OpenSea

Founded Year

2017Stage

Series C | AliveTotal Raised

$425.12MValuation

$0000Last Raised

$300M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-47 points in the past 30 days

About OpenSea

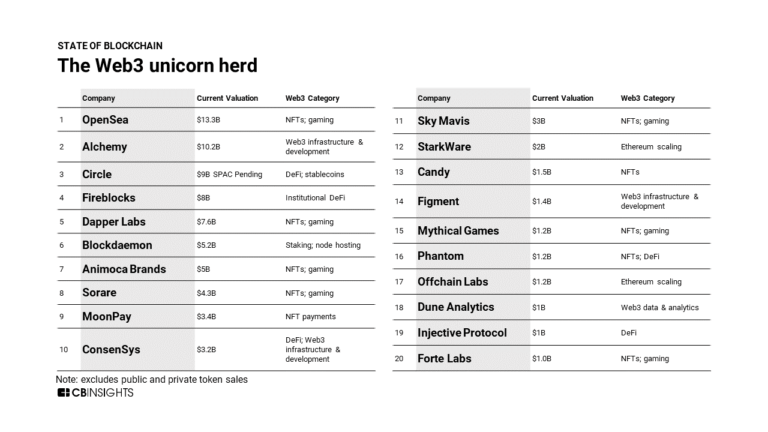

OpenSea operates as a digital marketplace specializing in the trade of non-fungible tokens (NFTs) within the web3 ecosystem. The platform facilitates the minting, buying, selling, and auctioning of NFTs across various categories such as art, gaming, music, and more. OpenSea provides a peer-to-peer trading environment that supports multiple blockchain networks. It was founded in 2017 and is based in New York, New York.

Loading...

Loading...

Research containing OpenSea

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned OpenSea in 6 CB Insights research briefs, most recently on May 24, 2023.

Dec 14, 2022

What L’Oréal, Nike, and LVMH are doing in Web3

Dec 22, 2021

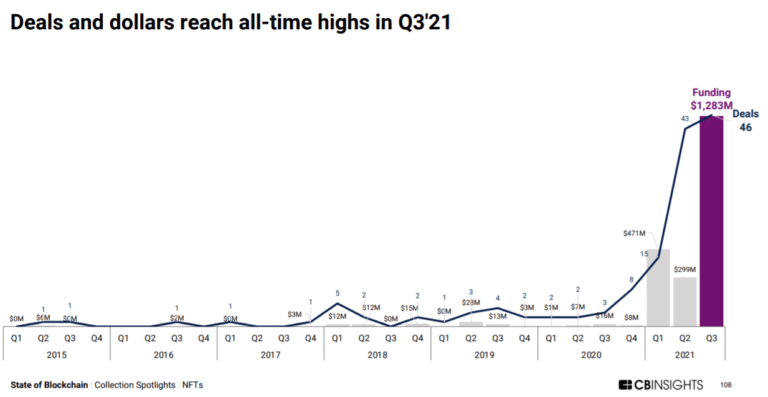

State Of Blockchain Spotlight: NFTs Gone Wild

Oct 19, 2021 report

Coinbase Strategy Teardown: How Coinbase Grew Into The King Midas Of CryptoExpert Collections containing OpenSea

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

OpenSea is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Blockchain

12,721 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Influencer & Content Creator Tech

337 items

Companies that serve independent creators who want to monetize their own work, from content creation tools to administrative back-end platforms to financing solutions.

Blockchain 50

50 items

Latest OpenSea News

Sep 14, 2024

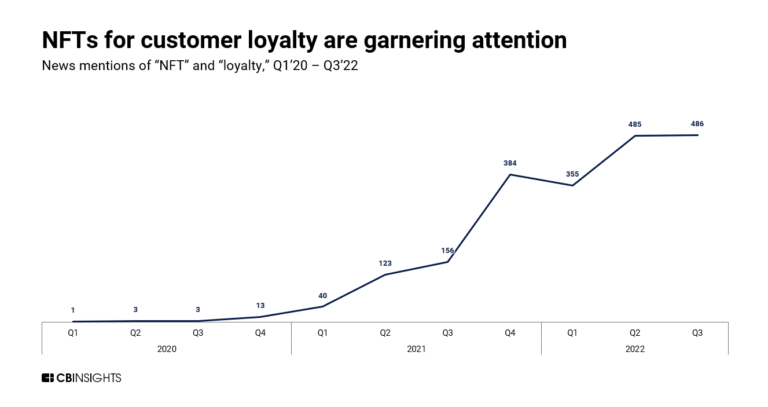

To embed, copy and paste the code into your website or blog: <iframe frameborder="1" height="620" scrolling="auto" src="//www.jdsupra.com/post/contentViewerEmbed.aspx?fid=0b3af94a-251e-40d1-86bb-5009eb5a5a05" style="border: 2px solid #ccc; overflow-x:hidden !important; overflow:hidden;" width="100%"></iframe> In the last few weeks, decisions by regulatory agencies and courts overseeing cryptocurrency disputes have dominated the Web3 legal news. This can be expected to continue, even as Congress comes back from its August break, as those agencies look to close out their financial year on September 30 and look to set budgets and agendas for the next year. However, with both the SEC and CFTC already embroiled in significant lawsuits against well-funded digital asset industry participants, those agencies must be feeling a strain on resources at this point. Meanwhile, settlements for actions dating back to pre-2023 conduct continue to be finalized, as both the industry participants and agencies overseeing those participants look to put prior alleged misdeeds to rest and move forward with ongoing business. These developments and a few other brief notes are discussed below. NFT Secondary Marketplace OpenSea Receives SEC Wells Notice: August 28, 2024 Background: The NFT marketplace OpenSea has reportedly received a Wells notice from SEC staff indicating the SEC’s staff intends to recommend a lawsuit for securities law violations be brought against the platform operator. At its peak in early 2022, over $6 billion of NFT sales a month occurred on its platform , but those numbers have sharply declined as competitors like Magic Eden and Blur emerged and NFT sales generally declined. There is no word yet as to the content of the Wells notice or what NFT sales will be at issue in any action brought by the agency. Opensea has pledged $5 million in legal defense fees for any creators on the platform similarly targeted by the agency . Analysis: It is easy to imagine that the transactions alleged to be unregistered securities transactions will be sales involving Impact Theory or Stoner Cats, which the SEC has previously alleged to be securities and settled with the issuers thereof (over dissents from Commissioners Peirce and Uyeda ). The charges could also stem from trades of Uniswap liquidity pool tokens or similar ERC-1155 types of tokens, which may resemble financial products. With outstanding Wells notices against Robinhood , UniSwap , and now OpenSea, there can be expected a flurry of new SEC lawsuits in the months leading up to and following the upcoming Presidential election, with Chair Gensler currently expected to leave his position at the SEC regardless of the election’s outcome. Uniswap Settles With CFTC: September 4, 2024 Background: The CFTC issued an Order filing and settled charges against Uniswap for an agreed-upon fine of $175,000. Commissioners Mersinger and Pham issued separate dissenting statements . The Order does not accuse Uniswap of creating the futures products at issue but instead states that “by operating a front-end user interface (the Interface) that facilitated and provide[d] a purchaser with the ability to source financing or leverage from other users or third parties,” Uniswap meets the definition of an “offeror” of the futures products under the applicable statute. Analysis: Anybody can still buy and sell the futures products the CFTC takes issue with by interacting directly with the application or through using a block explorer such as etherscan . The CFTC’s issue is merely with the interface provided by Uniswap, i.e., making it easier to interact with these assets. This begs the question of exactly how user-friendly a website needs to be to make it an “offeror,” according to the CFTC . Commissioner Mersinger had an especially strong dissent , stating, “This case has all the hallmarks of what we have come to know as regulation through enforcement: a settlement with a de minimis penalty that bears little relationship to the conduct alleged, sweeping statements about the broader industry that are not germane to the case at hand, and legal theories that have not been tested in court.” Coinbase Partially Wins in Discovery Dispute with the SEC: September 5, 2024 Background: Coinbase has partially won its Motion to Compel certain discoveries in the lawsuit brought against the exchange by the SEC. In an Order issued orally by Judge Failla , the Court held that “I agree with Coinbase that it should be able to defend itself against these very significant charges by obtaining at least some of the evidence it seeks in discovery. And as I have hinted at in the past, there’s a degree to which the SEC is the architect of Coinbase’s current discovery demands. By pleading the complaint as it did, it is the SEC who set the parameters of the universe of permissible discovery.” Analysis: This is just the first discovery skirmish in this high-profile litigation, and there can be expected further disputes over documents that the SEC logs as protected from discovery under the deliberative process privilege or others. The SEC also gained a partial victory in resisting efforts by Coinbase to get discovery into certain aspects of Chair Gensler’s communications . However, the SEC will be required to conduct substantial efforts at document collection, production, or privilege logging, which could limit resources the agency has to devote to other ongoing and anticipated lawsuits in the digital asset space such as those mentioned above. This discovery battle is seemingly part of a two-part strategy by Coinbase, which also has requested documents through a FOIA action in a separate court. Kalshi Predictive Markets Wins Lawsuit on Summary Judgment Against the CFTC: September 9, 2024 Background: Kalshi predictive markets won its lawsuit against the CFTC after the agency sought to block the company from offering prediction markets on U.S. election outcomes. Due to the proximity to the upcoming election , the CFTC has filed an emergency motion to stay the ruling pending an expedited appeal. Kalshi first brought this lawsuit in November of 2023, after the CFTC issued a final order, prohibiting Kalshi from offering prediction markets on certain federal elections due to Kalshi’s status as a federally regulated exchange. Analysis: CFTC Chair Behnam has made regulation of prediction markets a priority at the CFTC, with the agency proposing rulemaking regarding prediction markets earlier this year. Coinbase has commented on the CFTC’s proposal regarding the regulator entering an area that has been traditionally left to the states. Others in the space have also joined in the opposition to the CFTC’s proposed expansion of authority. While the memorandum with the reasoning for the Court’s decision has not been released yet, this could be a major blow to the agency in imposing regulations on prediction markets, which often use cryptocurrency and smart contracts to manage and settle event outcome payouts. Briefly Noted:

OpenSea Frequently Asked Questions (FAQ)

When was OpenSea founded?

OpenSea was founded in 2017.

Where is OpenSea's headquarters?

OpenSea's headquarters is located at 228 Park Avenue South, New York.

What is OpenSea's latest funding round?

OpenSea's latest funding round is Series C.

How much did OpenSea raise?

OpenSea raised a total of $425.12M.

Who are the investors of OpenSea?

Investors of OpenSea include Coatue, Paradigm, FinTech Collective, KRH, Andreessen Horowitz and 28 more.

Who are OpenSea's competitors?

Competitors of OpenSea include Zora, FirstMate, Fractal, UPYO, KnownOrigin and 7 more.

Loading...

Compare OpenSea to Competitors

Dixel Club is a company focused on providing a platform for launching non-fungible token (NFT) collections in the digital asset industry. Their main service allows users to quickly create and mint their own NFT collections, with a feature for minting various color editions following an original genesis edition. The platform caters to individuals and creators interested in the NFT marketplace. It is based in Singapore, Singapore.

Rarible focuses on the non-fungible token (NFT) sector, providing a marketplace for digital goods. It offer a platform for the discovery, purchase, and sale of NFTs, catering to brands, communities, and individual creators. The company primarily serves sectors that require blockchain technology for digital asset transactions. It was founded in 2020 and is based in Wilmington, Delaware.

MakersPlace operates a marketplace offering digital arts. It allows content creators to auction their creations such as photography, 3D art, illustration, animation, and more. The company was founded in 2018 and is based in San Francisco, California.

Exclusible operates as a gaming and immersive technology studio focusing on revolutionizing brand engagement. The company offers strategic solutions to integrate global brands into gaming communities, leveraging platforms like Roblox, Fortnite, and Minecraft to craft immersive experiences to resonate with younger audiences. It was founded in 2021 and is based in Cascais, Portugal.

Starly provides a launchpad and marketplace for users' gamified non-fungible tokens (NFT) collections. It allows anyone to create Top Shot style NFT packs of their own content end-to-end. The company was founded in 2021 and is based in Central Singapore, Singapore.

Magic Eden operates as an online marketplace for non-fungible tokens (NFTs). It enables users to create and sell their NFTs on the blockchain network. It aims to be the platform for discovering, trading, and creating NFTs. The company was founded in 2021 and is based in San Francisco, California.

Loading...