Navan

Founded Year

2015Stage

Line of Credit | AliveTotal Raised

$1.644BValuation

$0000Last Raised

$300M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-13 points in the past 30 days

About Navan

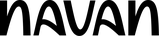

Navan specializes in business travel solutions and expense management within the corporate services sector. The company offers an integrated platform that simplifies travel booking and automates expense management, providing real-time visibility and control over corporate spending. Navan's platform is designed to serve various sectors, including small businesses, startups, and large enterprises, by offering customizable travel programs and expense management tools. Navan was formerly known as TripActions. It was founded in 2015 and is based in Palo Alto, California.

Loading...

Navan's Product Videos

Navan's Products & Differentiators

Virtual cards for travel payments

TripActions Liquid is a centralized billing solution that streamlines the payment process from reservation through reconciliation. Instead of using personal funds for travel, employees can pay with a virtual corporate card when booking travel on TripActions. At the end of each billing cycle, finance teams get one consolidated statement that details each traveler’s spend, making reconciliation fast and easy.

Loading...

Research containing Navan

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Navan in 7 CB Insights research briefs, most recently on Jan 3, 2024.

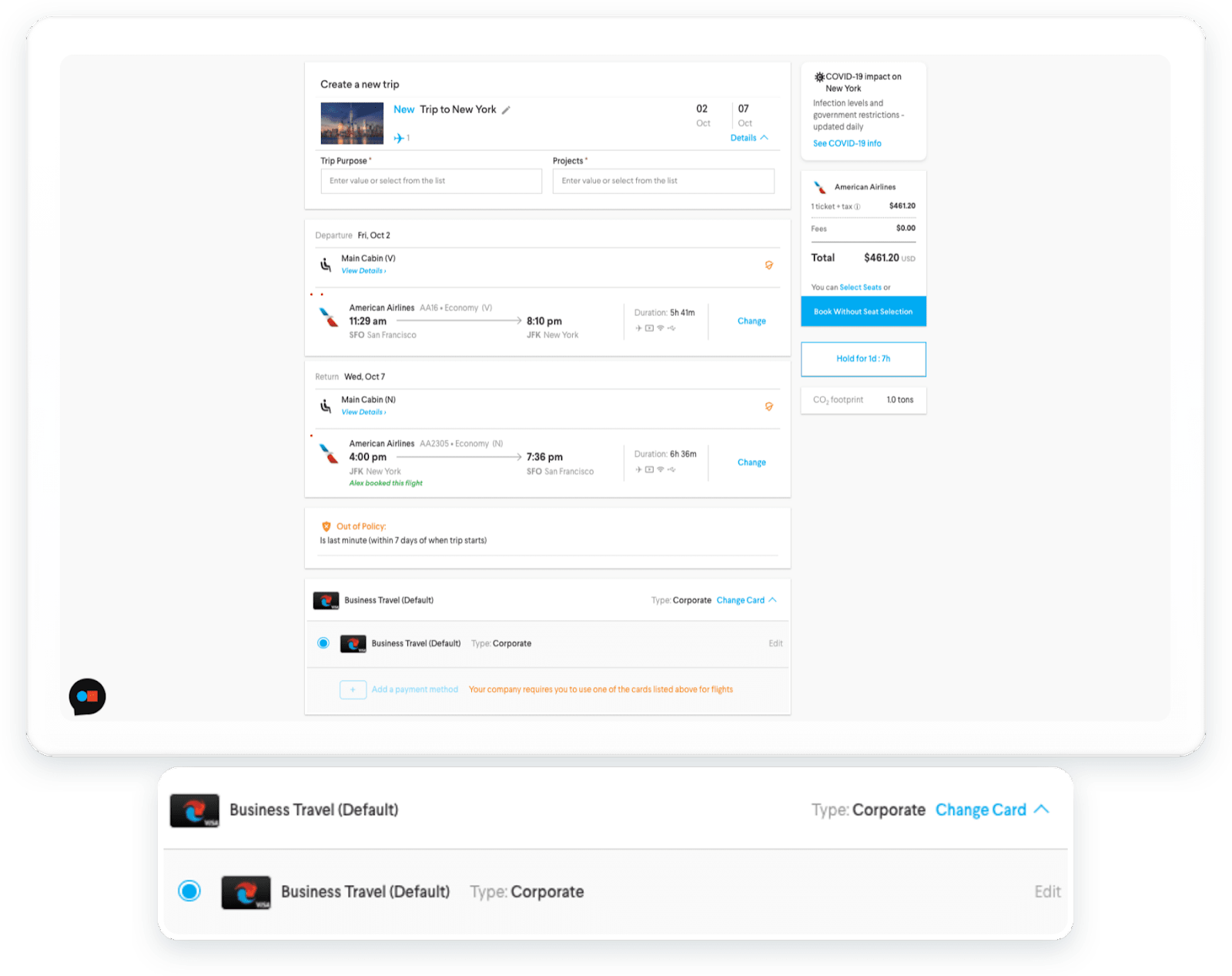

Oct 26, 2023

The CFO tech stack market map

Oct 18, 2022

The Transcript from Yardstiq: Is Okta an M&A target?Expert Collections containing Navan

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Navan is included in 5 Expert Collections, including HR Tech.

HR Tech

4,044 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,244 items

Travel Technology (Travel Tech)

2,715 items

The travel tech collection includes companies offering tech-enabled services and products for tourists and travel players (hotels, airlines, airports, cruises, etc.). It excludes financial services and micro-mobility solutions.

Tech IPO Pipeline

825 items

SMB Fintech

355 items

Navan Patents

Navan has filed 12 patents.

The 3 most popular patent topics include:

- identifiers

- biological databases

- network protocols

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/7/2021 | 8/8/2023 | Graphical user interface elements, Identifiers, URI schemes, Domain name system, Mobile computers | Grant |

Application Date | 7/7/2021 |

|---|---|

Grant Date | 8/8/2023 |

Title | |

Related Topics | Graphical user interface elements, Identifiers, URI schemes, Domain name system, Mobile computers |

Status | Grant |

Latest Navan News

Sep 19, 2024

The on-demand pay provider expands B2B unit with General Manager position EarnIn , a pioneer in on-demand pay, announced the company’s latest appointment of Penelope Talbot-Kelly as its General Manager of B2B sales and solutions. Talbot-Kelly will lead the B2B team in partner acquisition, client management, and partnerships across the country. Her team will focus on supporting employers by addressing the issue of employee financial stress by offering financial wellness solutions. Just last year, a survey highlighted that 78% of Americans live paycheck to paycheck, and another survey found that financially stressed employees spend 3+ hours a week dealing with personal finances at work. This loss in productivity impacts both employees and employers, leading to an overwhelming need for financial health benefits like on-demand pay to sustain healthy financial habits. “Financial anxiety and uncertainty is the leading cause of stress among employees today, and there is an incredible need for tools and resources to manage these pressures. To stay ahead in a competitive labor market, employers need to address employee financial stress, starting with products and solutions that they actually want,” said Talbot-Kelly. “EarnIn is focused on giving employees access to their pay as they earn it, along with a suite of services to help them build and maintain healthier financial behaviors. I’m thrilled to be joining the EarnIn team and help employers understand the benefits and importance of building financial momentum for their employees.” With over 15 years of experience in strategy and business development, Talbot-Kelly has worked with Series A to publicly traded companies in a variety of industries, including technology, payments, and the financial sector. Most recently, she was a General Manager at DoorDash leading white label businesses, one of which grew 50x and established a multi-million dollar ARR line, and was one of the fastest growing B2B businesses in the company’s history. Other previously held positions include leading Strategy & Operations, Product, Product Operations and Customer Success teams at Navan, formerly TripActions, Finance & Operations teams at the Chan Zuckerberg Initiative, and Business Operations at a Series A healthtech company, OpenCare.

Navan Frequently Asked Questions (FAQ)

When was Navan founded?

Navan was founded in 2015.

Where is Navan's headquarters?

Navan's headquarters is located at 3045 Park Boulevard, Palo Alto.

What is Navan's latest funding round?

Navan's latest funding round is Line of Credit.

How much did Navan raise?

Navan raised a total of $1.644B.

Who are the investors of Navan?

Investors of Navan include SVB Financial Group, Goldman Sachs, Group 11, Andreessen Horowitz, Coatue and 14 more.

Who are Navan's competitors?

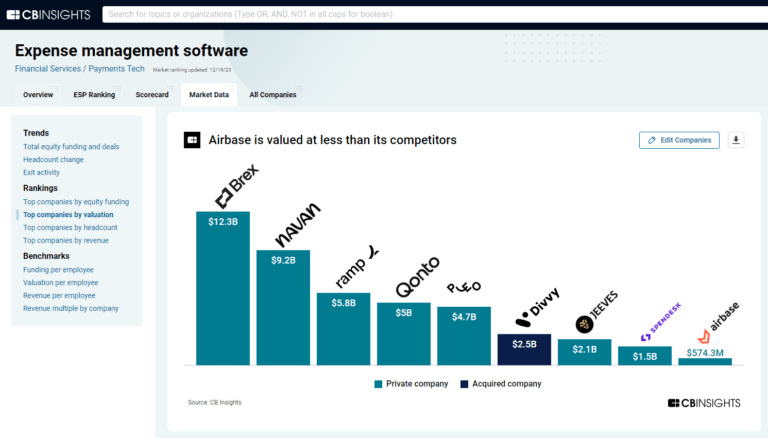

Competitors of Navan include Airbase, Inbanx, Center, Brex, WegoPro and 7 more.

What products does Navan offer?

Navan's products include Virtual cards for travel payments and 4 more.

Loading...

Compare Navan to Competitors

TravelPerk is a SaaS business travel platform that specializes in corporate travel management. The company offers an all-in-one platform for booking, organizing, and controlling business travel, with features such as travel policy automation, expense management, and 24/7 customer support. TravelPerk primarily serves sectors that require robust travel management solutions, including finance teams and travel managers within various organizations. It was founded in 2015 and is based in Barcelona, Spain.

Ramp specializes in spend management solutions within the financial technology sector. The company offers a suite of products that include corporate cards, expense management, and accounts payable automation designed to streamline finance operations and improve efficiency for businesses. Ramp's platform also provides features such as automated procurement, vendor management, and working capital solutions, catering to a diverse range of customer needs from startups to large enterprises. It was founded in 2019 and is based in New York, New York.

Brex is a financial technology company that specializes in AI-powered spend management for businesses. The company offers corporate credit cards, automated expense management, and bill payment software, as well as banking and treasury services that include high-yield deposits and FDIC-insured accounts. Brex primarily serves startups, mid-size companies, and enterprises, providing them with tools to control and track company spending in real-time. Brex was formerly known as Veyond. It was founded in 2017 and is based in San Francisco, California.

Fyle focuses on intelligent expense management. Its main services include tracking receipts, reporting expenses, managing credit card reconciliation, and providing analytics on company spending. The company primarily sells to sectors such as construction, non-profit, technology, and legal services. It was founded in 2016 and is based in Bengaluru, India.

Procurify is a company focused on intelligent spend management within the procurement and financial software sectors. It offers a comprehensive procure-to-pay platform that automates purchasing and accounts payable processes, providing real-time visibility and control over business spend. Procurify's platform serves various sectors, including technology, healthcare, biotech, manufacturing, cannabis, education, and nonprofit industries. It was founded in 2012 and is based in Vancouver, British Columbia.

Moss is a spend management platform that operates in the financial technology sector. The company provides solutions for corporate credit card issuance, expense management, and accounts payable automation, designed to streamline financial processes and enhance control over company spending. Moss's platform is tailored to the needs of modern SMB finance teams, offering features such as real-time budget tracking, receipt capture, and seamless integrations with accounting software. Moss was formerly known as Vanta. It was founded in 2019 and is based in Berlin, Germany.

Loading...