Trade Republic

Founded Year

2015Stage

Series C - II | AliveTotal Raised

$1.255BValuation

$0000Last Raised

$268.01M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-24 points in the past 30 days

About Trade Republic

Trade Republic is a financial technology company focused on providing easy access to the stock markets and democratizing investment for individuals across Europe. The company offers services that allow users to invest, save, and spend, with a user-friendly platform designed to simplify the investment process for everyday people. Trade Republic primarily serves individual investors looking to engage with the capital markets. It was founded in 2015 and is based in Berlin, Germany.

Loading...

Loading...

Research containing Trade Republic

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Trade Republic in 7 CB Insights research briefs, most recently on May 16, 2023.

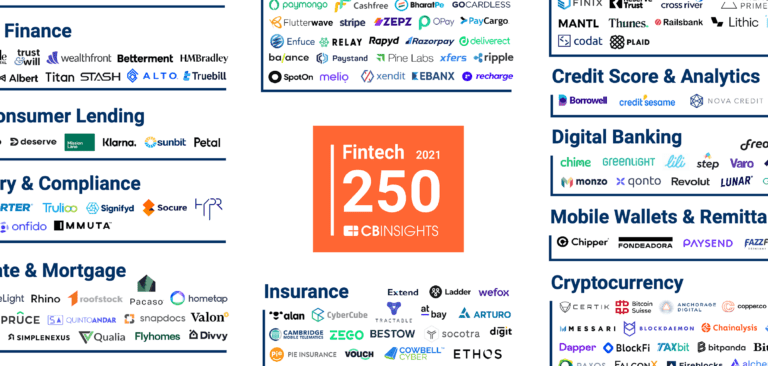

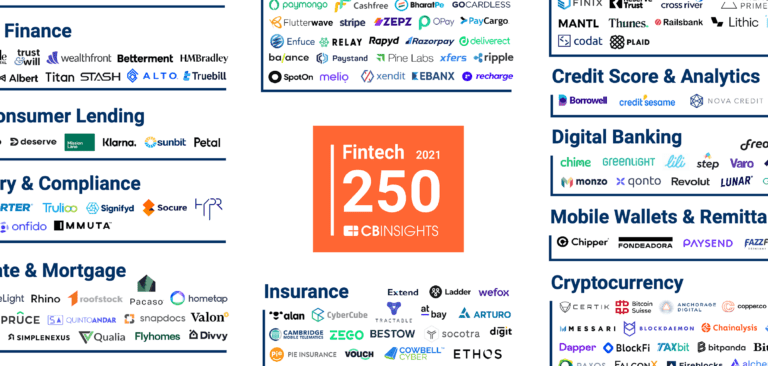

Oct 5, 2021 report

The Fintech 250: The Top Fintech Companies Of 2021

Oct 5, 2021 report

The Fintech 250: The top fintech companies of 2021Expert Collections containing Trade Republic

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Trade Republic is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Wealth Tech

2,296 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

13,398 items

Excludes US-based companies

Fintech 100

849 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Trade Republic News

Sep 12, 2024

N26, Trade Republic, Bitpanda: So stark wachsen die Milliarden-Fintechs Nach turbulenten Krisenjahren hat sich die Stimmung unter den hiesigen Milliarden-Fintechs zuletzt aufgehellt. Die Neobank N26 ist ihren Neukundendeckel los, Trade Republic hat ein neues Kontomodell gestartet und die Krypto-Börse Bitpanda bewegt sich im Bullenmarkt – wie wirkt sich das auf die App-Downloads der Anbieter aus? Der Abwärtstrend scheint gestoppt: Trotz anhaltender Sorgen um hohe Zinsen und geopolitische Konflikte konnte sich das Fundingklima unter deutschen Fintechs im ersten Halbjahr 2024 auf niedrigem Niveau stabilisieren, wie eine Studie der Beratung KPMG kürzlich zeigte . So gab es für Finanz-Startups insgesamt 51 Deals mit einem Investitionsvolumen von rund 480 Millionen Dollar – 20 Prozent mehr als im Vorjahreszeitraum. Auch unter den hiesigen Milliarden-Fintechs hat sich die Stimmung zuletzt aufgehellt. Die Zeit der Massenentlassungen und strikten Spardiktate scheint vorüber. Es wird wieder ins Wachstum investiert. Neobroker wie Trade Republic und Scalable Capital beispielsweise sorgten mit großen Werbekampagnen für Aufsehen. Dazu konnte die Berliner Neobank N26 nach Jahren die Finanzaufseher der Bafin zufriedenstellen . In allen Fällen machte sich das auch positiv bei der Zahl der App-Downloads der Anbieter bemerkbar: N26 zündet Wachstumsturbo Ungewohntes Bild bei Deutschlands größter Neobank: Seit Juni ziehen die wöchentlichen App-Downloads von N26 wieder deutlich an. Hintergrund dürfte das Neukundenlimit sein, das die Finanzaufsicht zu Anfang Juni nach mehreren Jahren vollständig aufgehoben hat. Seitdem dürfte N26 wieder vermehrt ins Marketing investiert haben – was sich in höheren Downloadzahlen niederschlägt. Kommt es nun zur Aufholjagd zum Rivalen Revolut ? Das ist wohl unwahrscheinlich. Während N26 die vergangenen Jahre viel mit der Bafin stritt, konnte Revolut nahezu ungehindert wachsen. Zeitweise verzeichneten die Briten rund 20 Mal so viele Downloads wie die Berliner Fintech-Bank. Dazu ist Revolut international nach wie vor gut aufgestellt. N26 wiederum hat sich – auch aus Kostengründen – aus wichtigen Wachstumsmärkten wie Brasilien oder den USA zurückgezogen. Eine Analyse von Finance Forward zeigte zudem, dass gut Dreiviertel der N26-Kunden aus nur zwei Ländern kommen – Deutschland und Frankreich. Revolut dürfte die europäische Marktführerschaft so kaum mehr zu nehmen sein. Neues Konto beflügelt Trade Republic Ähnlich sieht es bei den hiesigen Neobrokern aus: Trade Republic konnte seinen Vorsprung gegenüber Wettbewerbern wie Scalable Capital oder Finanzen.net Zero stark ausbauen. Bei dem Berliner Fintech ist laut Diagramm besonders zum Jahreswechsel ein deutlicher Anstieg der App-Downloads sichtbar. Das ist erst einmal nicht überraschend. Weil viele Menschen zum Jahreswechsel ihre Finanzen organisieren und etwa Sparpläne auflegen, gehört der Januar gewöhnlich zu den stärksten Monaten bei Neobrokern. Mehr zum Thema...

Trade Republic Frequently Asked Questions (FAQ)

When was Trade Republic founded?

Trade Republic was founded in 2015.

Where is Trade Republic's headquarters?

Trade Republic's headquarters is located at Köpenicker Strasse 40c, Berlin.

What is Trade Republic's latest funding round?

Trade Republic's latest funding round is Series C - II.

How much did Trade Republic raise?

Trade Republic raised a total of $1.255B.

Who are the investors of Trade Republic?

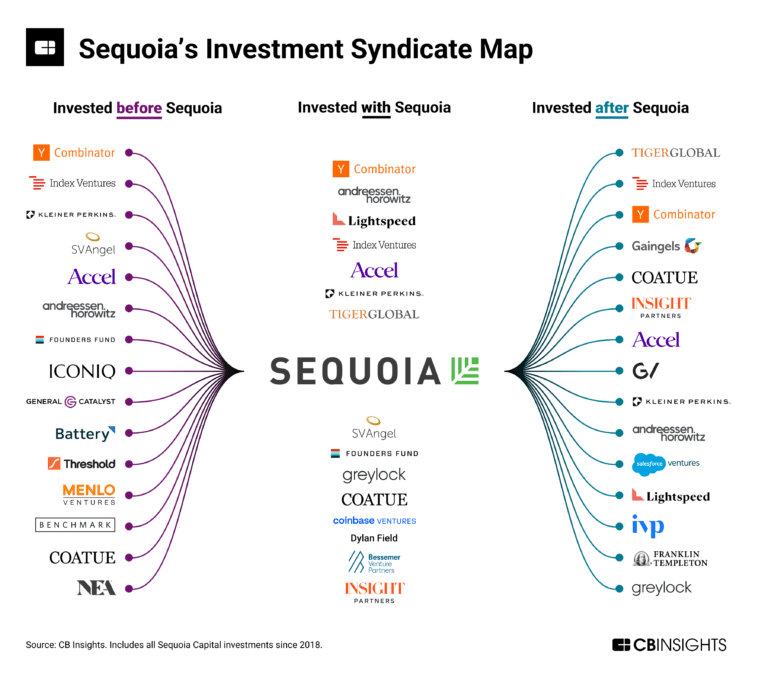

Investors of Trade Republic include Ontario Teachers', Accel, Creandum, Project A Ventures, Founders Fund and 5 more.

Who are Trade Republic's competitors?

Competitors of Trade Republic include Saxo Bank, Bitwala, Scalable Capital, Flink, Freetrade and 7 more.

Loading...

Compare Trade Republic to Competitors

EasyEquities is a financial services provider that operates in the investment sector. The company offers a low-cost platform for investing in a variety of assets including stocks, exchange-traded funds (ETFs), cryptocurrencies, and properties. It primarily serves individual investors, providing them with the tools and resources to invest in both local and international markets. It is based in Hyde Par, South Africa.

Scalable Capital is a financial technology company specializing in digital wealth management and brokerage services. The company offers a platform for trading stocks, exchange-traded funds, and other financial instruments, as well as automated wealth management services using globally diversified exchange-traded fund portfolios. Scalable Capital primarily serves private individuals looking to invest and manage their assets. It was founded in 2014 and is based in Munich, Germany.

Bumped is an app that links to an user's credit or debit card and gives users fractional shares of stock at stores they shop at.

N26 provides a mobile banking platform. It gives customers a solution to control finances. The company allows users to open an N26 account directly from their phone or computer. It also offers insights into spending habits. The company was founded in 2013 and is based in Berlin, Germany.

Stockal is a global investing platform that specializes in providing retail investors with the means to invest and save in international markets. The company offers a range of financial products including global stocks and ETFs, curated investment portfolios known as Stacks, and managed funds, alongside cash management services that allow users to save, invest, and spend from a single account. Stockal's platform is designed to be smart, simple, and secure, providing users with access to world-class research and analysis, real-time stock alerts, and the ability to invest in fractional shares. It was founded in 2016 and is based in New York, New York.

OANDA specializes in the online foreign exchange (forex) and cryptocurrency trading sectors. The company offers platforms for trading a variety of currency pairs and cryptocurrencies, as well as tools and resources for building trading strategies. OANDA primarily serves individual traders and institutions with a suite of products including technical analysis tools, mobile trading applications, and educational resources. It was founded in 1996 and is based in New York, New York.

Loading...