Pleo

Founded Year

2015Stage

Debt | AliveTotal Raised

$471.62MValuation

$0000Last Raised

$42.82M | 5 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-42 points in the past 30 days

About Pleo

Pleo operates as a business spend management platform. It provides virtual cards, expenses, automated expense reports for employees, invoices, and more. It serves industries such as retail, healthcare, technology, and more. It was founded in 2015 and is based in Kobenhavn N, Denmark.

Loading...

Pleo's Product Videos

ESPs containing Pleo

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The spend management market enable businesses to efficiently manage and control their expenditures through a suite of integrated software solutions, including virtual corporate cards, expense management systems, procurement software, budget tracking tools, and supplier management platforms. Vendors use APIs and cloud-based platforms to integrate these solutions into existing financial and operatio…

Pleo named as Leader among 15 other companies, including Coupa, Brex, and Ramp.

Pleo's Products & Differentiators

Smart company cards

Commercial Mastercards (physical, virtual, Apple Pay, Google Pay) distributed across a business to whoever needs to buy something for work.

Loading...

Research containing Pleo

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Pleo in 12 CB Insights research briefs, most recently on Aug 23, 2024.

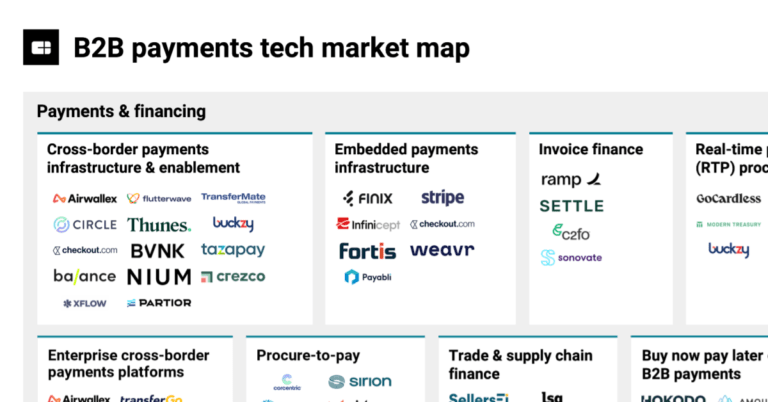

Aug 23, 2024

The B2B payments tech market mapExpert Collections containing Pleo

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Pleo is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,396 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Pleo News

Jul 9, 2024

Kinnevik : Interim Report 1 January - 30 June 2024 July 09, 2024 at 02:06 am EDT Share Kinnevik's Interim Report 1 January - 30 June 2024 "The second and largest part of the Tele2 divestment and our SEK 6.4bn extraordinary cash distribution were completed in the second quarter. Kinnevik now has a portfolio fully focused on growth companies and strong financial resources that enables us to capture the many opportunities that our portfolio and the state of growth markets provide. During the quarter, our core companies - Cityblock, Mews, Pleo, Spring Health and TravelPerk - continued to deliver strong operational performance as a group, providing support to our net asset value in the face of significant public market multiple contraction. We continue to pursue further, and in part opportunistic, investments in the companies where we hold a long-term strong conviction and can take advantage of our strong cash position and ability to invest for the long run, and see our capital reallocation intensifying during H2 2024." Georgi Ganev, CEO of Kinnevik Key Events In Q2, we completed the second step of the divestment of our full shareholding in Tele2 to iliad/NJJ, encompassing SEK 9.391m in sales proceeds in addition to the net SEK 2,840m received in Q1. The third and remaining step of the transaction representing SEK 637m in sales proceeds, adjusted for 23m of dividends received, is expected to be completed during Q3 2024 The AGM, held on 3 June 2024, resolved on an extraordinary cash distribution of SEK 23 per share, or SEK 6.4bn in total. This follows the Board's capital structure review undertaken after agreeing on the divestment of Tele2 In line with our priority to accelerate our portfolio concentration through proactive capital allocation, we acquired SEK 177m in secondary shares in Cityblock, and participated in the USD 200m private placement in Recursion, adding to our investments in Mews and Pleo during Q1 2024 The value of our unlisted portfolio was written down by 7 percent in the second quarter, driven primarily by multiple contractions in our public peer companies Our core companies - Cityblock, Mews, Pleo, Spring Health and TravelPerk - continued to deliver on operational expectations as a group, growing organically by more than 70 percent on average over the last 12 months and taking meaningful steps on their path to profitability Investment Activities We invested SEK 598m in the second quarter, of which 177m into our core company Cityblock through an acquisition of secondary shares and 103m into our newer investment Recursion 2024 to date, we have invested a total of SEK 625m into our core companies Cityblock, Mews and Pleo SEK 198m was invested into Oda in the second quarter, financing that was committed in connection with the company's merger with Mathem We released SEK 9.4bn from Tele2, having closed two of the three steps of our 13bn divestment during H1 2024 Financial Position Net Asset Value of SEK 39.3bn (SEK 140 per share), down 2.3bn or 4.7 percent in the quarter, and down 8.4bn or 16 percent compared to Q2 2023, when adjusting for the SEK 6.4bn extraordinary cash distribution Net Cash Position of SEK 12.8bn, or 13.5bn pro forma the third and last step of the Tele2 divestment Key Events After the End of the Quarter Effective 9 July, Christian Scherrer and Akhil Chainwala have been appointed new members of Kinnevik's management team. Further, Mattias Andersson, General Counsel, has decided to leave Kinnevik, and Andreas Bernström, Senior Investment Director, has transitioned into a role as Operating Partner A conference call will be held today at 10.00 CEST to present the results. Link to the webcast (listen only): https://edge.media-server.com/mmc/p/jdxb58ra Those who wish to ask questions during the conference call are welcome to register via the below link. Participants will receive dial-in numbers and confirmation code upon registration. Please make sure to register and dial in a few minutes before the call begins. Link to conference call (for participants): https://register.vevent.com/register/BI1b89053e3d6e4724a79c9524359f3dd7 This information is information that Kinnevik AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation (596/2014) and the Securities Markets Act (Sw. lagen (2007:528) om värdepappersmarknaden). The information was submitted for publication, through the agency of the contact person set out below, at 2024-07-09 08:00 CEST. For further information, visit www.kinnevik.com or contact: Torun Litzén, Director Investor Relations Phone +46 (0)70 762 00 50 Email press@kinnevik.com Kinnevik's ambition is to be Europe's leading listed growth investor. We back the best digital companies for a reimagined everyday and to deliver significant returns. We understand complex and fast-changing consumer behaviours, and have a strong and expanding portfolio in healthcare, software, marketplaces and climate tech. As a long-term investor, we strongly believe that investing in sustainable business models and diverse teams will bring the greatest returns for shareholders. We back our companies at every stage of their journey and invest in Europe and the US. Kinnevik was founded in 1936 by the Stenbeck, Klingspor and von Horn families. Kinnevik's shares are listed on Nasdaq Stockholm's list for large cap companies under the ticker codes KINV A and KINV B. Attachments:

Pleo Frequently Asked Questions (FAQ)

When was Pleo founded?

Pleo was founded in 2015.

What is Pleo's latest funding round?

Pleo's latest funding round is Debt.

How much did Pleo raise?

Pleo raised a total of $471.62M.

Who are the investors of Pleo?

Investors of Pleo include HSBC Innovation Banking, Founders, Creandum, Kinnevik, Seedcamp and 14 more.

Who are Pleo's competitors?

Competitors of Pleo include Airbase, Rydoo, CleverCards, PEX Card, Moss and 7 more.

What products does Pleo offer?

Pleo's products include Smart company cards and 4 more.

Loading...

Compare Pleo to Competitors

Spendesk is a spend management platform that offers a comprehensive solution for modern finance teams in various business sectors. The company provides corporate cards, invoice payments, expense reimbursements, budgets, approvals, reporting, compliance, and pre-accounting in one integrated system. Spendesk's platform is designed to give businesses complete visibility and control over their spending, with features such as built-in automation and an easily adopted approval process. It was founded in 2016 and is based in Paris, France.

Ramp specializes in spend management solutions within the financial technology sector. The company offers a suite of products that include corporate cards, expense management, and accounts payable automation designed to streamline finance operations and improve efficiency for businesses. Ramp's platform also provides features such as automated procurement, vendor management, and working capital solutions, catering to a diverse range of customer needs from startups to large enterprises. It was founded in 2019 and is based in New York, New York.

Brex is a financial technology company that specializes in AI-powered spend management for businesses. The company offers corporate credit cards, automated expense management, and bill payment software, as well as banking and treasury services that include high-yield deposits and FDIC-insured accounts. Brex primarily serves startups, mid-size companies, and enterprises, providing them with tools to control and track company spending in real-time. Brex was formerly known as Veyond. It was founded in 2017 and is based in San Francisco, California.

Payhawk is a spend management platform that operates in the financial technology sector. The company offers a suite of tools for managing corporate expenses, including issuance of corporate cards, automation of expense management, and comprehensive accounts payable software. Payhawk's solutions are designed to provide real-time visibility and control over business spending, streamline financial operations, and integrate with existing ERP and accounting systems. It was founded in 2018 and is based in London, England.

Soldo operates as a financial services and software company in the financial technology industry. The company offers a spend management platform that automates business and employee spending, along with prepaid company cards that provide real-time tracking and control over expenses. It primarily serves businesses across various sectors, with a focus on reducing financial administrative burdens. It was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Fyle focuses on intelligent expense management. Its main services include tracking receipts, reporting expenses, managing credit card reconciliation, and providing analytics on company spending. The company primarily sells to sectors such as construction, non-profit, technology, and legal services. It was founded in 2016 and is based in Bengaluru, India.

Loading...