Synctera

Founded Year

2020Stage

Series A - III | AliveTotal Raised

$79MLast Raised

$18.6M | 7 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-30 points in the past 30 days

About Synctera

Synctera provides partnerships between community banks and fintech companies through a two-sided marketplace. It offers business-to-business (B2B) transactions, business-to-consumer (B2C) transactions, wealth management, and investing, services for nonprofits, cannabis banking, and more. It serves individuals, enterprises, and banks. It was founded in 2020 and is based in Palo Alto, California.

Loading...

Synctera's Product Videos

ESPs containing Synctera

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

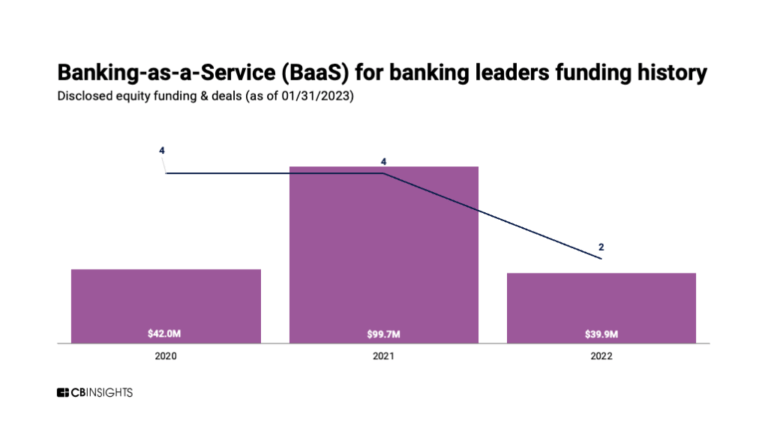

The banking-as-a-service (BaaS) market provides infrastructure platforms for banks and fintechs to digitize their services and expand their customer base through embedded banking and payment options. This market also allows established non-fintech companies to add banking services to differentiate their offerings and generate new revenue streams. BaaS providers offer a single API that enables clie…

Synctera named as Challenger among 15 other companies, including Stripe, Fiserv, and FIS.

Synctera's Products & Differentiators

Banking as a Service platform

Enhance your value proposition and boost revenue by offering banking products and services to your customers. Synctera's Banking as a Service platform has everything you need to build, launch, and scale embedded banking and FinTech products.

Loading...

Research containing Synctera

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Synctera in 5 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

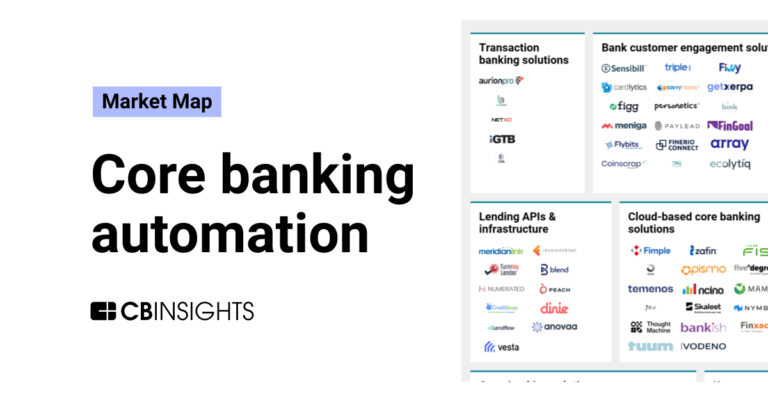

The core banking automation market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Synctera

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Synctera is included in 4 Expert Collections, including Wealth Tech.

Wealth Tech

2,294 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

871 items

Fintech 100

100 items

Latest Synctera News

Sep 4, 2024

The flurry of activity in BaaS is almost entirely restricted to community banks partnering with fintechs and other nonbanks to underpin their financial offerings. But the $121 million-asset North Bay is one of the few credit unions to participate as well, and one of the few to speak about it publicly. "The vast majority don't do it and legally, it's challenging," said Greg Mesack, senior vice-president of advocacy at . The biggest hurdle for credit unions to overcome is the field of membership requirement, which dictates which subsets of the population can be a member of the credit union, based on their location, employer, association membership, or other factors. Beyond that, as not-for-profit institutions, this kind of fintech partnership is not typically considered to be part of the credit union ethos. It is also an , from building or buying the necessary technology, such as application programming interfaces or anti-money laundering monitoring systems, to hiring staff that specializes in this niche. "It brings a lot more risk, a lot more rapid growth," said Mesack. "If you don't have the expertise to manage that, you are putting yourself at risk." But a few have made it work, and there are signs that others are eyeing the sector. July 26 Klaros Group keeps a proprietary database of depository fintech relationships and counts six credit unions on its list of 184 financial institutions. The BaaS Association, which is part of the , has five credit unions as members, including North Bay, and one that is pending. Financial institutions join the BaaS Association because they are actively involved in or exploring BaaS, or want to access the network's educational series covering regulation and compliance. For North Bay, its BaaS activity — which spans electronic payments, debit cards, depository services and more — is about standing out. "We're in a territory that is dominated by some much larger credit unions," said Chris Call, CEO of the Santa Rosa, California-based North Bay. "To find a niche, we had to develop an expertise." “We are sticklers about compliance,” said Chris Call, CEO of North Bay Credit Union. The credit union learned how to manage in November 2017. "We thought we could leverage this expertise in other ways," said Call. "We determined we could take the compliance oversight we were doing for cannabis and apply it to a fintech relationship." Call is not deterred by recent turmoil in the BaaS space. A number of banks engaging in BaaS have received . With the credit union's history in cannabis banking, "We are sticklers about compliance," he said. "We expect our customers, the fintechs, to have a strong compliance model and tools in place to monitor their customers' activity. It's our responsibility to make sure compliance is happening." North Bay "backed into" the BaaS model in January 2023 when it started sponsoring the activities of its cannabis subsidiary, Greenbax Marketplace, which provides accounts and payment processing for cannabis firms. North Bay now has a dozen clients, including ones that bank cannabis operators, process international payments and offer secured credit cards to people rebuilding their credit. The credit union built some compliance and know-your-customer software in house; it also uses Call is not aware of other credit unions in the BaaS space, based on his research. Some relationships resemble BaaS on the surface, but operate in a different fashion. with the help of three other credit unions before its launch in 2021. (Dora is a credit union services organization, as it is owned by these four credit unions.) USAlliance chief strategy and innovation officer Kevin Randall sees Dora as a marketing venture for people to open accounts and then graduate to a full credit union membership at USAlliance or one of the investor credit unions. When customers open accounts through Dora, "The account is at USAlliance, the statements are being generated by US Alliance, it's a USAlliance-issued card. It's a co-branded flow with Dora," he said. "Dora does not have account or card processing relationships and does not hold deposits. We want to take people who have limited banking experience and get them on a path to a full credit union relationship." USAlliance has a designation to serve low-income consumers; the primary audience that Dora is targeting, the underbanked, align with USAlliance's target member base as well. Synctera, which describes itself as a marketplace for banks and fintechs to form relationships and a system of record when these relationships form, chalks up hesitation among credit unions to the rules around membership. "We have spoken with several credit unions over the years, and there is certainly interest," said Shep Smith, chief operating officer of Synctera, via email. "However, the limiting factor historically has been that credit unions typically have membership requirements, making it difficult for them to support programs outside of very small niches." "Memberization" is a consideration for credit unions when forging fintech partnerships, said Carlin McCrory, an associate at Troutman Pepper. "When it comes to deposits, whether the credit unions are federally or state chartered, they usually want the deposits to be covered under NCUA [National Credit Union Administration] share insurance," she said. "They have to go through the process of making people members, generally speaking, but there are limited caveats." North Bay's membership requirements include those who live, work or worship in four northern California counties or are members of certain select employer groups or associations. To comply with these requirements, North Bay qualifies the fintech client for membership and creates a For Benefit Of account per client. The FBO account serves as a settlement account for all transactions occurring on the fintech platform and the fintech maintains its own platform as the books and records for its end-user accounts. The fintech's end users do not need to become members of North Bay individually. Because North Bay has a low-income designation, like USAlliance, it can take a certain number of non-member deposits that would be fully insured under the National Credit Union Share Insurance Fund. North Bay also has custodial relationships with third-party banks to hold excess deposits that it doesn't hold on its balance sheet, which are fully insured. In short, "All deposits are fully insured," said Call. Beyond the membership requirement, the fact remains that BaaS is outside of a credit union's cultural norm. "Credit unions are traditionally conservative, close-knit organizations that provide standard banking services," said Call. Partaking in BaaS "requires some expertise and expenditure of a fair amount of money to invest in the compliance tools and staffing needed." In North Bay's case, the inclination to push the envelope is supported by its board. BaaS is not an area where one can dip a toe. "The broader view on banking-as-a-service is you have to go big or go home," said Brian Graham, a partner at Klaros Group. Otherwise, "you pick up all the regulatory compliance exposures and you don't have the resources to do it right." Banking regulators . The NCUA has been even quieter on the matter. "The NCUA is studying the issue," said an NCUA spokesperson via email. "The regulatory regime applicable to credit unions is less prescriptive in the area of third party vendor management, including with respect to fintechs," said Graham. "You can argue about whether that's a good thing or bad thing." In theory, there is very little distinction between what services banks and credit unions can provide to their fintech partners. Going with one or the other "will be about the effectiveness of them as a partner," said Graham. "The more they invest in it and the more they have the capabilities and technology to do it well, the better it's going to be for a fintech." Clients have largely found North Bay through word of mouth. Call says there are advantages to fintechs in working with a credit union rather than a bank. "The corporate structure is a lot flatter," he said. "If people want to contact me as CEO they could ring my phone directly. Our decision-making process is more streamlined."

Synctera Frequently Asked Questions (FAQ)

When was Synctera founded?

Synctera was founded in 2020.

Where is Synctera's headquarters?

Synctera's headquarters is located at 228 Hamilton Avenue, Palo Alto.

What is Synctera's latest funding round?

Synctera's latest funding round is Series A - III.

How much did Synctera raise?

Synctera raised a total of $79M.

Who are the investors of Synctera?

Investors of Synctera include Lightspeed Venture Partners, Diagram Ventures, Fin Capital, NAventures, Popular and 15 more.

Who are Synctera's competitors?

Competitors of Synctera include ASA, Bond, Rize, Treasury Prime, Sandbox Banking and 7 more.

What products does Synctera offer?

Synctera's products include Banking as a Service platform.

Who are Synctera's customers?

Customers of Synctera include TipHaus, Float and Exo Freight.

Loading...

Compare Synctera to Competitors

Unit develops financial infrastructure for banking and lending solutions. The company offers a platform that enables technology companies to build banking and lending products, including features such as bank accounts, physical and virtual cards, payments, and lending services. Its dashboard and suite of application programming interface (API), software development kit (SDK), and white-labeled user interface (UI) enable developers to build financial features into their products. It was founded in 2019 and is based in New York, New York.

Treasury Prime is an embedded banking platform that specializes in connecting businesses with a network of banks and financial service providers. Their main offerings include API banking integrations that enable companies to develop and launch financial products such as FDIC insured accounts, payment processing solutions, and debit card issuance. Treasury Prime's platform is designed to support compliance program integration and multi-bank operations, facilitating the creation of investment vehicles and instant payout ecosystems for various industries. It was founded in 2017 and is based in San Francisco, California.

NovoPayment specializes in providing Banking as a Service (BaaS) platforms, focusing on digital financial and transactional services. The company offers a suite of bank-grade solutions including digital banking, payment processing, card issuing, and risk management services, all designed to integrate with existing systems to enhance financial operations and customer experiences. NovoPayment primarily serves banks, financial institutions, merchants, and other financial service providers looking to digitize and modernize their services. It was founded in 2007 and is based in Miami, Florida.

Productfy is a platform specializing in the embedding of financial products within various business sectors. The company offers a suite of services including branded card programs, digital banking solutions, secured charge card issuance, and disbursement mechanisms, all designed to be integrated seamlessly into clients' applications. Productfy primarily serves sectors such as community banks, credit unions, real estate, financial services, and insurance. It was founded in 2018 and is based in San Jose, California.

Hydrogen operates as a no-code embedded finance company. It offers United States dollar (USD) banking services, wealth management, personal financial management (PFM), and cryptocurrency payments solutions. The company was founded in 2017 and is based in Miami, Florida.

Agora Financial Technologies, the FinTech enabler for banks, helps banks to ramp up their digital experience without replacing their core banking system. Agora provides and co-creates tech tools for banks so that they can accelerate their digital journey and implement Fintech products. It was founded in 2018 and is based in New York, New York.

Loading...