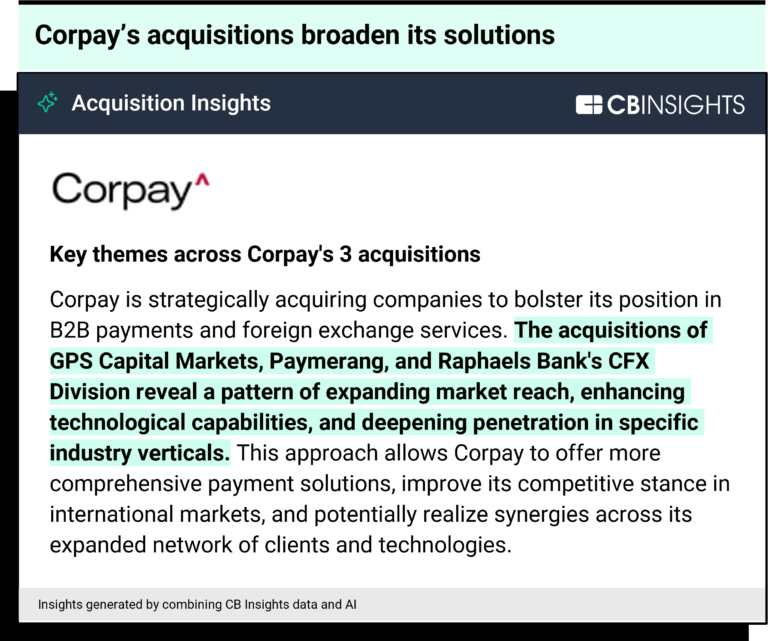

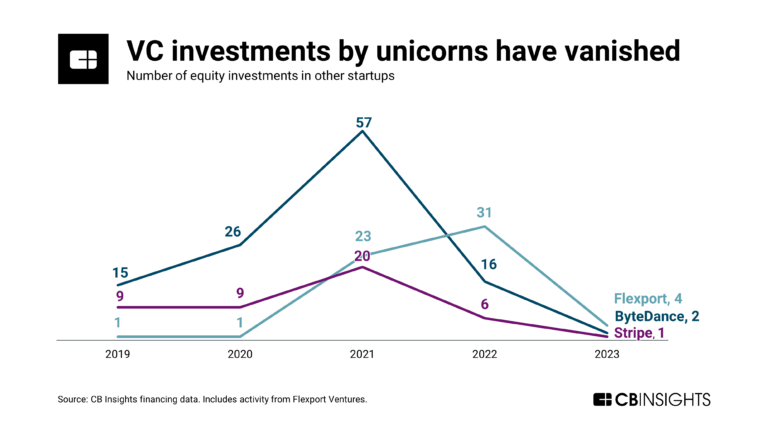

CB Insights Intelligence Analysts have mentioned Stripe in 47 CB Insights research briefs, most recently on Sep 6, 2024.

Aug 23, 2024

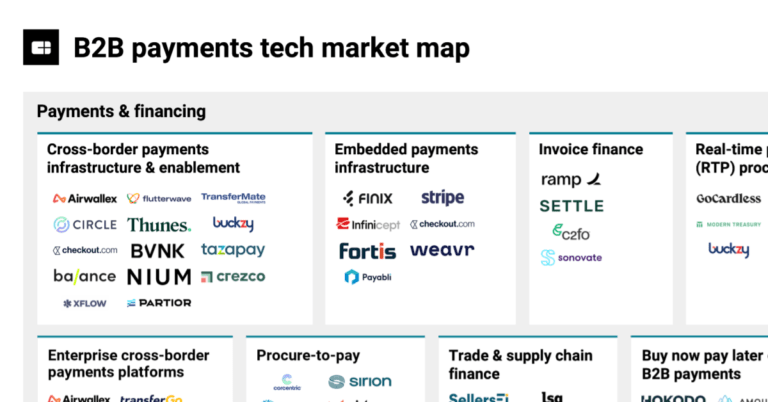

The B2B payments tech market map

Jul 16, 2024 report

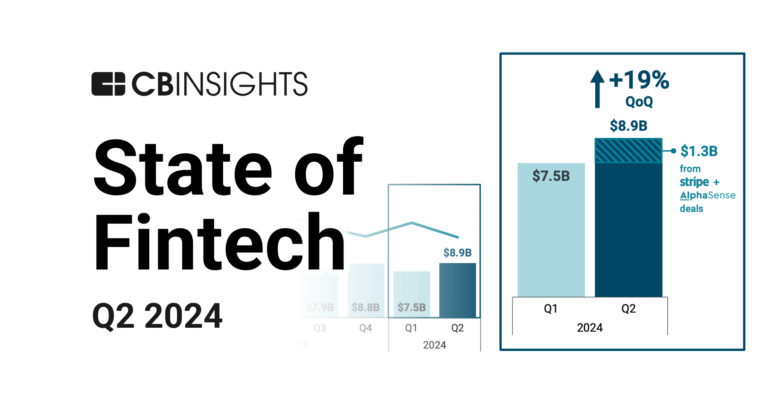

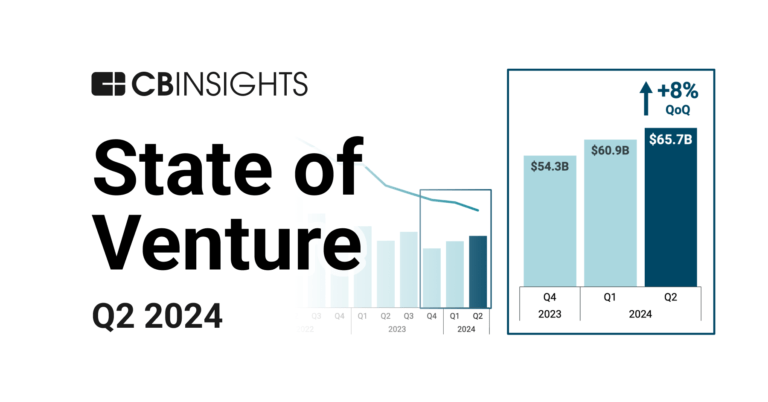

State of Fintech Q2’24 Report

Jul 3, 2024 report

State of Venture Q2’24 Report

May 8, 2024

The embedded banking & payments market map

Jan 18, 2024 report

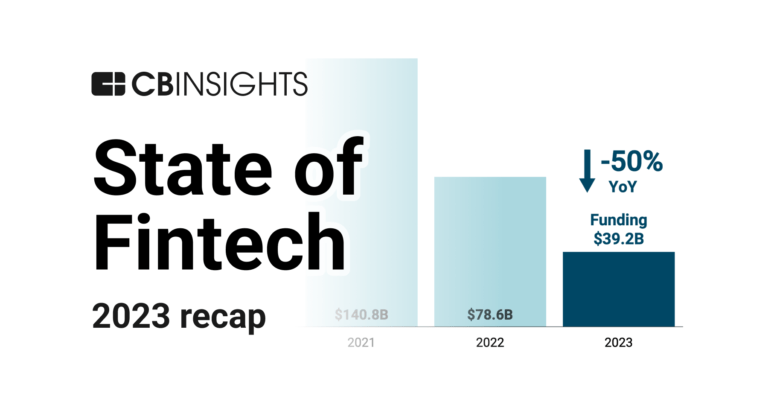

State of Fintech 2023 ReportExpert Collections containing Stripe

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Stripe is included in 12 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Blockchain

8,779 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

2,003 items

Gig Economy Value Chain

155 items

Startups in this collection are leveraging technology to provide financial services and HR offerings to the gig economy industry

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Stripe Patents

Stripe has filed 276 patents.

The 3 most popular patent topics include:

- payment systems

- payment service providers

- mobile payments

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/6/2023 | 9/17/2024 | Software design patterns, Java virtual machine, Software design, Java platform, Software developer communities | Grant |

Application Date | 1/6/2023 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Software design patterns, Java virtual machine, Software design, Java platform, Software developer communities |

Status | Grant |

Latest Stripe News

Sep 20, 2024

Heather Clancy, Trellis Share For five of the nine startups, the funding represents an initial corporate transaction Alphabet, H&M Group, Match, Shopify and Stripe are paying $4.5m to nine early-stage carbon removal startups to help them scale pilot and demonstration projects for their technologies. For five of the nine companies, this funding represents an initial corporate transaction. Each startup will receive upfront payments of $500,000. If they reach certain milestones, they will be considered for commercial contracts with Frontier, the corporate buyers group co-founded by Alphabet, McKinsey, Meta, Shopify and Stripe, said Joanna Klitzke, procurement and ecosystem strategy lead at Frontier. "There is no clawback if companies don't deliver," said Klitzke. Frontier's funding helps startups transition from research and development into commercial production more quickly, while helping corporate buyers assess the potential risks associated with emerging technologies. "It can help signals to other companies that we've cleared this hurdle," said Luk Shors, co-founder and president of Capture6 , one of the selected startups, which is developing an electrochemical system that captures carbon dioxide from industrial waste streams. The energy required for operations and whether it can be delivered by renewable power. For example, the process used by one startup, Planeteers , relies on water flowing away from water treatment plants and doesn't need extra infrastructure. How existing industrial processes might be harnessed for carbon removal. For example, one of the nine to receive funding is Exterra . It mineralises mining waste, which cleans up mining sites during extraction. Another company, Silica , works in collaboration with sugar cane farms. Whether there are "co-products" created during removal that could generate another revenue stream. Another startup, Alithic , produces a byproduct that can be sold for use in concrete, lowering its costs. This is the fourth cohort of entrepreneurs to receive money under Frontier's "prepurchase" track. At least two companies from its 2023 round of prepurchases have since signed sizeable, formal offtake contracts to deliver carbon removal credits: Vaulted Deep, which removes carbon dioxide in the form of carbon-rich slurry injected underground, won a $58.3m contract with Frontier less than a year after the prepurchase. Holocene, a direct air capture company, on Sept. 10 signed a $10m bilateral agreement with Google , which will pay $100 per tonne for the credits if things work out. There were 163 applicants for this funding round, and the decisions were made by 40 external experts as well as the internal team at Stripe that manages the Frontier program. The other selected startups are: Alt Carbon , which spreads basalt on Indian tea plantations to improve soil health Anvil , which uses rock minerals to turn atmospheric CO₂ into carbonate Flux , a startup using basalt to speed soil carbon capture in Sub-Saharan Africa Nulife , which turns wet waste biomass into bio-oil that's injected underground Frontier has pledged to spend $1bn on carbon removal contracts between 2022 and 2030. So far, the group has signed almost $320m in contracts, representing approximately 572,000 metric tonnes of carbon removal. This story originally appeared at Trellis . Download

Stripe Frequently Asked Questions (FAQ)

When was Stripe founded?

Stripe was founded in 2010.

Where is Stripe's headquarters?

Stripe's headquarters is located at 354 Oyster Point Boulevard, South San Francisco.

What is Stripe's latest funding round?

Stripe's latest funding round is Valuation Change - III.

How much did Stripe raise?

Stripe raised a total of $10.095B.

Who are the investors of Stripe?

Investors of Stripe include Sequoia Capital, General Catalyst, Andreessen Horowitz, Founders Fund, Thrive Capital and 54 more.

Who are Stripe's competitors?

Competitors of Stripe include Pomelo, Fundbox, Bolt, Finix, OwlTing and 7 more.

Loading...

Compare Stripe to Competitors

Worldpay provides electronic payment processing services to merchants and financial institutions. It offers merchant acquiring and payment processing services, such as authorization and settlement, customer service, chargeback and retrieval processing, and interchange management for national merchants, and regional and small-to-medium-sized businesses. The company was founded in 1993 and is based in London, United Kingdom.

Klarna specializes in providing payment solutions and services within the e-commerce sector. The company offers a platform for online shopping that includes price comparisons, deals, and various payment options to facilitate purchases for consumers. Klarna primarily serves the e-commerce industry by enabling a seamless shopping experience through its payment and financing services. It was founded in 2005 and is based in Stockholm, Sweden.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The company offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Pine Labs offers cloud-based point-of-sale (PoS) payment solutions. The company allows merchants to accept credit or debit card payments, as well as methods such as e-wallets, quick response (QR) code payment solutions, and unified payments interface (UPI)-based solutions. The company was founded in 1998 and is based in Noida, India.

TouchBistro is a company that focuses on providing an all-in-one point of sale (POS) and restaurant management system in the restaurant industry. The company offers a range of services including front of house, back of house, and guest engagement solutions, which help restaurateurs streamline their operations, manage their menu, sales, staff, and more. These services are designed to increase sales, improve guest experiences, and save time and money. It was founded in 2011 and is based in Toronto, Ontario.

PayNearMe develops technology to facilitate the end-to-end customer payment experience. It offers a billing and payment platform. Its platform helps users pay with cash for a range of goods and services from companies in e-commerce, property management, consumer finance, and transportation, enabling businesses and government agencies as well as retail stores to digitize cash collection processes. PayNearMe was formerly known as Handle Financial. The company was founded in 2009 and is based in Santa Clara, California.

Loading...